High Samsung shares hit a three-year high on Friday after the South Korean tech giant forecast a 15-fold increase in its second quarter operating profit from the same time last year, as the global artificial intelligence boom buoys demand for advanced computer chips.

High Certainly!

Samsung Electronics, a key player in the global tech industry, has seen a notable resurgence in its performance, particularly in its semiconductor division. Here are some key points that contribute to Samsung’s current success:

- AI and Semiconductor Demand: The demand for artificial intelligence (AI) technologies has been a significant driver of growth for Samsung’s semiconductor business. AI applications require powerful processors and memory chips, which are essential components in devices ranging from smartphones to data centers.

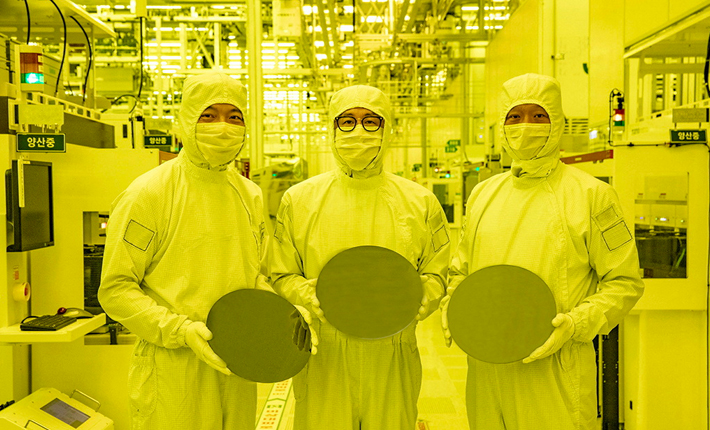

- Memory Chips: Samsung is one of the largest manufacturers of memory chips in the world, including DRAM and NAND flash memory. These chips are crucial for storing and processing data in AI applications, autonomous vehicles, cloud computing, and other advanced technologies.High

- Market Position: Samsung has strengthened its position in the semiconductor market, competing closely with other giants like Intel and TSMC. Its advanced manufacturing capabilities and ongoing investments in research and development have allowed it to stay at the forefront of technological innovation.

- Revenue and Profit Growth: The increased demand for semiconductor products, driven by AI and other emerging technologies, has translated into higher revenue and profits for Samsung. This growth has been particularly evident in recent quarters, leading to a three-year high in the company’s stock performance.

- Strategic Investments: Samsung has been strategically investing in expanding its semiconductor production capacity and developing new technologies. This includes investments in next-generation chip technologies such as EUV (Extreme Ultraviolet Lithography) for more advanced and efficient chip manufacturing.

- Diversification and Innovation: Beyond semiconductors, Samsung continues to innovate and diversify its product offerings, including consumer electronics, displays, and telecommunications equipment. This diversification helps mitigate risks and leverages its technological expertise across multiple sectors.

In summary, Samsung’s recent success can largely be attributed to its leadership in the semiconductor market, fueled by the growing demand for AI and other advanced technologies. As these trends continue to evolve, Samsung’s strategic focus on innovation and production capacity expansion will likely play a crucial role in maintaining its competitive edge in the global tech landscape.

Certainly! Here are some key facts about Samsung Electronics, particularly focusing on its semiconductor and AI-related businesses:High

- Semiconductor Dominance: Samsung is one of the world’s largest semiconductor manufacturers, competing closely with companies like Intel and TSMC. It holds a significant market share in both DRAM (Dynamic Random-Access Memory) and NAND flash memory chips.

- AI Market Growth: The increasing adoption of artificial intelligence (AI) technologies across various industries has boosted demand for Samsung’s semiconductor products. AI applications require powerful processors and memory chips, driving growth in Samsung’s semiconductor business.

- Financial Performance: Samsung’s semiconductor division has been a major contributor to its overall financial performance. The company has seen substantial revenue and profit growth, particularly in recent quarters, which has led to a rise in its stock price to a three-year high.

- Technological Innovation: Samsung continues to invest heavily in research and development, focusing on advancing semiconductor technologies such as EUV (Extreme Ultraviolet Lithography). These innovations enable Samsung to produce more advanced and efficient chips, meeting the demands of AI and other emerging technologies.High

- Global Presence: Samsung Electronics is a global leader in consumer electronics, semiconductors, and display technologies. It operates manufacturing facilities and research centers worldwide, ensuring a strong global footprint and market presence.High

- Diversification Strategy: While semiconductors are a cornerstone of Samsung’s business, the company also diversifies its portfolio with products such as smartphones, televisions, home appliances, and telecommunications equipment. This diversification helps mitigate risks and leverage synergies across different business segments.

- Environmental and Social Responsibility: Samsung has been proactive in addressing environmental and social issues, committing to sustainable practices and corporate social responsibility initiatives. This includes efforts to reduce environmental impact in manufacturing and promote ethical business practices.High

These key facts highlight Samsung Electronics’ leadership in the semiconductor industry, driven by its innovative capabilities, strategic investments, and responsiveness to market trends such as the AI boom.High

When monitoring Samsung Electronics, here are several key aspects to keep an eye on:High

- Semiconductor Market Trends: Watch for developments in the global semiconductor market, including shifts in demand for memory chips and processors. Changes in technology trends, such as AI adoption, data center growth, and mobile device innovations, can significantly impact Samsung’s semiconductor business.

- Innovation in AI and Emerging Technologies: Keep track of Samsung’s advancements in AI-related technologies, such as new chip designs optimized for AI applications, collaborations with AI software developers, and integration of AI into consumer electronics and industrial applications.High

- Competitive Landscape: Monitor competition from other semiconductor giants like Intel, TSMC, and emerging players in the AI hardware space. Samsung’s ability to stay ahead in technology innovation and maintain competitive pricing will be crucial.

- Financial Performance: Continuously assess Samsung’s financial results, including revenue, operating profit margins, and semiconductor sales growth. Quarterly earnings reports and annual financial disclosures provide insights into the company’s overall health and performance in key business segments.

- Supply Chain and Manufacturing Capacity: Given the semiconductor industry’s cyclicality and supply chain challenges, monitor Samsung’s manufacturing capacity expansions, supply chain resilience, and response to global supply chain disruptions.High

- Regulatory and Geopolitical Developments: Stay informed about regulatory changes, trade policies, and geopolitical tensions that could impact Samsung’s operations, particularly its global supply chain and market access.High

- Environmental and Social Initiatives: Samsung’s commitment to sustainability and corporate social responsibility (CSR) practices can influence its brand reputation and stakeholder perceptions. Watch for advancements in green technologies, energy efficiency initiatives, and social impact programs.High

By monitoring these factors, investors, industry analysts, and stakeholders can gain a comprehensive understanding of Samsung Electronics’ performance, strategic direction, and responsiveness to market dynamics in the semiconductor and AI industries.

ChatGPT

Certainly! Here are some frequently asked questions (FAQs) about Samsung Electronics and its business operations:High

1. What does Samsung Electronics do?

- Samsung Electronics is a global leader in technology, primarily involved in the manufacturing and sales of consumer electronics, semiconductors, telecommunications equipment, and home appliances. It is known for its smartphones, tablets, TVs, memory chips, and displays.High

2. Where is Samsung Electronics headquartered?

- Samsung Electronics is headquartered in Suwon, South Korea. It has a significant global presence with subsidiaries and offices in various countries around the world.

3. What are Samsung’s main business segments?

- Samsung operates in several main business segments:High

- IT & Mobile Communications: Includes smartphones, tablets, wearables, and related accessories.High

- Consumer Electronics: Includes TVs, home appliances (refrigerators, washing machines, etc.), and audio-video products.

- Device Solutions: Includes semiconductor products such as memory chips (DRAM, NAND flash) and System LSI (Logic Solutions Integrated Circuits).

- Harman: A subsidiary specializing in connected technologies for automotive, consumer, and enterprise markets.High

4. How important is Samsung’s semiconductor business?

- Samsung’s semiconductor business is crucial to its overall operations and financial performance. It is one of the largest semiconductor manufacturers globally, known for memory chips (DRAM, NAND flash) and System LSI chips used in various electronic devices, including smartphones, servers, and IoT devices.High

5. What is Samsung doing in artificial intelligence (AI)?

- Samsung is actively integrating AI technologies into its products and services. This includes developing AI-powered applications for smartphones, enhancing AI capabilities in home appliances, and optimizing AI algorithms for better performance in semiconductor chips.High

6. How does Samsung contribute to sustainability and corporate social responsibility (CSR)?

- Samsung has committed to sustainability through initiatives such as reducing environmental impact in manufacturing, energy efficiency improvements, and responsible sourcing of raw materials. It also promotes diversity and inclusion in its workforce and supports community development programs globally.

7. What are some recent developments at Samsung Electronics?

- Recent developments include advancements in semiconductor technology (such as EUV lithography), launches of new smartphones and consumer electronics products, collaborations in AI research, and strategic investments in emerging technologies and markets.

8. How does Samsung compete with other tech giants like Apple and Huawei?

- Samsung competes by leveraging its strengths in manufacturing capabilities, technological innovation, and diversified product portfolio. It focuses on continuous R&D investments, brand recognition, and addressing consumer needs across different market segments.

9. What are the challenges facing Samsung Electronics?

- Challenges include intense competition in the global smartphone market, fluctuating demand in the semiconductor industry, geopolitical tensions affecting supply chains, and regulatory changes impacting global operations.

10. How can I invest in Samsung Electronics?

- Samsung Electronics is listed on the Korea Exchange (KRX) under the ticker symbol 005930. It also has a global presence through its ADRs (American Depositary Receipts) traded on the OTC market. Investors can purchase shares through brokerage accounts that offer international trading options.

These FAQs provide a broad overview of Samsung Electronics, its business activities, strategic initiatives, and market dynamics. For more detailed information, ongoing developments, and financial performance updates, investors and stakeholders typically refer to Samsung’s official announcements, financial reports, and industry analyses.

Certainly! Here’s a breakdown of the advantages and disadvantages associated with Samsung Electronics:

Advantages:

- Diversified Product Portfolio: Samsung offers a wide range of products across multiple sectors including consumer electronics (smartphones, TVs, home appliances), semiconductors (memory chips, processors), and IT & mobile communications. This diversification helps mitigate risks and leverages economies of scale.

- Technological Innovation: Samsung is renowned for its strong focus on research and development (R&D), continuously innovating in areas such as semiconductor technology, display technologies (OLED), and AI applications. This innovation allows Samsung to introduce cutting-edge products and stay competitive in the global market.

- Global Market Presence: Samsung has a strong global presence with a widespread distribution network and brand recognition. This enables the company to reach diverse markets and cater to different consumer preferences and demands worldwide.

- Vertical Integration: Samsung benefits from vertical integration across its supply chain, particularly in the semiconductor division. By manufacturing key components like memory chips and displays in-house, Samsung can control costs, quality, and supply chain efficiency.

- Strong Financial Performance: Historically, Samsung has demonstrated robust financial performance, driven by strong sales in its semiconductor business and consumer electronics divisions. This financial stability allows Samsung to invest in R&D, expand its manufacturing capabilities, and pursue strategic acquisitions.

Disadvantages:

- Market Saturation and Competition: Samsung operates in highly competitive markets such as smartphones and consumer electronics. Intense competition from rivals like Apple, Huawei, and other Asian manufacturers can pressure profit margins and market share.

- Dependence on Semiconductor Market: While Samsung’s semiconductor business is a major strength, it also exposes the company to cyclicality and fluctuations in global demand for memory chips and processors. Economic downturns or shifts in technology trends can impact semiconductor sales.

- Brand Perception Challenges: Samsung has faced challenges in brand perception, particularly related to product recalls (e.g., Galaxy Note 7 battery issues) and legal disputes. Managing brand reputation and consumer trust is critical in maintaining market leadership.

- Geopolitical Risks: As a global company, Samsung is exposed to geopolitical tensions, trade policies, and regulatory changes in various countries. These factors can affect supply chain operations, market access, and profitability.

- Operational Complexities: Managing a diverse portfolio of products and global operations presents operational complexities. Coordination across different business units, regions, and functions requires effective management and strategic alignment.

In conclusion, while Samsung Electronics enjoys significant strengths such as technological innovation, global market presence, and diversified product offerings, it also faces challenges including intense competition, market fluctuations, and operational complexities. Understanding these advantages and disadvantages helps stakeholders assess Samsung’s strategic positioning and navigate its opportunities and risks in the dynamic technology industry.

Samsung Electronics faces several threats in the competitive and global landscape of the technology industry:

- Intense Competition: Samsung competes fiercely with global giants like Apple, Huawei, and other prominent technology companies across various sectors including smartphones, consumer electronics, and semiconductors. Intense competition can lead to price wars, reduced profit margins, and challenges in maintaining market share.

- Technological Disruption: Rapid advancements in technology, particularly in areas like artificial intelligence (AI), Internet of Things (IoT), and 5G connectivity, pose a threat to Samsung’s existing product lines. Failure to innovate or adapt to technological shifts could result in product obsolescence or loss of competitive edge.

- Supply Chain Vulnerabilities: Samsung’s operations rely on a complex global supply chain for sourcing raw materials and components, manufacturing, and distribution. Disruptions such as natural disasters, geopolitical tensions, trade disputes, or supplier issues could impact production schedules, product availability, and profitability.

- Regulatory and Legal Challenges: Operating in multiple countries subjects Samsung to varying regulatory environments, legal disputes, and compliance requirements. Changes in regulations related to data privacy, environmental standards, or trade policies can affect business operations and profitability.

- Market Saturation: Samsung faces challenges in saturated markets, particularly in mature markets like North America, Europe, and parts of Asia. Slower growth rates in these regions necessitate strategic focus on emerging markets where competition and consumer preferences may differ.

- Brand Reputation and Trust: Past incidents such as product recalls (e.g., Galaxy Note 7 battery issues) and legal disputes have impacted Samsung’s brand reputation and consumer trust. Maintaining and rebuilding trust is crucial for sustaining customer loyalty and market position.

- Economic Uncertainty: Fluctuations in global economic conditions, currency exchange rates, and consumer spending patterns can impact demand for Samsung’s products. Economic downturns or recessions may lead to reduced consumer confidence and discretionary spending on electronics.

- Environmental and Sustainability Pressures: Increasing emphasis on environmental sustainability and corporate social responsibility (CSR) requires Samsung to adopt eco-friendly practices in manufacturing, recycling, and product design. Failure to meet sustainability expectations could lead to reputational damage and regulatory scrutiny.

Navigating these threats requires Samsung to maintain agility, innovate continuously, strengthen brand resilience, diversify market strategies, and invest strategically in technology and operational resilience. By proactively addressing these challenges, Samsung can mitigate risks and capitalize on opportunities for sustained growth and competitiveness in the global technology landscape.

The bottom line for Samsung Electronics revolves around leveraging its strengths in innovation, global presence, and diversified product portfolio while effectively managing challenges and threats in the technology industry:

- Strengths to Leverage:

- Technological Innovation: Continue investing in R&D to drive advancements in semiconductor technology, AI, IoT, and other emerging areas.

- Diversified Portfolio: Utilize the breadth of products across consumer electronics, semiconductors, and IT & mobile communications to balance revenue streams and mitigate market-specific risks.

- Global Market Presence: Leverage a strong distribution network and brand recognition to penetrate diverse markets and capitalize on growth opportunities.

- Key Challenges to Address:

- Competitive Pressure: Navigate intense competition by continuously improving product offerings, enhancing customer value, and optimizing cost structures.

- Market Dynamics: Monitor and adapt to shifting consumer preferences, technological disruptions, and economic uncertainties in key markets.

- Operational Resilience: Strengthen supply chain management, mitigate supply chain risks, and enhance operational efficiencies to ensure continuity and reliability.

- Strategic Imperatives:

- Innovation Leadership: Maintain leadership in technological innovation through strategic investments, partnerships, and talent acquisition in key growth areas.

- Customer Centricity: Enhance customer engagement and satisfaction through personalized experiences, quality products, and responsive support services.

- Sustainability and Responsibility: Commit to environmental sustainability, ethical business practices, and corporate social responsibility initiatives to uphold brand reputation and meet stakeholder expectations.

By focusing on these strategic imperatives, Samsung can navigate challenges, capitalize on opportunities, and sustain its leadership position in the competitive global technology landscape.