Cryptocurrency, called crypto for short, is a digital payment system that doesn’t rely on banks or governments to verify transactions. It uses cryptography for security and operates on a decentralized system called a blockchain.

Understanding cryptocurrency basics

What is cryptocurrency?

Cryptocurrencies are digital currencies (digital representations of value) that are secured using cryptography. Interested parties can use them to purchase goods and services. Past that, they enable individuals to make transactions without the interference of third-party intermediaries.

Table of Contents

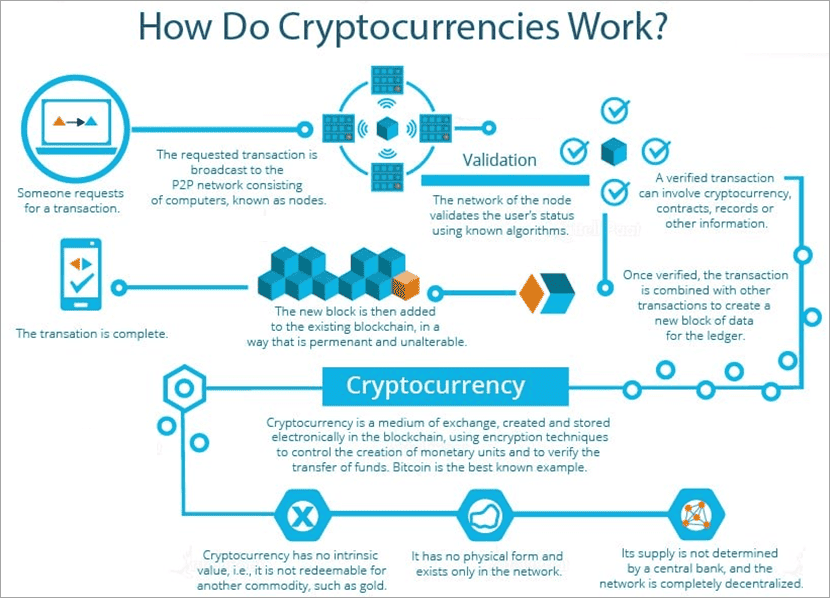

How does cryptocurrency work?

Unlike physical fiat currencies (e.g., the U.S. dollar), cryptocurrencies make use of decentralized networks, and their transactions are generally recorded on the blockchain, which is an immutable, decentralized ledger.

The first known blockchain was rolled out for use with bitcoin, the first digital currency to scale. This blockchain was designed to be immutable (meaning transactions cannot be reversed or deleted) and decentralized (meaning its records are stored on many different computers) in order to safeguard against fraud and also boost transparency.

Every bitcoin transaction that has taken place in the more than 15 years since the digital currency network has existed has been logged on the network’s blockchain. This feature helps create greater transparency.

“If I own a bitcoin, I don’t really own anything physical,” Allen says. “I just own a key that allows me to move a record or a unit of measure from one person to another, without a trusted third party.” And that’s really all the cryptocurrency is, he explains.

So if I own two bitcoins, he adds, I can move it from myself to someone else without a trusted third party in the middle. “And that transaction would be verified by this decentralized network of computers from nodes and miners.”

Why invest in cryptocurrency?

Investing in cryptocurrencies can potentially deliver substantial returns. The price of bitcoin, for example, has gone from pennies during the first few years of the digital currency’s existence to more than $60,000 per unit at the time of this writing, according to CoinMarketCap figures.

Another benefit of investing in digital currency is that it can be used to diversify one’s portfolio. The idea behind diversification is including multiple assets (potentially from various asset types) so that if one component of a portfolio falls in value, the other components rise in order to maintain the overall value of the portfolio.

While investing in cryptocurrency certainly has its benefits, interested parties should keep in mind that these digital assets can experience sharp volatility. Stocks can certainly experience price fluctuations, but the volatility experienced by digital currencies is more intense.

As a result, individuals who put their money into digital currency face significant downside risk, referring to the risk that the value of their principal could fall in value.

Past that, digital currencies are a very new asset class, at least compared to other more established asset classes like stocks and real estate. The first units of bitcoin came into existence in 2009, which would mean that this digital asset has been around for 15 years at the time of this writing.

How can start investing in cryptocurrency?

If you’re new to the world of crypto, figuring out how to buy Bitcoin, Dogecoin, Ethereum and other cryptocurrencies can be confusing at first. Thankfully, it’s pretty simple to learn the ropes. You can start investing in cryptocurrency by following these five easy steps.

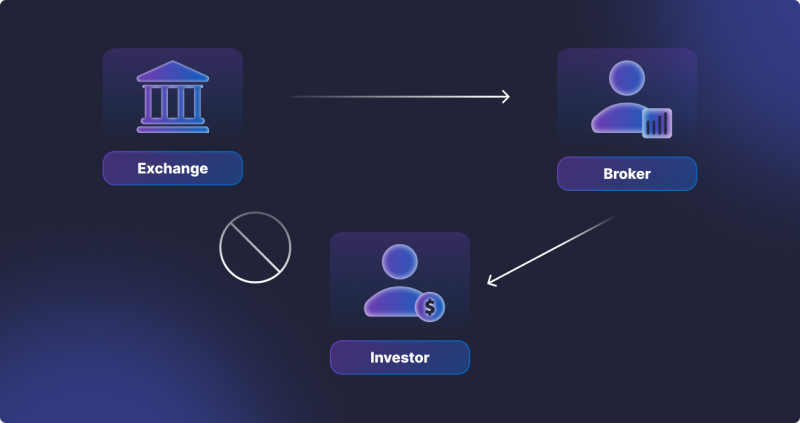

1. Choose a Broker or Crypto Exchange

To buy cryptocurrency, first you need to pick a broker or a crypto exchange. While either lets you buy crypto, there are a few key differences between them to keep in mind.

What Is a Cryptocurrency Exchange?

A cryptocurrency exchange is a platform where buyers and sellers meet to trade cryptocurrencies. Exchanges often have relatively low fees, but they tend to have more complex interfaces with multiple trade types and advanced performance charts, all of which can make them intimidating for new crypto investors.

Some of the most well-known cryptocurrency exchanges are Coinbase, Gemini and Binance-US. While these companies’ standard trading interfaces may overwhelm beginners, particularly those without a background trading stocks, they also offer user-friendly easy purchase options.

The convenience comes at a cost, however, as the beginner-friendly options charge substantially more than it would cost to buy the same crypto via each platform’s standard trading interface. To save on costs, you might aim to learn enough to utilize the standard trading platforms before you make your fist crypto purchase—or not long after.

An important note: As someone new to crypto, you’ll want to make sure your exchange or brokerage of choice allows fiat currency transfers and purchases made with U.S. dollars. Some exchanges only allow you to buy crypto using another crypto, meaning you’d have to find another exchange to buy the tokens your preferred exchange accepts before you could begin trading crypto on that platform.

What Is a Cryptocurrency Broker?

Cryptocurrency brokers take the complexity out of purchasing crypto, offering easy-to-use interfaces that interact with exchanges for you. Some charge higher fees than exchanges. Others claim to be “free” while making money by selling information about what you and other traders are buying and selling to large brokerages or funds or not executing your trade at the best possible market price. Robinhood and SoFi are two of the most well-known crypto brokers.

While they’re undeniably convenient, you have to be careful with brokers because you may face restrictions on moving your cryptocurrency holdings off the platform. At Robinhood and SoFi, for instance, you cannot transfer your crypto holdings out of your account. This may not seem like a huge deal, but advanced crypto investors prefer to hold their coins in crypto wallets for extra security. Some even choose hardware crypto wallets that are not connected to the internet for even more security.

2. Create and Verify Your Account

Once you decide on a cryptocurrency broker or exchange, you can sign up to open an account. Depending on the platform and the amount you plan to buy, you may have to verify your identity. This is an essential step to prevent fraud and meet federal regulatory requirements.

You may not be able to buy or sell cryptocurrency until you complete the verification process. The platform may ask you to submit a copy of your driver’s license or passport, and you may even be asked to upload a selfie to prove your appearance matches the documents you submit.

3. Deposit Cash to Invest

To buy crypto, you’ll need to make sure you have funds in your account. You might deposit money into your crypto account by linking your bank account, authorizing a wire transfer or even making a payment with a debit or credit card. Depending on the exchange or broker and your funding method, you may have to wait a few days before you can use the money you deposit to buy cryptocurrency.

Here’s one big buyer beware: While some exchanges or brokers allow you to deposit money from a credit card, doing so is extremely risky—and expensive. Credit card companies process cryptocurrency purchases with credit cards as cash advances. This means they’re subject to higher interest rates than regular purchases, and you’ll also have to pay additional cash advance fees. For example, you may have to pay 5% of the transaction amount when you make a cash advance. This is on top of any fees that your crypto exchange or brokerage may charge; these can run up to 5% themselves, meaning you might lose 10% of your crypto purchase to fees.

Related: Best Crypto Credit Cards

4. Place Your Cryptocurrency Order

Once there is money in your account, you’re ready to place your first cryptocurrency order. There are hundreds of cryptocurrencies to choose from, ranging from well-known names like Bitcoin and Ethereum to more obscure cryptos like Theta Fuel or Holo.

When you decide on which cryptocurrency to purchase, you can enter its ticker symbol—Bitcoin, for instance is BTC—and how many coins you’d like to purchase. With most exchanges and brokers, you can purchase fractional shares of cryptocurrency, allowing you to buy a sliver of high-priced tokens like Bitcoin or Ethereum that otherwise take thousands to own.

The symbols for the 10 biggest cryptocurrencies based on market capitalization* are as follows:

- Bitcoin (BTC)

- Ethereum (ETH)

- Tether (USDT)

- Binance Coin (BNB)

- Cardana (ADA)

- Dogecoin (DOGE)

- XRP (XRP)

- USD Coin (USDC)

- Polkadot (DOT)

- Uniswap (UNI)

*Based on market capitalization as of June 28, 2021

5. Select a Storage Method

Cryptocurrency exchanges are not backed by protections like the Federal Deposit Insurance Corp. (FDIC), and they’re at risk of theft or hacking. You could even lose your investment if you forget or lose the codes to access your account, as millions of dollars of Bitcoin already has been. That’s why it’s so important to have a secure storage place for your cryptocurrencies.

As noted above, if you’re buying cryptocurrency via a broker, you may have little to no choice in how your cryptocurrency is stored. If you purchase cryptocurrency through an exchange, you have more options:

- Leave the crypto on the exchange. When you buy cryptocurrency, it’s typically stored in a so-called crypto wallet attached to the exchange. If you don’t like the provider your exchange partners with or you want to move it to a more secure location, you might transfer it off of the exchange to a separate hot or cold wallet. Depending on the exchange and the size of your transfer, you may have to pay a small fee to do this.

- Hot wallets. These are crypto wallets that are stored online and run on internet-connected devices, such as tablets, computers or phones. Hot wallets are convenient, but there’s a higher risk of theft since they’re still connected to the internet.

- Cold wallets. Cold crypto wallets aren’t connected to the internet, making them your most secure option for holding cryptocurrency. They take the form of external devices, like a USB drive or a hard drive. You have to be careful with cold wallets, though—if you lose the keycode associated with them or the device breaks or fails, you may never be able to get your cryptocurrency back. While the same could happen with certain hot wallets, some are run by custodians who can help you get back into your account if you get locked out.

Alternatives Ways to Buy Cryptocurrency

While buying cryptocurrency is a major trend right now, it’s a volatile and risky investment choice. If investing in crypto on an exchange or via a broker doesn’t feel like the right choice for you, here’s are a few options to indirectly invest in Bitcoin and other cryptocurrencies:

1. Wait for Crypto Exchange-Traded Funds (ETFs)

ETFs are extremely popular investment tools that let you buy exposure to hundreds of individual investments in one fell swoop. This means they provide immediate diversification and are less risky than investing in individual investments.

There is a huge appetite for cryptocurrency ETFs, which would allow you to invest in many cryptocurrencies at once. No cryptocurrency ETFs are available for everyday investors quite yet, but there may be some soon. As of June 2021, the U.S. Securities and Exchange Commission (SEC) is reviewing three cryptocurrency ETF applications from Kryptcoin, VanEck and WisdomTree.

2. Invest in Companies Connected to Cryptocurrency

If you’d rather invest in companies with tangible products or services and that are subject to regulatory oversight—but still want exposure to the cryptocurrency market—you can buy stocks of companies that use or own cryptocurrencies and the blockchain that powers them. You’ll need an online brokerage account to buy shares of public companies like:

- Nvidia (NVDA). This technology company designs and sells graphics processing units, which are at the heart of the systems used to mine cryptocurrency.

- PayPal (PYPL). Already a popular choice for people buying items online or transferring money to family and friends, this payments platform recently expanded to allow customers to buy and sell select cryptocurrencies with their PayPal and Venmo accounts.

- Square (SQ). This payment services provider for small businesses has purchased over $220 million in Bitcoin since October 2020. In February 2021, the firm disclosed that Bitcoin made up around 5% of the cash on its balance sheet. In addition, Square’s Cash App allows people to buy, sell and store cryptocurrency.

As with any investment, make sure you consider your investment goals and current financial situation before investing in cryptocurrency or individual companies that have a heavy stake in it. Cryptocurrency can be extremely volatile—a single tweet can make its price plummet—and it’s still a very speculative investment. This means you should invest carefully and with caution.

Disclaimer ||

The Information provided on this website article does not constitute investment advice ,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!