The cryptocurrency market currently navigates in a slightly bearish momentum, with most cryptocurrencies accumulating losses in a downtrend. Bitcoin analysts, (BTC) could break from its six-month “reaccumulation” sideways range between mid-September and early-October if history repeats.

A historical analysis from Rekt Capital on X highlighted the chart pattern that uses the bitcoin-halving as a breakout baseline. As posted, the trader explained that BTC tends to break from consolidation between 150 and 160 days after the halving.

In 2020, Bitcoin took 161 days to start the bull run, leading to staggering highs of $69,000 in 2021. If this historical pattern plays out again this cycle, BTC could experience a major breakout by late September.

Commenting on the original post, other analysts confirmed Rekt Capital‘s price prediction, identifying the same historical behavior for Bitcoin.

Counterpoints of Bitcoin’s historical breakout pattern

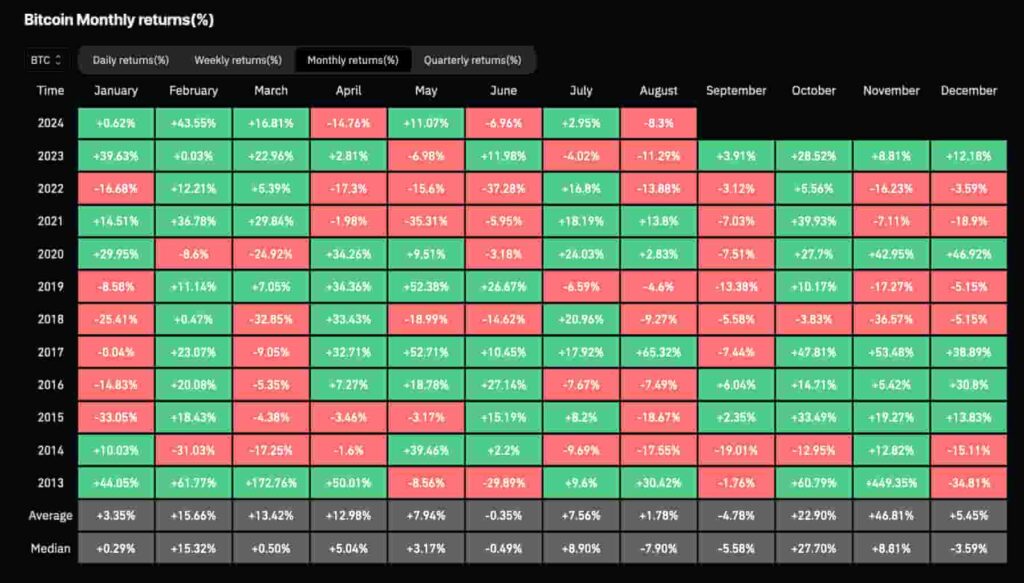

However, the analyst warns of another historical pattern that could delay the expected movement this cycle. September has been a historically losing month for Bitcoin, a victim of what the stock market calls the “September Effect.”

Coin Data Cap reported in detail on August 31 about this effect on BTC’s price throughout the years. As observed in the report, September has had the worst average and median returns for Bitcoin since 2013.

Moreover, this current cycle has, so far, played out differently from Bitcoin’s history as traditional Finance giants joined the market. For the first time, BTC made a new all-time high before the halving – reaching $73,800 in March.

In closing, the Bitcoin halving pattern could indeed trigger a bull run in the following weeks, in September or early October, with the expected breakout from this consolidation range. Yet, history may not repeat, as demonstrated by this year’s deviation, surprising traders who are betting in patterns.

Traders and investors should constantly evaluate their moves according to the market’s upcoming information – remaining cautious with proper risk management.

Understanding Cryptocurrency

Cryptocurrency is a digital or virtual currency that uses cryptography for security and to control the creation of units of currency. It’s a decentralized system, meaning there’s no central authority or bank involved in its creation or distribution.

Key Concepts:

- Blockchain: This is the underlying technology that powers cryptocurrency. It’s a distributed ledger that records transactions. Each block in the chain contains a timestamp and a link to the previous block, creating a chain of blocks.

- Mining: This is the process of verifying and adding new transactions to the blockchain. Miners use powerful computers to solve complex mathematical problems. As a reward, they receive newly created cryptocurrency.

- Wallet: A digital wallet is used to store and manage cryptocurrency. It’s essentially a software program that holds your private keys, which are necessary to access your coins.

- Decentralization: This means that no single entity controls the cryptocurrency network. This makes it resistant to censorship and manipulation.

Popular Cryptocurrencies:

- Bitcoin: The first and most well-known cryptocurrency.

- Ethereum: A platform that allows developers to build decentralized applications on top of its blockchain.

- Binance Coin: The native cryptocurrency of the Binance exchange.

- Tether: A stablecoin pegged to the US dollar.

Why Use Cryptocurrency?

- Decentralization: It offers a way to escape the control of traditional financial institutions.

- Security: Cryptography makes it difficult for hackers to tamper with transactions.

- Privacy: Transactions can be anonymous, although not completely private.

- Potential for High Returns: While highly volatile, cryptocurrency can offer significant returns on investment.

How does cryptocurrency work?

Bitcoin is the first and most well-known, but there are thousands of types of cryptocurrencies. Many, like Litecoin and Bitcoin Cash, share Bitcoin’s core characteristics but explore new ways to process transactions. Others offer a wider range of features. Ethereum, for example, can be used to run applications and create contracts. All four, however, are based on an idea called the blockchain, which is key to understanding how cryptocurrency works.

Key concept

- At its most basic, a blockchain is a list of transactions that anyone can view and verify. The Bitcoin blockchain, for example, is a record of every time someone sends or receives bitcoin. This list of transactions is fundamental for most cryptocurrencies because it enables secure payments to be made between people who don’t know each other without having to go through a third-party verifier like a bank.

- Blockchain technology is also exciting because it has many uses beyond cryptocurrency. Blockchains are being used to explore medical research, improve the sharing of healthcare records, streamline supply chains, increase privacy on the internet, and so much more.

- The principles behind both bitcoin and the Bitcoin blockchain first appeared online in a white-paper published in late 2007 by a person or group going by the name Satoshi Nakamoto.

- The blockchain ledger is split across all the computers on the network, which are constantly verifying that the blockchain is accurate.This means there is no central vault, entity, or database that can be hacked, stolen, or manipulated.

Cryptocurrencies use a technology called public-private key cryptography to transfer coin ownership on a secure and distributed ledger. A private key is an ultra secure password that never needs to be shared with anyone, with which you can send value on the network. An associated public key can be freely and safely shared with others to receive value on the network. From the public key, it is impossible for anyone to guess your private key.

What is BTC?

BTC is the abbreviation for bitcoin.

Is Bitcoin cryptocurrency?

Yes, bitcoin is the first widely adopted cryptocurrency, which is just another way of saying digital money.

Is there a simple bitcoin definition?

Bitcoin is a decentralized digital currency used for encrypted, peer-to-peer transactions without needing a central bank

What’s the price of bitcoin?

The current price of Bitcoin can be found on Coinbase’s website.

Is Bitcoin an investment opportunity?

Like any other asset, you can make money by buying BTC low and selling high, or lose money in the inverse scenario.

At what price did Bitcoin start?

One BTC was valued at a fraction of a U.S. penny in early 2010. During the first quarter of 2011, it exceeded a dollar. In late 2017, its value skyrocketed, topping out at close to $20,000, and Bitcoin ended up topping $64,899 in November 2021.

Bitcoin is a decentralized digital currency used for encrypted, peer-to-peer transactions without needing a central bank

Bitcoin Basics

Since Bitcoin’s creation, thousands of new cryptocurrencies have been launched, but bitcoin (abbreviated as BTC) remains the largest by market capitalization and trading volume.

- Depending on your goals, bitcoin can function as

– an investment vehicle

– a store of value similar to gold

– a way to transfer value around the world

– even just a way to explore an emerging technology

- Bitcoin is a currency native to the Internet. Unlike government-issued currencies such as the dollar or euro, Bitcoin allows online transfers without a middleman such as a bank or payment processor. The removal of those gatekeepers creates a whole range of new possibilities, including the potential for money to move around the global internet more quickly and cheaply, and allowing individuals to have maximum control over their own assets.

- Bitcoin is legal to use, hold, and trade, and can be spent on everything from travel to charitable donations. It’s accepted as payment by businesses including Microsoft and Expedia.

- Is bitcoin money? It’s been used as a medium of exchange, a store of value, and a unit of account—which are all properties of money. Meanwhile, it only exists digitally; there is no physical version of it.

How Bitcoin works

Unlike credit card networks like Visa and payment processors like Paypal, bitcoin is not owned by an individual or company. Bitcoin is the world’s first completely open payment network which anyone with an internet connection can participate in. Bitcoin was designed to be used on the internet, and doesn’t depend on banks or private companies to process transactions.

One of the most important elements of Bitcoin is the blockchain, which tracks who owns what, similar to how a bank tracks assets. What sets the Bitcoin blockchain apart from a bank’s ledger is that it is decentralized, meaning anyone can view it and no single entity controls it.

Here are some details about how it all works:

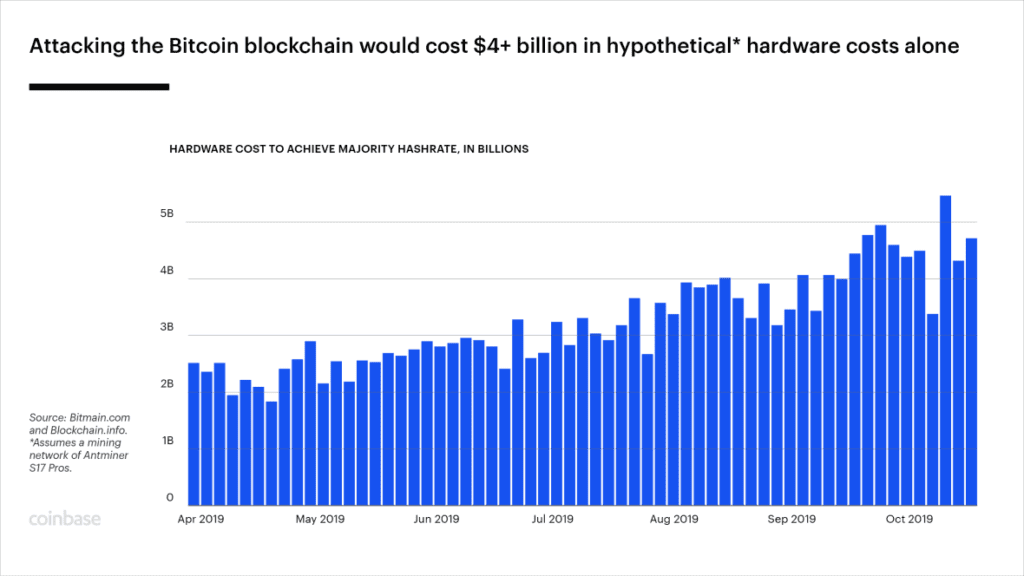

- Specialized computers known as ‘mining rigs’ perform the equations required to verify and record a new transaction. In the early days, a typical desktop PC was powerful enough to participate, which allowed pretty much anyone who was curious to try their hand at mining. These days the computers required are massive, specialized, and often owned by businesses or large numbers of individuals pooling their resources. (In October 2019, it required 12 trillion times more computing power to mine one bitcoin than it did when Nakamoto mined the first blocks in January 2009.

- The miners’ collective computing power is used to ensure the accuracy of the ever-growing ledger. Bitcoin is inextricably tied to the blockchain; each new bitcoin is recorded on it, as is each subsequent transaction with all existing coins.

- How does the network motivate miners to participate in the constant, essential work of maintaining the blockchain—verifying transactions? The Bitcoin network holds a continuous lottery in which all the mining rigs around the world race to be the first to solve a math problem. Every 10 min or so, a winner is found, and the winner updates the Bitcoin ledger with new valid transactions. The prize changes over time, but in May 2020, the reward for each winner of this raffle went from 12.5 bitcoin per block to 6.25, and in 2024, with the halving, this reward further dropped from 6.25 to 3.125 as a mechanism to increase scarcity.

- At the beginning, a bitcoin was technically worthless. At the end of 2019, it was trading at around $7,500, and in November 2021, it topped $64,000. As bitcoin’s value has risen, its easy divisibility (the ability to buy a small fraction of one bitcoin) has become a key attribute. One bitcoin is currently divisible to eight decimal places (100 millionths of one bitcoin); the bitcoin community refers to the smallest unit as a ‘Satoshi.’

- Nakamoto set the network up so that the number of bitcoin will never exceed 21 million, ensuring scarcity. As of December 2023, there were around 1,4 million bitcoins still available to be mined. The last blocks will theoretically be mined in 2140.

Cryptocurrencies and traditional currencies share some traits — like how you can use them to buy things or how you can transfer them electronically — but they’re also different in interesting ways. Here are a few highlights.

Bitcoin is the world’s first completely open payment network which anyone with an internet connection can participate in.

Key question

How does bitcoin have value?

Essentially the same way a traditional currency does – because it’s proven itself to be a viable and convenient way to store value, which means it can easily be traded for goods, services, or other assets. It’s scarce, secure, portable (compared to, say, gold), and easily divisible, allowing transactions of all sizes.

Disclaimer ||

The Information provided on this website article does not constitute investment advice ,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency Stocks Bonds should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!