What Is a Primary Market?

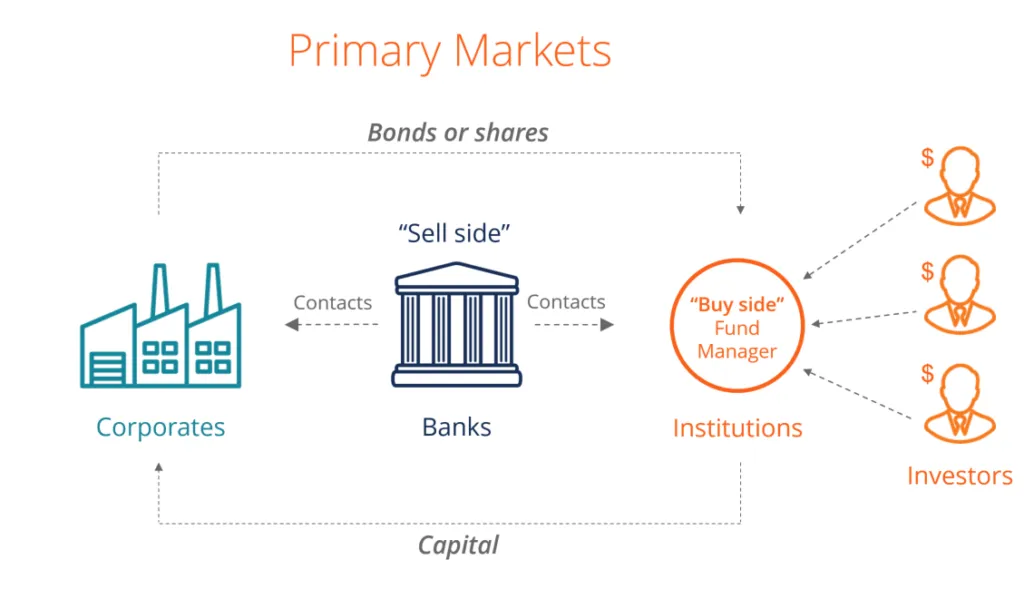

A primary market is a source of new securities. Often on an exchange, it’s where companies, governments, and other groups go to obtain financing through debt-based or equity-based securities. Primary markets are facilitated by underwriting groups consisting of investment banks that set a beginning price range for a given security and oversee its sale to investors.

Once the initial sale is complete, further trading is conducted on the secondary market, where the bulk of exchange trading occurs each day.

KEY TAKEAWAYS

- In the primary market, new stocks and bonds are sold to the public for the first time.

- In a primary market, investors are able to purchase securities directly from the issuer.

- Types of primary market issues include an initial public offering (IPO), a private placement, a rights issue, and a preferred allotment.

- Stock exchanges instead represent secondary markets, where investors buy and sell from one another.

- After they’ve been issued on the primary market, securities are traded between investors on what is called the secondary market—essentially, the familiar stock exchanges.

Understanding Primary Markets

The primary market is where securities are created. It’s in this market that firms sell or float (in finance lingo) new stocks and bonds to the public for the first time during the primary distribution. These stocks and bonds—also called primary instruments—trade on mainstream exchanges with prices based on their market value.

Companies and government entities sell new issues of common and preferred stock, corporate bonds, and government bonds, notes, and bills on the primary market to fund business improvements or expand operations. Although an investment bank may set the securities’ initial price and receive a fee for facilitating sales, most of the money raised from the sales goes to the issuer.

The primary market isn’t a physical place; it reflects more the nature of the goods. The key defining characteristic of a primary market is that securities on it are purchased directly from an issuer—as opposed to being bought from a previous purchaser or investor, “second-hand” so to speak.

Investors typically pay less for securities on the primary market than on the secondary market.

All issues on the primary market are subject to strict regulation. Companies must file statements with the Securities and Exchange Commission (SEC) and other securities agencies and must wait until their filings are approved before they can offer them for sale to investors.

After the initial offering is completed—that is, all the stock shares or bonds are sold—that primary market closes. Those securities then start trading on the secondary market.

Types of Primary Market Issues

An initial public offering, or IPO, is an example of a security issued on a primary market. An IPO occurs when a private company sells shares of stock to the public for the first time, a process known as “going public.” The process, including the original price of the new shares, is set by a designated investment bank, hired by the company to do the initial underwriting for a particular stock.

For example, company ABCWXYZ Inc. hires five underwriting firms to determine the financial details of its IPO. The underwriters detail that the issue price of the stock will be $15. Investors can then buy the IPO at this price directly from the issuing company. This is the first opportunity that investors have to contribute capital to a company through the purchase of its stock. A company’s equity capital is comprised of the funds generated by the sale of stock on the primary market.

A rights offering (issue) permits companies to raise additional equity through the primary market after already having securities enter the secondary market. Current investors are offered prorated rights based on the shares they currently own, and others can invest anew in newly minted shares.

Private Placement and Primary Market

Other types of primary market offerings for stocks include private placement and preferential allotment. Private placement allows companies to sell directly to more significant investors such as hedge funds and banks without making shares publicly available. Preferential allotment offers shares to select investors (usually hedge funds, banks, and mutual funds) at a special price not available to the general public.

Similarly, businesses and governments that want to generate debt capital can choose to issue new short- and long-term bonds on the primary market. New bonds are issued with coupon rates that correspond to the current interest rates at the time of issuance, which may be higher or lower than those offered by pre-existing bonds.

Primary Market vs. Secondary Market

The primary market refers to the market where securities are created and first issued, while the secondary market is one in which they are traded afterward among investors.

Primary Market

Take, for example, U.S. Treasuries—the bonds, bills, and notes issued by the U.S. government. The Dept. of the Treasury announces new issues of these debt securities at periodic intervals and sells them at auctions, which are held multiple times throughout the year. This is an example of the primary market in action.

Tips: Individual investors can buy newly issued U.S. Treasuries directly from the government via TreasuryDirect, an electronic marketplace and online account system.1 This can save them money on brokerage commissions and other middleman fees.

Secondary Market

Now, let’s say some of the investors who bought some of the government’s bonds or bills at these auctions—they’re usually institutional investors, like brokerages, banks, pension funds, or investment funds—want to sell them. They offer them on stock exchanges or markets like the NYSE, Nasdaq, or over-the-counter (OTC), where other investors can buy them. These U.S. Treasuries are now on the secondary market.

With equities, the distinction between primary and secondary markets can seem a little cloudier. Essentially, the secondary market is what’s commonly referred to as “the stock market,” the stock exchanges where investors buy and sell shares from one another. But in fact, a stock exchange can be the site of both a primary and secondary market.

For example, when a company makes its public debut on the New York Stock Exchange (NYSE), the first offering of its new shares constitutes a primary market. The shares that trade afterward, with their prices daily listed on the NYSE, are part of the secondary market.

Types of Secondary Markets

Secondary markets are further divided into two types:

- An auction market, an open outcry system where buyers and sellers congregate in one location and announce the prices at which they are willing to buy and sell their securities

- A dealer market, in which participants in the market are joined through electronic networks. The dealers hold an inventory of security, then stand ready to buy or sell with market participants.

The key distinction between primary and secondary markets: the seller or source of the securities. In a primary market, it’s the issuer of the shares or bonds or whatever the asset is. In a secondary market, it’s another investor or owner. When you buy a security on the primary market, you’re buying a new issue directly from the issuer, and it’s a one-time transaction. When you buy a security on the secondary market, the original issuer of that security—be it a company or a government—doesn’t take any part and doesn’t share in the proceeds.

In short, securities are bought on the primary market. They trade on the secondary market.

Examples of Primary Markets

In June 2017, the Republic of Argentina announced it was selling $2.75 billion worth of debt in a two-part U.S. dollar bond sale. Funding was going toward liability management purposes. Joint underwriters included Morgan Stanley, Bank of America, Merrill Lynch, Deutsche Bank, and Credit Suisse. It marked the first time a junk-rated government—Argentina had only returned to the debt markets the previous year after massive defaults had barred it for a while—offered century bonds (which mature in 100 years).2

Facebook’s Initial Public Offering

Facebook’s (META), now Meta, initial public offering in 2012 was, at the time, the largest IPO of an online company and the largest IPOs in the technology sector in US history. Expectations were high: Many investors believed the stock’s value would very quickly increase on the secondary market due to the company’s popularity and rapid success. Because of high demand in the primary market, underwriters priced the stock at $38 per share, at the top of the targeted $35-38 range, and raised the stock offering level by 25% to 421 million shares. The stock valuation became $104 billion, the largest of any newly public company.34

Although Facebook raised $16 billion through the primary market, the stock did not greatly increase in value the day of the IPO: It closed at $38.23 after 460 million shares were sold and turnover exceeded 100%. Facebook actually went significantly lower later in 2012, hitting an all-time low of $17.73 on Sept. 4, 2012.

But it recovered, thanks partly to the company’s heavy focus on its mobile platform.

If you invested $10,000 in the company at its IPO, you would have received 263 shares of Facebook common stock. As of February 23, 2024, those shares were selling for $484 a piece, making your investment worth $127,292.5 In retrospect, that primary market purchase of $38 per share seems like quite a discount.

What Is the Primary Market and Secondary Market?

Both the primary market and the secondary market are aspects of a capitalist financial system, in which money is raised by the buying and selling of securities—financial assets like stocks and bonds. New securities are issued (created) and sold to investors for the first time in the primary market. Thereafter, investors trade these securities on the secondary market.

The primary market is also known as the new issues market. The secondary market is what we commonly think of as the stock market or stock exchange.

What Are the Types of Primary Markets?

There’s a primary market for just about every sort of financial asset out there. The biggest ones are the primary stock market, the primary bond market, and the primary mortgage market.

The most common type of primary market issues include:

- Initial public offering (IPO): when a company issues shares of stock to the public for the first time

- Rights issue/offering: an offer to the company’s current stockholders to buy additional new shares at a discount.

- Private placement: an issue of company stock shares to an individual person, corporate entity, or a small group of investors—usually institutional or accredited ones—as opposed to being issued in the public marketplace.

- Preferential allotment: shares offered to a particular group at a special or discounted price, different from the publicly traded share price

What Is the Role of the Primary Market?

The primary market is like a debutante ball or a wedding: It marks the launch of a new security—a corporate stock shares or a bond—into the financial marketplace. Primary markets enable companies and governments to attract investors and raise money—to pay debts or to expand. They also enable investors with assets to put their money into, to generate income, or get in on the ground floor of a promising young venture.

What Is the Primary Market and Secondary Market in India?

The primary and secondary markets in India function as they do anywhere: In the primary market, the investor purchases shares or bonds directly from a company in a one-time transaction; in the Secondary Market, investors buy and sell the stocks and bonds among themselves, and can do so an infinite number of times.

In India, when companies wish to go public and establish a primary market for their shares, they must get approval from the Securities and Exchange Board of India (SEBI), the equivalent of the SEC in the U.S.

The secondary market in India includes the BSE Limited (BSE), and the National Stock Exchange (NSE)—the Subcontinent’s two most widely traded exchanges.

Types of Primary Market Issuance

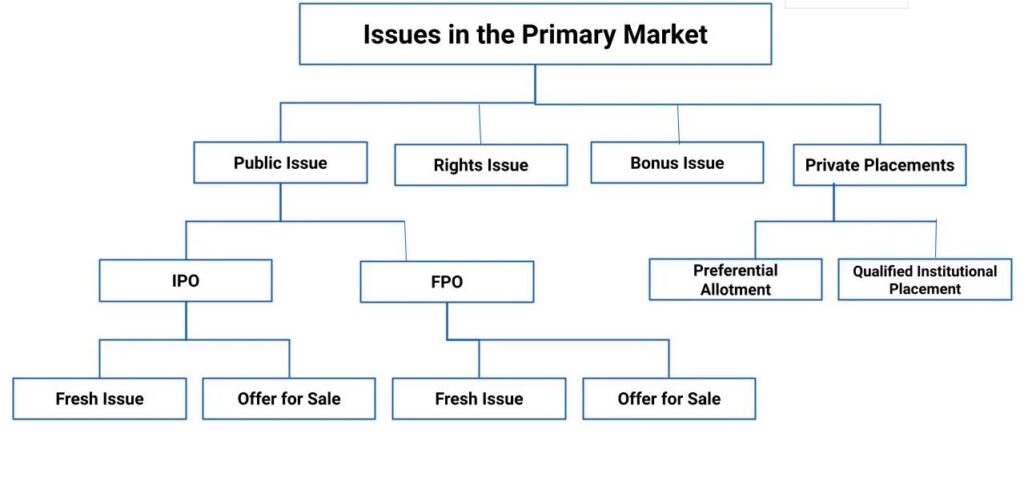

After the issuance of securities, investors can purchase such securities in various ways. There are 5 types of primary market issues.

- Public Issue

Public issue is the most common method of issuing securities of a company to the public at large. It is mainly done via Initial Public Offering (IPO) resulting in companies raising funds from the capital market. These securities are listed in the stock exchanges for trading.

A privately held company converts into a publicly-traded company when its shares are offered to the public initially through IPO. Such a public offer allows a company to raise funds for expansion of business, improving infrastructure, and repaying its debts, among others.

Trading in an open market also increases a company’s liquidity and provides a scope for issuance of more shares in raising further capital for business.

The Securities and Exchange Board of India is the regulatory body that monitors IPO. As per its guidelines, a requisite due enquiry is conducted for a company’s authenticity, and the company is required to mention its necessary details in the prospectus for a public issue.

- Private Placement

When a company offers its securities to a small group of investors, it is called private placement. Such securities may be bonds, stocks or other securities, and the investors can be both individual and institutional.

Private placements are easier to issue than initial public offerings as the regulatory stipulations are significantly less. It also incurs reduced cost and time, and the company can remain private.

Such issuance is suitable for start-ups or companies which are in their early stages. The company may place this issuance to an investment bank or a hedge fund or place before ultra-high net worth individuals (HNIs) to raise capital.

- Preferential Issue

A preferential issue is one of the quickest methods available to companies for raising capital. Both listed and unlisted companies can issue shares or convertible securities to a select group of investors. However, the preferential issue is neither a public issue nor a rights issue.

The shareholders in possession of preference shares stand to receive the dividend before the ordinary shareholders are paid.

- Qualified Institutional Placement

Qualified institutional placement is another kind of private placement where a listed company issues securities in the form of equity shares or partly or wholly convertible debentures apart from such warrants convertible to equity shares and purchased by a Qualified Institutional Buyer (QIB).

QIBs are primarily such investors who have the requisite financial knowledge and expertise to invest in the capital market.

Some QIBs are –

- Foreign Institutional Investors registered with the Securities and Exchange Board of India.

- Foreign Venture Capital Investors.

- Alternate Investment Funds.

- Mutual Funds.

- Public Financial Institutions.

- Insurers.

- Scheduled Commercial Banks.

- Pension Funds.

Issuance of qualified institutional placement is simpler than preferential allotment as the former does not attract standard procedural regulations like submitting pre-issue filings to SEBI. The process thus becomes much easier and less time-consuming.

- Rights and Bonus Issues

Another issuance in the primary market is rights and bonus issue, in which the company issues securities to existing investors by offering them to purchase more securities at a predetermined price (in case of rights issue) or avail allotment of additional free shares (in case of bonus issue).

For rights issues, investors retain the choice of buying stocks at discounted prices within a stipulated period. Rights issue enhances control of existing shareholders of the company, and also there are no costs involved in the issuance of these kinds of shares.

For bonus issues, stocks are issued by a company as a gift to its existing shareholders. However, the issuance of bonus shares does not infuse fresh capital.

The Bottom Line

A primary market is a figurative place where securities make their debut—where new bonds and shares of corporate stock are issued to be sold to investors for the first time. They are sold by the companies, governments, or other entities issuing them, often with the help of investment banks, who underwrite the new issues, setting their price and overseeing their launch.

There is a primary market for most types of assets, with equities (stocks) and bonds being the most common. And there are several different types of primary market issues. The most familiar are IPOs. Others include private placements and rights offerings.

Most primary market buyers are institutional investors, though individual investors can get easily get in on certain offerings, like new US Treasury bonds.

After they’ve been issued on the primary market, existing shares of stock, bonds, and other securities are traded between investors on what is called the secondary market—essentially, the familiar stock exchanges and stock markets.

Disclaimer ||

The Information provided on this website article does not constitute investment advice ,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!