Ethena Finance (ENA/USDe) is emerging as a notable player in the cryptocurrency and decentralized finance (DeFi) sectors. Powered by its proprietary stablecoin, USDe, Ethena aims to offer a synthetic dollar that operates across various DeFi applications without relying on traditional financial infrastructure.

Ethena Finance was mentioned as a trade idea for the latest edition of the Weekly Crypto Market Wrap, released every Monday in your inbox and our Insights section. Subscribe below to get weekly expert crypto insights.

Table of Contents

How Does Ethena Finance Work?

Ethena Finance project is empowered by the Ethereum blockchain network that is well-known for security and building decentralized applications. The Ethena Finance ensures to achieve all its functionalities through the minting of USDe stablecoin. For minting USDe stablecoin, users need to deposit Ethereum or its staked derivatives as collateral on the Ethena Finance.

As we mentioned before, Ethena Finance uses a different type of architecture for developing its USDe synthetic dollar. Delta-hedging is the core mechanism used by the Ethena Finance to develop synthetic stablecoin. This technology opens short positions in derivatives equal to the value of Ethereum that was deposited as collateral. And, makes sure that the value of USDe remains stable and any price movements of the underlying asset are counterbalanced.

The delta-hedging technology ensures that the USDe synthetic dollar is protected from the volatility of the crypto market. Apart from serving as a stablecoin, USDe also allows holders to earn yield. USDe token holders can generate yield either through staking rewards or through funding and basis spreads from delta-hedging activities.

Ethena’s Core Technology

Ethena operates on the Ethereum blockchain, employing a delta-neutral strategy to maintain the stability of its synthetic dollar, USDe. This approach involves minting USDe against staked Ethereum or its derivatives, while simultaneously opening short positions in derivatives to counteract the volatility of the underlying collateral. This ensures that the value of USDe remains stable despite fluctuations in the value of the collateral.

USDe and Asset Backing Mechanism

USDe

USDe, the stablecoin of Ethena, is designed to provide a stablecoin solution that is stable and not controlled by central authorities. USDe is backed by Ethereum tokens through a process called delta-hedging.

Delta-hedging is a risk management strategy in derivative finance, helping to balance the position of the collateral asset to minimize price volatility risk. In this case, Ethereum is used as the collateral asset, and USDe maintains its stable value through continuously adjusting the delta position.

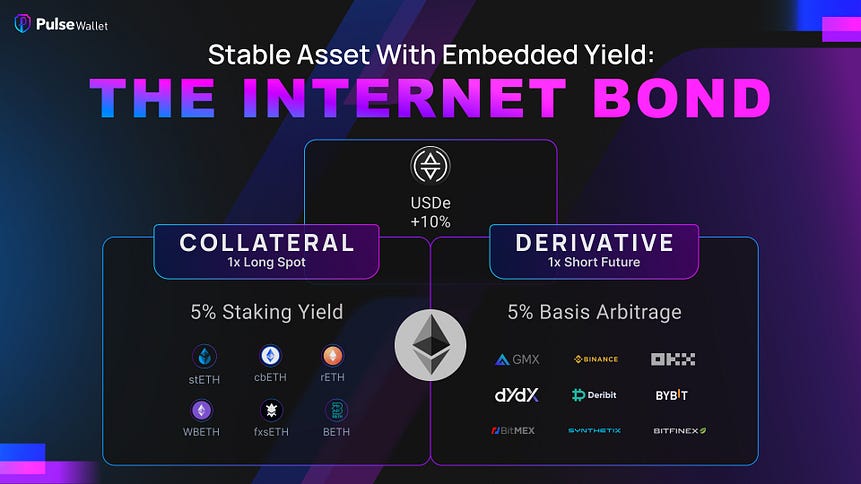

Internet Bond

The Internet Bond is a type of digital bond operating on the Ethereum blockchain platform. The Internet Bond helps USDe maintain a stable price by staking Ethereum and using a two-way hedging strategy to keep the price at $1.

To maintain the peg for USDe, Ethena Labs executes hedging by establishing offsetting positions in the derivatives market or through other financial instruments.

For example, if users stake Ethereum to obtain USDe, Ethena will also open a ‘short’ position on Ethereum with equivalent value. This means they are betting on the price of Ethereum decreasing.

If the price of Ethereum rises, the value of the collateral asset (Ethereum) used to secure USDe increases, but the loss from the short position will offset this price increase. Conversely, if the price of Ethereum decreases, the loss from the decrease in Ethereum’s price will be offset by the profit from the short position.

In this way, any price fluctuations of Ethereum will be balanced by the profit or loss from the hedging position, helping to maintain a stable value for USDe relative to USD. This condition allows USDe to maintain its pegged value, independent of market fluctuations.

Ethena Tokenomics and Distribution

The total supply of Ethena’s native token, ENA, is capped at 15 billion. The initial circulating supply is about 1.425 billion tokens. The distribution includes allocations for core contributors, ecosystem development, investors, and a foundation that supports further initiatives to expand USDe’s reach.

Market Performance and Adoption

Since its launch, Ethena has shown impressive market adoption with a total value locked (TVL) of over $1.5 billion in just under two months. This rapid growth underscores the market’s confidence and the perceived stability of the USDe as a synthetic stablecoin.

Unique Features and Challenges

Unlike traditional stablecoins, USDe is not backed by fiat currency but by crypto assets, which introduces unique risks and challenges. These include exposure to derivative market risks and the need for rigorous counterparty risk management. Nonetheless, Ethena leverages these mechanisms to offer competitive yields and facilitate growth within the DeFi space.

Ethena Finance stands out in the DeFi space with a couple of key features:

- Crypto-native stablecoin: Unlike traditional stablecoins pegged to fiat currencies, Ethena’s USDe is backed by other crypto assets. This allows for:

- Competitive yields: Ethena can leverage complex financial instruments to potentially generate higher returns for users.

- Growth within DeFi: The crypto-backed nature makes USDe a good fit for the decentralized finance ecosystem.

Challenges of Ethena Finance:

There are also some inherent challenges with Ethena’s approach:

- Derivative market risk: Since USDe relies on other crypto assets for stability, it exposes users to the volatility of the derivative markets.

- Counterparty risk management: As with any DeFi project, managing the risk associated with interacting with other parties in the ecosystem is crucial for Ethena.

The USDe Controversy

Ethena Finance’s approach to maintaining USDe’s peg has sparked debate. Unlike traditional stablecoins backed by real-world assets (like US dollars), USDe relies on a combination of crypto collateral and derivatives strategies. This algorithmic approach has raised concerns about its stability, particularly after the collapse of TerraUSD (UST) in 2022. Critics argue that complex financial instruments can be vulnerable to market crashes and unforeseen events.

High Yields vs. High Risk

Ethena Finance has attracted users with its attractive yields on USDe deposits. However, these high yields come with an inherent risk. To generate these returns, Ethena employs strategies like “cash-and-carry trades” which involve shorting other cryptocurrencies. This strategy can backfire if the market moves against Ethena, potentially leading to losses for USDe holders.

High yields and high risk are two sides of the same coin in the world of investment. Here’s a breakdown of the relationship:

High Yields

- Pros: The attraction of high yields is obvious – potentially bigger returns on your investment. This can be especially appealing if you’re looking to grow your wealth quickly.

High Risk

- Cons: Unfortunately, the promise of high yields comes with a significant downside – increased risk. Here’s what you need to be aware of:

- Default risk: High-yield investments are often issued by companies or entities considered less creditworthy. This means there’s a higher chance they might default on their debt, leaving you with nothing.

- Market volatility: High-yield investments tend to be more sensitive to market fluctuations. So, if the market takes a downturn, the value of your investment could plummet.

- Liquidity risk: Some high-yield investments may be less liquid, meaning it might be difficult to sell them quickly if you need the money.

The Trade-Off

Investors are generally compensated for taking on more risk. So, high-yield investments typically offer higher potential returns than their lower-risk counterparts.

Finding the Balance

The decision of whether to pursue high yields comes down to your individual risk tolerance and investment goals. Here are some factors to consider:

- Investment horizon: If you have a long investment time frame, you can potentially ride out market downturns and allow your high-yield investments to recover.

- Risk tolerance: How comfortable are you with the possibility of losing money?

- Portfolio diversification: Including some high-yield investments in a well-diversified portfolio can help boost returns, but it’s important to manage the overall risk.

Transparency and User Experience

While Ethena Finance operates on a decentralized platform, the complexities of its workings might be a hurdle for some users. Understanding the mechanics behind USDe’s stability and the risks involved in yield generation requires a higher level of financial literacy.

Transparency of Ethena Finance

Potential Strengths:

- Whitepaper: A well-written whitepaper that clearly explains the mechanics of USDe, the underlying assets backing it, and the associated risks.

- Smart Contract Audits: Availability of independent audits of the Ethena smart contracts by reputable security firms. Public reports of the audit findings can build user trust.

- On-chain Data: Transparency into the on-chain activity of the Ethena protocol. Users can potentially verify the backing assets and their performance.

Potential Weaknesses:

- Limited Team Information: Lack of clear information about the team behind Ethena, their experience, and track record. This can raise concerns about accountability.

- Opaque Risk Management: Unclear communication regarding Ethena’s strategies for managing counterparty risk and mitigating the volatility of its backing assets.

User Experience of Ethena Finance

Potential Strengths:

- Intuitive Interface: A user-friendly platform that allows for easy interaction with USDe, including depositing, earning yields, and potentially swapping for other crypto assets.

- Detailed Documentation: Comprehensive user guides and tutorials explaining how to use the Ethena platform and its features.

- Responsive Support: A readily available and helpful customer support team to answer user questions and address any issues.

Potential Weaknesses:

- Limited Platform Features: A platform that may lack functionalities compared to more established DeFi projects.

- Complexities Not Addressed: The platform might not adequately explain the intricate financial instruments used by Ethena, potentially leaving users confused about the risks involved.

- Limited Educational Resources: A lack of educational resources to help users understand the concept of crypto-backed stablecoins and the specific risks associated with USDe.

5 Use Cases of USDe Synthetic Stablecoin

Apart from performing all the activities of a stablecoin, USDe stablecoin also has several use cases in the Ethena Finance ecosystem. Let us have a closer look at the use cases of the USDe synthetic stablecoin in this section.

1. Hedge Against Volatility

Being a stablecoin, USDe can be used as a hedge against the market volatility of cryptocurrencies. When there are unpredictable conditions in the market, users can convert their funds into USDe and ensure that their value remains stable.

2. Medium of exchange

USDe can be used as a medium of exchange for different types of financial transactions. This way, users can avoid the volatility that usually exists with other cryptocurrencies. The stable nature of USDe makes it a viable option for different types of transactions such as cross-border payments and other everyday transactions.

3. DeFi Applications

Additionally, USDe also helps token holders to access various decentralized financial applications on Ethena Finance. DeFi applications like lending, borrowing, and yield farming are all accessible for users through USDe. The stablecoin nature and its ability to seamlessly integrate with the Ethereum blockchain makes it a viable option to be used as a collateral for DeFi loans.

4. Savings and Investment Instrument

Having claimed to be the “Internet Bond”, USDe envisions becoming a savings instrument. Ethena Finance’s core vision is to create a stablecoin that is more efficient than the traditional stablecoins. Furthermore, it even helps users by generating yield from staking and hedging. This way, USDe synthetic stablecoin also acts as a savings and investment instrument.

5. Accelerating Crypto Adoption

With its innovative approach to providing a scalable and efficient form of money, USDe also helps accelerate crypto adoption in a broader sense. It eliminates all the usual limitations of cryptocurrencies such as volatility, complexity, and dependence on traditional financial systems.

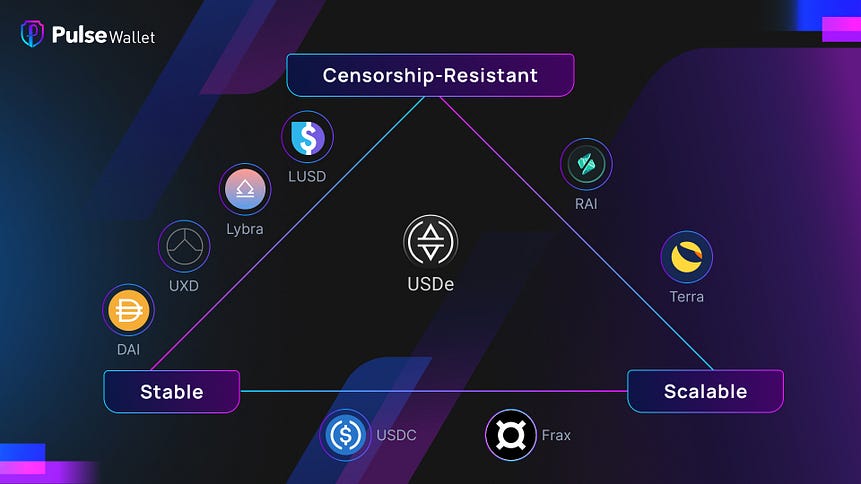

What problem does USDe solve?

Centralized stablecoins like USDC and USDT rely on collateral assets managed by financial institutions and banks. This creates inherent risks associated with asset management and regulatory control. USDe addresses this issue by not relying on collateral assets within the traditional banking system.

Stablecoins backed by overcollateralization and algorithmic stablecoins face difficulties in scaling and maintaining stability. USDe addresses this issue by applying a new model, utilizing derivatives on Ethereum that are staked, helping to enhance scalability and stability without relying on traditional collateral assets or complex algorithmic mechanisms.

USDe aims to generate economic profit from using the derivative structure on Ethereum, distributing profits to ecosystem members. This differs from the model of other stablecoins, where profits are typically internalized by the issuer without sharing with users. The project aims to minimize reliance on trust in centralized entities and enhance decentralization by using decentralized infrastructure for collateral asset maintenance and management.

The USDe Minting Mechanism

Users deposit Liquid Staking Tokens (such as stETH, rETH) into the Ethena protocol to receive USDe. These tokens represent Ethereum that has been staked.

When creating (minting) or redeeming USDe, users will incur slippage fees and transaction execution costs. These fees are included in the total transaction cost.

After receiving LST from users, Ethena Labs proceeds to open a short order on derivative exchanges. This order does not use leverage and has a value equivalent to the assets deposited into the protocol by users. The purpose of this is to hedge the price risk associated with the deposited assets.

How USDe Generates Profit and Prevents Slippage

How USDe Generates Profit

USDe earns profits through the following methods:

1 — Staking Ethereum: Users earn profits from staking Ethereum, including inflationary rewards from the Consensus Layer, fees from the Execution Layer, and MEV (Miner Extractable Value) capture. These profits are paid and calculated in ETH.

2 — Funding and Basis Spread from Hedging Delta Positions in Derivative Trading: When USDe is created, Ethena Labs opens short positions to hedge the delta of the received assets. Due to the imbalance between supply and demand for exposure to assets, there is often a positive interest rate and basis spread, one of the fees being the funding rate.

How USDe Prevents Slippage:

1 — USDe maintains its value equal to USD by automatically executing delta-neutral hedges through smart contracts for collateral assets. This ensures the stable USD value of collateral assets in all market conditions.

2 — Cross Market Arbitrage: Users can capitalize on the price difference of USDe between Ethena Labs and different markets to make profits. When USDe is bought or sold at a price different from 1 USD, users can execute buy or sell trades to bring USDe back to the $1 price, thereby helping to maintain the pegged value.

Future of Ethena Finance

Despite the controversies, Ethena Finance boasts a rapidly growing user base and significant trading volume. Its success hinges on its ability to maintain USDe’s peg and navigate the ever-changing DeFi landscape.

Here are some additional points to consider:

- Regulation: How will potential regulations in the cryptocurrency space impact Ethena Finance’s operations?

- Competition: How will Ethena Finance compete with other established DeFi platforms and stablecoin projects?

- Innovation: Will Ethena Finance continue to innovate and develop new features to stay ahead of the curve?

By staying informed about these developments, you can make a more informed decision about whether Ethena Finance aligns with your investment goals. Remember, it’s crucial to conduct your own research before investing in any cryptocurrency project.

Conclusion

Ethena Finance is carving out a niche in the DeFi landscape by providing a crypto-native stablecoin solution that leverages complex financial strategies to maintain currency stability and generate yields. Its innovative approach, combined with rapid adoption, suggests a promising future, although it also faces challenges typical of the volatile cryptocurrency market.

Disclaimer ||

The Information provided on this website article does not constitute investment advice ,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!

Leave feedback about this