Santander Private Banking International, the part of Banco Santander focused on high-net-worth clients, is now offering Bitcoin (BTC) and Ethereum (ETH) investing and trading services to customers with accounts in Switzerland.

The Spanish financial services giant is also reportedly planning to expand its offering to include other cryptocurrencies that meet its criteria in the coming months, according to a Coindesk report published on Monday, November 20.

The move that offers direct crypto exposure to the bank’s clients follows a marked shift in Santander’s approach to cryptocurrencies.

While Santander remained skeptical of the crypto market throughout 2022 and even limited its customers’ Bitcoin payments, it took a major turn in 2023. In June, for example, Santander rolled out a series of lectures titled “Digital Assets 101”, in which it sought to better educate its clients about the world of cryptocurrencies.

The lectures, among other topics, focused on explaining the key concepts pertaining to Bitcoin, such as the utility and advantages of its Lighting Network.

Santander Private Banking International, the part of Banco Santander focused on high-net-worth clients, is now offering Bitcoin (BTC) and Ethereum (ETH) investing and trading services to customers with accounts in Switzerland.

The Spanish financial services giant is also reportedly planning to expand its offering to include other cryptocurrencies that meet its criteria in the coming months, according to a Coindesk report published on Monday, November 20.

The move that offers direct crypto exposure to the bank’s clients follows a marked shift in Santander’s approach to cryptocurrencies.

While it remained skeptical of the crypto market throughout 2022 and even limited its customers’ Bitcoin payments, it took a major turn in 2023. In June, for example, Santander rolled out a series of lectures titled “Digital Assets 101”, in which it sought to better educate its clients about the world of cryptocurrencies.

Table of Contents

History of Santander Bank

Santander Bank, formally known as Santander Bank, N.A., is a significant player in the United States banking sector. Here’s a breakdown of the key aspects of this financial institution:

Origins and Reach:

- Founded in 1868 as Slavet Mutual Savings Bank in Wyomissing, Pennsylvania.

- Acquired by Sovereign Bank in 1997.

- Sovereign Bank was then acquired by Spain’s Banco Santander in 2008, forming Santander Bank, N.A.

- Operates as a wholly-owned subsidiary of Santander Group, a global banking giant with over 145 million customers worldwide.

- Maintains a strong presence in the northeastern United States, particularly in Massachusetts, Rhode Island, Connecticut, New York, New Jersey, Pennsylvania, and Delaware.

Products and Services:

- Offers a comprehensive range of personal and commercial banking products, including:

- Checking and savings accounts

- Credit cards

- Mortgage loans

- Small business loans

- Wealth management services

- Online and mobile banking platforms

- Focuses on providing convenient and accessible banking solutions for its customers.

- Known for its competitive interest rates and commitment to customer service.

Strengths and Competitive Advantages:

- Strong brand recognition as part of the global Santander Group.

- Extensive branch network in the northeastern United States.

- Wide range of financial products and services to cater to diverse customer needs.

- Focus on digital banking solutions for increased convenience.

- Commitment to financial inclusion and serving underserved communities.

Recent Developments and Future Outlook:

- Santander Bank has been actively investing in digital banking initiatives, expanding its online and mobile banking platforms.

- The bank faces competition from both traditional and online-only financial institutions.

- Continued focus on digital innovation and customer service will be crucial for maintaining a competitive edge.

Additional Points of Interest:

- Santander Bank is a strong supporter of financial literacy initiatives and community development programs.

- The bank has received some criticism for fees associated with certain accounts and services.

- It’s important for potential customers to compare rates and features before choosing a bank.

A Legacy Spanning Continents:

While Santander Bank in the US has its roots in the 19th century, its true story begins in 1857 with Banco Santander in Spain. This rich history positions the bank as a global leader with a deep understanding of international finance. The 2008 acquisition by Banco Santander wasn’t just a financial move; it brought a wealth of experience and a global network to the US market.

Beyond the US: A Global Powerhouse

Santander Group, the parent company, boasts a presence in over 10 countries in Europe and the Americas, with a particularly strong foothold in Latin America. This global reach allows Santander Bank, N.A. to leverage its international expertise to offer its US customers unique products and services. For example, international money transfers or trade finance solutions for businesses with international operations.

Community Focus: More Than Just Banking

Santander Bank recognizes its role goes beyond simply providing financial products. The bank actively participates in community development programs, promoting financial inclusion and empowering underserved communities. Initiatives like their “Inclusive Communities Plan” demonstrate a commitment to social responsibility and creating a positive impact on the communities they serve.

Navigating the Digital Age: Innovation and Security

Santander Bank understands the importance of digital banking in today’s world. They’ve invested heavily in user-friendly online and mobile banking platforms, allowing customers to manage their finances conveniently and securely. Cybersecurity is a top priority, and the bank implements robust measures to protect customer information.

A Look at the Competition: Standing Out in a Crowded Market

Santander Bank faces competition from both traditional brick-and-mortar banks and online-only financial institutions. To stay ahead, the bank focuses on:

- Competitive Rates: Offering attractive interest rates on deposit accounts and competitive loan terms.

- Superior Customer Service: Providing exceptional customer support through various channels, including branches, phone, and online chat.

- A Blend of Traditional and Digital: Maintaining a physical branch network while offering cutting-edge digital tools.

Choosing the Right Bank: It’s All About You

Santander Bank is a strong contender in the US banking sector. However, choosing the right bank depends on your individual needs. Consider factors like:

- The types of accounts and services you require.

- The fees associated with different accounts.

- The convenience of branch locations or online banking features.

- The bank’s reputation for customer service.

Santander Bank’s future looks bright. By leveraging its global expertise, commitment to digital innovation, and focus on social responsibility, the bank is positioned to be a trusted financial partner for individuals and businesses alike. It’s important to compare this Bank with other options before making a decision, but for those seeking a well-established bank with a global perspective and a local focus, Santander Bank is definitely worth considering.

Santander Bank model

Santander Bank model is based on three pillars:

01. Customer focus:

Building a digital bank with branches

New operating model to build a digital bank with branches, with a multichannel offer to fulfil all our customers’ financial needs.

02. Our scale:

Local and global scale

- Our global and in-market scale helps us to improve our local banks’ profitability, adding value and network benefits.

- Our activities are organized under five global businesses: Retail & Commercial Banking (Retail), Digital Consumer Bank (Consumer), Corporate & Investment Banking (CIB), Wealth Management & Insurance (Wealth) and Payments.

- Our five global businesses and our presence in Europe, DCB Europe, North America and South America support value creation based on the profitable growth and operational leverage that ONE Santander provides.

03. Diversification:

Business, geographical and balance sheet

Well-balanced diversification between businesses and markets with a solid and simple balance sheet that gives us recurrent net operating income with low volatility and more predictable results.

Know more visit: https://www.santanderbank.com/

Growing interest in crypto among major banks

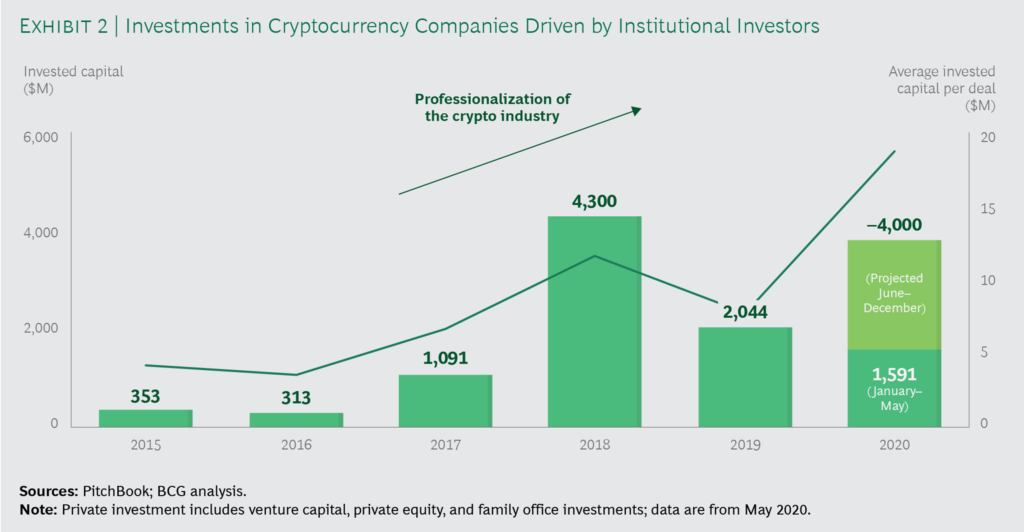

Santander’s decision to start offering Bitcoin and Ethereum to high-net-worth clients in Switzerland comes at a time of growing institutional interest in digital assets. This year has, for example, seen a deluge of German banks seeking crypto-focused licenses.

In June, the $1.2 trillion banking giant Deutsche filed for a crypto custody license. More recently, other major institutions, including DZ Bank and Commerzbank – Germany’s third and fourth-largest banks – gained said licenses from BaFin.

The move toward greater crypto adoption can also be seen globally. This summer, HSBC added support for Bitcoin and Ethereum exchange-traded funds (ETFs) in Hong Kong. The trend is also visible in the U.S. where, for example, BNY Mellon called blockchain technology its “longest-term play” in January despite the regulatory pressure on the wider crypto industry being near a boiling point at the time.

Santander Bank, Spain’s leading financial institution and a major player in the US market, has been showcasing a growing interest in the cryptocurrency space. This aligns with the broader trend of major banks like JPMorgan Chase and Goldman Sachs exploring ways to engage with the digital asset world. Here’s a closer look at Santander’s foray into crypto:

From Skeptic to Supporter:

It’s stance on crypto has evolved over time. Initially, they expressed concerns about volatility and security risks. However, recent developments suggest a shift in their perspective:

- Brazilian Crypto Trading Launch: In July 2023, Santander Bank Brazil became the first major bank in Latin America to offer Bitcoin and Ethereum trading services to its high-net-worth clients. This move indicates a willingness to cater to the growing demand for crypto exposure among their customer base.

- Focus on Security and Regulation: The bank prioritizes security and regulatory compliance when venturing into crypto. They leverage partnerships with established custody providers and emphasize responsible, regulated crypto adoption.

- Educational Initiatives: The bank is actively educating its customers about digital assets. This suggests a long-term commitment to building trust and understanding within their client base regarding cryptocurrency.

Santander’s Potential Impact:

It’s growing interest in crypto holds significance for several reasons:

- Legitimizes the Market: The involvement of a well-respected and established financial institution like Santander validates cryptocurrency as a legitimate asset class. This could attract more traditional investors who may have been hesitant before.

- Sets a Precedent for Other Banks: Santander’s success in navigating the crypto space could pave the way for other major banks to follow suit. This would accelerate mainstream adoption and potentially lead to a more robust regulatory framework.

- Focus on Client Needs: The bank focus on high-net-worth clients initially suggests a cautious approach. However, it also indicates an understanding of the growing demand for crypto exposure among their client base.

Looking Ahead: What to Expect from Santander

The future of Santander’s crypto involvement remains to be seen. Here are some possibilities:

- Expanding Crypto Offerings: The initial focus on Bitcoin and Ethereum might broaden to other established cryptocurrencies as regulations and security measures evolve.

- Increased Accessibility: This bank may offer crypto-related services beyond high-net-worth clients, potentially catering to a wider range of customers.

- Integration with Traditional Banking: The bank could explore ways to integrate crypto assets into existing financial products and services.

Disclaimer ||

The Information provided on this website article does not constitute investment advice ,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!

Leave feedback about this