Stable assets are investments designed to hold their value, or fluctuate minimally, over time. They’re ideal for investors seeking to preserve their capital rather than chase high returns.pen_spark

In the ever-changing world of investments, the search for stability can feel like chasing a mirage. However, amidst the whirlwind of volatility, one option has caught the attention of savvy investors: stable assets. These assets have seen an unprecedented surge in popularity in recent years, especially with the dominance of cryptocurrencies and their wild price swings.

But what exactly are stable assets, and how can they provide calm amidst the storm? Join us on this enlightening journey as we unravel the mysteries of stable assets, their inner workings, and why they have emerged as a beacon of security in an uncertain financial landscape.

What are Stable Assets?

Stable assets are assets that are designed to maintain a stable value, often by being pegged to a more stable asset or by using advanced financial instruments. These assets offer a reliable store of value compared to volatile assets like cryptocurrencies.

Available options for investing in stable assets

There are various options available for investing in stable assets:

Stablecoins

Stablecoins, such as NeoNomad’s ZARC Stablecoin, are one of the most popular types of stable assets. They are cryptocurrencies pegged to more stable assets like the US dollar or gold, ensuring a stable value. Stablecoins offer the benefits of fast transaction times and low fees while providing the stability of a traditional currency.

Bonds

Government and corporate bonds are considered relatively stable investments. Government bonds, especially those from stable governments, are backed by the government’s ability to repay the debt and are low-risk investments. Corporate bonds offer higher yields but have slightly more risk. Bonds pay fixed interest rates over a specified period, making them a reliable source of income.

Money Market Funds

Money market funds invest in short-term debt securities like Treasury bills, certificates of deposit, and commercial paper. These funds aim to provide stability, liquidity, and modest returns. They are low-risk investments suitable for those seeking stability and easy access to their funds.

Precious Metals

Investing in stable assets like gold, silver, or other precious metals can be done through physical holdings, ETFs (exchange traded funds), or mutual funds that track the performance of these assets.

Certificate of Deposit (CD)

Certificates of deposit are time deposits offered by banks and credit unions. They offer a fixed interest rate and a specific term length. CDs are considered low-risk investments but offer lower returns compared to other investment options. They are suitable for investors looking for stability and a guaranteed return over a fixed period.

How do Stable Assets Work?

They maintain their stable value through various mechanisms. One common mechanism is pegging the stable asset to a more stable asset, like the US dollar, by holding a reserve in a bank account or through a decentralized finance platform.

Other mechanisms that stable assets employ include:

- Advanced Financial Instruments: Derivatives can be used to hedge against price fluctuations, helping to keep a stable value.

- Collateralization: Stablecoins are generally backed by reserves of assets held in a trusted custodian. These reserves act as collateral to ensure the stability of the stablecoin’s value. For example, a stablecoin pegged to the US dollar may hold a reserve of US dollars in a bank account or other secure assets.

- Overcollateralization (for decentralized stablecoins): Decentralized stablecoins require users to lock up collateral greater than the value of the stablecoin issued. This added collateral acts as a buffer against potential price fluctuations, ensuring stability.

- Algorithmic Stability: Stablecoins utilizing algorithms manage supply and demand by adjusting the coin’s price or issuing new coins. These algorithms respond to market fluctuations, increasing or decreasing the coin’s supply to maintain its value.

- Governance and Risk Management: Governance involves a community of stakeholders making decisions on changes to the stablecoin’s protocol or parameters. This allows for adjustments to be made if the stability of the asset is at risk.

- Market Making and Arbitrage: Market makers and arbitrageurs ensure stablecoin prices align with their pegged values by facilitating trades on different exchanges. This balance of supply and demand helps maintain price stability.

It is important to note that stable assets are not entirely risk-free. Factors such as regulatory changes, counterparty risk, or events affecting the underlying collateral can still pose risks to their stability.

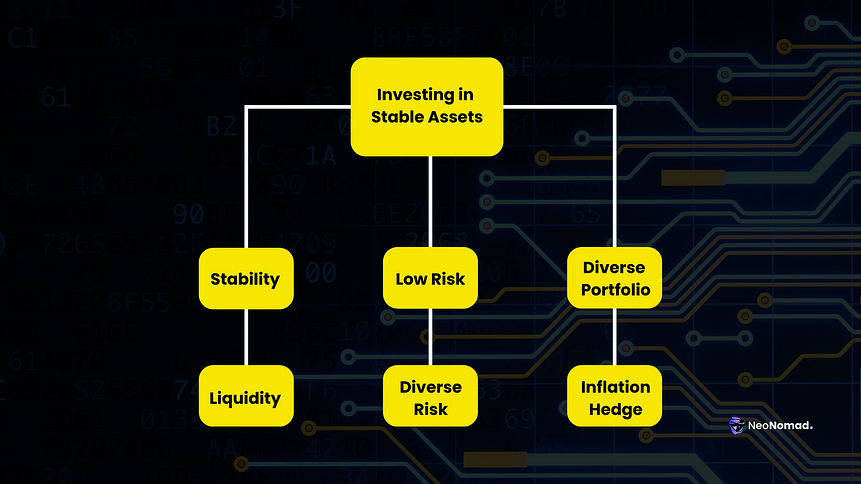

Why Invest in Stable Assets?

Investing in stable assets offers many advantages:

- Stability/Capital Preservation: It provide a reliable store of value, ideal for those seeking stability and capital preservation.

- Low Risk: Due to their stable value, stable assets are considered low-risk investment options.

- Portfolio Diversification: By investing in stable assets, you can diversify your portfolio and reduce overall risk.

- Accessibility: Accessible to anyone with an internet connection, stable assets provide a convenient investment option.

- Liquidity: Many stable assets offer elevated levels of liquidity, allowing for quick access to funds in times of need.

- Risk Diversification: Stable assets have a low correlation with other asset classes, helping to mitigate overall risk during market downturns.

- Inflation Hedging: Some stable assets act as a hedge against inflation, preserving the value of investments in the long term.

Challenges, Considerations, and Risks: Investing in Stable Assets.

While it offer stability and conservative returns, they are not entirely risk-free. It is important to consider the following risks:

- Counterparty Risk: Certain stable assets, like stablecoins, may involve counterparty risk. Evaluating the credibility and financial stability of issuers is crucial to mitigate this risk.

- Regulatory and Legal Risks: Changes in regulations or legal uncertainties can impact the stability and viability of stable assets.

- Currency Risk: Stable assets tied to specific currencies or pegged to different currencies are exposed to currency risk. Fluctuations in exchange rates can impact their value.

- Liquidity Risk: Although they are considered liquid, market stress or economic volatility may limit liquidity, hindering access to funds.

- Inflation Risk: Stable assets may not always provide full protection against inflation, as the rate of inflation may exceed their returns or interest earned.

Stable assets are an attractive investment option for those seeking stability, low risk, and diversification. However, investors must be aware of the associated risks, such as counterparty risk, regulatory changes, currency risk, liquidity risk, and inflation risk. Proper evaluation of mechanisms and risks associated with each stable asset is vital before making investment decisions. By carefully considering your investment goals, risk tolerance, and time horizon, you can make informed investment choices that align with your financial objectives.

Learn more: https://gemini.google.com/app

Disclaimer ||

The Information provided on this website article does not constitute investment advice ,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!