Ford vs. General Motors: An Overview

Ford Motor Company (F) and Chevrolet, which is owned by General Motors Company (GM), are the two largest automobile brands in the United States.1 Both Ford and GM are leaders and fierce competitors in the global automobile industry. Ford’s largest brand is its namesake, Ford, while GM’s largest brand is Chevrolet.

At first glance, the two large car makers may appear to have similar business models. However, potential investors who dive deeper will find key differences as well as many similarities between the two companies. The following is a comparison of Ford and GM’s business models, which describes critical factors for potential investors.

KEY TAKEAWAYS

- Ford and General Motors are the two biggest automakers in the United States and are also big players on the world stage. General Motors leads in US market share.

- Both companies were hit by the credit crisis of 2008. GM took a government bailout, while Ford declined; both companies have recovered in the years since.

- Ford’s brand strategy has been to scale back; Ford and Lincoln are the automaker’s only significant brands globally.

- Ford and GM have both produced electric vehicles, but GM has more fully embraced the technology.

Table of Contents

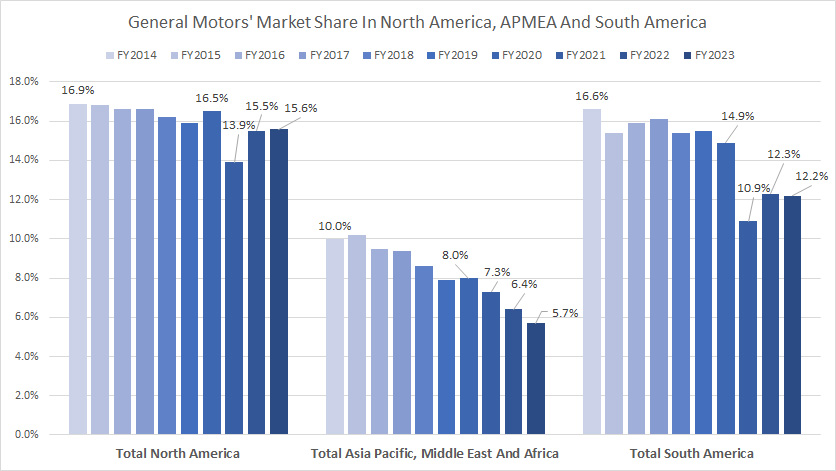

GM Leads U.S. Market Share

GM remains the largest market shareholder in the United States, controlling 17% of the industry’s total sales as of 2020.2

In terms of the worldwide market, neither Ford nor GM lead the way. In 2019, Toyota held the largest global market share at 10.24%, followed by Volkswagen Group at 7.59%. Ford was third with 5.59%.3

The global market is highly competitive and diversified. As emerging economies with large populations such as India, China, and Brazil continue to develop, establishing a significant presence in these areas is critical for the future growth of both Ford and GM.

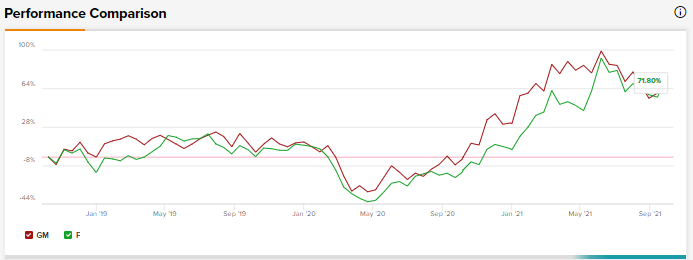

General Motors vs. Ford: Performance

GM is a smaller company than Ford. GM’s total revenue for 2020 was $122 billion, a 10.75% decrease from the previous year. Ford’s total revenue was $127 billion, an 18.45% decrease from the previous year.

Both companies have achieved significant revenue growth since the economic crisis of 2008 and 2009, but neither has returned to its previous total sales volume.45 Each company has experienced serious financial difficulties in the past 10 years.

Ford’s product line fell behind its competition in the early 2000s, and it began losing market share. It reported substantial net operating losses in 2006, 2007, and 2008. During this period, under the leadership of CEO Alan Mulally, Ford began initiatives to consolidate operations and create more appealing car models. These plans to become more efficient and innovative were already in process when the economic recession hit in 2008.

Although the decreased demand for cars during the recession hurt Ford, the company refused a government bailout offer, avoided bankruptcy, and generally emerged from the recession a stronger company.

General Motors became insolvent in 2008 and required government bailout assistance and a Chapter 11 bankruptcy reorganization in 2009 to keep the company operational.6 The company has since fully repaid its bailout loan and returned positive net income to shareholders since then. GM is making strategic investments to produce more innovative, efficient, and technologically savvy vehicles, which it believes drive future growth. It is also investing significantly in emerging markets such as China.

Important: Revenue and profit generation through vehicle financing and leasing arrangements are critical to both Ford and GM’s business models. Ford runs Ford Credit and GM owns the General Motors Financial Company.

Ford vs. General Motors: Brand Strategy

One of the main differences between these two competitors is the number of brands owned and marketed by each company. Ford’s “One Ford” plan, which was implemented during difficult years for the company leading up to the economic crisis of 2008, included reducing the total number of brands it owns and operates worldwide.

Ford’s only significant brands on the global market are Ford and Lincoln. Recent divestitures or discontinuations of brands include the following:

- Aston Martin (sold in 2007)

- Jaguar (sold in 2008)

- Land Rover (sold in 2008)

- Volvo (sold in 2010)

- Mazda (controlling interest sold in 2010 (minority interest remains)

- Mercury (discontinued in 2011)

Ford’s belief is that by reducing the number of brands and consolidating the number of vehicle platforms upon which various models are built, it can become more efficient and more innovative. In 2007, Ford had 27 different vehicle platforms across the world; in 2015, it had 12, and as of 2021, it only owns two: Ford and Lincoln.

General Motors owns and operates a plethora of automobile brands across the globe. These brands include Chevrolet, Buick, GMC, Cadillac, and Hummer.7 General Motors, similar to Ford, has divested or discontinued several brands, including the following:

- Oldsmobile (discontinued in 2004)

- Pontiac (discontinued in 2010)

- Daewo (discontinued in 2011)

- Saturn (discontinued in 2010)

- Saab (sold in 2010)

Hummer was discontinued by GM in 2010 but has since returned.

Although General motor’s actions in previous years pointed towards a belief that its different brands are essential to serving different market segments, its continuing divestment in the global markets shows General Motors is following Ford’s strategy.

Many of its discontinued brands were shut down due to poor performance rather than strategic planning. In mid-2017, after 16 consecutive yearly losses in Europe, General Motors sold its European division to French automaker PSA Groupe.8

Fuel Efficiency and New Technologies

Both Ford and General Motors recognize the importance of improving fuel efficiency and leveraging technology to keep their product lines popular among customers. Many countries, including the United States, have strict laws requiring improvements in fuel efficiency and the amount of environmental pollution created by vehicles. Both companies have significantly reduced the fuel consumption of their overall fleets.

Both Ford and General Motors have also embraced the movement towards all-electric vehicles. As of June 2021, Ford offers two fully electric vehicles: the 2021 Mustang Mach-E and the 2022 F-150 Lightning. It also manufactures six hybrid vehicles. Hybrid versions are available of all three of the company’s most popular models: the Fusion, Escape, and Explorer.9

General Motors was one of the first auto manufacturers to jump on the hybrid electric vehicle trend when it produced the Chevrolet Volt, which was since been discontinued.

The quest for ever-increasing fuel efficiency is a constant battleground for car manufacturers. Not only does it benefit drivers by reducing gas station trips, but it also plays a crucial role in reducing greenhouse gas emissions and combating climate change.

Here are some of the new technologies that are revolutionizing fuel efficiency:

- Electric Vehicles (EVs): EVs are the ultimate in fuel efficiency, using electric motors powered by batteries to propel the car. They produce zero tailpipe emissions, making them a clean transportation option. While the range and charging infrastructure for EVs are still evolving, they are becoming an increasingly popular choice for drivers.pen_spark Opens in a new window afdc.energy.gov Electric vehicle

- Hybrid Electric Vehicles (HEVs): HEVs combine an electric motor with a gasoline engine. They can run on electricity alone for short distances, and the gasoline engine kicks in when the battery is depleted or for additional power. HEVs offer improved fuel efficiency compared to traditional gasoline-powered vehicles. Opens in a new window energy.gov Hybrid electric vehicle

- Plug-in Hybrid Electric Vehicles (PHEVs): PHEVs are like HEVs on steroids. They can be plugged in to recharge their batteries, giving them a longer electric-only range than HEVs. This means that for many everyday commutes, PHEVs can operate solely on electricity. Opens in a new window afdc.energy.gov Plugin hybrid electric vehicle

- Advanced Engine Technologies: Even traditional gasoline-powered vehicles are getting more fuel-efficient thanks to advancements in engine technology. These include:

- Cylinder Deactivation: This system shuts off cylinders when the engine doesn’t need to work as hard, reducing fuel consumption.

- Direct Injection: This technology injects fuel directly into the cylinders, resulting in a more efficient burn.

- Turbochargers: Turbochargers use exhaust gases to force more air into the engine, allowing for a smaller engine to produce more power, which can improve fuel efficiency. Opens in a new window www.capitalone.com Turbocharger in a car engine

- Lightweight Materials: Car manufacturers are increasingly using lightweight materials like aluminum, carbon fiber, and high-strength steel to reduce the weight of vehicles. Lighter vehicles require less energy to move, which translates into better fuel economy.

- Connected Vehicle Technology: This technology allows vehicles to communicate with each other and with infrastructure, such as traffic lights. This can help to optimize traffic flow and reduce congestion, which can lead to improved fuel efficiency.

Fast Fact

According to the U.S. Energy Information Administration, the miles per gallon for all motor vehicles have slowly risen from 2000 to 2020. In 2000, the average stood at 16.9 mpg; in 2020, it stands at 18.1 mpg.10

Though the Volt was discontinued, GM has not slowed down in its commitment to producing electric vehicles. In fact, GM has been praised for spearheading the movement. The company announced it will be offering 30 new EVs by 2035, helped by a new technology it produced named the Ultium Platform. According to GM’s website, the new technology has been “engineered for range, power, and flexibility to charge fast, run long, and fit every type of vehicle.”11

Learn more: https://gemini.google.com/app

The Bottom Line

As the two largest automakers in the United States, Ford and GM are incredibly powerful companies with an immense responsibility to shape the future of global auto manufacturing. Just as the industry had to adapt to new safety regulations such as the seat belt, the success of either company moving forward will lie in how it can appease consumers who worry about climate change.

Disclaimer ||

The Information provided on this website article does not constitute investment advice ,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!

Leave feedback about this