Centralized cryptocurrency exchanges are online platforms used to buy and sell cryptocurrencies. They are the most common means investors use to buy and sell cryptocurrency holdings. For most digital currency investors, the centralized cryptocurrency exchange is one of the most important vehicles for transacting.

Some investors may find the concept of a “centralized” exchange somewhat misleading, as digital currencies are often billed as “decentralized.” Here’s what it means for an exchange of this type to be “centralized” and why these exchanges are so crucial for the success of the cryptocurrency industry as a whole.

Understanding Centralized Exchanges

In the term “centralized exchange,” the idea of centralization refers to using an intermediary or third party to help conduct transactions. Buyers and sellers alike trust this entity to handle their assets. This is common in a bank setup, where a customer trusts the bank to hold their money.

The reason for this setup is that banks offer security and monitoring that an individual cannot accomplish on their own. In the case of a centralized cryptocurrency exchange, the same principle applies. Transactors trust not only that the exchange will safely complete their transactions for them but also that it will use the network of users in the exchange to find trading partners.

In the case of cryptocurrencies, which are often stored in digital wallets, an individual can lose hundreds or thousands of dollars in digital currency holdings simply by forgetting the key to a wallet. An exchange will not allow this to happen, as it attempts to safeguard the holdings for the individual investor.

Key Elements of Centralized Crypto Exchanges

New centralized exchanges are emerging all the time. However, not all of them are successful—it’s not uncommon for them to fold. The success or failure of an exchange is dependent upon a large number of factors. However, one of the key components to success is trading volume.

Generally speaking, the higher the levels of trading volume, the lower the volatility and market manipulation likely to occur on that exchange. Volatility is a crucial consideration. Because of the time it takes for transactions to be completed, the price of a given token or coin can change between the time the transaction is initiated and the time it is finished. The higher the trade volume and the faster the transaction can be processed, the less likely this fluctuation will be a problem.

The way an exchange reacts to an event such as a hack is by no means a given. Some exchanges have worked hard to refund customer losses, while others have been less successful in that regard. Still others have shuttered as a result of these types of attacks.

For investors looking to enter the cryptocurrency space, a centralized exchange is still the most common means of doing so. When selecting an exchange, it’s important to keep in mind the host of factors that will impact user experience, including which pairs are traded, how high the trading volume is, and the security measures exchanges have adopted to protect their customers.

Centralized vs. Decentralized Exchanges

Centralized exchanges can be used to conduct trades from fiat to (or vice versa). They can also be used to conduct trades between two different cryptocurrencies. While this may seem to cover all of the potential transaction types, there is still a market for another type of cryptocurrency exchange as well.

Decentralized exchanges are an alternative; they cut out the intermediary, generating what is often thought of as a “trustless” environment. These types of exchanges function as peer-to-peer exchanges. Assets are never held by an escrow service, and transactions are done entirely based on smart contracts and atomic swaps.1

The crucial difference between centralized and decentralized exchanges is whether or not a third party is present. Decentralized exchanges are less widespread and popular compared with centralized exchanges, at least in the U.S. (due to regulatory issues). Nonetheless, it’s possible that they will give centralized exchanges a run for their money in the future.

Fiat/Cryptocurrency Pairs

It’s common for a centralized exchange to offer pairing. This allows customers to trade, for instance, bitcoin for ether tokens. Fewer exchanges offer fiat currency pairs, which would allow crypto trades for regular currency exchanges.

Some of the largest centralized exchanges in the world offer these fiat pairs; however, most are not regulated. Part of the reason for this is likely that they serve as a direct access point to the global cryptocurrency market and don’t have an established presence in the U.S.

Since many investors in the space are relatively new to investing in digital currencies, they may be more likely to turn to these types of exchanges. Some of these exchanges include Coinbase, Robinhood, Kraken, and Gemini.

Is Coinbase a Centralized Crypto Exchange?

Yes. Coinbase is a centralized cryptocurrency exchange that operates in the U.S. and globally.

A Centralized Cryptocurrency Exchanges Safe?

Cryptocurrency exchanges are often targeted by sophisticated hackers. Some exchanges have taken measures to prevent or deter theft attempts, while others may not have been as diligent.

What Is the Most Secure Centralized Crypto Exchange?

It depends on what you believe secure means. Some exchanges provide insurance against theft and network security techniques, while others add deep cold storage methods that take your keys offline until you need them. Still others use a combination of technologies to try and secure your crypto. This means that you should do your homework and learn all your options before choosing an exchange.

The Bottom Line

Centralized exchanges are online trading platforms that facilitate exchanges between customers who prefer a familiar trading environment. These platforms are often used to store cryptocurrency and expose traders and investors to assets that are otherwise difficult for many people to access.

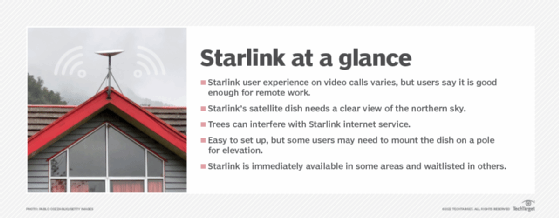

Starlink is a satellite constellation system that aims to deliver global internet coverage. This system is ideally suited for rural and geographically isolated areas where internet connectivity is unreliable or nonexistent.

A SpaceX initiative to create a global broadband network, Starlink uses a constellation of low Earth orbit (LEO) satellites to provide high-speed internet services. SpaceX, more formally known as Space Exploration Technologies Corp., is a privately held rocket and spacecraft company that Elon Musk founded in 2002.

How does Starlink work?

Starlink operates on a satellite internet service technology that has existed for decades. Instead of using cable technology, such as fiber optics to transmit internet data, a satellite system uses radio signals through the vacuum of space. Ground stations broadcast signals to satellites in orbits, which in turn relay the data back to the Starlink users on Earth. Each satellite in the Starlink constellation weighs 573 pounds and has a flat body. One SpaceX Falcon 9 rocket can fit up to 60 satellites.

The goal of Starlink is to create a low latency network in space that facilitates edge computing on Earth. The challenge of creating a global network in outer space isn’t a small one, especially because low latency is an important demand. SpaceX has proposed a constellation of almost 42,000 tablet-size satellites circling the globe in low orbit to meet this demand. The CubeSats — miniature satellites commonly used in LEO — create tight network coverage, and their low Earth orbit produces low latency.

However, Starlink isn’t the only contender in the space race and has a few competitors, including OneWeb, HughesNet, Viasat and Amazon. HughesNet has been providing signal coverage from 22,000 miles above the Earth since 1996, but Starlink follows a slightly different approach and presents the following improvements:

- Instead of using a couple of large satellites, Starlink uses thousands of small satellites.

- Starlink uses LEO satellites that circle the planet at only 300 miles above surface level. This shortened geostationary orbit improves internet speeds and reduces latency levels.

- The newest Starlink satellites have laser communication elements to transmit signals between satellites, reducing dependency on multiple ground stations.

- SpaceX aims to launch as many as 40,000 satellites in the near future, ensuring global and remote satellite coverage with reduced service outages.

- Starlink has the advantage of being part of SpaceX, which in addition to launching Starlink satellites, also conducts regular partner launches. Other satellite internet providers may not be able to schedule regular satellite launches due to the high-cost factors involved.

How fast are Starlink’s internet speeds?

Starlink offers unlimited high-speed data through an array of small satellites that deliver up to 150 Megabits per second (Mbps) of internet speed. SpaceX plans to double this rate in the coming months.

According to a recent Speedtest by Ookla, Starlink recorded its fastest median download speed in the first quarter of 2022 at 160 Mbps in Lithuania. Starlink also clocked in at 91 Mbps in the U.S., 97 Mbps in Canada and 124 Mbps in Australia. Starlink in Mexico was the fastest satellite internet in North America, with a median download speed of 105.91 Mbps. The Speedtest further revealed that upload speeds have seen a downward curve of at least 33% in the U.S. — from 16.29 Mbps in the first quarter of 2021 to 9.33 Mbps in the second quarter of 2022.Cryptocurrency

https://www.youtube.com/embed/pWmJLgBacUQ?Cryptocurrency autoplay=0&modestbranding=1&rel=0&widget_referrer=https://www.techtarget.com/whatis/definition/Starlink&enablejsapi=1&origin=https://www.techtarget.com

How much does Starlink cost?

Starlink offers the following three internet packages:Cryptocurrency

- Starlink Internet. This package is geared toward residential use and costs $110 per month plus a one-time charge for the hardware of $599.Cryptocurrency

- Starlink Business. The business package provides twice the antenna capability of the residential offering along with faster internet speeds. It costs $500 per month with a one-time equipment charge of $2,500.

- Starlink RV. In June 2022, the U.S. Federal Communications Commission authorized SpaceX to use Starlink with moving vehicles, including recreation vehicles, airlines, ships and trucks. So, people on the road can now get access to the Starlink RV service for $135 per month plus $599 for the hardware.

To request service, a user must enter their address on Starlink’s website to check for service availability in their area. If the service isn’t available in their area, Starlink will provide an approximate date of when it will arrive. Most users stay on the waitlist for months, and most waitlists have been pushed into early 2023.

For those coverage areas where service is currently available, Starlink fills the service requests on a first-come, first-served basis. To reserve a spot for service, a customer can preorder Starlink through its website, which requires a refundable $99 deposit.

Where is Starlink available?

Starlink currently provides service to 36 countries with limited coverage areas. In the United States, the company plans to expand coverage to the rest of the continental U.S. by the end of 2023. Although a few countries, including Pakistan, India, Nepal and Sri Lanka, are marked as “Coming soon” on Starlink’s coverage map, Starlink has no current plans to offer services to several countries, including Russia, China, Cuba and North Korea.

The coverage map on the company’s website shows where it offers Starlink.

How to connect to Starlink?

Once users subscribe to Starlink, they receive a Starlink kit that includes a satellite dish, a dish mount and a Wi-Fi router base unit. Starlink also comes with a power cable for the base unit and a 75-foot cable for connecting the dish to the router.

To use the service, Starlink customers must first set up the satellite dish to start receiving the signal and pass the bandwidth to the router. The company offers various mounting options for the dish, including for yards, rooftops and home exteriors. There’s also a Starlink app for Android and Apple iOS that uses augmented reality to guide users in selecting the best location and position for their receivers.

Can you use Starlink in bad weather?

Starlink was designed with rugged weather conditions in mind. According to the company’s website:

“Designed and rigorously tested to handle a wide range of temperatures and weather conditions, Starlink is proven to withstand extreme cold and heat, sleet, heavy rain, and gale force winds — and it can even melt snow.”

Starlink uses LEO satellites and a phased array antenna to help keep its performance intact during extreme weather conditions. The following examines how well the Starlink satellite operates in various weather conditions:

Cloudy weather. A typical cloudy day won’t affect Starlink. However, storm clouds could affect the signals, as they tend to create rain, which may cause signal interruptions. Storm clouds are also moister and denser, which can play a big part in the degradation of a satellite signal.

Rain. Light rain generally doesn’t cause issues, but a heavy downpour can affect the Starlink signal quality. Heavy rain is associated with thick, dense clouds. The denser the clouds are, the higher the chances that the radio signals coming to and from the Starlink satellites could get blocked.

Winds. A properly secured and mounted Starlink dish that doesn’t sway or move won’t be affected by strong winds. The Starlink dish comes with a phased array antenna that can track satellites flying overhead without the need to move physically. This also helps prevent signal interruptions.Cryptocurrency

Snow. Light snowfall shouldn’t affect the Starlink signals, but heavy snow can affect performance due to the moisture buildup. Starlink dish comes with a heating function that melts the snow automatically, but if the snow buildup is on top of the dish, it might need to be cleaned out manually to avoid signal issuesCryptocurrency.

Sleet and ice. Similar to rain and snow, heavy sleet and ice could also negatively affect the Starlink signals. The heating function automatically melts ice and snow, but a heavy icing or sleet event would require manual intervention for cleaning the dish.Cryptocurrency

Fog. Normal fog shouldn’t affect Starlink’s signal, but dense fog could cause signal loss or interruptions. Heavy fog carries a lot of moisture and can be dense enough to interrupt the signal.

How many Starlink satellites are in space?

As of July 24, 2022, SpaceX launched 53 satellites in what was the 33rd Starlink launch of 2022. This follows a successful launch on July 22, 2022, in which 46 Starlink satellites were sent into orbit. So far, the company has launched almost 3,000 satellites in low Earth orbit.

Starlink aims to provide high-speed internet coverage in remote and rural areas, but some users complain about spotty signals. Is Starlink’s coverage good enough for remote work? Read on to find out.

Features of a Centralized Exchange

So what features does an exchange need to have in order to be “centralized”? Well, most centralized exchanges follow a similar model. Let’s take a look at what makes them unique.Cryptocurrency

Governed by a Single Entity

The defining feature of a centralized exchange is that it is controlled by a single entity, allowing for faster decision-making and subsequent implementation of strategies. This means more streamlined and efficient services. Cryptocurrency

As a result, CEXs can offer features like advanced trading tools, fiat currency support, simplified account management, and customer support. This allows them to attract a large number of users and offer higher trading volumes and increased liquidity which translates to faster trade execution and tighter bid-ask spreads.Cryptocurrency

But one organization in control means a single point of failure. Any issue on such a platform can have widespread consequences, be it a technical glitch, server outage, or financial difficulty. Plus, since centralized exchanges are governed by a single entity, it means they are subject to the regulations in a specific region. This can leave your funds vulnerable to regulatory action–which is especially worrisome in countries with draconian laws.Cryptocurrency

Not to mention, you are trusting the exchange to execute your trades fairly and honestly. If a centralized entity decides to mismanage your funds, there’s not a lot you can do. This creates a risk of front-running, market manipulation, or even insider trading Cryptocurrency.

Finally, centralized management means that company policy is often opaque–you don’t know the principles on which the exchange operates. That may be fine if you use an exchange purely for buying crypto, nd choose to store your assets elsewhere. However, most centralized exchanges don’t work like that. Let’s explore why.Cryptocurrency

Custodial Wallets

When it comes to security, centralized exchanges implement several measures to protect users’ funds and personal information: a password, two-factor authentication (2FA), cold storage, withdrawal restrictions, and regular security audits.Cryptocurrency

However, a CEX usually requires you to use their own custodial wallets. This means you are depositing your funds into accounts under the exchange’s control. You receive the login details to access the wallet, but you don’t actually own it. Instead, the exchange holds the account’s private key, and you are simply “borrowing” the wallet to transact and store your crypto. This lack of ownership comes with a risk: It means that the centralized entity that controls your funds may revoke your access at any point. Cryptocurrency

For this reason, many centralized exchanges, such as Kraken, recommend that you transfer your funds to non-custodial wallets as soon as you’ve made your crypto purchase. Even centralized exchanges themselves acknowledge that managing your funds yourself is always the best answer.Cryptocurrency

Require KYC

Finally, CEXs also require official documents to verify your identity. That’s because CEXs are businesses and, therefore, subject to local laws. This means by using these sorts of exchanges, you lack privacy, being forced to share your sensitive information with centralized entities Cryptocurrency.

How Do Centralized Exchanges Work?

A centralized exchange uses an order book system to facilitate crypto trading. The order book is an electronic list a CEX maintains. It lists all the buy and sell orders, displaying the price and quantity of each order. An order book records ongoing trading activity and allows the user to see the current market depth and liquidity.

The way it works is: users place a buy or sell order on the CEX, and when the order finds a compatible price, the exchange matches the orders and executes the trade for a fee.Cryptocurrency

For instance: If A wants to buy 1 BTC at $30k and B wants to sell 1 BTC for $30k, the exchange will match A and B seamlessly.

Centralized Vs. Decentralized Exchanges (CEX VS DEX): What’s The Difference?

As users seek greater control over their assets, the growing demand for self-custody has led to the emergence and popularity of decentralized exchanges.

The key defining feature of a decentralized exchange is that instead of an order book, it uses an Automated Market Maker (AMM) to eliminate all intermediate processes in crypto trading.

AMMs use smart contracts to determine prices and provide liquidity. For this, users deposit assets into smart contracts called liquidity pools. These pools automatically execute trades based on predefined mathematical formulas rather than relying on individual buy and sell orders.

Unlike a CEX, a DEX does not support custodial infrastructures where the exchange holds all the wallet’s private keys; rather, it allows you to be in control of your funds. When using a DEX, you simply connect your non-custodial wallet to trade crypto and use your own private keys to manage your funds.Cryptocurrency

Leave feedback about this