Sending cryptocurrency is as easy as choosing the amount to send and deciding where it goes. The exact procedure for doing so will depend on the type of cryptocurrency wallet you are using, but the main thing you need to know is the ‘address’ of the recipient.

What is Sending crypto?

Sending crypto, also referred to as transferring crypto, is the process of moving your cryptocurrency holdings from one wallet to another. It’s similar to sending money electronically between bank accounts, but instead of traditional financial institutions, crypto transactions happen on blockchain networks.

Here’s a breakdown of the key points involved in sending crypto:

- What you need:

- Recipient’s wallet address: This unique identifier acts like a crypto bank account number specific to the blockchain network.

- Crypto to send: Ensure you have enough to cover the transfer amount and any fees.

- Your crypto wallet: You’ll need access to initiate the transfer from your own wallet.

- The process (generally):

- Log in to your crypto wallet.

- Locate the “Send” or “Transfer” section (may vary depending on your wallet).

- Choose the cryptocurrency you’re sending.

- Input the recipient’s wallet address (be very careful to enter it correctly, mistakes can result in lost funds).

- Specify the amount of crypto you want to transfer.

- Review the transaction fee (fees can vary depending on network conditions and urgency).

- Confirm the transaction after double-checking all the details.

- Important things to remember:

- Blockchain confirmations: Transactions need confirmation on the blockchain network, which can take seconds to hours depending on the cryptocurrency.

- Transaction fees: Blockchain transactions often involve fees paid to miners or validators who secure the network. These fees can fluctuate based on traffic and chosen transaction speed.

- Sending to the correct address is crucial: Sending crypto to an incorrect address can result in permanent loss of funds. Always verify the recipient’s address meticulously before confirming.

- Wallet functionalities may differ: Some wallets offer features like address books or QR code scanning for recipient addresses.

- Additional considerations:

- Sending limits: Some exchanges or wallets may have limitations on the amount of crypto you can send in one go.

- Minimum transfer amounts: There might be a minimum amount required to send a specific cryptocurrency.

How it Sending crypto Work?

Sending crypto involves transferring your digital assets from one crypto wallet to another on a blockchain network. Here’s a deeper dive into the process:

Behind the Scenes:

- Initiating the Transfer: You start by logging in to your crypto wallet and navigating to the send/transfer section. There, you select the type of cryptocurrency you’re sending and enter the recipient’s wallet address.

- Broadcast to the Network: Once you confirm the transaction, your wallet broadcasts the transaction details to the blockchain network. This transaction includes:

- Sender’s address: Identifies where the crypto originates.

- Recipient’s address: Specifies the destination of the crypto.

- Amount of crypto being Sending crypto

- Digital signature: This proves you have the private key to authorize the transfer (kind of like a secret handshake).

- Miners or Validators Verify: Miners (for Proof-of-Work blockchains) or validators (for Proof-of-Stake blockchains) on the network pick up the transaction. They verify the following:

- Sufficient funds: Do you have enough crypto to cover the transfer amount and fees?

- Valid signature: Does your digital signature match the sender’s private key?

- Adding to the Block: If everything checks out, the miners/validators add the verified transaction to a new block on the blockchain. This new block is cryptographically linked to the previous block, creating a secure chain of transactions.

- Confirmation and Completion: Once a certain number of blocks (determined by the specific blockchain) are added on top of the block containing your transaction, it’s considered confirmed. This signifies a successful transfer of crypto.

The Role of Fees:

Transaction fees play a crucial role in incentivizing miners/validators to process your transaction and secure the network. Fees can vary depending on:

- Network congestion: When there’s a high volume of transactions happening, fees tend to be higher due to increased demand for block space.

- Transaction speed: If you want your transfer prioritized and confirmed faster, you might need to pay a higher fee.

Important Considerations:

- Irreversible Transactions: Once a transaction is confirmed on the blockchain, it’s generally irreversible. Sending to the wrong address can result in lost funds. Double-check the recipient’s address meticulously before confirming.

- Confirmation Times: Confirmation times can vary depending on the blockchain network. Bitcoin transactions might take several minutes to confirm, while others like Solana can be much faster.

Sending crypto offers several advantages:

- Fast and global: Crypto transactions can be significantly faster and more global compared to traditional bank transfers.

- Security: Blockchain technology provides a secure and transparent way to transfer crypto assets.

- Lower fees: In some cases, sending crypto can be cheaper than traditional money transfers, especially for international transactions.

However, there are also some limitations to keep in mind:

- Volatility: Cryptocurrencies can be highly volatile, meaning their value can fluctuate significantly.

- Complexity: Crypto wallets and transactions can be more complex to understand and use compared to traditional banking systems.

- Regulation: The regulatory landscape surrounding cryptocurrencies is still evolving, which can create uncertainty for some users.

By understanding how sending crypto works and the factors involved, you can make informed decisions when transferring your crypto assets. Remember, it’s always a good practice to be cautious and double-check everything before initiating a crypto transaction. Sending crypto

How to securely send crypto

To send cryptocurrency, you need to know the address of the recipient. A crypto address is an alphanumeric string that looks something like this Bitcoin address:

3J98t1WpEZ73CNmQviecrnyiWrnqRhWNLy

Or this Ethereum address:

0xb794f5ea0ba39494ce839613fffba74279579268

One way to send crypto, then, is to simply copy the recipient’s address to your clipboard, then paste it in the send field of the cryptocurrency wallet app you are using.

Cryptocurrency addresses can also be displayed in QR code format. If you’re sending crypto from a mobile wallet like the multi-chain Bitcoin.com Wallet, you can use your phone’s camera to scan the QR code of the address you want to send to. This will automatically fill in the address.

As for the amount to send, most wallets allow you to toggle between showing the send amount in cryptocurrency units, for example bitcoin (BTC) or Ethereum (ETH), or showing it in your local currency.

IMPORTANT: Cryptocurrency transactions are irreversible, so if you send to the wrong address, you’ll most likely never see that crypto again. Sending crypto

Is Sending crypto Safe?

Sending crypto can be safe, but it depends on several factors and how carefully you approach it. Here’s a breakdown of the safety considerations:

Safety Measures:

- Choose a reputable wallet: Store your crypto in a secure wallet that offers strong security features. Consider using a hardware wallet for significant holdings, as they offer the highest level of security.

- Double-check recipient addresses: This is crucial to avoid accidentally sending your crypto to the wrong address, which could result in permanent loss.

- Verify transaction details: Before confirming the transaction, carefully review the amount you’re sending, the recipient’s address, and any applicable fees.

- Enable 2FA (two-factor authentication): This adds an extra layer of security to your wallet login process, making it harder for unauthorized access.

- Beware of scams: Be cautious of phishing attempts or social engineering scams that try to trick you into revealing your private key or sending crypto to fraudulent addresses.

Risks Involved:

- Hacking: Crypto wallets and exchanges can be vulnerable to hacking attempts. Choose a reputable provider with a strong security track record.

- Human error: Mistakes like sending crypto to the wrong address can lead to permanent loss of funds.

- Rug pulls: Not all projects listed on exchanges are legitimate. Be wary of new and unproven cryptocurrencies.

Security Tips:

- Only send crypto to trusted recipients.

- Don’t share your private key with anyone.

- Be cautious of unsolicited investment advice or offers that seem too good to be true.

- Stay informed about crypto scams and security vulnerabilities.

Overall:

By following Sending crypto these safety practices and being cautious, you can minimize the risks involved in sending crypto. However, it’s important to remember that cryptocurrencies and blockchain technology are still relatively new and evolving. There will always be some inherent risk involved, so it’s crucial to be aware of the potential dangers before making any transactions. Sending crypto

What are cryptocurrency network fees?

Network fees were initially used as a way to deter people from flooding the network with transactions. While that original use still exists, it is mostly a way to incentivize miners or validators to add transactions to the next block.

Many crypto wallets (including the multi-chain Bitcoin.com Wallet) allow you to customize the network fees you pay when you send crypto. This will depend on the cryptocurrency.

For example, Bitcoin transactions incur a small fee which is paid to the miners that confirm them. Transactions with higher fees attached to them are picked up sooner by miners (who optimize for profitability), so higher-fee transactions are more likely to be included in the next batch, or ‘block,’ of transactions that’s added to the Bitcoin blockchain. This means you can opt for faster transaction processing by paying a higher fee. Alternatively, if you’re not in a rush to have your transaction confirmed, you can save money by opting for a lower fee.

However, you need to be careful because if you set the fee too low, your transaction may take hours or get stuck for days. Don’t worry though, you’re never in danger of losing bitcoin by setting the fee too low. In the worst case, you’ll have to wait 72 hours with your bitcoin in limbo until the transaction is cancelled, at which point you’ll again have access to it. Sending crypto

How are cryptocurrency fees determined?

Crypto fees are determined with minor differences blockchain to blockchain. As a general rule, there will be a base fee priced by the amount of data in the transaction. Transactions that require more data to execute will have a higher base fee. On top of that, people can manually add extra to help get their transaction included in the next block.

In Bitcoin, fees are measured in satoshis/byte. A satoshi is the smallest divisible unit of bitcoin, which is 0.00000001 BTC (a hundred millionth of a bitcoin). Each transaction is made up of data, which is measured in bytes. More complicated transactions involve more data and so are more expensive.

In Ethereum, transactions cost gas to execute. Gas is paid in ether (ETH), Ethereum’s native currency. However, the price is denoted in gwei, which is equal to 0.000000001 ETH, because it is more human readable to say a transaction cost 5 gwei than 0.000000005 ETH.

Why are some cryptocurrency transactions more expensive than others?

As stated in the above answer, blockchain transactions are in part determined by the amount of data in the transaction. The more data necessary to complete a transaction, the greater this part of the cost will be. For example, on the Ethereum network, transferring a token from one address to another is a much simpler, and therefore smaller, transaction than minting an NFT.

The above simple example is easy to understand, but there can be pronounced differences between like transactions too, and this requires a more technical explanation. Let’s imagine Alice and Bob both send 1 BTC each to Carol at approximately the same time. Alice’s transaction fee is 100 satoshis and Bob’s is 100,000. How is that possible?

Alice bought her BTC in two 0.5 amounts. Her wallet total is 1 BTC, but the two halves will have originated from different ‘notes.’ In effect, this means Alice has two 0.5 notes in her wallet. When Alice sent Carol 1 BTC, she actually sent those two notes. More notes means more data.

Bob received his 1 BTC in one hundred 0.1 BTC increments, or 100 notes. When Bob sent Carol his 1 BTC, it was actually 100 notes, which required significantly more data.

How do I set the network fee in my cryptocurrency wallet?

This, again, depends on the wallet. In fact, many centralized cryptocurrency exchanges don’t give you any control over the network fee whatsoever. Instead, they have a predetermined fee (which is almost always set higher than the actual fees the exchange will pay). In other words, the exchange profits when their customers withdraw cryptocurrency. This is a common revenue-generation strategy for centralized cryptocurrency exchanges.

Most self-custodial wallets, however, allow you to customize the fee you attach to your crypto transactions. The Bitcoin.com Wallet, for example, has three convenient fee settings for Bitcoin and Ethereum, as well as the option to set custom fees.

The default speed (“Fast”) is set to have your transaction confirmed most likely within the next three blocks (so less than 30 minutes). If you change it to “Fastest,” you’ll pay a higher fee and likely have your transaction confirmed in the next two blocks (so less than 20 minutes). Changing it to “Eco” will save you some money, but still result in your transaction most likely getting confirmed within the next six blocks, so generally less than 60 minutes.

Here’s an example of how to customize the transaction fee in the Bitcoin.com Wallet for Ethereum and Ethereum Virtual Machine (EVM) chains including Avalanche and Polygon:

If you’re setting custom fees, which is only recommended for advanced users, you’ll want to use a tool like Bitcoinfees for Bitcoin or Etherscan’s Gas Tracker for Ethereum to ensure you’re choosing an appropriate fee given the current state of network congestion.

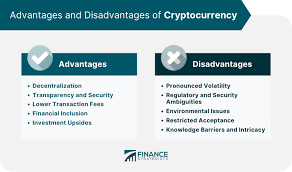

Advantages & Disadvantages

Advantages of Sending Crypto

- Fast and Global: Crypto transactions can be significantly faster than traditional bank transfers, especially for international transactions. Transactions can be initiated and completed in minutes or even seconds, depending on the blockchain network.

- Security: Blockchain technology provides a secure and transparent way to transfer crypto assets. Transactions are recorded on a public ledger, making them tamper-proof and verifiable. Additionally, features like digital signatures help ensure only the authorized owner can transfer the crypto.

- Lower Fees: In some cases, sending crypto can be cheaper than traditional money transfers, especially for international transactions. Traditional transfers often involve intermediary banks and fees at each stage. Crypto transactions typically only involve a network fee paid to miners or validators.

- Decentralization: Crypto transactions bypass traditional financial institutions, offering greater control and independence to users. You don’t need permission from a bank or any other central authority to send crypto.

- 24/7 Availability: Crypto markets operate globally and constantly, so you can send and receive crypto anytime, unlike traditional banking systems that may have limited operating hours.

- Potential for Investment: Sending crypto can be seen as a way to invest in a new asset class. The value of some cryptocurrencies has experienced significant growth in the past.

Disadvantages of Sending Crypto

- Volatility: Cryptocurrencies can be highly volatile, meaning their value can fluctuate significantly in a short period. This can be risky if you’re sending crypto for a purchase and the price drops before the transaction is completed.

- Complexity: Crypto wallets and transactions can be more complex to understand and use compared to traditional banking systems. There’s a learning curve involved in using crypto wallets and understanding blockchain technology.

- Irreversible Transactions: Once a transaction is confirmed on the blockchain, it’s generally irreversible. Sending to the wrong address can result in permanent loss of funds. There’s no way to recover crypto sent in error.

- Regulation: The regulatory landscape surrounding cryptocurrencies is still evolving. This can create uncertainty for some users and may impact how easily you can send and receive crypto in certain regions.

- Security Risks: Crypto wallets and exchanges can be vulnerable to hacking attempts. It’s crucial to choose reputable providers with strong security measures and to practice safe habits like using strong passwords and 2FA.

- Scams: The crypto space can attract scammers. Be cautious of phishing attempts, social engineering scams, and unsolicited investment advice.

Overall, sending crypto offers advantages like speed, security, and lower fees for some transactions. However, it’s important to be aware of the disadvantages as well, such as volatility, complexity, and security risks.

Disclaimer ||

The Information provided on this website article does not constitute investment advice ,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency Stocks Bonds should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!

Leave feedback about this