DeFi capitalization of over $1.3 trillion. It was designed to be a decentralized currency and real-time gross settlement system. The decentralized, protocol-based approach enables holders to shift trust from a centralized actor to a decentralized, code-enforced protocol.

Bitcoin DeFi Opportunity.

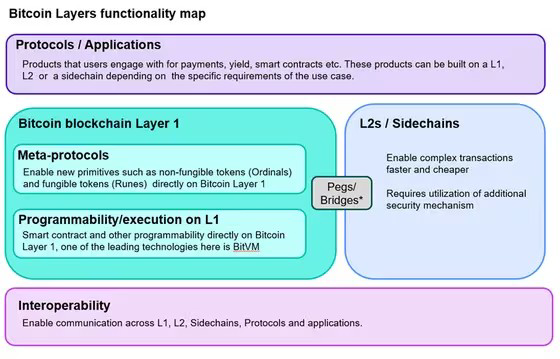

Despite bitcoin being the original cryptocurrency and corresponding blockchain, its functionality has been extremely limited up to this point relative to the smart contracts and decentralized finance (DeFi) functionality offered by Ethereum, Solana and other blockchains. However, this dynamic is set to change with the emergence of Bitcoin Layers, the meta-protocols, sidechains, layer 2’s and other technologies currently being built on the Bitcoin blockchain. These layers will enable faster payments, as well as lending, enhanced functionality of fungible and non-fungible tokens, decentralized exchanges, GameFi, SocialFi and many other use cases. Holders of bitcoin will soon be able to increase the productivity of their asset via a protocol-based decentralized financial system. The primary differentiator between DeFi on Bitcoin and DeFi on other chains is the underlying asset (native token). Whereas Ethereum, Solana and next-gen blockchains compete on the merits of their respective technologies, DeFi on Bitcoin is purely focused on increasing the productivity of bitcoin, placing the Bitcoin DeFi ecosystem in a league of its own.

The case for value creation via a Bitcoin-based decentralized financial system is driven by three assumptions:

- preference for the Bitcoin blockchain as the base layer for other tokenized assets

- demand for greater productivity of bitcoin, the asset

- demand for a financial system that reflects the decentralized principles of Bitcoin

We already see strong demand signals for the Bitcoin blockchain as a base layer for other tokenized assets. The market for non-fungible tokens on Bitcoin, called Ordinals, grew from less than $100 million to over $1.5 billion in less than six months.

However, the largest opportunity is still ahead. Most of the market value of Bitcoin’s decentralized finance system will show up in the value of fungible tokens on Bitcoin. Fungible tokens will power greater productivity of bitcoin (the asset) via yield-bearing instruments and decentralized financial systems via protocols and layer 2s. Relative to Ethereum, Solana and other chains, the value of fungible tokens on Bitcoin is still minuscule, largely because we are in the early innings of programmable functionality on that blockchain.

Bitcoin’s leading non-fungible token protocol, Ordinals, wasn’t released until January 2023. BRC20s and Runes, Bitcoin’s leading fungible token protocols, were launched in March 2023 and April 2024, respectively. Even with these recent releases, additional functionality is required for a robust decentralized finance ecosystem to exist on Bitcoin.

Additional functionality is being introduced to Bitcoin in two ways:

- Bitcoin Improvement Proposals (BIPs): Upgrades to Bitcoin’s core software are being pursued through BIPs, such as OP_CAT, which aims to enhance smart contract functionality and increase efficiency on Bitcoin.

- Technological Developments: Innovations like BitVM, pegs and bridges are being developed to provide users with enhanced programmability and efficiency without requiring an upgrade to Bitcoin’s core software.

As previously mentioned, Bitcoin’s decentralized finance ecosystem is still in the early stages of its life cycle. However, strong indicators of future growth can be seen via growing developer and DeFi activity in the space. In 2023, 40% of Bitcoin open-source developers were focused on Bitcoin L2s and scaling solutions. Then, in the first quarter of 2024, Bitcoin ecosystem total value locked (TVL) grew over six times from $492 million to over $2.9 billion. Given these early indicators, coupled with what we’ve seen transpire across other ecosystems, we believe over $1 trillion in value could be created in the Bitcoin DeFi ecosystem within the next five to 10 years.

Disclaimer from Franklin Templeton:

All investments involve risk, including the loss of principal.

Investments in Digital Assets are subject to many specialized risks and considerations, including but not limited to risks relating to:

(i)immature and rapidly developing technology underlying Digital Assets, (ii) security vulnerabilities of this technology, (iii) credit risk of Digital Asset exchanges that may hold an Account’s Digital Assets in custody, (iv) regulatory uncertainty around the rules governing Digital Assets, Digital Asset exchanges and other aspects and parties involved with Digital Asset transactions, (v) high volatility in the value/price of Digital Assets, (vi) unclear acceptance of some or all Digital Assets by users and global marketplaces, and (vii) manipulation or fraud resulting from the pseudo-anonymous manner in which ownership of Digital Assets is recorded and managed.

This communication is general in nature and provided for educational and informational purposes only. It should not be considered or relied upon as legal, tax or investment advice or an investment recommendation, or as a substitute for legal or tax counsel. Prospective investors should always consult a qualified financial professional for personalized advice or investment recommendations tailored to their specific goals, individual situation, and risk tolerance. Views expressed are those of the author and do not reflect views of other managers or the firm overall. Views are current as of the date of this publication and are subject to change. The information is based on current market conditions, which will fluctuate and may be superseded by subsequent market events. References to specific securities, asset classes and financial markets are for illustrative purposes only and should not be interpreted as recommendations.

Bitcoin can be a potential opportunity, but it’s important to understand both the potential benefits and risks before investing. Here’s a breakdown:

Possible benefits:

- High Growth Potential: Bitcoin has a history of significant price appreciation, though also periods of volatility.

- Limited Supply: There’s a finite amount of Bitcoin that can ever be created, potentially driving up its value in the long run.

- Decentralized: Bitcoin operates outside traditional financial systems, appealing to some investors.

Potential risks:

- Volatility: Bitcoin’s price can fluctuate significantly, leading to potential losses.

- Uncertain Regulation: Governments around the world are still figuring out how to regulate cryptocurrency, which could impact its value.

- Security Risks: Bitcoin wallets and exchanges can be vulnerable to hacking.

Here are some resources to help you decide if Bitcoin is right for you:

- Bitcoin Opportunity Fund: This fund invests in various aspects of the Bitcoin ecosystem [Bitcoin Opportunity Fund]. It can be an option for those who want broader exposure to Bitcoin than just buying the currency itself.

- Bitcoin Risks and Opportunities: This article from City National Bank provides a balanced view of the pros and cons of investing in Bitcoin [Bitcoin Risks and Opportunities].

Ultimately, the decision to invest in Bitcoin is up to you. Make sure you do your own research and understand the risks involved before putting any money in.

DeFi, short for decentralized finance, refers to a whole new way of managing your finances without relying on traditional intermediaries like banks or brokerages. It leverages blockchain technology and cryptocurrency to create peer-to-peer financial services.

Here’s the gist of DeFi:

- Decentralized: Transactions happen directly between users, facilitated by smart contracts (automated code on a blockchain) instead of institutions.

- Open and Accessible: DeFi services are generally available to anyone with an internet connection and a crypto wallet, removing barriers to entry.

- Transparent: All transactions are recorded publicly on the blockchain, promoting trust and security.

DeFi offers a wide range of financial products, including:

- Lending and Borrowing: Borrow crypto without a credit check or earn interest on your holdings.

- Trading: Decentralized exchanges (DEXs) allow users to trade cryptocurrencies directly with each other.

- Payments: Send and receive crypto payments without relying on traditional payment processors.

- Yield Farming: Earn rewards by locking up your crypto assets in DeFi protocols.

However, DeFi is still a developing field and comes with its own set of risks:

- Volatility: Cryptocurrencies can experience significant price swings, leading to potential losses.

- Complexity: Understanding and using DeFi applications can be challenging for beginners.

- Security Risks: DeFi protocols can be vulnerable to hacks and smart contract bugs.

If you’re interested in learning more about DeFi, here are some helpful resources:

- CoinDataCap DeFi Guide: A good starting point for beginners to understand the basics of DeFi https://www.CoinDataCap.com/learn/wallet/how-to-get-started-in-defi

- Cdatacap DeFi: Provides a more in-depth explanation of DeFi and its various aspects https://www.cdatacap.com/decentralized-finance-defi-5113835

Remember, DeFi is a rapidly evolving space. Do your research, understand the risks, and only invest what you can afford to lose.

Getting started

- If you haven’t already done so, the first thing you’ll need to do is set up a crypto wallet compatible with DeFi apps, like Coinbase Wallet or Coinbase dapp wallet. Your wallet is your gateway into web3 and the ecosystem of dapps (decentralized applications) like DeFi apps. If you are reading this from your Coinbase dapp browser, then you are already set.

- Once your wallet is set up, you’ll need to add some crypto to it. If you already have an account with Coinbase’s exchange, you can easily link it to your Coinbase Wallet to securely move your crypto from your exchange account into your wallet. Coinbase dapp wallet is located within your primary Coinbase app and provides easy in-app funding flows.

- You can also transfer crypto from places other than Coinbase, using your wallet’s public address. Your wallet address can be found by tapping the QR code icon in the mobile app or browser extension.

- Once your wallet is loaded with the cryptocurrencies of your choice (there are thousands of options compatible with either Coinbase product), you’re ready to navigate to your first dapp.

Leave feedback about this