As of my last update, detailed information on the net worth of Mark Robinson, the Lieutenant Governor of North Carolina, wasn’t readily available or widely reported in the public domain. Net worth can be difficult to pin down, especially for public officials whose financial disclosures may not provide a full picture. For the most accurate and up-to-date information, you might want to check recent financial disclosures, news reports, or official statements.

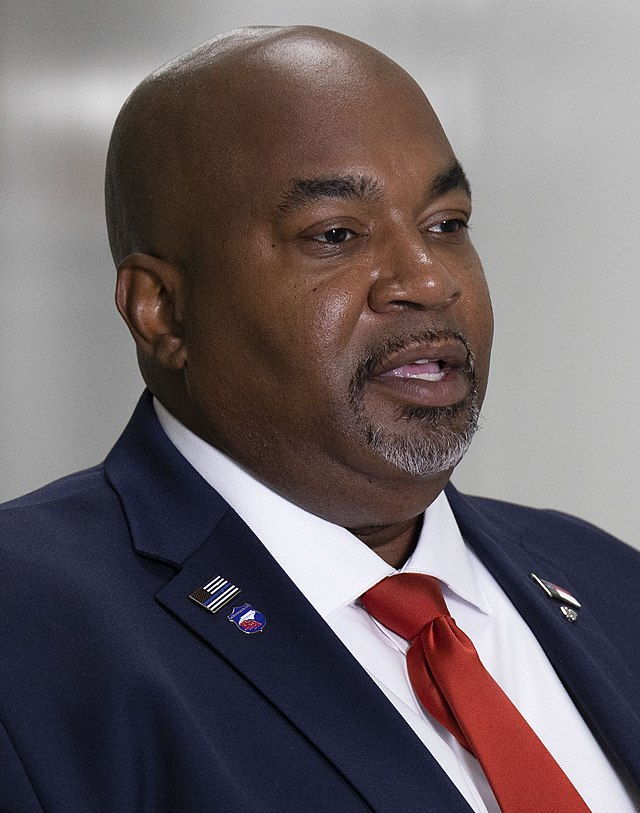

Mark Robinson is the current Lieutenant Governor of North Carolina, having assumed office on January 9, 2021. Before entering politics, Robinson was known for his activism and as a business owner. He first gained widespread attention with his passionate speeches on various social and political issues, particularly focusing on conservative values and individual liberties.

Robinson’s background includes a career as a small business owner and military service. His rise to political prominence came through his advocacy on issues like education and gun rights. As Lieutenant Governor, he has been involved in several initiatives and has made headlines for his outspoken views on a range of topics.

Regarding his financial status, like many public officials, Robinson’s assets and liabilities are subject to disclosure requirements, though specific details about his net worth may not always be publicly detailed. For precise and up-to-date information, the best sources are typically his financial disclosure forms, which can be accessed through state government websites or financial oversight bodies. Additionally, news outlets and official statements might provide insights into his financial standing.

Mark Robinson’s financial details, including his net worth, have not been extensively detailed in the public domain. Here’s what is generally known about him:

- Background and Career:

- Military Service: Robinson served in the U.S. Army.MarkMarkMarkMarkMarkMarkMarkMarkMarkMarkMarkMarkMarkMarkMarkMark

- Business: He is a former small business owner and has worked in various fields.Mark

- Activism: Gained prominence through activism and public speaking on conservative issues before entering politics.

- Political Career:

- Lieutenant Governor of North Carolina: Took office on January 9, 2021. His role involves presiding over the North Carolina Senate and assuming gubernatorial duties if needed.

- Advocacy: Known for his outspoken views on education, gun rights, and conservative values.

- Financial Disclosure:

- Public Disclosure: Like other public officials, Robinson is required to file financial disclosures. These disclosures generally include information about income, assets, liabilities, and any potential conflicts of interest.

- Accessibility: Specific figures regarding his net worth or detailed financial information might not be fully public or easily accessible. To get precise details, you would typically refer to the North Carolina Secretary of State’s website or similar state government resources where such disclosures are filed.

- Recent Developments:

- News and Media: For up-to-date information on his financial status, you might need to consult recent news reports, official statements, or financial disclosures that have been updated since my last training cut-off.

If you’re looking for the latest and most specific information, reviewing official state financial disclosures or recent media reports would be the best approach.

FAQ on Mark Robinson’s Net Worth and Financial Status

1. Who is Mark Robinson?

- Mark Robinson is the Lieutenant Governor of North Carolina, having assumed office on January 9, 2021. He is known for his conservative views and activism on various social and political issues.

2. What is Mark Robinson’s professional background?

- Before entering politics, Robinson served in the U.S. Army and worked as a small business owner. He gained public attention through his advocacy on conservative issues and his speeches.

3. How can I find information about Mark Robinson’s net worth?

- Information about Robinson’s net worth can be found in his financial disclosure forms, which are publicly accessible through the North Carolina Secretary of State’s website or other state government resources. News outlets may also report on his financial status.

4. What is included in financial disclosure forms for public officials?

- Financial disclosure forms typically include details about income, assets, liabilities, and any potential conflicts of interest. They provide a general picture of a public official’s financial standing.

5. Has Mark Robinson’s net worth been reported in the media?

- Detailed media reports on Robinson’s net worth are not widely available. For the most recent and accurate information, consult recent news articles or official financial disclosures.

6. How can I access Mark Robinson’s financial disclosure forms?

- You can access financial disclosure forms through the North Carolina Secretary of State’s website or by contacting the office directly. These forms are public records and are meant to provide transparency about the financial interests of public officials.

7. Are there any specific sources for updates on Mark Robinson’s financial status?

- Reliable sources include the North Carolina Secretary of State’s website, local news outlets, and official statements from Robinson’s office. These sources can provide updates on any changes in his financial status.

8. Why is it important to review financial disclosures for public officials?

- Reviewing financial disclosures helps ensure transparency and accountability. It allows the public to understand potential conflicts of interest and the financial background of those in positions of power.

Advantages of Financial Disclosures

**1. Transparency and Accountability:

- Public Trust: Financial disclosures help build public trust by providing transparency about the financial interests and potential conflicts of interest of public officials.

- Preventing Corruption: By revealing assets, income, and liabilities, disclosures help prevent corruption and ensure that officials are not influenced by personal financial gains.

**2. Conflict of Interest Identification:

- Monitoring Influence: Disclosures allow the public and oversight bodies to identify and address potential conflicts of interest that could affect decision-making and policy implementation.

- Ensuring Integrity: Helps ensure that public officials’ decisions are made based on public interest rather than personal financial interests.

**3. Informed Voting Decisions:

- Electoral Choices: Voters can make more informed decisions during elections by understanding the financial backgrounds of candidates, including their potential financial motivations or connections.

**4. Legal and Ethical Standards:

- Regulatory Compliance: Ensures compliance with legal and ethical standards for public officials, promoting fair practices and integrity in public service.

Disadvantages of Financial Disclosures

**1. Privacy Concerns:

- Personal Privacy: Detailed financial disclosures can intrude on personal privacy by exposing private financial details that may not be directly relevant to an official’s public duties.

- Potential Misuse: Information might be misused or misinterpreted, leading to unwarranted scrutiny or public backlash.

**2. Potential for Misinterpretation:

- Complexity: Financial statements can be complex and difficult for the general public to understand fully, which might lead to misinterpretation of the data.

- Public Perception: Misinterpretations or incomplete information can lead to misleading conclusions about an official’s financial status or integrity.

**3. Security Risks:

- Personal Safety: Public disclosure of financial information might pose security risks for officials and their families if sensitive details are misused.

- Target for Criticism: Officials might become targets for criticism or harassment based on their financial status or the perception of their wealth.

**4. Administrative Burden:

- Reporting Requirements: The process of compiling and submitting financial disclosures can be time-consuming and administratively burdensome for public officials.

- Cost of Compliance: Ensuring accurate and timely financial disclosures might require additional resources and administrative support.

Summary

Financial disclosures for public officials offer significant benefits in terms of transparency, accountability, and public trust, but they also come with challenges related to privacy, potential misinterpretation, and administrative burdens. Balancing transparency with privacy and security is essential to maintaining the integrity of public office while respecting personal boundaries.

The impact of financial disclosures for public officials, such as Mark Robinson, can be significant and multifaceted. Here’s an overview of the various ways these disclosures can impact both the officials and the public:

Impact on Public Officials

**1. Enhanced Accountability:

- Public Scrutiny: Financial disclosures can lead to increased public scrutiny and accountability. Officials must be prepared to explain their financial status and potential conflicts of interest.

- Ethical Standards: Compliance with disclosure requirements promotes adherence to ethical standards, helping to prevent unethical behavior and corruption.

**2. Reputation Management:

- Trust and Credibility: Accurate and transparent disclosures can enhance an official’s reputation and credibility, fostering public trust.

- Risk of Misinterpretation: Conversely, incomplete or misleading information might lead to negative perceptions or unwarranted criticism.

**3. Political Impact:

- Election Campaigns: Financial disclosures can influence election campaigns by providing voters with insights into candidates’ financial backgrounds and potential conflicts of interest.

- Public Perception: The way financial information is presented and perceived can impact an official’s political standing and effectiveness.

**4. Legal and Compliance Risks:

- Regulatory Compliance: Failure to properly disclose financial information can result in legal consequences or penalties.

- Administrative Burden: The process of preparing and submitting disclosures adds an administrative burden and requires meticulous record-keeping.

Impact on the Public

**1. Informed Voting Decisions:

- Transparency: Voters have access to critical information that helps them make informed decisions about who to elect, understanding the financial backgrounds of candidates.

- Trust in Government: Transparent financial disclosures can build public trust in government institutions and officials.

**2. Identification of Conflicts of Interest:

- Policy Influence: Public disclosures help identify and address potential conflicts of interest that could affect policy decisions and governance.

- Monitoring Integrity: Citizens and watchdog organizations can monitor the integrity of public officials and ensure that decisions are made in the public interest.

**3. Public Engagement and Advocacy:

- Increased Engagement: Transparency in financial matters can lead to increased public engagement and advocacy, as citizens are more informed about the financial interests of their leaders.

- Activism and Oversight: Enhanced transparency can stimulate activism and oversight by civil society organizations, contributing to more robust democratic processes.

**4. Perception of Government Effectiveness:

- Accountability and Trust: Effective financial disclosure can enhance the perception of government effectiveness and accountability, reinforcing confidence in public institutions.

- Potential Distrust: On the flip side, if disclosures reveal concerning financial practices or conflicts of interest, it might lead to public distrust and criticism of governmental operations.

Summary

The impact of financial disclosures for public officials is significant, affecting both the officials themselves and the public they serve. For officials, disclosures can lead to enhanced accountability and reputation management, but also come with risks of misinterpretation and administrative burden. For the public, these disclosures provide crucial transparency, help identify conflicts of interest, and influence voting decisions and public trust. Balancing transparency with privacy and ensuring the accurate and ethical presentation of financial information are key to maximizing the positive impact of financial disclosures.

The bottom line on financial disclosures for public officials is that they play a crucial role in promoting transparency, accountability, and public trust. Here’s a succinct summary:

Bottom Line

**1. Transparency and Accountability:

- Financial disclosures ensure that public officials are transparent about their financial interests, which helps prevent conflicts of interest and corruption. This transparency is essential for maintaining public trust and ensuring that officials act in the public’s best interest.

**2. Public Trust and Informed Decision-Making:

- By providing clear information about officials’ financial status, disclosures help voters make informed decisions and enhance trust in government. They allow the public to hold officials accountable for their actions and decisions.

**3. Potential Risks and Challenges:

- While financial disclosures are vital for transparency, they also come with challenges such as privacy concerns, potential for misinterpretation, and administrative burdens. Balancing transparency with respect for personal privacy and security is crucial.

**4. Impact on Governance:

- Properly managed financial disclosures contribute to more ethical and effective governance. They facilitate oversight, help identify potential conflicts of interest, and reinforce democratic principles by ensuring that public officials remain accountable to the electorate.

In essence, financial disclosures are a fundamental tool for ensuring that public officials operate with integrity and that their actions are aligned with the public’s interest.

Certainly! Expanding on the bottom line, here’s a more detailed view of the implications and nuances surrounding financial disclosures for public officials:

Detailed Implications of Financial Disclosures

**1. Promotion of Ethical Behavior:

- Ethical Standards: Disclosures set a standard for ethical behavior by making officials’ financial interests public. This transparency discourages unethical practices and promotes a culture of accountability.

- Conflict Resolution: Identifying and addressing potential conflicts of interest before they impact decision-making ensures that officials are making choices based on public benefit rather than personal gain.

**2. Enhanced Public Engagement:

- Informed Citizenry: By understanding officials’ financial backgrounds, citizens are better equipped to engage in meaningful discussions and advocate for issues that matter to them.

- Empowerment: Transparency empowers citizens to hold officials accountable and participate actively in democratic processes.

**3. Legal and Regulatory Framework:

- Compliance Requirements: Financial disclosures are mandated by law and contribute to a regulatory framework designed to uphold public integrity. Failure to comply can result in legal consequences and damage to an official’s reputation.

- Ongoing Reforms: The regulatory environment surrounding financial disclosures may evolve, leading to more stringent requirements or new mechanisms for ensuring transparency.

**4. Challenges and Limitations:

- Privacy vs. Transparency: Balancing the need for transparency with respect for personal privacy is a challenge. Overly detailed disclosures might infringe on personal privacy, while insufficient details might not provide a complete picture.

- Complexity and Misinterpretation: The complexity of financial disclosures can lead to misunderstandings or misuse of information. Simplifying the disclosure process and ensuring clarity can help mitigate this risk.

**5. Impact on Public Officials:

- Increased Scrutiny: Officials may face heightened scrutiny, which can be both a benefit (promoting accountability) and a drawback (potentially leading to undue criticism or personal attacks).

- Professional Conduct: The requirement for disclosure can influence officials to maintain higher standards of financial and professional conduct.

**6. Broader Governance Impact:

- Institutional Integrity: Financial disclosures contribute to the overall integrity of governmental institutions by reinforcing the principles of transparency and accountability.

- Public Confidence: Effective disclosure practices help build public confidence in the governance system, fostering a healthier and more engaged democratic environment.

**7. Best Practices:

- Clear Guidelines: Establishing clear guidelines for what should be disclosed helps ensure that the information is relevant and understandable to the public.

- Regular Updates: Regular and timely updates to financial disclosures help maintain current and accurate information, further reinforcing transparency and trust.

**8. International Perspective:

- Global Standards: Different countries have varying standards and practices for financial disclosures. Comparing these practices can provide insights into best practices and potential improvements for existing systems.

Conclusion

Financial disclosures for public officials are a vital mechanism for promoting transparency, accountability, and public trust in government. While they come with challenges related to privacy, complexity, and potential for misinterpretation, their benefits in fostering ethical behavior, informed citizenry, and institutional integrity are substantial. Balancing transparency with respect for privacy and continually refining disclosure practices are key to maximizing their positive impact on governance and public confidence.

Financial disclosures for public officials come with several risks that need to be managed carefully. Here’s an overview of the key risks associated with financial disclosures:

Risks Associated with Financial Disclosures

**1. Privacy Concerns:

- Personal Information Exposure: Detailed financial disclosures can reveal sensitive personal information about officials, such as assets, income sources, and liabilities, which may be perceived as an invasion of privacy.

- Risk of Targeting: Publicly available financial details could lead to increased scrutiny or targeting by individuals with malicious intent or those seeking to exploit vulnerabilities.

**2. Misinterpretation and Public Perception:

- Complexity of Information: Financial statements can be complex and difficult for the general public to interpret accurately, leading to potential misunderstandings or misinterpretations.

- Misuse of Information: Data might be taken out of context or selectively reported, leading to misleading conclusions or unfair criticism.

preserving the integrity and purpose of financial disclosures.

Leave feedback about this