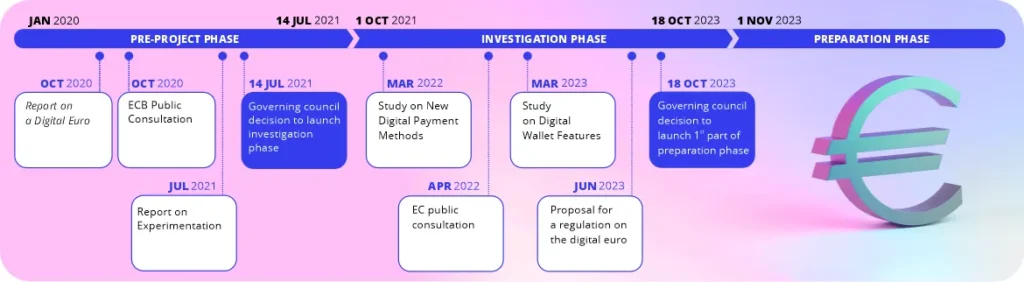

The Governing Council of the European Central Bank (ECB) has recently announced it was moving onto the next phase of the digital euro project, starting to lay the foundations for its possible issuance next month, although it has not yet made a definite decision on issuing it.

Specifically, the preparation phase for this central bank digital currency (CBDC) follows the conclusion of a two-year research of its design and distribution and aims to “lay foundations for a potential digital euro,” the ECB said in a press release published on October 18.

“This decision follows the completion of the investigation phase launched by the Eurosystem in October 2021 to explore possible design and distribution models for a digital euro.”

This decision follows the completion of the investigation phase launched by the Eurosystem in October 2021 to explore possible design and distribution models for a digital euro. Based on the findings from this phase, detailed in a report published today, the ECB has designed a digital euro that would be widely accessible to citizens and businesses through distribution by supervised intermediaries, such as banks.

The design envisages the digital euro as a digital form of cash that could be used for all digital payments throughout the euro area. It would be widely accessible, free for basic use and available both online and offline. It would offer the highest level of privacy and allow users to settle payments instantly in central bank money. It could be used from person to person, at the point of sale, in e-commerce and in government transactions. No digital payment instrument offers all these features. The digital euro would fill that gap.

The next phase of the digital euro project – the preparation phase – will start on 1 November 2023 and will initially last two years. It will involve finalising the digital euro rulebook and selecting providers that could develop a digital euro platform and infrastructure. It will also include testing and experimentation to develop a digital euro that meets both the Eurosystem’s requirements and user needs, for example in terms of user experience, privacy, financial inclusion and environmental footprint.

The ECB will continue to engage with the public and all stakeholders during this phase. After two years, the Governing Council will decide whether to move to the next stage of preparations, to pave the way for the possible future issuance and roll-out of a digital euro.

The launch of the preparation phase is not a decision on whether to issue a digital euro. That decision will only be considered by the Governing Council once the European Union’s legislative process has been completed. The ECB will take into account any adjustments to the design of the digital euro that may become necessary as a result of the legislative deliberations.

“We need to prepare our currency for the future,” said Christine Lagarde, President of the ECB. “We envisage a digital euro as a digital form of cash that can be used for all digital payments, free of charge, and that meets the highest privacy standards. It would coexist alongside physical cash, which will always be available, leaving no one behind.”

The digital euro would make data protection a priority. The Eurosystem would not be able to see users’ personal data or link payment information to individuals. The digital euro would also achieve a cash-like level of privacy for offline payments.

The digital euro would promote resilience, competition and innovation in the European payments sector. It would ensure that there is a pan-European payment solution for the euro area under European governance. It would rely on its own infrastructure, thereby strengthening resilience. And it would provide a platform on which European supervised intermediaries could build pan-European services for their customers, increasing efficiency, reducing costs and fostering innovation.

“As people increasingly choose to pay digitally, we should be ready to issue a digital euro alongside cash,” said Fabio Panetta, ECB Executive Board member and Chair of the High-Level Task Force on a digital euro. “A digital euro would increase the efficiency of European payments and contribute to Europe’s strategic autonomy.”

Table of Contents

History of European Central Bank (ECB)

The European Central Bank (ECB), the central bank for the eurozone, boasts a relatively young history compared to some long-established national banks. However, its journey has been marked by significant milestones that shaped the economic landscape of Europe. Let’s delve into the key events that transformed the ECB from a conceptual vision to a powerful monetary institution.

The Seeds of Monetary Union (1960s-1980s):

- The Werner Report (1970): This report, commissioned by the European Commission, laid the groundwork for economic and monetary union (EMU) in Europe. It proposed a gradual approach towards a single currency and a central bank.

- The Snake in the Tunnel (1972-1979): This mechanism aimed to stabilize exchange rates between European currencies. While ultimately unsuccessful, it highlighted the challenges and complexities of European monetary integration.

- The Delors Report (1989): This report, named after European Commission President Jacques Delors, outlined a three-stage roadmap for achieving EMU. It paved the way for the creation of the ECB.

The Birth of the ECB and the Dawning of the Euro (1989-1999):

- The Maastricht Treaty (1992): This treaty formally established the European Union (EU) and set a clear timeline for EMU. It included provisions for the creation of the ECB and the introduction of the euro.

- The Treaty of Amsterdam (1999): This treaty established the legal framework for the ECB, defining its key functions and objectives. It paved the way for the official launch of the ECB on June 1, 1998.

- The Euro Arrives (1999): On January 1, 1999, the euro was introduced as a virtual currency. National currencies continued to circulate for a transitional period until the physical euro coins and banknotes were launched in 2002.

The ECB’s Evolving Role in the 21st Century (2000-Present):

- Monetary Policy Guardian: The ECB’s primary function is to maintain price stability within the eurozone. It uses various monetary policy tools, such as setting interest rates, to achieve this objective.

- Financial Crisis Response: The ECB played a crucial role in managing the global financial crisis of 2008 and the subsequent European sovereign debt crisis. It implemented various measures to provide liquidity and support financial stability.

- A Widening Eurozone: Since its inception, the eurozone has expanded to include several new member states. The ECB has adapted its policies and operations to accommodate this growth.

- New Challenges and Opportunities: The ECB faces new challenges in the 21st century, including digitalization, climate change, and geopolitical tensions. It is continuously adapting its strategies to address these evolving economic and financial landscapes.

What next phase entails

According to the statement, moving to the next phase envisions “finalizing rulebook and selecting providers to develop platform and infrastructure” for the currency on the basis of the findings detailed in a summary report for the previous phase, titled ‘A stocktake on the digital euro.’

As per the press release, the next phase, which the press release refers to as the preparation phase, will begin on 1 November 2023 “and will initially last two years,” including testing and experimentation to develop a digital euro that meets both the Eurosystem’s requirements and user needs.”

That said, the Governing Council will only decide after these two years whether it would “move to the next stage of preparations, to pave the way for the possible future issuance and roll-out of a digital euro,” stressing that “the launch of the preparation phase is not a decision on whether to issue a digital euro,” which means that the currency is still a long way to go.

Commenting on the development, the ECB president Christine Lagarde said:

“We need to prepare our currency for the future. (…) We envisage a digital euro as a digital form of cash that can be used for all digital payments, free of charge, and that meets the highest privacy standards. It would coexist alongside physical cash, which will always be available, leaving no one behind.”

Digital euro and privacy concerns

Earlier, Lagarde strongly defended the digital euro project, saying the currency “will not be completely anonymous as is the case with a banknote,” after some members of the European Parliament voiced their concerns regarding its impact on user data privacy, as Finbold reported in September.

Back in March, she had also admitted that “there will be control” after the issuance of the digital euro, albeit specifying that it would be a “limited amount of control,” during a prank interview in which Lagarde believed she was talking to the Ukrainian President Volodymyr Zelensky.

Digital euro distribution

Users could access digital euro services via their payment service provider’s proprietary app and online interface, or via a digital euro app provided by the Eurosystem. People without access to a bank account or digital devices would also be able to pay with digital euro, for example by using a card provided by a public body such as a post office. Users would also be able to exchange digital euro for cash or vice versa at cash machines.

The Eurosystem envisions a digital euro that would be free for basic use for individuals. A compensation model between intermediaries and merchants would ensure that there are incentives for intermediaries to distribute digital euro, as is the case for other electronic payment instruments, and that there are adequate safeguards against excessive service charges for merchants. The Eurosystem would bear its own costs, including those related to scheme management and settlement processing.

Transparency and close cooperation with stakeholders remain key pillars of the project. The Eurosystem has benefited greatly from feedback from European decision-makers, market participants and potential users, and will continue to engage actively with a wide range of stakeholders. We will also continue to cooperate closely with EU legislators.

Europe Inches Closer to Digital Currency: ECB Prepares for Digital Euro Launch

The European Central Bank (ECB) has taken a significant step towards launching a digital euro, signaling a potential shift in the way Europeans interact with money. The bank’s Governing Council has decided to move forward with the “preparation phase” of the digital euro project, following a successful investigation period.

From Investigation to Preparation: Paving the Way for a Digital Euro

This decision marks a crucial milestone in the development of a central bank digital currency (CBDC) for the eurozone. The ECB initiated an investigation phase in October 2021 to explore the feasibility and potential design of a digital euro. After two years of research and analysis, the bank is now confident in moving forward with the next stage of development.

What Does the Preparation Phase Entail?

The preparation phase, expected to last for two years, will focus on several key objectives:

- Finalizing the Digital Euro Design: The ECB will work on finalizing the technical specifications and functionalities of the digital euro. This will involve decisions concerning user access, transaction privacy, and offline functionality.

- Selecting Partners: The European Central Bank (ECB) will select private sector partners to collaborate on the development and implementation of the digital euro platform. This collaboration will ensure the digital euro leverages cutting-edge technology and expertise.

- Further Testing and Experimentation: The preparation phase will involve further testing and experimentation with the digital euro concept. This will allow The European Central Bank (ECB) to refine its design and address any potential technical or operational hurdles.

Why a Digital Euro? Potential Benefits and Considerations

The ECB sees several potential benefits associated with a digital euro:

- Enhanced Financial Inclusion: A digital euro could potentially improve access to digital payments for all citizens, particularly those who may not have access to traditional bank accounts.

- Increased Efficiency and Security: Digital transactions can be faster and more secure compared to cash payments.

- Maintaining Control over Money Supply: A central bank digital currency allows The European Central Bank (ECB) to maintain control over the money supply and potentially implement new monetary policy tools.

However, there are also some considerations to address:

- Privacy Concerns: The ECB needs to ensure a balance between user privacy and the need for AML/KYC (Anti-Money Laundering/Know Your Customer) compliance.

- Impact on Commercial Banks: The introduction of a digital euro could potentially impact the role of commercial banks in the financial system.

- Integration with Existing Systems: Ensuring seamless integration with existing payment systems will be crucial for widespread adoption of the digital euro.

A Look Ahead: The Future of the Digital Euro

The ECB’s decision to move to the preparation phase signifies its commitment to exploring the potential of a digital euro. While there’s still some way to go before a digital euro becomes a reality, this development marks a significant step forward for Europe’s digital currency ambitions. Over the next two years, we can expect further details about the design and functionality of the digital euro as European Central Bank (ECB) progresses through the preparation phase.

Beyond the Headlines: Unveiling the Digital Euro Project

A Collaborative Effort: The ECB’s digital euro project is not a solitary endeavor. The bank is actively seeking collaboration with various stakeholders throughout the preparation phase. This includes national central banks within the eurozone, academic institutions, and private sector firms with expertise in digital payments and technology. Open dialogue and collaboration will be crucial for developing a digital euro that meets the needs of all users.

Public Engagement in Focus: Public opinion and trust are paramount for the success of the digital euro. The European Central Bank (ECB) is committed to ongoing public engagement throughout the preparation phase. This will involve surveys, focus groups, and educational initiatives to ensure citizens understand the potential benefits and implications of a digital euro.

Competition and Innovation: The rise of private cryptocurrencies and stablecoins has undoubtedly influenced the ECB’s decision to explore a digital euro. A central bank digital currency can potentially offer a more secure and stable alternative to these private ventures, while fostering innovation within the European financial ecosystem.

Navigating the Road Ahead: Challenges and Opportunities

The Evolving Regulatory Landscape: The regulatory landscape surrounding digital currencies is still evolving. The ECB will need to work closely with policymakers to ensure the digital euro operates within a clear and efficient regulatory framework. This will address concerns surrounding money laundering, financial stability, and consumer protection.

Addressing Cybersecurity Threats: The digital world is constantly evolving, and cybersecurity threats are ever-present. The ECB needs to prioritize robust cybersecurity measures to safeguard the digital euro platform and user information. This will involve continuous investment in cybersecurity infrastructure and expertise.

The Future of Cash: The introduction of a digital euro raises questions about the future of cash. While the ECB maintains its commitment to cash as legal tender, the digital euro could potentially lead to a decline in its usage over time. The ECB will need to carefully manage this transition to ensure continued financial inclusion for all citizens.

A Global Conversation: The development of the digital euro is being closely monitored by central banks around the world. The ECB’s experience can inform the development of CBDCs in other countries, potentially leading to a more interconnected and efficient global financial system in the future.

Conclusion: A Digital Future for Europe’s Currency

The ECB’s move to the preparation phase marks a significant step towards a potential digital euro. While challenges remain, the project presents exciting opportunities for enhancing financial inclusion, fostering innovation, and shaping the future of payments in Europe. As the preparation phase progresses, we can expect to see a clearer picture emerge of what a digital euro might look like and how it will impact the lives of European citizens.

Disclaimer ||

The Information provided on this website article does not constitute investment advice ,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!

Leave feedback about this