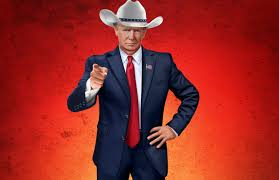

Kanpai Pandas NFTs saw a 45% floor price drop amid allegations that the team promoted a Trump-themed token which was later disavowed by the Trump family.

It sounds like there’s been quite a bit of drama in the NFT world with the Kanpai Pandas NFTs dropping in value due to some controversy involving Trump tokens. If you’d like to dive into the details, I can help break it down or provide more context on how political or celebrity-related controversies can impact NFT markets.

It seems like there’s been a significant drop in the value of Kanpai Pandas NFTs, falling by 45%, and this decline is linked to controversy involving Trump tokens. Here’s a breakdown of the situation:

- Kanpai Pandas NFTs: Kanpai Pandas is a collection of NFTs, which are digital assets verified using blockchain technology. NFTs often have value based on their rarity, utility, and the reputation of the project.

- Trump Tokens: This likely refers to NFTs or digital assets associated with former President Donald Trump. Trump-themed NFTs have been a hot topic, especially given Trump’s high profile and political controversies. These could be official tokens from a project or unofficial ones created by fans or other parties.

- Controversy Impact: When high-profile figures like Trump are involved in NFT projects, it can lead to significant media coverage and public debate. If the controversy surrounding Trump tokens is negative or polarizing, it can affect related NFT markets, including those of other projects like Kanpai Pandas. The market reaction might be driven by concerns over legality, public perception, or the overall impact on the NFT space.

- Market Dynamics: The NFT market is highly sensitive to news and controversies. Significant drops like this can result from a mix of investor panic, shifting sentiments, and speculative trading. If the controversy surrounding Trump tokens affects investor confidence or market stability, it can have ripple effects on related NFT projects.

It seems like there’s been a significant drop in the value of Kanpai Pandas NFTs, falling by 45%, and this decline is linked to controversy involving Trump tokens. Here’s a breakdown of the situation:

- Kanpai Pandas NFTs: Kanpai Pandas is a collection of NFTs, which are digital assets verified using blockchain technology. NFTs often have value based on their rarity, utility, and the reputation of the project.

- Trump Tokens: This likely refers to NFTs or digital assets associated with former President Donald Trump. Trump-themed NFTs have been a hot topic, especially given Trump’s high profile and political controversies. These could be official tokens from a project or unofficial ones created by fans or other parties.

- Controversy Impact: When high-profile figures like Trump are involved in NFT projects, it can lead to significant media coverage and public debate. If the controversy surrounding Trump tokens is negative or polarizing, it can affect related NFT markets, including those of other projects like Kanpai Pandas. The market reaction might be driven by concerns over legality, public perception, or the overall impact on the NFT space.

- Market Dynamics: The NFT market is highly sensitive to news and controversies. Significant drops like this can result from a mix of investor panic, shifting sentiments, and speculative trading. If the controversy surrounding Trump tokens affects investor confidence or market stability, it can have ripple effects on related NFT projects.

FAQ: Kanpai Pandas NFTs and Trump Tokens Controversy

1. What are Kanpai Pandas NFTs?

Kanpai Pandas are a collection of digital collectibles in the form of NFTs (Non-Fungible Tokens). Each NFT features unique panda-themed artwork and is traded on blockchain platforms. The value of these NFTs is influenced by factors such as rarity, creator reputation, and community engagement.

2. What are Trump Tokens?

Trump tokens refer to NFTs or digital assets associated with Donald Trump. These could be official tokens created by or endorsed by Trump or unofficial ones created by fans or third parties. They may feature Trump-themed artwork or messages and are typically traded in the NFT market.

3. What controversy is affecting Trump Tokens?

The controversy surrounding Trump tokens could involve legal issues, political disputes, or negative publicity. For example, there might be legal challenges related to the use of Trump’s image or other disputes that have attracted media attention and public debate.

4. How has this controversy impacted Kanpai Pandas NFTs?

The value of Kanpai Pandas NFTs has dropped by 45%, possibly due to the negative impact of the Trump tokens controversy. This drop could be driven by investor concern over potential regulatory implications, market volatility, or a general decrease in confidence in the NFT market.

5. Why does the Trump tokens controversy affect Kanpai Pandas NFTs?

NFT markets are interconnected, and controversies involving high-profile figures can create broader market turbulence. Negative news or legal issues surrounding Trump tokens can lead to reduced investor confidence, prompting sell-offs in related projects, including Kanpai Pandas.

6. What are the broader implications for the NFT market?

The controversy highlights the NFT market’s sensitivity to external factors, including legal and political issues. Such controversies can lead to increased volatility and affect investor sentiment across various projects.

7. How can I stay updated on this situation?

To stay informed, follow recent news from reliable sources, monitor NFT community forums, and track updates from official Kanpai Pandas and Trump token platforms. Social media and NFT market analysis tools can also provide real-time insights.

8. Are there any actions investors should consider?

Investors should stay informed about the latest developments and consider the potential risks associated with market volatility. Diversifying investments and being cautious with speculative assets can help manage risks in uncertain times.

Advantages of Investing in NFTs

- Unique Ownership:

- Advantage: NFTs represent unique digital assets with verifiable ownership. This uniqueness can make them valuable as collectibles or digital art.

- Potential for High Returns:

- Advantage: NFTs have the potential for significant appreciation in value, especially if they gain popularity or if the project behind them becomes well-known.

- Ownership and Provenance:

- Advantage: Blockchain technology ensures clear ownership and provenance. This can reduce issues related to forgery and counterfeit items.

- Diverse Market:

- Advantage: The NFT market encompasses a wide range of assets, from art to virtual real estate. This diversity allows investors to find opportunities that match their interests.

- Liquidity:

- Advantage: NFTs can be traded on various platforms, providing liquidity. If the NFT is desirable or popular, it might be relatively easy to sell.

Disadvantages of Investing in NFTs

- Market Volatility:

- Disadvantage: NFT values can be highly volatile. Prices can fluctuate wildly based on market trends, news, and investor sentiment, as seen with the recent drop in Kanpai Pandas NFTs.

- Regulatory Risks:

- Disadvantage: The NFT market is still evolving, and regulatory frameworks are not fully established. Legal issues or regulatory changes can impact the value and legality of NFT investments.

- Speculative Nature:

- Disadvantage: Many NFT investments are speculative. The value of NFTs can be driven more by hype and trends than by intrinsic value or utility.

- High Entry Costs:

- Disadvantage: Some NFTs, especially those from well-known projects or artists, can have high entry costs. This can be a barrier for new or smaller investors.

- Lack of Standardization:

- Disadvantage: The NFT market lacks standardization in terms of valuation, quality, and authenticity. This can make it challenging to assess the true value of an NFT.

- Potential for Scams:

- Disadvantage: The NFT space has seen its share of scams and fraudulent projects. Investors need to be cautious and conduct thorough research to avoid falling victim to fraud.

- Impact of Controversies:

- Disadvantage: As seen with the Trump tokens controversy affecting Kanpai Pandas, external factors and controversies can significantly impact NFT values, leading to sudden drops or increased uncertainty.

Conclusion

Investing in NFTs offers unique opportunities but comes with risks and challenges. It’s important to carefully weigh these factors, stay informed about market trends, and consider the potential impact of external events and controversies. Diversifying investments and conducting thorough research can help manage some of these risks.

Risks Associated with NFTs

- Market Volatility:

- Risk: NFT values can experience significant fluctuations due to market trends, hype, and speculative trading. Prices can drop suddenly, leading to potential losses for investors.

- Mitigation: Diversify your investments and avoid putting more money into NFTs than you can afford to lose.

- Regulatory Uncertainty:

- Risk: The NFT market is relatively new and may face evolving regulations. Changes in legal frameworks or enforcement actions could impact the value and legality of NFTs.

- Mitigation: Stay informed about regulatory developments and consider consulting legal experts if you’re heavily invested in the NFT space.

- Fraud and Scams:

- Risk: The NFT space has seen cases of fraud, including fake listings, phishing attacks, and counterfeit assets.

- Mitigation: Verify the authenticity of projects and creators, use reputable platforms, and be cautious with personal information.

- Lack of Liquidity:

- Risk: Some NFTs may be difficult to sell quickly, especially if the market for that particular asset becomes illiquid.

- Mitigation: Invest in well-established or highly sought-after NFTs to improve liquidity, and be prepared for potential holding periods.

- Technical Risks:

- Risk: Technical issues such as smart contract bugs, platform outages, or security vulnerabilities can affect NFTs.

- Mitigation: Use platforms with strong security protocols and conduct due diligence on the technology behind the NFTs.

- Intellectual Property Issues:

- Risk: Disputes over intellectual property rights and copyright issues can arise, particularly with NFTs featuring artwork or media.

- Mitigation: Ensure that NFTs are sourced from legitimate creators and that rights are clearly defined.

- Environmental Concerns:

- Risk: The environmental impact of blockchain transactions, particularly those using proof-of-work systems, can be significant.

- Mitigation: Consider NFTs on platforms that use more sustainable blockchain technologies or contribute to carbon offset initiatives.

Policy Considerations for NFTs

- Regulatory Framework:

- Policy: Governments and regulatory bodies are developing frameworks to address NFTs. These may include rules on taxation, anti-money laundering (AML), and consumer protection.

- Impact: Compliance with these regulations can affect how NFTs are traded and valued.

- Intellectual Property Rights:

- Policy: Policies surrounding the copyright and intellectual property rights of NFT content are evolving. Proper rights management is crucial for creators and buyers.

- Impact: Clear policies can help prevent disputes and ensure fair compensation for creators.

- Consumer Protection:

- Policy: Regulations aimed at protecting consumers from fraud and misleading practices in the NFT space are being considered.

- Impact: Enhanced consumer protection can reduce the risk of scams and improve overall market trust.

- Taxation:

- Policy: Tax policies for NFT transactions vary by jurisdiction. Some countries classify NFTs as taxable assets or income, while others are still defining their stance.

- Impact: Understanding local tax regulations is essential for compliance and financial planning.

- Data Privacy:

- Policy: Data protection and privacy regulations, such as GDPR, may apply to the personal information collected during NFT transactions.

- Impact: Ensuring that platforms and transactions comply with data privacy laws can help avoid legal issues.

- Environmental Regulations:

- Policy: Some regions are considering regulations related to the environmental impact of blockchain technologies used for NFTs.

- Impact: Adoption of eco-friendly technologies or practices may become a regulatory requirement.

Conclusion

Navigating the NFT space requires awareness of both the inherent risks and evolving policies. By understanding these aspects, you can make more informed decisions and better manage potential challenges. Keeping up with regulatory changes and adopting best practices for security and due diligence are essential steps in mitigating risks associated with NFTs.

1. Impact on the Art and Creative Industries

- Positive Impact:

- Ownership and Revenue: NFTs provide artists with a new revenue stream by enabling them to sell digital art with verifiable ownership. Creators can also earn royalties from secondary sales.

- Exposure: Digital platforms for NFTs can increase exposure for artists and creators, allowing them to reach global audiences without traditional gatekeepers.

- Negative Impact:

- Market Saturation: The rapid growth of the NFT market can lead to oversaturation, making it difficult for individual artists to stand out.

- Copyright Issues: There are concerns about unauthorized use and reproduction of digital art, leading to potential disputes over intellectual property rights.

2. Impact on the Gaming Industry

- Positive Impact:

- Ownership and Interoperability: NFTs enable true ownership of in-game assets and items, which players can trade or use across different games and platforms.

- Monetization: Game developers can create new revenue models through NFT sales, including exclusive content or collectible items.

- Negative Impact:

- Play-to-Earn Concerns: Some games use NFTs in “play-to-earn” models, which can lead to concerns about the exploitation of players and create an imbalance between paying and non-paying users.

- Environmental Impact: Many NFT transactions are energy-intensive, raising concerns about the environmental footprint of gaming platforms that integrate NFTs.

3. Impact on Finance and Investment

- Positive Impact:

- New Asset Class: NFTs introduce a new class of digital assets that can diversify investment portfolios and attract new investors.

- Liquidity: NFTs can be traded on various platforms, offering liquidity for investors and opportunities for speculative trading.

- Negative Impact:

- Speculative Bubble: The NFT market is highly speculative and can experience extreme volatility, potentially leading to financial losses for investors.

- Lack of Regulation: The relatively unregulated nature of the NFT market can increase the risk of fraud and market manipulation.

4. Impact on Technology and Blockchain

- Positive Impact:

- Innovation: NFTs drive innovation in blockchain technology, including improvements in smart contract functionality and decentralized applications (dApps).

- Adoption: The popularity of NFTs can encourage broader adoption of blockchain technology across various sectors.

- Negative Impact:

- Scalability Issues: The high transaction volume associated with NFTs can strain existing blockchain networks, leading to issues with scalability and transaction fees.

- Environmental Concerns: The energy consumption associated with proof-of-work blockchains used for NFTs has raised significant environmental concerns.

5. Impact on Legal and Regulatory Frameworks

- Positive Impact:

- Legal Precedents: The NFT space is prompting the development of new legal frameworks and precedents, which can clarify intellectual property and ownership rights in the digital realm.

- Negative Impact:

- Regulatory Uncertainty: The evolving nature of NFT regulations can create uncertainty for investors and businesses, potentially leading to legal challenges and compliance issues.

- Potential for Overregulation: Excessive regulation could stifle innovation and growth in the NFT space if not carefully balanced.

6. Impact on Consumer Behavior

- Positive Impact:

- New Experiences: NFTs provide consumers with novel digital experiences, from owning unique digital art to participating in virtual worlds.

- Negative Impact:

- Speculative Behavior: The allure of NFTs can lead to speculative behavior and impulsive buying decisions, potentially resulting in financial losses for consumers.

Conclusion

NFTs have a profound impact across various industries, offering new opportunities and challenges. They can democratize access to digital assets, create new revenue streams, and drive technological innovation. However, they also pose risks such as market volatility, regulatory uncertainty, and environmental concerns. Balancing these impacts requires careful consideration by creators, investors, regulators, and consumers to ensure that the benefits of NFTs are maximized while mitigating potential downsides.

Bottom Line on NFTs

NFTs (Non-Fungible Tokens) represent unique digital assets verified using blockchain technology. They have made significant waves in various sectors, but their impact is multifaceted:

Key Advantages:

- Unique Ownership: NFTs offer verifiable ownership of digital assets, such as art, music, and virtual goods.

- New Revenue Streams: They provide creators with new ways to monetize their work and earn royalties from secondary sales.

- Market Diversification: They introduce a new asset class, diversifying investment opportunities.

Key Disadvantages:

- Volatility: NFT values can fluctuate dramatically, leading to potential financial losses.

- Regulatory Uncertainty: The evolving regulatory landscape can create legal and compliance challenges.

- Environmental Impact: Many NFTs are minted on energy-intensive blockchains, raising sustainability concerns.

Impact Summary:

- Art and Creative Industries: NFTs empower artists and creators but can lead to market oversaturation and intellectual property disputes.

- Gaming: They enhance digital ownership and create new monetization models but also raise concerns about balance and environmental impact.

- Finance: They offer new investment opportunities but carry risks of speculation and lack of regulation.

- Technology: They drive blockchain innovation but strain existing networks and have environmental implications.

- Consumer Behavior: They offer novel digital experiences but can lead to speculative buying and impulsive decisions.

In essence, NFTs present exciting opportunities for innovation and investment but come with risks that require careful consideration. Staying informed, diversifying investments, and being mindful of environmental and regulatory issues are key to navigating the NFT space effectively.