What Is the Federal Reserve System (FRS)?

The Federal Reserve System (FRS) is the central bank of the United States. Often called the Fed, it is arguably the most influential financial institution in the world. It was founded to provide the country with a safe, flexible, and stable monetary and financial system.1 The Fed has a board of seven members and 12 Federal Reserve banks, each operating as a separate district with their own presidents.23

There is a common misconception that the Federal Reserve System is privately owned. In fact, it combines public and private characteristics: The central governing board of the FRS is an agency of the federal government and reports to Congress. The Federal Reserve Banks that it oversees are set up like private corporations.

KEY TAKEAWAYS

- The Federal Reserve System is the central bank and monetary authority of the United States.

- The Fed works to provide the country with a safe, flexible, and stable monetary and financial system.

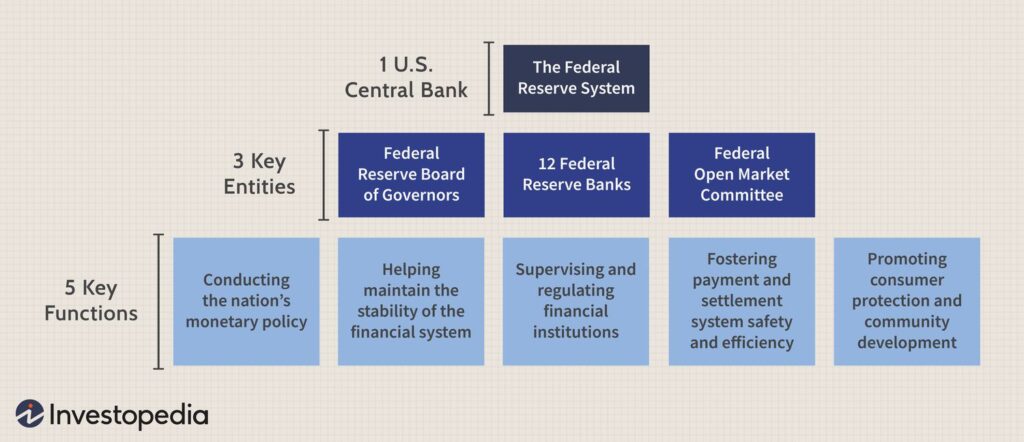

- The Federal Reserve System is composed of a board of seven members, 12 regional Federal Reserve Banks, and the Federal Open Market Committee.

- The Fed’s main duties include conducting national monetary policy, supervising and regulating banks, maintaining financial stability, and providing banking services.

- There is a common misconception that the Federal Reserve System is privately owned; while its Board of Governors is a government agency, the regional Federal Reserve Banks are set up like private corporations.

Table of Contents

Understanding the Federal Reserve System (FRS)

A central bank is a financial institution given privileged control over the production and distribution of money and credit for a nation, union, or group of countries. In modern economies, the central bank is usually responsible for formulating monetary policy and regulating member banks. The Fed is composed of 12 regional Federal Reserve Banks that are each responsible for a specific geographic area of the U.S.3

The Fed was established by the Federal Reserve Act, which was signed by President Woodrow Wilson on Dec. 23, 1913, in response to the financial panic of 1907.4 Before that, the U.S. was the only major financial power without a central bank. Its creation was precipitated by repeated financial panics that afflicted the U.S. economy over the previous century, leading to severe economic disruptions due to bank failures and business bankruptcies. A crisis in 1907 led to calls for an institution that would prevent panics and disruptions.

The Fed has broad power to act to ensure financial stability, and it is the primary regulator of banks that are members of the Federal Reserve System. It also serves as the lender of last resort to member institutions. Often referred to simply as the Fed, it has what is often called its “dual mandate” of ensuring price stability and maximum employment.6

The system’s 12 regional Federal Banks are based in Boston, New York, Philadelphia, Cleveland, Richmond, Atlanta, Chicago, St. Louis, Minneapolis, Kansas City, Dallas, and San Francisco.7

:max_bytes(150000):strip_icc():format(webp)/Clipboard01-5f81c3d8028b4eb8b1fc5f704d05ea75.jpg)

The Federal Reserve System’s Mandate and Duties

The monetary policy goals of the Federal Reserve are twofold: to foster economic conditions that achieve stable prices and maximum sustainable employment.8

The Fed’s duties can be further categorized into four general areas:3

- Conducting national monetary policy by influencing monetary and credit conditions in the U.S. economy to ensure maximum employment, stable prices, and moderate long-term interest rates.

- Supervising and regulating banking institutions to ensure the safety of the U.S. banking and financial system and to protect consumers’ credit rights.

- Maintaining financial system stability and containing systemic risk.

- Providing financial services, including a pivotal role in operating the national payments system, depository institutions, the U.S. government, and foreign official institutions.

The Federal Reserve System’s Organizational Structure

There are seven members of the Board of Governors. These individuals are nominated by the President and approved by the U.S. Senate. Each governor serves a maximum of 14 years. Their appointment is staggered by two years, which is intended to limit the political influences it might be subjected to when control of appointments shifts to different political parties during elections.9 The law also dictates that appointments represent all broad sectors of the U.S. economy.

At times, there may be an empty seat on the board, but as of October 2023, all board positions are occupied.10

| Fed Governors (as of October 2023) | |

|---|---|

| Chair | Jerome H. Powell |

| Vice Chair | Philip N. Jefferson |

| Vice Chair of Supervision | Michael S. Barr |

| Board Member | Michelle W. Bowman |

| Board Member | Lisa D. Cook |

| Board Member | Adriana D. Kugler |

| Board Member | Christopher J. Waller |

Source: Federal Reserve

In addition to the governors of the Fed’s board, each of the 12 regional banks has a president. Each of these banks is set up in a different Federal Reserve district.7

| Fed Regional Bank Presidents (as of October 2023) | |

|---|---|

| Name of President | Bank Location-District |

| Susan M. Collins | Boston-1 |

| John C. Williams | New York-2 |

| Patrick T. Harker | Philadelphia-3 |

| Loretta J. Mester | Cleveland-4 |

| Thomas I. Barkin | Richmond-5 |

| Raphael W. Bostic | Atlanta-6 |

| Austan Goolsbee | Chicago-7 |

| Kathleen O’Neill Paese | St. Louis-8 |

| Neel Kashkari | Minneapolis-9 |

| Jeffrey R. Schmid | Kansas City-10 |

| Lorie K. Logan | Dallas-11 |

| Mary C. Daly | San Francisco-12 |

Source: Federal Reserve

The Federal Reserve System’s Independence

Central bank independence refers to the question of whether the overseers of monetary policy should be completely disconnected from the realm of government. Those who favor independence recognize the influence of politics in promoting monetary policy that can favor re-election in the near term but cause lasting economic damage down the road. Critics say that the central bank and government must tightly coordinate their policies and that central banks must have regulatory oversight.

The Fed is also considered independent because its decisions do not have to be ratified by the president or any other government official. However, it is still subject to congressional oversight and must work within the framework of the government’s monetary and fiscal policy objectives.

The Fed is considered to be independent because its decisions do not have to be ratified.

The Federal Reserve System (FRS) vs. Federal Open Market Committee (FOMC)

The Federal Reserve System is composed of the Federal Reserve Board of Governors, the Federal Reserve Banks, the Federal Open Market Committee, and all the programs created by the Fed as a whole to accomplish its dual mandate.

The Federal Open Market Committee (FOMC) is the Federal Reserve’s main monetary policymaking body. It is responsible for open market operations, which is buying and selling government securities to influence the amount of money banks keep in reserve.

The FOMC includes the Board of Governors (or the Federal Reserve Board (FRB) as it’s also called), the president of the Federal Reserve Bank of New York, and the presidents of four other regional Federal Reserve Banks who serve on a rotating basis.11

The committee is responsible for monetary policy decisions, which are categorized into three areas: maximizing employment, stabilizing prices, and moderating long-term interest rates.1213

Special Considerations

The Fed’s main income source is interest charges on a range of U.S. government securities acquired through its open market operations (OMO). Other income sources include interest on foreign currency investments, interest on loans to depository institutions, and fees for services—such as check clearing and fund transfers—provided to these institutions. After paying expenses, the Fed transfers the rest of its earnings to the U.S. Treasury.14

The Federal Reserve payments system, commonly known as the Fedwire, moves trillions of dollars daily between banks throughout the U.S. Transactions are for same-day settlement.1516 In the aftermath of the 2008 financial crisis, the Fed has paid increased attention to the risk created by the time lag between when payments are made early in the day and when they are settled and reconciled. The Fed is pressuring large financial institutions to improve real-time monitoring of payments and credit risk, which has been available only on an end-of-day basis.

The Fed has developed a payment system it calls FedNow, which is designed to take the place of the traditional and slower settlement systems. FedNow was launched in July 2023.17

Who Owns the Federal Reserve?

The Federal Reserve System is not owned by anyone. It was created in 1913 by the Federal Reserve Act to serve as the nation’s central bank. The Board of Governors is an agency of the federal government and reports to and is directly accountable to Congress.18

What Does It Mean That the Federal Reserve Is a Central Bank?

A central bank is a financial institution responsible for overseeing a nation’s monetary system and policies. A central bank monitors economic changes, controls the money supply, and sets interest rates to influence price stability and employment.

Does the Fed Print U.S. Money?

Money is printed by the Bureau of Engraving and Printing. The Federal Reserve controls the amount of money circulating by implementing monetary policy.19 You may also hear that the Fed “prints” or creates money through its operations. However, this is untrue. Depository institutions and lenders are the ones who “print” money through fractional reserve banking.20

How Does the Fed Set Interest Rates?

The Federal Reserve sets the rate for its Overnight Reverse Repurchase (ON RREP) Agreement Facility, where it buys and sells securities. This rate helps set the bottom number for the rate range. It also pays Interest on Reserve Balances (IORB), the rate of which helps set the top number for the range. The Fed also uses the rate at its discount window and open market operations to help establish interest rates that it believes will influence the economy to produce an average inflation rate of 2% over the long run.21

Does the Fed Collect Taxes?

No. The Fed is responsible only for monetary policy and banking system oversight. Federal taxes are approved and collected exclusively by Congress—via the Internal Revenue Service (IRS), a federal agency)—which is an instance of fiscal policy.22 State and local taxes are collected by individual states or municipalities.

The Bottom Line

The Federal Reserve System is the central banking system of the United States. The Fed uses the system and the tools it has to set interest rates and regulate the money supply to accomplish its mandate of price stability and maximum employment.

Disclaimer ||

The Information provided on this website article does not constitute investment advice ,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!

Leave feedback about this