If it feels like your dollar doesn’t go quite as far as it used to, you aren’t imagining it. The reason is inflation, which describes the gradual rise in prices and slow decline in purchasing power of your money over time. Here’s how to understand inflation, plus a look at steps you can take to protect the value of your money.

How Does Inflation Work?

It occurs when prices rise across the economy, decreasing the purchasing power of your money. In 1980, for example, a movie ticket cost on average $2.89. By 2019, the average price of a movie ticket had risen to $9.16. If you saved a $10 bill from 1980, it would buy two fewer movie tickets in 2019 than it would have nearly four decades earlier.

Don’t think of inflation in terms of higher prices for just one item or service, however. Inflation refers to the broad increase in prices across a sector or an industry, like the automotive or energy business—and ultimately a country’s entire economy.

The chief measures of U.S. inflation are the Consumer Price Index (CPI), the Producer Price Index (PPI) and the Personal Consumption Expenditures Price Index (PCE), all of which use varying measures to track the change in prices consumers pay and producers receive in industries across the whole American economy.

Though it can be frustrating to think about your dollars losing value, most economists consider a small amount of inflation a sign of a healthy economy. A moderate inflation rate encourages you to spend or invest your money today, rather than stuff it under your mattress and watch its value diminish.

It can become a destructive force in an economy if it is allowed to get out of hand and rise dramatically. Unchecked it can topple a country’s economy, like in 2018 when Venezuela’s its rate hit over 1,000,000% a month, causing the economy to collapse and forcing countless citizens to flee the country.

Related: 2 Out Of 3 Americans Say They’re Blowing Through Savings to Cope With Inflation

What Is Deflation?

When prices decline across a sector of the economy or throughout the entire economy, it’s called deflation. While it might seem nice that you can buy more for less tomorrow, economists warn that deflation can be even more dangerous for an economy than unchecked it.

When deflation takes hold, consumers delay purchases in the present as they wait for prices to decline even further in the future. If left unchecked, deflation can diminish or freeze economic growth, which in turn decimates wages and paralyses an economy.

Extreme Inflation: Hyperinflation & Stagflation

When inflation isn’t kept in check, it’s commonly known as hyperinflation or stagflation. These terms describe out-of-control it that cripples consumers’ purchasing power and economies.

What Is Hyperinflation?

Hyperinflation occurs when inflation rises rapidly and the value of the currency of the country tumbles rapidly. Economists define hyperinflation as taking place when prices rise by at least 50% each month. Though rare, past instances of hyperinflation have taken place during civil unrest, during war time or when regimes have been taken over, rendering currency effectively worthless.

Perhaps the best-known example of hyperinflation took place in Weimar Germany, in the early 1920s. Prices rose by tens of thousands of percent each month, which very badly damaged the German economy.

What Is Stagflation?

Stagflation occurs when inflation remains high, but a country’s economy is not growing and its unemployment is rising. Usually, when unemployment increases, consumer demand decreases as people watch their spending more closely. This decrease in demand lowers prices, helping to recalibrate your purchasing power.

When stagflation happens, however, prices remain high even as consumer spending decreases, making it increasingly expensive to buy the same goods. We don’t have to look abroad to find examples, as the U.S. experienced stagflation in the mid to late 1970s, as high prices from OPEC oil embargoes drove inflation higher even as recession lowered GDP and increased unemployment.

What Causes Inflation?

The gradually rising prices associated with it can be caused two main ways: demand-pull inflation and cost-push inflation. Both come back to the fundamental economic principles of supply and demand.

Demand-Pull Inflation

Demand-pull inflation is when demand for goods or services increases but supply remains the same, pulling up prices.

It can be caused a few ways. In a healthy economy, people and companies increasingly make more money. This growing purchasing power allows consumers to buy more than they could before, increasing competition for existing goods and raising prices while companies attempt to ramp up production. On a smaller scale, it can be caused by sudden popularity of certain products.

For example, at the start of the coronavirus pandemic, the increase in demand for indoor, socially distant activities combined with the highly anticipated release of Animal Crossing: New Horizons saw the price of the Nintendo Switch gaming system almost double on some secondary markets. Because Nintendo could not increase production, due to factory production halts from Covid-19, Nintendo could not raise its supply to meet rising consumer demand, resulting in increasingly higher prices.

Cost-Push Inflation

Cost-push inflation is when supply of goods or services is limited in some way but demand remains the same, pushing up prices. Usually, some sort of external event, like a natural disaster, hinders companies’ abilities to produce enough of certain goods to keep up with consumer demand. This allows them to raise prices, resulting in it.

For example, think about oil prices. You—and pretty much everyone else—need a certain amount of gas to fuel your car. When international treaties or disasters drastically reduce the oil supply, gas prices rise because demand remains relatively stable even as supply shrinks.

How Is Inflation Measured?

The U.S. inflation rate is measured by the CPI, PPI and PCE indexes. Because no single index captures the full range of price changes in the U.S. economy, economists must consider these multiple indexes to get a comprehensive picture of the rate of it.

The basic formula to calculate the inflation rate is as follows:

(Current Price – Former Price)/Former Price

Consumer Price Index (CPI)

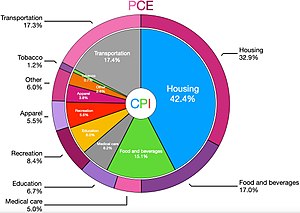

The U.S. Bureau of Labor Statistics calculates CPI monthly based on the changes in prices consumers pay for goods and services. The CPI uses a “basket of goods” approach, meaning it tracks changes in the costs of eight major categories people spend money on: food and beverages, housing, apparel, transportation, education and communication, recreation, medical care, and other goods and services.

Many consider the CPI the benchmark for measuring it in the United States. The CPI is especially important because it is used to calculate cost of living increases for Social Security payments and for many companies’ annual raises. It is also used to adjust the rates on some inflation-protected securities, like Treasury Inflation-Protected Securities (TIPS).

Producer Price Index (PPI)

Also published by the Bureau of Labor Statistics, PPI tracks the changes in prices that companies receive for the goods and services they sell each month. Costs can rise when producers face an increase in tariffs, higher oil and gas prices to transport their items, or other issues, such as the impact of a long-lasting pandemic or environmental changes, like a rise in hurricanes, wildfires, or flooding.

The PPI plays an important role in business contracts. Businesses that enter into long-term contracts with suppliers frequently use the PPI to automatically adjust the rate they pay for raw goods and services over time. Otherwise, suppliers would lock themselves into years-long contracts at rates that might lose them purchasing power over the long term.

Personal Consumption Expenditures Price Index (PCE)

Published by the Bureau of Economic Analysis, PCE tracks how much consumers pay for goods and services in the economy. This index considers a broader range of consumer expenditures than CPI, like healthcare spending. It also updates the basket of goods it uses for calculations based on what consumers are actually spending money on each month, rather than limiting data to a fixed set of goods.

PCE is an especially important because it’s the Federal Reserve’s preferred measure of it when making monetary decisions.

Inflation and the Fed

The Federal Reserve is the central bank of the U.S., and the Fed—like central banks around the world—is tasked with maintaining a stable rate of it. The Federal Open Markets Committee (FOMC) has determined that an inflation rate around 2% is optimal employment and price stability.

This level of inflation gives the FOMC scope to jump-start the economy during downturns by decreasing interest rates, which makes borrowing cheaper and helps boost consumption. Lower interest rates reduce costs for businesses and consumers to borrow money, stimulating the economy. Lower interest rates also mean individuals earn less on their savings, encouraging them to spend. But all this extra demand can push up it.

What Investments Beat Inflation?

Even a moderate rate of inflation means that money held as cash or in low-APY bank accounts will lose purchasing power over time. You can beat inflation and boost your purchasing power by investing your money in certain assets.

Beat Inflation with Stocks

Investing in the stock market is one way to potentially beat inflation. While individual stock prices may fall or single companies may go out of business, and bear markets may even depress indices for certain periods, broader stock market indexes rise over the long run, beating inflation.

From 1920 to 2020, the S&P 500, which tracks the performance of 500 of the largest companies in the U.S., generated an average annual return of just over 10%, with dividends reinvested. This is a long-term average—in some years, the S&P 500 had lower or even negative returns.

Investing in individual stocks offers no guarantees, but a well-diversified investment in a broad market index fund can grow wealth over decades and beat inflation. Even adjusting for inflation, investments in an S&P 500 index fund have averaged over 6% returns from June 1930 to June 2020.

Beat Inflation with Bonds

Bonds on average offer lower returns than stocks, but they can also regularly beat inflation. Risk averse investors or those approaching or in retirement may seek out the more consistent returns of investments in bonds and bond funds to beat inflation.

From June 2005 to June 2020, the Bloomberg Barclays U.S. Aggregate Bond Index, a benchmark index tracking thousands of U.S. bonds, saw annual returns of 4.47%. Even accounting for it, those with money in bonds would have seen modest increases in the purchasing power of their money. Keep in mind, though, that bond yields are tied to the overall economy and current bond yields may be drastically less than historical bond yields.

Treasury Inflation-Protected Security (TIPS)

Treasury Inflation-Protected Securities (TIPS) are a special class of U.S. treasury bonds specifically designed to protect investors from it. TIPS automatically adjust the value of your investment based on changes to CPI, meaning the value of your bond rises with it. TIPS pay interest over the five-, 10-, or 30-year life of the bond.

Can You Beat Inflation with Gold?

Many investors consider gold as the ultimate inflation hedge, although the debate over this proposition is far from settled.

From April 1968 to June 2020, for instance, gold increased in value on average 7.6% a year. When adjusted for it, returns average 3.6%. Yet in 2013 and 2015, gold’s value decreased 28% and 12%, respectively, suggesting gold is far from the stable safehaven some envision it to be.

That’s because the price of gold can wildly fluctuate over time and is impacted by movements of global currencies, monetary policy choices made by the Fed and other central banks, not to mention erratic supply and demand.

Investing in gold also comes with its own unique set of challenges. If you buy gold, you have to find a secure location to store it, which comes with costs of its own. If you sell gold after holding it for a year or more, it’s subject to a higher long-term capital gains tax rates than stocks and bonds.

Disclaimer ||

The Information provided on this website article does not constitute investment advice ,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!

Leave feedback about this