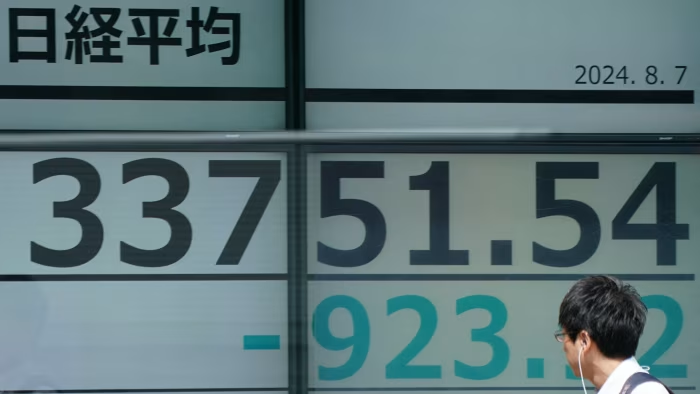

The BOJ recently raised rates for the first time in over a decade, destabilizing global markets, including bitcoin.

It sounds like you’re referring to a recent update from a former Bank of Japan official regarding monetary policy. If they’re ruling out another rate hike this year, it suggests they believe the current economic conditions don’t warrant further tightening of monetary policy. This could be due to a range of factors, including current inflation rates, economic growth, or other economic indicators.

Economic Conditions: The official’s stance suggests that the BoJ might be prioritizing economic stability over tightening monetary policy. If inflation is not rising rapidly or if economic growth is weaker than expected, the BoJ might choose to maintain the current interest rates to avoid stifling economic activity.

Inflation and Growth: The BoJ has historically faced challenges with low inflation and sluggish growth. If inflation is still below the target or if economic growth is not strong enough, the central bank might avoid further rate hikes to support consumption and investment.

Global Influences: Global economic conditions and geopolitical events can also impact monetary policy decisions. For example, if there are concerns about a global economic slowdown or financial instability, the BoJ might opt to keep rates steady to mitigate potential risks.

Policy Continuity: Former officials sometimes have insights into the central bank’s decision-making process or internal discussions. Their views can reflect a consensus or a shift in thinking among policymakers. However, it’s important to differentiate between the views of a former official and current policy stances.

Market Expectations: Central banks often aim to manage market expectations. If an official is publicly ruling out a rate hike, it could be an effort to communicate stability and reduce market volatility.

Economic Indicators: Key indicators such as GDP growth, unemployment rates, and consumer spending are closely watched by central banks. If these indicators are not signaling the need for a rate hike, the BoJ might choose to maintain its current stance.

Context of the BoJ’s Monetary Policy

- Current Policy Stance: The BoJ has historically maintained very low interest rates and engaged in quantitative easing to combat deflation and stimulate economic growth. In recent years, Japan has struggled with low inflation and slow economic growth, which have influenced its monetary policy decisions.

- Inflation Targets: The BoJ has aimed for a 2% inflation target. If inflation is still below this target, or if it’s volatile and not consistently reaching the goal, the central bank might be cautious about raising rates. Higher rates could potentially dampen economic activity and further hinder inflation growth.

- Economic Growth: Japan’s economy has faced challenges such as an aging population, low productivity growth, and external economic pressures. If economic growth is sluggish or uncertain, raising interest rates might exacerbate these issues by reducing consumer and business spending.

Possible Reasons for Ruling Out a Rate Hike

- Inflation Trends: If recent data show that inflation is not accelerating as anticipated, the BoJ might decide against raising rates. Persistent low inflation can indicate that the economy still requires accommodative monetary policy to spur demand.

- Economic Data: Key economic indicators such as GDP growth, unemployment rates, and consumer confidence play a crucial role in monetary policy decisions. Weak economic data could lead the BoJ to avoid tightening monetary conditions.

- Global Economic Conditions: External factors like global economic slowdowns, trade tensions, or geopolitical uncertainties can impact Japan’s economy. If there are concerns about global economic stability, the BoJ might prefer to maintain its current policy to avoid adding further stress to the economy.

- Financial Market Stability: Rapid increases in interest rates can lead to financial market volatility. The BoJ might be wary of disrupting financial markets or causing adverse reactions in the stock and bond markets.

Implications of the Decision

- Market Reactions: Financial markets closely watch central bank signals. Ruling out a rate hike could stabilize market expectations and reduce volatility. Investors and businesses might view this as a signal of continued accommodative conditions.

- Economic Policy: The decision to hold rates steady aligns with the BoJ’s broader economic strategy, which may involve supporting domestic demand and encouraging investment. This approach can be seen as a way to sustain economic momentum and counteract deflationary pressures.

- Future Outlook: While ruling out a rate hike for the year, the BoJ will likely continue to assess economic conditions and adjust its policy as needed. Future decisions will depend on how economic indicators evolve, including inflation trends and growth prospects.

In summary, a former BoJ official’s ruling out of another rate hike indicates a cautious approach in response to current economic conditions. The BoJ’s focus appears to be on maintaining economic stability and supporting growth, given the challenges Japan’s economy faces.

FAQ: Former Bank of Japan Official Rules Out Another Rate Hike

1. What does it mean for the BoJ to rule out another rate hike?

- When a former BoJ official rules out another rate hike, it means they believe that increasing interest rates further this year is unlikely. This stance suggests that current economic conditions do not warrant tightening monetary policy.

2. Why might the BoJ decide not to raise interest rates?

- The BoJ might choose not to raise rates due to several factors:

- Inflation: If inflation is not rising as expected or remains below the target, there might be no immediate need for a rate hike.

- Economic Growth: Weak or sluggish economic growth might warrant maintaining lower rates to support economic activity.

- Financial Stability: Raising rates too quickly could lead to financial market instability or affect economic confidence.

3. What impact does this decision have on the Japanese economy?

- Keeping interest rates steady can help support economic growth by encouraging borrowing and spending. It can also provide stability in financial markets. However, it may also mean that inflationary pressures are not being addressed as aggressively.

4. How does this decision affect Japanese businesses and consumers?

- Businesses: Low interest rates can make borrowing cheaper, potentially encouraging investment and expansion. However, if the economy remains weak, businesses may still face challenges.

- Consumers: Low rates can benefit consumers by making loans and mortgages more affordable, which can support spending. However, if inflation is not rising, wage growth might remain stagnant, affecting purchasing power.

5. What are the broader implications for global markets?

- Decisions from major central banks like the BoJ can influence global financial markets. Ruling out a rate hike might stabilize investor expectations and impact currency exchange rates, particularly the Japanese yen.

6. How does this decision relate to the BoJ’s historical policies?

- The BoJ has historically maintained low interest rates and engaged in quantitative easing to combat deflation and stimulate economic growth. This decision aligns with its ongoing strategy to support the economy in the face of low inflation and slow growth.

7. What factors might lead the BoJ to reconsider its stance later?

- The BoJ might revisit its decision if there are significant changes in economic conditions, such as:

- A marked increase in inflation.

- Stronger-than-expected economic growth.

- Significant shifts in global economic conditions or financial markets.

8. Are there any upcoming economic indicators to watch?

- Key indicators to watch include:

- Inflation rates and trends.

- GDP growth figures.

- Employment and wage data.

- Consumer spending and business investment.

9. How does this decision affect monetary policy expectations in Japan?

- Ruling out a rate hike might signal a continued focus on supportive monetary policy. It suggests that the BoJ is prioritizing economic stability and growth over immediate monetary tightening.

10. Can former BoJ officials’ views influence current policy decisions?

- While former officials may provide valuable insights based on their experience, actual policy decisions are made by current policymakers. Their views can, however, reflect broader discussions or sentiments within economic circles.

Risks Influencing Monetary Policy

- Inflation Risks:

- High Inflation: If inflation is rising rapidly, the BoJ might consider increasing interest rates to cool down the economy and bring inflation under control. High inflation can erode purchasing power and create uncertainty.

- Low Inflation: Persistent low inflation, or deflation, can prompt the BoJ to keep interest rates low or even consider additional monetary easing to stimulate demand and support economic growth.

- Economic Growth Risks:

- Recession Risks: In the face of economic downturns or recessions, the BoJ may lower interest rates or use other stimulative measures to encourage borrowing, spending, and investment.

- Overheating: Conversely, if the economy is growing too quickly, leading to asset bubbles or unsustainable growth, the BoJ might raise rates to prevent overheating.

- Financial Stability Risks:

- Market Volatility: Rapid changes in interest rates can lead to financial market instability. The BoJ must balance its policy decisions to avoid excessive market fluctuations.

- Banking Sector Health: Central banks need to ensure that changes in policy do not adversely impact the health of banks and financial institutions, which are crucial for economic stability.

- Global Economic Risks:

- External Shocks: Global events such as geopolitical tensions, trade conflicts, or financial crises can impact Japan’s economy. The BoJ must consider these external risks when setting policy.

- Exchange Rates: Changes in interest rates can affect the value of the yen. A stronger or weaker yen can influence Japan’s trade balance and overall economic conditions.

- Demographic Risks:

- Aging Population: Japan faces demographic challenges with an aging population and declining workforce. These factors can affect economic growth and productivity, influencing monetary policy decisions.

Policy Responses

- Monetary Easing:

- Interest Rate Cuts: Lowering interest rates can stimulate economic activity by making borrowing cheaper, encouraging consumer spending and business investment.

- Quantitative Easing (QE): The BoJ may buy government bonds and other assets to increase money supply and lower long-term interest rates, supporting economic growth and boosting asset prices.

- Monetary Tightening:

- Interest Rate Hikes: Raising interest rates can help control inflation and prevent the economy from overheating. It can also stabilize asset prices and strengthen the currency.

- Reducing Asset Purchases: The BoJ might scale back its asset purchases as part of tightening measures to normalize monetary conditions.

- Forward Guidance:

- Communication: The BoJ provides guidance on future policy directions to help manage market expectations and reduce uncertainty. Clear communication can influence economic behavior and market reactions.

- Macroprudential Measures:

- Regulations and Controls: To address financial stability risks, the BoJ might implement regulatory measures or controls on lending practices, especially if there are signs of asset bubbles or excessive risk-taking in the financial sector.

- Fiscal and Structural Policies:

- Coordination with Government: The BoJ may work in tandem with fiscal authorities to address broader economic challenges. Structural reforms and fiscal policies can complement monetary policy in promoting long-term economic stability.

Impact and Considerations

- Balancing Act: The BoJ must carefully balance its policy decisions to manage inflation, support growth, and maintain financial stability. Each policy action carries potential risks and benefits.

- Market Reactions: Central bank policies significantly impact financial markets, affecting interest rates, currency values, and investor sentiment.

- Long-Term Strategy: The BoJ’s policies are part of a broader strategy aimed at achieving sustainable economic growth and stability. Short-term measures are often aligned with long-term goals.

Certainly! Here’s an overview of the advantages and disadvantages of the Bank of Japan’s (BoJ) monetary policy tools and approaches, particularly in the context of ruling out another rate hike and maintaining the current policy stance:

Advantages of Maintaining Low Interest Rates

- Stimulates Economic Growth:

- Encourages Borrowing: Lower interest rates reduce the cost of borrowing for consumers and businesses, promoting investment and spending.

- Boosts Consumption: Cheaper loans can increase consumer spending on big-ticket items and services, supporting overall economic growth.

- Supports Asset Prices:

- Enhances Wealth: Lower rates can drive up asset prices (stocks, real estate), which can boost household wealth and further stimulate economic activity.

- Helps Combat Deflation:

- Inflation Target: Maintaining low rates helps to prevent deflation and supports the BoJ’s inflation target. It can also help in achieving stable, positive inflation rates.

- Financial Stability:

- Eases Debt Burden: Lower rates can reduce the debt servicing costs for households and businesses, helping to avoid defaults and maintain financial stability.

- Encourages Investment:

- Business Expansion: Lower interest rates can make financing for expansion and capital investment more attractive for businesses, potentially leading to job creation and economic growth.

Disadvantages of Maintaining Low Interest Rates

- Risk of Asset Bubbles:

- Overvaluation: Prolonged low rates can lead to overvaluation of assets, such as real estate and stocks, creating asset bubbles that can be detrimental if they burst.

- Reduced Bank Profitability:

- Narrow Margins: Banks may face squeezed profit margins due to lower interest rates, as the spread between lending and deposit rates narrows. This can impact their ability to lend and support economic activity.

- Potential for Financial Instability:

- Excessive Risk-Taking: Low interest rates can encourage excessive risk-taking and speculative behavior in financial markets, potentially leading to instability.

- Diminished Effectiveness Over Time:

- Limited Impact: If rates are kept too low for too long, their effectiveness in stimulating the economy can diminish, leading to diminished returns on monetary policy actions.

- Savings Disincentives:

- Low Returns: Savers and retirees may receive lower returns on their savings and investments, which can reduce their income and spending ability.

Advantages of Ruling Out Rate Hikes

- Economic Stability:

- Predictability: By not raising rates, the BoJ provides a stable environment for businesses and consumers, reducing uncertainty and allowing for more predictable economic planning.

- Continued Support for Growth:

- Stimulative Effect: Keeping rates steady supports continued economic growth and can help sustain consumer and business confidence.

- Avoids Negative Impact on Recovery:

- Supports Recovery: In a period of weak economic recovery or growth, ruling out rate hikes can prevent additional pressure on the economy and support ongoing recovery efforts.

Disadvantages of Ruling Out Rate Hikes

- Inflation Risks:

- Potential for Rising Inflation: Prolonged low rates might eventually lead to higher inflation, especially if economic conditions improve or if there are supply chain issues.

- Perception of Inaction:

- Market Confidence: Ruling out rate hikes might be perceived as a lack of action or a signal that the BoJ is not addressing potential inflationary pressures, which could impact market confidence.

- Long-Term Constraints:

- Limited Policy Space: By keeping rates low, the BoJ may have limited room to maneuver if economic conditions change or if a more aggressive monetary response is needed in the future.

- Debt Accumulation:

- Increased Debt: Continued low rates can encourage higher levels of borrowing, potentially leading to unsustainable debt levels among consumers and businesses.

In summary, maintaining low interest rates and ruling out rate hikes have both benefits and drawbacks. The BoJ must weigh these factors carefully to balance economic growth, financial stability, and inflation control. The effectiveness of these policies can vary based on the overall economic environment and specific challenges faced by the Japanese economy

Impact on Bank Profitability

Advantages:

- Increased Loan Demand:

- Higher Volume: Lower interest rates can stimulate demand for loans, leading to increased lending volumes. While the profit margin on each loan may be lower, the total revenue from a higher volume of loans can still be significant.

- Enhanced Asset Management:

- Investment Opportunities: Banks may find new investment opportunities in a low-rate environment, such as higher-risk assets that offer better returns than traditional investments.

- Reduced Default Risk:

- Debt Servicing: Lower rates make debt servicing more manageable for borrowers, potentially reducing default rates and associated losses for banks.

Disadvantages:

- Narrower Interest Margins:

- Reduced Spread: With low interest rates, the spread between deposit rates and lending rates is reduced. This can squeeze the net interest margin (NIM), which is a primary source of bank revenue.

- Profitability Pressure:

- Lower Returns: Persistent low rates can pressure bank profitability, as the traditional model of earning from the difference between deposit and loan rates becomes less effective.

- Increased Competition:

- Pricing Pressure: Banks might face competitive pressure to lower interest rates on loans, further impacting their profit margins.

Impact on Business Profitability

Advantages:

- Lower Borrowing Costs:

- Reduced Expenses: Lower interest rates decrease the cost of financing for businesses, which can enhance profitability by lowering operational costs and increasing margins.

- Enhanced Investment:

- Growth Opportunities: Cheaper financing can enable businesses to invest in expansion, innovation, and other growth opportunities, potentially leading to higher revenues and profits.

- Increased Consumer Spending:

- Boosted Demand: Lower rates can increase consumer spending, which can drive higher sales and revenues for businesses.

Disadvantages:

- Cost of Capital:

- Risk of Over-Leverage: Lower rates might encourage excessive borrowing, leading to over-leverage and increased financial risk if business conditions deteriorate.

- Reduced Return on Investment:

- Lower Yield: Businesses investing their own funds might experience lower returns on investments in a low-rate environment, as the opportunity cost of capital is reduced.

Impact on the Broader Economy

Advantages:

- Stimulated Economic Growth:

- Economic Expansion: Low interest rates can stimulate overall economic activity, potentially leading to increased business profitability and job creation.

- Asset Price Inflation:

- Wealth Effect: Rising asset prices can increase household wealth and spending, further supporting economic growth.

- Debt Relief:

- Reduced Financial Stress: Lower rates can alleviate financial stress for households and businesses, contributing to a more stable economic environment.

Disadvantages:

- Asset Bubbles:

- Overvaluation: Prolonged low rates can lead to the creation of asset bubbles, which can pose risks to economic stability and profitability if they burst.

- Inequality:

- Uneven Benefits: The benefits of low rates may not be evenly distributed, potentially exacerbating economic inequality if wealthier individuals and businesses are better positioned to benefit from lower borrowing costs.