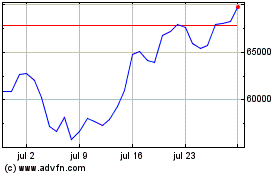

Bitcoin is still due to close a daily chart “death cross,” but $62,000 resistance could be key to mitigating the BTC price downside that has followed in the past.

A “death cross” in technical analysis refers to a situation where a short-term moving average crosses below a long-term moving average, often seen as a bearish signal. For Bitcoin, a significant death cross might involve the 50-day moving average crossing below the 200-day moving average.

If the Bitcoin price needs to flip $62,000 to avoid the worst consequences of a death cross, it suggests that this level could be critical in maintaining positive momentum or avoiding deeper declines. The price at this level might be crucial for maintaining investor confidence and avoiding a prolonged downtrend.

It’s important to remember that while technical indicators can provide insights, they are not foolproof. Market sentiment, macroeconomic factors, and other influences also play a significant role in price movements. Always consider multiple factors and consult various sources before making investment decisions.flip

1. Death Cross Explanation

- Definition: A death cross occurs when a short-term moving average (commonly the 50-day) crosses below a long-term moving average (commonly the 200-day). It’s viewed as a bearish indicator suggesting a potential shift from an uptrend to a downtrend.

- Implications: Historically, a death cross can signal the beginning of a longer-term downtrend, though it’s not a guaranteed prediction. It can indicate a loss of momentum and may prompt traders and investors to reassess their positions.

2. Why $62K Matters

- Technical Significance: If Bitcoin’s price is near or below $62,000, this level might be significant for several reasons:

- Support and Resistance: Price levels often act as support (a floor) or resistance (a ceiling). If Bitcoin is struggling to maintain above $62K, it could indicate a weakening bullish trend.

- Moving Averages Interaction: For the death cross to have the worst consequences, Bitcoin’s price would need to stay below or fail to recover above key moving averages. A price above $62K might suggest strength and could counteract the bearish signal of the death cross.

3. Historical Context

- Past Occurrences: Historically, death crosses have sometimes led to prolonged downturns, but not always. They are often followed by volatility, and the actual outcomes can vary based on broader market conditions and external factors.flip

- Market Sentiment: During past death crosses, market sentiment and broader economic factors often influenced the extent of the impact. For example, the overall market environment, regulatory news, or major economic events can all affect how severe the consequences are.flip

4. Other Considerations

- Technical Analysis Limitations: While useful, technical analysis isn’t foolproof. It’s based on historical price movements and patterns, and doesn’t account for new, unforeseen events or fundamental changes in the market.

- Market Sentiment and Fundamentals: The broader market sentiment, news, and fundamental factors (like institutional investment, regulatory developments, or macroeconomic trends) can heavily influence price movements, sometimes overriding technical signals.

- Risk Management: Regardless of technical indicators, it’s crucial for investors to employ good risk management strategies. This might include diversifying investments, setting stop-loss orders, and staying informed about market developments.

In summary, while the $62,000 level could be crucial in maintaining bullish sentiment and avoiding the worst effects of a death cross, it’s just one piece of the puzzle. Market conditions and broader factors should always be considered when evaluating potential price movements.flip

1. Understanding the Death Cross

**A. Moving Averages:

- Short-Term Moving Average (e.g., 50-day): This average is calculated over the past 50 days and reacts more quickly to recent price changes.

- Long-Term Moving Average (e.g., 200-day): This average is calculated over the past 200 days and provides a smoother view of the overall trend.

**B. Formation of a Death Cross:

- Crossing: The death cross occurs when the 50-day moving average crosses below the 200-day moving average. This crossover indicates that short-term momentum is weakening relative to the longer-term trend.flip

**C. Historical Context:

- Bearish Signal: Traditionally, a death cross is seen as a bearish indicator, suggesting a potential shift from an uptrend to a downtrend. However, it’s not always a guaranteed predictor of a prolonged decline.flip

2. Bitcoin’s Price Dynamics and the $62,000 Level

**A. Price Levels:

- Support Level: If Bitcoin has previously traded around $62,000 and it is struggling to stay above this level, it might be a critical support level. Breaking below this support can indicate potential further declines.

- Resistance Level: Conversely, if Bitcoin is below $62,000, this level could act as a resistance point. It might need to surpass this level to show a recovery and potentially negate bearish signals.

**B. Moving Averages Interaction:

- Current Price vs. Moving Averages: If Bitcoin’s price is significantly below the 50-day and 200-day moving averages, it can confirm a bearish trend. Staying above $62,000 might suggest strength and a potential for a bullish reversal.

3. Historical Occurrences and Their Implications

**A. Past Performance:

- Death Cross Outcomes: Historically, death crosses have sometimes led to substantial declines in the price of an asset, but they have also occasionally resulted in brief periods of volatility rather than long-term downturns.

**B. Bitcoin’s Specific History:

- Volatility: Bitcoin has shown high volatility, and its past death crosses have sometimes been followed by both significant declines and quick recoveries. The outcomes can vary greatly based on broader market conditions and news.flip

4. Broader Market Considerations

**A. Market Sentiment:

- Influences: Market sentiment, driven by news, macroeconomic factors, and investor behavior, can impact how severe the consequences of a death cross are. For Bitcoin, sentiment around regulations, technological developments, or institutional adoption can play a significant role.flip

**B. Macroeconomic Factors:

- Economic News: Factors such as interest rate changes, inflation data, or geopolitical events can influence Bitcoin’s price and potentially overshadow technical indicators.

5. Risk Management and Strategy

**A. Diversification:

- Investment Strategy: Investors should consider diversifying their portfolios to manage risk, rather than relying solely on technical indicators.

**B. Stop-Loss Orders:

- Protection: Implementing stop-loss orders can help protect investments from significant declines, providing an exit strategy if the market moves against the position.

**C. Ongoing Analysis:

- Adaptation: Continuously monitor Bitcoin’s price, moving averages, and broader market conditions. Adapt strategies based on new information and market trends.

Summary

A death cross in Bitcoin’s technical analysis suggests a potential bearish trend, especially if Bitcoin’s price struggles to stay above critical levels like $62,000. However, the impact of a death cross can vary, influenced by historical performance, broader market sentiment, and macroeconomic factors. Effective risk management and continuous analysis are essential to navigating these market signals.flip

Frequently Asked Questions (FAQ)

1. What is a death cross?

A death cross occurs when a short-term moving average, typically the 50-day, crosses below a long-term moving average, usually the 200-day. This is often interpreted as a bearish signal, suggesting a potential shift from an uptrend to a downtrend.

2. Why is the $62,000 level significant for Bitcoin?

The $62,000 level could be significant as it might represent a key support or resistance level. If Bitcoin’s price is below this level, it may act as resistance. If it’s above this level, it may act as support. Maintaining or breaking through this level can influence Bitcoin’s price trend and technical outlook.flip

3. How reliable is the death cross as a predictor?

While a death cross is a commonly used technical indicator, it is not infallible. It can sometimes signal a prolonged downtrend but can also be followed by short-term volatility or even price increases. It’s one of many tools and should be used alongside other analysis methods.flip

4. What happens after a death cross?

After a death cross, the price may continue to decline, enter a period of volatility, or even recover and trend upward. Historical outcomes can vary widely depending on market conditions, investor sentiment, and other factors.

5. How can I protect my investments during a potential death cross?

Implementing risk management strategies such as setting stop-loss orders, diversifying your investment portfolio, and staying informed about market trends can help protect your investments. Regularly reviewing and adjusting your strategy based on new information is also crucial.

6. Are there other technical indicators to watch besides the death cross?

Yes, several other technical indicators can provide additional insights, including:

- Golden Cross: The opposite of a death cross, where the short-term moving average crosses above the long-term moving average, often seen as a bullish signal.

- Relative Strength Index (RSI): Measures the speed and change of price movements, indicating whether an asset is overbought or oversold.

- MACD (Moving Average Convergence Divergence): A trend-following momentum indicator that shows the relationship between two moving averages of an asset’s price.

7. How does market sentiment affect Bitcoin’s price?

Market sentiment, influenced by news, regulatory developments, technological advancements, and macroeconomic factors, can significantly impact Bitcoin’s price. Positive sentiment may drive prices higher, while negative sentiment can lead to declines or increased volatility.flip

8. What role do macroeconomic factors play in Bitcoin’s price movements?

Macroeconomic factors like interest rates, inflation, and geopolitical events can influence Bitcoin’s price by affecting investor behavior and market conditions. For instance, changes in interest rates or inflation data might alter investor preferences between assets like Bitcoin and traditional investments.

9. How should I stay informed about Bitcoin and market conditions?

Regularly follow reliable financial news sources, market analysis, and updates on Bitcoin and the broader cryptocurrency market. Engaging with investment communities, attending webinars, and using financial tools can also provide valuable insights.

10. Where can I learn more about technical analysis?

Many resources are available for learning technical analysis, including online courses, books, and financial websites. Some popular options include:

- Books: “Technical Analysis of the Financial Markets” by John Murphy.

- Online Courses: Platforms like Coursera, Udemy, or Investopedia offer courses on technical analysis.flip

- Financial News Websites: Websites like Bloomberg, CNBC, and MarketWatch provide analysis and updates.

Advantages of Using Technical Analysis Indicators

- Data-Driven Decisions:

- Advantage: Technical indicators provide a systematic approach to analyzing price movements based on historical data. This can help traders make more objective decisions rather than relying solely on intuition.

- Trend Identification:

- Advantage: Indicators like the death cross can help identify potential shifts in market trends. For example, a death cross might signal a bearish trend, helping traders prepare for possible declines.flip

- Timing:

- Advantage: Technical analysis can assist in determining optimal entry and exit points. By analyzing patterns and indicators, traders can potentially time their trades more effectively.

- Quantitative Analysis:

- Advantage: Indicators provide quantitative data, such as moving averages or RSI values, which can be used to gauge market conditions and make data-driven decisions.

- Versatility:

- Advantage: Technical analysis tools can be applied to various asset classes, including stocks, cryptocurrencies, forex, and commodities, making them versatile for different trading environments.flip

- Visual Representation:

- Advantage: Charts and technical indicators provide visual representations of market data, making it easier to identify patterns and trends.

Disadvantages of Using Technical Analysis Indicators

- Lagging Indicators:

- Disadvantage: Many technical indicators, including the death cross, are lagging because they are based on historical price data. This can result in delayed signals and missed opportunities.flip

- False Signals:

- Disadvantage: Technical indicators can produce false signals, leading to incorrect trade decisions. For example, a death cross might signal a decline that doesn’t materialize or is short-lived.flip

- Over-Reliance:

- Disadvantage: Relying solely on technical indicators without considering other factors, such as fundamental analysis or market news, can lead to incomplete analysis and poor decision-making.

- Market Conditions:

- Disadvantage: Technical analysis might be less effective in highly volatile or unusual market conditions where historical patterns and trends are less reliable.

- Complexity:

- Disadvantage: Some technical indicators can be complex and require a deep understanding to use effectively. Misinterpreting these indicators can lead to erroneous decisions.flip

- Lack of Predictive Power:

- Disadvantage: Technical analysis does not predict future events or market conditions. It’s based on historical data and patterns, which may not always accurately reflect future movements.

Specific Considerations for Bitcoin

- Volatility:

- Advantage: Bitcoin’s high volatility can create trading opportunities and make technical indicators more relevant for short-term trading.

- Disadvantage: The same volatility can also lead to erratic signals and increased risk of false positives or negatives.flip

- Market Sentiment:

- Advantage: Technical analysis can help gauge market sentiment and identify trends based on price action.

- Disadvantage: Bitcoin’s price is heavily influenced by news, sentiment, and macroeconomic factors, which may not always be reflected in technical indicators.

- Historical Patterns:

- Advantage: Bitcoin’s historical price patterns can provide useful insights and help identify potential trends.

- Disadvantage: Bitcoin’s relatively short trading history compared to traditional assets may limit the reliability of historical patterns.flip

- Integration with Fundamental Analysis:

- Advantage: Combining technical analysis with fundamental analysis can provide a more comprehensive view of Bitcoin’s potential movements.

- Disadvantage: Focusing only on technical indicators without considering fundamentals can lead to incomplete analysis.

Summary

Technical analysis indicators like the death cross offer valuable insights for identifying trends and making informed trading decisions. However, they have limitations such as lagging signals, potential for false positives, and the need for complementary analysis. For Bitcoin and other assets, balancing technical analysis with fundamental analysis and being aware of market conditions can enhance decision-making and risk management.

Impact on Bitcoin Price and Market Behavior

- Price Movements:

- Short-Term Declines: The death cross often triggers selling pressure due to its bearish signal. Traders who use technical analysis might sell off their positions, causing a decline in Bitcoin’s price.flip

- Market Reaction: A death cross can lead to increased volatility as traders react to the signal. This may result in sharp price swings and heightened market activity.

- Investor Sentiment:

- Bearish Sentiment: The death cross can influence investor sentiment, leading to a more cautious or bearish outlook. This shift in sentiment can prompt more selling and reduced buying interest.flip

- Market Psychology: Investors might interpret the death cross as a confirmation of a downtrend, reinforcing negative market psychology and potentially leading to a self-fulfilling prophecy.

- Trading Volume:

- Increased Activity: The appearance of a death cross can lead to increased trading volume as traders and investors react to the signal. Higher trading volume can amplify price movements and contribute to increased volatility.flip

Impact on Trading Strategies

- Technical Trading Strategies:flip

- Trend Reversal Strategies: Traders might use the death cross to adjust their strategies, such as shifting to bearish positions or employing short-selling strategies.

- Stop-Loss Adjustments: Traders may tighten stop-loss orders to protect against potential declines, impacting market liquidity and price stability.

- Algorithmic Trading:

- Automated Responses: Many algorithmic trading systems are programmed to respond to technical indicators like the death cross. This can lead to automated selling or buying activity based on predefined criteria.

- Investment Decisions:

- Portfolio Rebalancing: Investors who follow technical analysis might rebalance their portfolios in response to a death cross, potentially shifting assets away from Bitcoin or adjusting their risk exposure.flip

Impact on Market Dynamics

- Market Trends:

- Trend Confirmation: The death cross can confirm existing bearish trends, reinforcing downward momentum and influencing broader market trends.

- Potential Recovery: Conversely, if the price recovers quickly after a death cross, it can signal a potential bullish reversal, challenging the initial bearish outlook.

- Investor Behavior:

- Herd Behavior: Technical indicators like the death cross can contribute to herd behavior, where many investors react similarly to the signal, amplifying its impact on the market.flip

- Sentiment Shifts: The response to a death cross can vary based on market sentiment, news, and other factors, leading to differing impacts across different market conditions.

Impact on Broader Financial Markets

- Correlation with Other Assets:

- Market Correlation: Bitcoin’s reaction to a death cross can influence other cryptocurrencies and financial assets, especially if Bitcoin is a leading indicator for the crypto market.flip

- Spillover Effects: Significant price movements in Bitcoin due to a death cross can have spillover effects on related assets, including traditional equities and commodities.

- Institutional Involvement:

- Institutional Reactions: Institutional investors and funds that use technical analysis may react to a death cross by adjusting their positions, which can influence overall market dynamics and liquidity.

Limitations and Considerations

- False Signals:

- Risk of Misinterpretation: The death cross can produce false signals or lead to short-term price fluctuations that do not reflect a long-term trend. Traders and investors should be cautious of relying solely on this indicator.

- Context Matters:

- Broader Context: The impact of a death cross should be assessed in the context of other market factors, such as news, macroeconomic conditions, and fundamental analysis. Relying solely on technical indicators may overlook important influences.

Summary

The death cross can significantly impact Bitcoin’s price, market behavior, and trading strategies. It often leads to increased volatility, changes in investor sentiment, and adjustments in trading and investment strategies. However, it is essential to consider the limitations of technical indicators and integrate them with broader market analysis and risk management strategies for a more comprehensive approach.