A bull market is when the overall rise of stocks rise around 20% for an extended period of time.

- A bull market is an extended period when prices for stocks or other assets are steadily on the rise, usually during the expansion phase in the business cycle.

- Bull markets are usually accompanied by high investor confidence and a strong overall economy.

- Trying to time a bull market is harder than it looks, and most investors should stick to their long-term strategy and goals.

If you’re interested in investing, you’ll notice the phrase “bull market” often comes up in common parlance. “The bulls were out today,” says some strategist on TV or X (formerly known as Twitter). But what is a bull market? And how does it affect you?

Let’s break down what bull markets are, how they differ from bear markets, and what they mean for institutional and individual investors.

Table of Contents

What is a bull market?

A bull market (aka a bull run) is a long, extended period in the market when overall stock prices are on the rise.

“Bull markets happen when the economy is strengthening, and stock prices are rising,” says Teresa J.W. Bailey, CFP and senior wealth strategist at Waddell & Associates.

Defining a bull market

A period of rising prices and optimism

There’s no formal metric that defines a bull market. But one common rule of thumb is a 20% price increase from the most recent low. This rise could coincide with signs that prices will continue to grow.

The term is often applied to the stock market, as measured by the major indexes:

- S&P 500

- Nasdaq Composite

- Dow Jones Industrial Average

But bull markets can apply to any asset class, whether it be stocks, real estate, bonds, or currencies.

Investor confidence

As asset values follow a steady, upward trend, market participants feel optimistic they will keep appreciating. In other words, investors grow more confident, which causes them to buy more, therefore fueling additional gains.

Economic growth

Steady improvement in leading indicators, for example increases in economic input or a labor market that is slowly gaining strength, frequently coincide with a bull market in assets like stocks. As business conditions improve and asset values climb, it causes continued increases in investor confidence, which in turn may make it easier for these individuals to spend on consumer goods and invest more money into assets, therefore creating further price gains.

Companies bet more on their future during bull markets. Buoyed by consumer buying, businesses focus on expansion and invest in themselves.

Unemployment rates frequently go down during bull markets. With companies expanding, they hire more employees, decreasing unemployment. Average wages go up as companies compete for workers. Workers are also more likely to look for a job since they have a better chance of finding one that pays them more than their current job.

Christian Nwasike, principal & executive managing partner at Practice Management Consultants, LLC, and chairman of the board of the Association of African American Advisors, spoke to how this impacts one specific segment of the labor market.

“Unemployment in the black African American community is lower than it has been in the past,” says Nwasike. “Since more people work, they can invest money in the market for long-term planning on whatever they choose.”

Money is easier to spend amid these improving conditions. Increased wages mean customers have more money to spend. After all, it feels like getting more will be relatively easy.

This can in turn fuel inflation, since all that excess money can increase the price of goods.

How does Bull Market work?

A bull market is essentially a period of optimism in the investment world. Here’s how it works:

- Prices go up: The key feature is a sustained increase in security prices, typically stocks. This rise can be measured by major indexes like the S&P 500. While there’s no exact threshold, a common benchmark is a 20% increase from recent lows.

- Investor confidence: This optimism fuels the rise. Investors are more likely to buy stocks in the belief that their value will continue to climb, allowing them to profit by selling later. This increased buying drives prices even higher.

- Psychology plays a role: Bull markets can become self-fulfilling prophecies. As prices rise, more investors jump in, further accelerating the rise. Positive media coverage adds to the feeling that the good times will keep rolling.

- It’s not always smooth sailing: Even during bull markets, there will be fluctuations and corrections (temporary dips). But the overall trend is expected to be upward.

Here’s an interesting point: bull markets tend to be less volatile than bear markets (when prices fall). So, while they may not be as exciting, they can be a good time for long-term investors to grow their wealth.

Why do bull markets happen?

Multiple potential factors (economic, political, etc.)

Many different variables can ignite the broad, upward trend in asset values that characterizes a bull market. For example, changes in the business cycle can help contribute to a bullish trend.

A bull market tends to occur when the economy is strengthening from greater business investment and higher consumer spending. As people spend more on goods and services, businesses can generate more revenue, create jobs, and invest in new technologies.

The more the economy can grow, the longer the bull market can run. However, as spending and production increase, the prices of goods and services can inflate. Too much inflation can end up hurting the economy.

Another factor that could coincide with the start of a bull market is changes in policy. For example, if a new regime takes control of a country, it could potentially enact legislative changes that are more favorable for businesses, therefore jumpstarting more robust economic growth and motivating investors to put their money into risk assets like stocks. If a new regime reduces regulation or cuts taxes, for example, it can help fuel stronger economic growth and greater investor confidence.

Strong earnings and positive outlook

If corporate earnings improve, this can help make investors more optimistic about how well businesses, and therefore the broader economy, are performing. This can make these investors more likely to put their money into assets like stocks and real estate that benefit from improving business conditions.

Further, more robust earnings can coincide with greater business spending, whether that comes in the form of stronger hiring or more spending on capital equipment, both which help stimulate the broader economy.

How to identify a bull market

Sustained increase in stock prices

One clear indicator of a bull market is continued gains in the prices of assets that benefit from economic growth and strengthening business conditions, for example stocks. When the price of these securities keeps pushing higher, investors are frequently confident that this upside will continue, therefore fueling additional purchases of these assets.

High investor demand

Another sign that can serve as a clear indicator of a bull market is robust investor demand. When the value of assets are following a steady, upward trend, inventors tend to be optimistic about their future price direction, which in turn motivates them to buy, as they expect they will get a compelling return on their initial investment.

This of course contributes to additional gains in asset values.

How long do bull markets last?

It’s impossible to predict exactly when a bull market will end. But it always does, after an external force affects investors’ feelings about the future and stock prices start to look too pricey. Plus, no two bull markets are the same.

As the old saying goes, bull markets don’t die of old age. They die when the market changes fundamentally, prices rise too high or fast, or some other event deflates investor confidence. Because it’s impossible to tell when a market has reached its top from a ground-level perspective, it’s very difficult to foresee the turning point before you are in it. Of course, that doesn’t stop investors from trying.

“Markets move quickly. Historically, we’ve seen markets move as much as 9 or 10% in one day,” says Bailey.

Why is it called a bull market?

Though a charging bull and a hibernating bear are useful images, bear and bull markets are thought to have gotten their names from how they attack. Bears swipe down at their prey while bulls buck their heads up. The term “bull” is also believed to describe how confident investors “charge” the market.

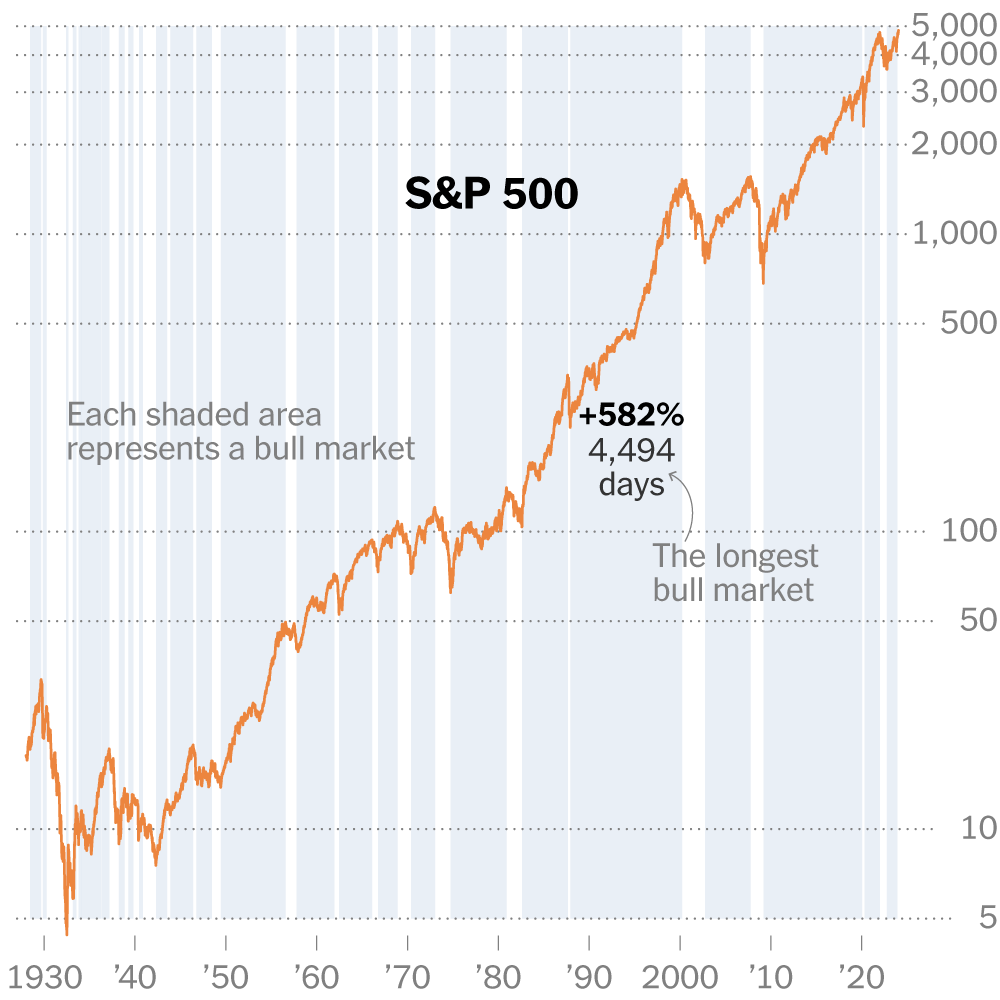

Historic bull markets

The length of any given bull market is informed by the factors of its time — a concept made clear if you take a moment to examine some of the biggest bull markets in history:

Post-World War II Rally: June 1949 to August 1956

In these prime post-war years, the S&P 500 rose 267% over 86 months, leading to a commendable annualized return of 20%. On the home front, consumer goods purchased to fuel the Baby Boom were the main driver, while a strong export market also helped companies grow.

The Federal Reserve raising interest rates and international tension stopped this bull’s run, beginning a bear market phase. However, the market was back in bull territory by 1957.

The Housing Boom: October 2002 to October 2007

The Housing Bubble coincided with dramatic growth in the real estate sector that began after the federal government deeply cut interest rates in hopes of encouraging investment. The financial institutions that encouraged home financing, real estate investing, and mortgage trading did extremely well until interest rates started to climb again. Subprime borrowers also began defaulting on their loans, leading to the subprime mortgage crisis.

The bull market ended in early October 2007 as stocks peaked, marking the start of a recession. A bear market arrived the following summer.

The Longest Bull Run in History: March 2009 to March 2020

This record-breaking bull market lasted 131.4 months (nearly 11 years), making it the longest in history.

After taking a beating during the Great Recession (2007 to 2009), the S&P 500 gained over 400% after reaching a low of roughly 666 points on March 6, 2009. On February 12, 2020, the Dow Jones Industrial Average reached a record high of 29,551 points. The gains for the S&P alone amounted to over $18 trillion on paper, and unemployment was at a 40-year low, under 4%.

But just a month later, on March 11, the Dow lost over 20% of its value, falling to under 19,000. The S&P 500 and the Nasdaq were pounded soon after. The most obvious cause? The global spread of the new Coronavirus brought widespread fears over economic and social damage, as businesses shuttered and millions of people were thrown out of work.

Are we in a bull market in 2024?

Stock traders are officially running with the bulls as the S&P 500 skyrockets amidst enthusiasm for artificial intelligence (AI) in mega-cap tech stocks like Nvidia, which has surged more than 200% over the last year. January 2024 is the first time the S&P 500 reached a record high in two years. After the October 2022 low point — the definitive start of the bull market — the market made a remarkable 42% recovery with the help of the AI boom and bullish tech sector.

Stock traders can expect more stock growth in their portfolios, especially for folks largely invested in tech stock powerhouses like Nvidia, Alphabet, and Amazon. Some stock experts believe the S&P 500 is expected to rise another 99% over the next four years. But not everyone is as confident in this prediction.

However, it’s important to remember that the stock market is unpredictable, and while history tells us that a bull market can last for many years, there’s no guarantee. Therefore, it’s best to think long-term, thoroughly research potential investment opportunities, frequently rebalance your portfolio, and diversify your asset allocation to match your goals.

Disclaimer ||

The Information provided on this website article does not constitute investment advice ,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!

Leave feedback about this