What Is Market Capitalization?

Market capitalization, or “market cap,” represents the total dollar market value of a company’s outstanding shares of stock. Investors use this figure to determine a company’s size instead of sales or total asset value. In an acquisition, the market cap helps determine whether a takeover candidate represents a good value for the acquirer.

KEY TAKEAWAYS

- Market capitalization shows how much a company is worth as determined by the total market value of all outstanding shares.

- To calculate a company’s market cap, multiply the number of outstanding shares by the current market value of one share.

- Market cap is used to determine a company’s size, and then compare the company’s financial performance to other companies of various sizes.

Table of Contents

How to Calculate Market Cap

Market capitalization estimates a company’s value by extrapolating what the market thinks it is worth for publicly traded companies and multiplying the share price by the number of available shares. After a company goes public and begins trading on an exchange, its share price is determined by supply and demand. As market prices move, the market cap becomes a real-time estimate of the company’s value. The formula for market capitalization is:

Market Cap = Current Share Price * Total Number of Shares Outstanding

A company with 20 million shares selling at $100 a share has a market cap of $2 billion. A second company with a share price of $1,000 but only 10,000 shares outstanding, has a market cap of $10 million.

An initial public offering (IPO) helps determine a company’s first market capitalization. An investment bank employs valuation techniques to derive a company’s value and determine how many shares will be offered to the public and at what price.

Market Cap and Company Size

Large-cap companies typically have a market capitalization of $10 billion or more and represent major players in well-established industries and sectors.1 These companies generally reward investors with a consistent increase in share value and dividend payments. Examples of large-cap companies include Apple Inc., Microsoft Corp., and Alphabet Inc.

Mid-cap companies generally have a market capitalization between $2 billion and $10 billion.2 Mid-cap companies operate in an industry expected to experience rapid growth. Mid-cap companies are in the process of expanding and carry an inherently higher risk than large-cap companies. One example of a mid-cap company is Eagle Materials Inc. (EXP).3

Companies with a market capitalization between $250 million and $2 billion are commonly classified as small-cap companies. These small companies may serve niche markets and new industries. These companies are considered higher-risk investments due to their age, the markets they serve, and their size. Small-cap share prices may be more volatile but provide greater growth opportunities than large caps. Smaller companies, known as micro-cap, have values below $250 million.2

Market Cap and Digital Currency

Because new digital currency offerings theoretically thin the value of existing coins, tokens, or shares, a different market cap formula can be used to calculate the market cap for all authorized shares or tokens. Analysts use diluted market cap to understand potential changes to a security, token, or coin’s price.4 The diluted market cap formula is:

Diluted Market Cap = Current Share Price * Total Number of Shares Authorized

Assume Bitcoin trades at $24,000 per coin, with 19.1 million Bitcoin already issued. The total number of potential Bitcoin that may be minted is 21 million. Therefore, Bitcoin’s market cap calculations are:

Market Cap = $24,000 * 19.1 million = $458.4 billion

Diluted Market Cap = $24,000 * 21 million = $504 billion

Misconceptions About Market Caps

Although it is used to describe a company, market capitalization does not measure the equity value of a company. Only a thorough analysis of a company’s fundamentals can do that. Shares are often over- or undervalued by the market, meaning the market price determines only how much the market is willing to pay for its shares.

The market cap does not determine the amount the company would cost to acquire in a merger transaction. A better method of calculating the price of acquiring a business outright is the enterprise value.

Learn more: https://gemini.google.com/app

Market Capitalization Categories

Broadly speaking, based on market capitalization, the stock market classifies stocks into various categories:

- Large Cap – Companies with a market cap above $10 billion are classified as large-cap stocks. Some examples would be Apple, Microsoft, IBM, Facebook, etc.

- Mid Cap – Companies whose market cap ranges from $1 billion to $10 billion. Mid-cap stocks, in general, are more volatile than large-cap stocks and consist more of growth-oriented stocks.

- Small Cap – Companies with a market capitalization between $250 million to $1 billion. They are high risk and high return stocks, as the companies are in the growth stage. A large number of companies belong to the small-cap category.

- Micro Cap – They are the penny stocks that are relatively young. The micro-cap companies’ potential for growth and decline are of similar nature. They are not considered to be the safest investment. Hence, they require lots of research before investment.

The table below shows the Market Capitalization of selected companies as of May 2021:

| Name of the Company | Sector | Market Cap (Bn) |

|---|---|---|

| Apple Inc. | IT | $2,080.8 |

| Alphabet Inc. | IT | $1,534.3 |

| Facebook Inc. | IT | $889.2 |

| Microsoft Corp. | IT | $1,831.1 |

| Amazon.com | Consumer Discretionary | $1,629.9 |

| Walmart Inc. | Consumer Staples | $399.3 |

| JP Morgan Chase & Co. | Financials | $487.7 |

| Goldman Sachs Group | Financials | $121.8 |

| Nike Inc. | Footwear | $210.1 |

| AT&T Inc. | Telecom | $206.8 |

| US Cellular Corp. | Telecom | $3.2 |

Investors can use a company’s classification and actual market capitalization value to make smart investment decisions. Generally, large-cap companies own more capital and assets than small-cap companies, and as such, are considered lower-risk investments than small-cap ones. Moreover, small-cap companies tend to show higher growth potential than their larger counterparts and, as such, are likely to provide investors with more opportunities for capital gains.

Equity Value Metric

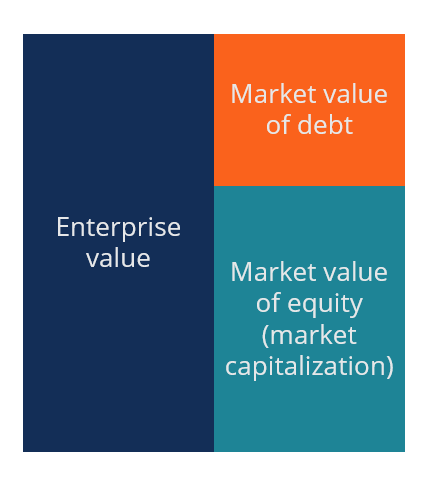

It’s important to know that a company’s market capitalization is the total value of its equity only. A company’s Enterprise Value is the value of the entire business, including both equity and debt capital.

A simple example of the difference between equity value vs enterprise value is with a house. If a house is worth $1,000,000 and has a $700,000 mortgage, the equity value is $300,000. The same applies to a business. A company with a Market Cap (equity value) of $10 billion and debt of $5 billion has an Enterprise Value of $15 billion.

Learn more about enterprise value vs equity value.

Market Capitalisation Formula

One of the major factors while evaluating a stock is on the basis of the market capitalization in India. Before going into the finer nuances, knowing the formula for this evaluation method can provide clarity to investors.

MC = N X P

Where,

MC stands for Market Capital,

N for the number of outstanding shares,

And P is the closing price of each share of the concerned company.

An example can demonstrate the calculation of market capitalization with more ease. If a company has 10,000 shares, each with a closing price of Rs.100; the total MC of the company would be computed as follows.

MC = N X P

= 10,000 X Rs.100

= Rs.1,000,000

The total value of this company comes at Rs.10 lakh.

Importance of Market Cap

While the importance of market capitalization has been touched upon in its definition, it is crucial for potential investors to understand its need in further detail. This can also help them in understanding the market as well as its impact on the shares and value of a company.

- Universal Method

This is the most widely used method around the globe to evaluate a company. Since this is one of the universally accepted methods, this makes it easy for investors to understand a company’s value irrespective of their geographical or economic locus.

- Precise in Suggestion

Suggesting market conditions is always subject to risks since it can fluctuate due to many factors. Nevertheless, the market cap is one method which is quite precise in its evaluation. As a result, though not full-proof due to obvious reasons, it is a reliable method to judge the risk associated with investing in a company.

- Affects the Index

This method is also used to weigh the shares of different companies for the index in the share market. Using this method, stocks with higher market capitalization get better weight in the index.

- Helps in Comparison

Since this is a universal method that can be applied to evaluate any company’s market worth, it is a convenient method for investors to compare different companies. This comparison not only helps in understanding the size of a company, but also the risk associated with investing in them.

- Balanced Portfolio

Investors should maintain a balanced portfolio to ensure they do not run the risk of any major loss. This includes opting to invest in a few top companies by market cap, along with the high-risk investments in developing enterprises.

While this evaluation process is convenient and universally accepted, investors should also note that it does not consider debt and other financial liabilities of a company. Furthermore, it also does not take into account the different types of returns, like the splitting of stocks, dividends, etc.

Types of Companies Based on Market Cap

Based on this popular method of evaluating a company, there are 3 different types of stocks from which an investor can choose. Balancing out the portfolio with a good combination of all of these can minimise the chances of risk.

| Type of Stock | Market Cap |

| Small-Cap Stocks | Up to Rs.500 crore |

| Mid-Cap Stocks | From Rs.500 crore up to Rs.7,000 crore |

| Large-Cap Stocks | From Rs.7,000 crore up to Rs.20,000 crore |

Companies with MC above Rs.20,000 crore are often termed as Mega-Cap Stocks. The 3 major types of stocks which investors go on to invest in are discussed in further detail underneath.

- Large-cap

These are some of the most stable groups of companies in the market. Consequently, investing in these companies is the least risky option. However, another important factor to keep in mind is that since these are stable companies, the return from these companies is comparatively low.

Typically, these companies have reached the pinnacle of their growth, and as a result, there is a lesser chance of any drastic change in stock prices. However, the low risk accompanied by less aggressive growth makes investment in these stocks a conservative option.

- Mid-cap

Companies which have had a certain growth and are somewhat stable; and yet have immense potential of growth, come under this group of evaluation by market capitalization. These stocks indicate that a company is established to a certain extent in its industry, along with the promise of further growth.

While investing in these companies can still be risky since they are not established in their industry, the risk in investing in their stocks is much less than that of the next group of companies. Subsequently, the return on them can be potentially higher than those of large-cap stocks.

- Small-cap

Constituting companies which have the least market cap are the riskiest of all stocks. These are companies who are budding and are yet to establish themselves in their industry. This makes them highly risky. Success can sky-rocket their stock prices while failure can lead to a major loss for their shareholders. These are the most aggressive investment options.

What Factors Alter a Company’s Market Cap?

Two factors can alter a company’s market cap: significant changes in the price of a stock or when a company issues or repurchases shares. An investor who exercises a large amount of warrants can also increase the number of shares on the market and negatively affect shareholders in a process known as dilution.

What Does a High Market Cap Tell You?

A high market cap signifies that the company has a larger presence in the market. Larger companies may have less growth potential than start-up firms, but established companies may be able to secure financing cheaper, have a more consistent stream of revenue, and capitalize on brand recognition.

Does Market Cap Affect Stock Price?

Market cap does not affect stock price; rather, market cap is calculated by analyzing the stock price and number of shares issued. Although a blue-chip stock may perform better because of organizational efficiency and greater market presence, having a higher market cap does not directly impact stock prices.

What Is the Importance of Market Cap?

Market cap is often used as a baseline for analysis as all other financial metrics must be viewed through this lens. For example, a company could have had twice as much revenue as any other company in the industry. However, if the company’s market cap is four times as large, the argument could be made that the company is underperforming.

What Are the Factors Which Impact Market Caps?

There are quite a few factors which impact the market cap of a company. Learning these factors can aid investors in judging if a specific company is expected to offer good returns.

- Demand for the products or service of an institution and its ability to serve that demand, both are crucial factors which impact the MC of a company.

- Fluctuations in the market can impact the MC. This can be in the specific industry or an economic downturn, or both.

- Exercising warrant on the stocks of an enterprise can reduce its value.

- Performance and ingenuity of competitor brands or institutions.

- The reliability and the reputation of a company.

The number of outstanding shares of a company depends on factors like buying back of shares or issuing of new shares. In case of stock splits to issue new shares, the market capitalization of a company remains unchanged.

While understanding the impact of different factors on the MC, it is also advisable for investors to understand how investments grow or decline over the years. This is explained with the help of an example.

Considering the price of every share of a company is Rs.100 if a certain Mr. Bhagat invests Rs.10,000 he would acquire 100 shares of the company. Now when the market capitalization of this company goes up, the share prices are affected positively too. If the share prices go up to Rs. 120, the total value of Mr. Bhagats’s investment stands at Rs.12,000. Consequently, Mr. Bhagat stands to make a profit of Rs.2,000 on his initial investment of Rs.10,000.

The Bottom Line

Market cap can be a valuable tool for investors watching stocks and evaluating potential investments. Market capitalization is a quick and easy method for estimating a company’s value by extrapolating what the market thinks it is worth for publicly traded companies. In an acquisition, the market cap helps determine whether a takeover candidate represents a good value to the acquirer.

Disclaimer ||

The Information provided on this website article does not constitute investment advice ,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!

Leave feedback about this