The recent seizure of Republic First, a Chicago-based mid-sized bank, has cast a shadow of concern over the financial sector.

During 2008, the US housing market’s decline triggered a global financial crisis, spreading from the United States to other parts of the world through interconnections in the global financial system. Numerous banks worldwide faced substantial losses and had to seek government assistance to avert bankruptcy, and one expert pointed to signs that indicated its repetition.

The resurgence of challenges within the banking industry is currently the most notable development, echoing the script of the 2008 financial crisis. As per the usual sequence, one issue triggers another, creating a cascading effect that transforms into a more substantial problem, prompting government intervention, as financial expert Otavio Costa indicated on February 1.

Even though, in 2023, four failing financial institutions collectively held more assets than the entire banking crisis during the Global Financial Crisis, it’s crucial to note that over 150 institutions failed back then.

This unfolding chain reaction is in its early stages, notably if the Bank Term Funding Program concludes on March 11. Fundamentally, these challenges underscore the Federal Reserve’s role as the lender of last resort, emphasizing the growing importance for investors to possess tangible assets in this environment.

The recent seizure of Republic First, a mid-sized bank headquartered in Chicago, has sent ripples of anxiety through the financial sector. Memories of the devastating 2008 financial crisis are still fresh in many minds, and the similarities between the two events have some questioning if history is about to repeat itself.

A Shadow of the Past: The 2008 Financial Crisis

The 2008 crisis was a perfect storm of deregulation, risky lending practices, and a housing market bubble that finally burst. Banks were heavily invested in subprime mortgages – loans issued to borrowers with poor creditworthiness. When these borrowers began defaulting on their loans en masse, the value of mortgage-backed securities (investments tied to mortgage performance) plummeted. This triggered a domino effect, crippling major financial institutions and plunging the global economy into a deep recession.

Cause for Concern: The Republic First Seizure

The Federal Deposit Insurance Corporation (FDIC) took control of Republic First on [Date], citing “critical violations of law or regulation” and “unsafe and unsound banking practices.” While the specific details behind the seizure are still under investigation, it has undoubtedly raised concerns about the health of the banking system and the potential for a broader financial crisis.

Is a 2008 Repeat on the Horizon? Experts Weigh In

Financial experts are quick to point out that the current situation differs significantly from the events leading up to the 2008 crisis. Here’s a breakdown of some key differences:

- Stronger Regulations: Following the 2008 meltdown, stricter regulations were implemented on banks. These include higher capital requirements, meaning banks are required to hold more of their own funds as reserves. Additionally, tighter oversight on lending practices, particularly for high-risk mortgages, has been established. These regulations make the banking system more resilient to financial shocks.

- Improved Economic Conditions: The overall economic situation in the US is currently stronger than it was in 2008. Unemployment rates are lower, and while inflation is a concern, the Federal Reserve is actively taking steps to address it. This creates a more stable economic foundation compared to the pre-crisis environment.

- Limited Exposure: While some banks might have exposure to troubled sectors or institutions like Republic First, it’s likely to be isolated and not widespread. Unlike the systemic issues of 2008, where the entire financial system was entangled in subprime mortgages, the current situation appears to be more contained.

However, experts also caution against complacency.

- Unforeseen Events: The global economy is a complex system, and unforeseen events like geopolitical tensions or natural disasters can still trigger market volatility. It’s crucial to remain vigilant and prepared for potential disruptions.

- Industry-Wide Issues: The specific reasons behind Republic First’s collapse need thorough investigation. Were there broader industry-wide factors at play, or were they isolated issues specific to the bank? Identifying these factors can help assess potential vulnerabilities in the banking system as a whole.

- Regulatory Response: The way regulatory bodies handle the Republic First situation is also crucial. Proactive measures to prevent similar occurrences and ensure the safety and soundness of the banking system are essential to maintain confidence in the financial sector.

What You Can Do to Protect Yourself

While the risk of a full-blown 2008-style crisis seems low, it’s always wise to be informed and take steps to safeguard your financial well-being:

- Stay Informed: Keep up with financial news and updates on the Republic First case and the broader banking industry. Reliable sources like reputable financial news outlets and government websites can provide valuable insights.

- Monitor Your Bank: If you have concerns about the health of your bank, don’t hesitate to take action. You can review their latest financial statements, contact them directly to inquire about their financial standing, or consider diversifying your banking needs across multiple institutions.

- Be Proactive with Your Finances: Maintain a healthy emergency fund to weather unexpected financial hardships. It’s generally recommended to have enough saved to cover 3-6 months of living expenses.

- Review Your Investments: If you invest in any financial instruments linked to the banking sector, like bank stocks or mutual funds, re-evaluate your risk tolerance and consider diversifying your investment portfolio to minimize potential losses.

The Road Ahead: A More Resilient Financial System?

The Republic First seizure serves as a reminder of the importance of a strong and well-regulated financial system. While there’s no guarantee that future crises can be entirely prevented, the stricter regulations and improved economic conditions suggest a more resilient financial sector compared to the pre-2008 era. By staying informed, taking proactive steps with your finances, and holding regulatory.

Table of Contents

Worrying indicators

With the persisting problem come persistent indicators that haven’t changed since the previous collapse and which showcase the connection between the housing market and financial institutions.

David Sommers, a financial analyst, pointed out that notwithstanding the widely acknowledged challenges in the commercial real estate sector, particularly with office properties, banks’ exposure to these loans reached a new all-time high in December.

The U.S. real estate sector is causing concern with dropping sales and fears of a market crash. In Q4 2023, Redfin reported that an average American household needs over $115,000 to afford a home, given a 15% increase in prices from the previous year. The average U.S. salary is only half of what’s needed. Financial experts, including Robert Kiyosaki, have warned of economic challenges and potential market crashes.

Some banks are already suffering

With the potential storm brewing, some banks are already experiencing heavy losses and are being forced to engage in cost-saving layoffs.

One is Deutsche Bank, set to eliminate 3,500 positions as part of a cost-cutting initiative following a 30% decline in its Q4 profit. This move follows Citigroup’s announcement of significant layoffs affecting 20,000 employees three months ago.

Regional banks in the U.S. have already suffered the worst effects. Western Alliance shares fell by up to 13%, Valley National Bancorp dropped by over 11.8%, and Zions Bancorp stock declined by about 9.8%. East West Bancorp and M&T Bank shares saw losses of around 7% before a slight rebound.

Looking overseas, Japanese bank Aozora is witnessing a significant downturn, with its shares experiencing the steepest two-day drop since its initial public offering. The cause behind this decline is the bank’s revelation of substantial exposure to the US commercial real estate market.

Whether this is the beginning of another banking crisis, which might be even worse than 2008, or just a false alarm, only time will tell. However, some compelling arguments and signs indicate a negative outcome.

3 reasons we don’t think the banking crisis is a repeat of 2008

Market update

The crossroads

This week tested policymakers’ resolve to calm the turmoil caused by the banking sector, while also fighting inflation. Stocks and bonds swung on every headline.

Heading into Friday, investors seemed to be taking shelter in high-quality tech companies, pushing the market higher despite volatility in both large and regional it.

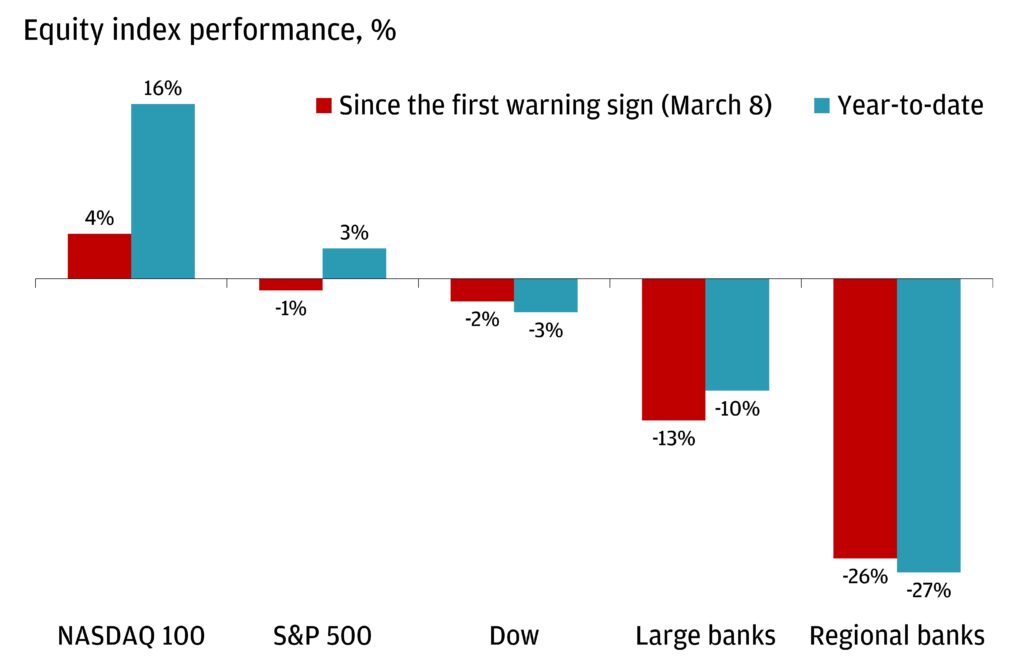

Bank stocks have underperformed the market this year

Source: Bloomberg Finance L.P. Data as of March 23, 2023. Note: Large banks represented by the S&P Diversified Banks Index and regional banks by the S&P Regional Banking Index. Past performance is no guarantee of future results. It is not possible to invest directly in an index.

At Wednesday’s Federal Reserve meeting, the central bank raised rates by another 25 basis points (bps), bringing the cumulative total over the last year to a staggering 475 bps. Policy rates are now the highest they’ve been since 2007, and financial conditions have tightened meaningfully as a result. The banking sector is the latest to feel the impact.

From here, the banking shock should work to slow the economy, and may accelerate the path to recession. As a result, the Fed may be nearing the end of its rate hiking cycle. Its projections released this week suggest just one more hike this year. But as Chair Powell made clear, if things change and the outlook darkens, policymakers seem to have the right tools to help support the economy and financial markets if it’s needed.

Also in the press conference, Chair Powell clearly stated that the banking system was “sound and resilient.” While we wouldn’t say the current banking sector turmoil is over, we tend to agree. We may be at a crossroads in terms of monetary policy and the growth outlook, but we don’t believe the challenges we face today are like the Global Financial Crisis.

Spotlight

Why this isn’t the Global Financial Crisis

This latest episode of banking turmoil has reminded many of the Global Financial Crisis. Investors are concerned that the problems in U.S. regional banks and certain European lenders such as Credit Suisse are analogous to the first tremors of the crisis in late 2007 and early 2008. A similar upheaval in the financial system, deep recession, painful deleveraging and staggered recovery would obviously be very detrimental to the economy and investment portfolios.

The banking system is, and has always been, built on confidence. When confidence comes into question, it can lead to a sense of panic that feeds on itself and becomes hard to contain. It also makes this situation very difficult to forecast with any precision.

While there is tremendous uncertainty, given that the banking sector drives credit creation and subsequent economic growth, this episode is probably a negative for the market and economic outlook.

But this probably isn’t 2008, for three key reasons:

- Policymakers have tools to solve banking crises, and the bigger banks are much stronger

- The economy is in a much different place

- The magnitude of the problem is, so far, much smaller

Policymakers have the tools to solve a banking crisis, and the bigger banks are much stronger

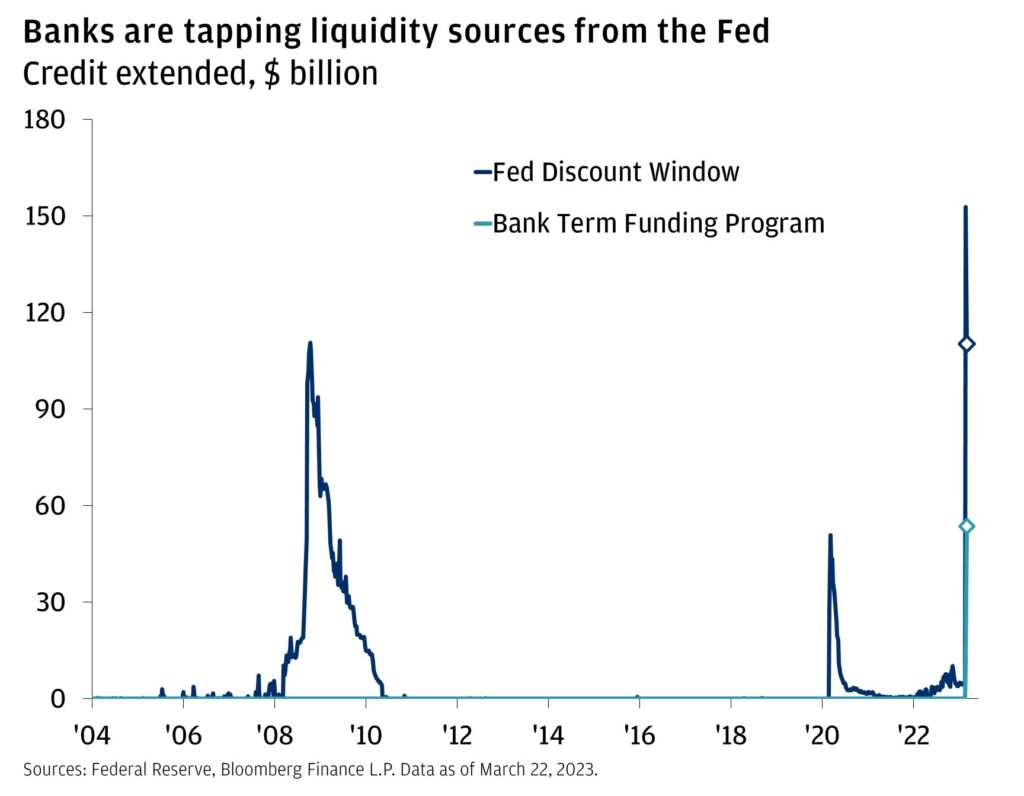

The primary function of central banks isn’t managing inflation and employment, it is acting as a lender of last resort. In this way, central banks provide the bedrock for the banking system. The Fed’s ability to perform this role expanded during the Global Financial Crisis. It created many different types of lending facilities to provide liquidity to banks, and many former “broker-dealers” (such as Morgan Stanley and Goldman Sachs) became bank holding companies so that they could access them.

Policymakers also understand how impactful decisive action can be. The new Bank Term Funding Program they instituted the other week is designed to alleviate the pressure that banks face from unrealized losses on their portfolios of high-quality Treasury, agency and mortgage-backed debt securities. U.S. dollar swap lines are also underappreciated tools that alleviate the strain that can come from a global scramble for dollars. During the Global Financial Crisis, the U.S. dollar surged 25% in 12 months following the Bear Stearns collapse. Throughout this episode, the dollar has been falling, which signals a more sanguine liquidity environment.

While the nominal amount drawn from the Fed’s discount window (the primary facility through which banks can borrow) is concerning, it also seems to have been concentrated in the banks that are under the most stress (three of which have already failed). It usually isn’t “good” when banks are using the discount window, but it does signal that the Fed is able to serve its primary function for the financial system.

It is also clear that policymakers are trying to ring-fence the weakest links in order to arrest a downward spiral in confidence. It may take time, a more powerful form of intervention, capital raises at much lower valuations, or a combination of all three, but policymakers understand what it takes to soften the blow of a banking crisis.

Post–financial crisis regulations have required the largest financial institutions to be much less levered, better capitalized, more transparent and more liquid. The Volcker Rule prohibits banks from having their own proprietary trading and investment desks that could put depositor funds at risk. They also have lower reliance on wholesale (i.e., market-based) funding from institutional investors that is usually less sticky than standard deposits. The biggest banks are much stronger now than they were in 2008.

The big risk in the current instance is deposit flight, but that could prove to be an easier problem to solve than the core issues of leverage, mistrust between financial institutions, deteriorating credit and asset quality in the U.S. housing market, and difficult price discovery that occurred in 2008. On the other hand, profitability of its sector will likely be impaired as banks raise rates on deposit accounts and add debt to their balance sheets to add capital.

The economy is in a much different place

When J.P. Morgan purchased Bear Stearns from the brink of failure in March 2008, the economy had shed jobs for three straight months, and the critical construction sector had peaked a full two years earlier. Home prices peaked in the spring of 2007, and there was a tremendous glut of supply: Vacant homes accounted for almost 15% of the total housing stock.

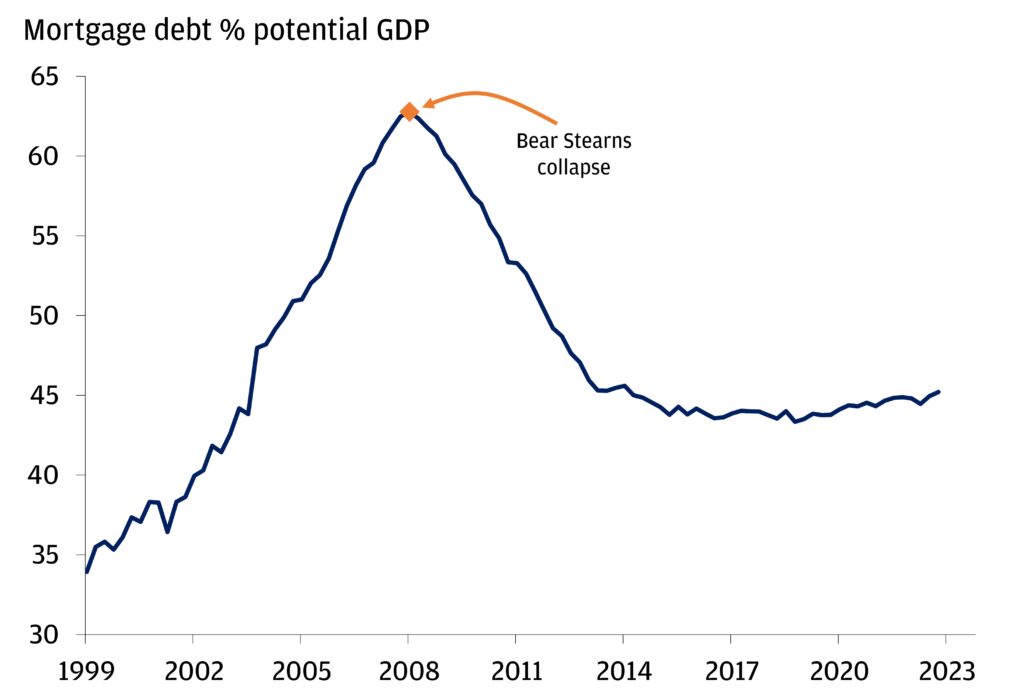

Household and corporate balance sheets were also much weaker. Mortgage debt was a staggering 65% of GDP versus a more manageable ~45% today. Consumer and corporate debt service ratios are at secular lows.

Households had too much leverage in 2008

Sources: NY Fed, Haver Analytics. Data as of December 31, 2022.

Over the last three months, the economy has averaged 350,000 jobs gained per month, the construction sector is still growing, home prices are only down marginally from the peak, and housing inventory is very tight.

Today, the residential real estate market that was the epicenter of the 2008 collapse is much more resilient. Credit standards are higher (the cutoff for a bottom-quartile credit score today is above 700 versus 650 in 2007), and most borrowers are locked into a low rate.

That are in trouble today had concentrated deposit bases and poor interest rate risk management, not necessarily bad loans. Further, the FDIC has guaranteed the deposits, so there has been no asset impairment (at least so far). The extent to which FDIC deposit insurance is augmented is still an outstanding question, but any action on that front could reduce the risk of further it runs.

The growth picture going forward will probably be challenged as banks pull in their horns to manage through this shock, but this economy looks very different from the one that existed in 2008.

The magnitude of the problem, so far, is much smaller

At the time of failure, Silicon Valley Bank ($209bn) and Signature Bank (~$110bn) combined have around half the assets that Lehman Brothers (~$640bn) had. Bear Stearns (~$400bn in assets) was also larger than each. That’s not to mention the many other firms that were acquired, placed into receivership or otherwise assisted by the government (Merrill Lynch, Wachovia, Washington Mutual and AIG come to mind).*

More importantly, the interconnectedness of the system in 2008 is hard to quantify. Trillions of dollars of opaque securities with tranches and derivatives formed a knot of Gordian proportions. The 2010 Dodd-Frank Act and subsequent regulations required these positions to be registered with transparent clearing houses. From a market perspective, the financial sector was the largest weight in the S&P 500 in 2008. Today, it’s ~13% weight is still meaningful, but it’s dwarfed by technology (~25%).

That isn’t to say this situation couldn’t spiral into a much larger problem. It is to say that as of now, the magnitude and potential for contagion due to complex counterparty risk seem much smaller than they were in March of 2008. For what it’s worth, the latest indications from real-time indicators funding stress, searches for “deposit insurance” and similar phrases, and commentary from Fed Chair Powell suggest that deposit outflows have stabilized.

Most importantly, the fundamental nature of this problem is different.

The Global Financial Crisis was driven by price declines in low-quality assets with poor disclosure, leading to a solvency crisis. This episode has been driven by price declines in high-quality assets with pristine disclosure, leading to a liquidity issue.

Investment implications

Stick to your plan

This spate of banking stress is likely to drag on growth, and raises the (already elevated) probabilities of a recession later this year. Even if market volatility subsides in the coming weeks and months, banks will probably lend less. Less credit flowing into the economy means lower growth. We are particularly worried about the linkages between regional banks and the commercial real estate sector (especially office). On the other hand, it probably means less restrictive Fed policy and lower interest rates, which could lead to a further boost for the residential housing market.

But this seems like a very different situation than the Global Financial Crisis. Then, oversupply in the housing sector, poor underwriting standards, overleverage and interconnectedness combined to create a downward spiral for asset prices and the economy. Today, we are dealing with banks whose high-quality bond portfolios have lost value, depositors who can move their cash quickly, and the threat of impaired profitability for smaller banks as they raise deposit rates to compete with larger ones.

Markets, for their part, are already pricing in a materially weaker outlook for banks. In fact, the relative performance of banks versus the rest of the market is already commensurate with the experience of both the Savings and Loan crisis of the early 1990s and the Global Financial Crisis.

Investors should rely on steady hands to guide their long-term portfolios, and focus on investments that can protect through a downturn. This banking turmoil has references to 2008, but it probably isn’t a shot-for-shot remake.

Disclaimer ||

The Information provided on this website article does not constitute investment advice ,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!