With Lucid Group (NASDAQ: LCID) stock facing significant challenges this year, including a 30% price drop in 2024 alone and over 60% over the past year, analysts are cautious regarding its performance in the next 12 months, most of them advising that investors refrain from any action at the moment.

As it happens, the electric vehicle (EV) manufacturer has been struggling lately and has announced a restructuring plan, which involves cutting 400 job positions, or 6% of its entire workforce, in an effort to reduce costs, according to an 8-K filing and staff email from CEO Peter Rawlison on May 24.

However, a glimmer of hope has emerged in the form of the launch of Lucid’s first electric SUV, called the Lucid Gravity, set to happen by the end of this year, which Rawlison told his employees would be “the world’s best SUV and dramatically expand our total addressable market.”

Lucid stock price prediction

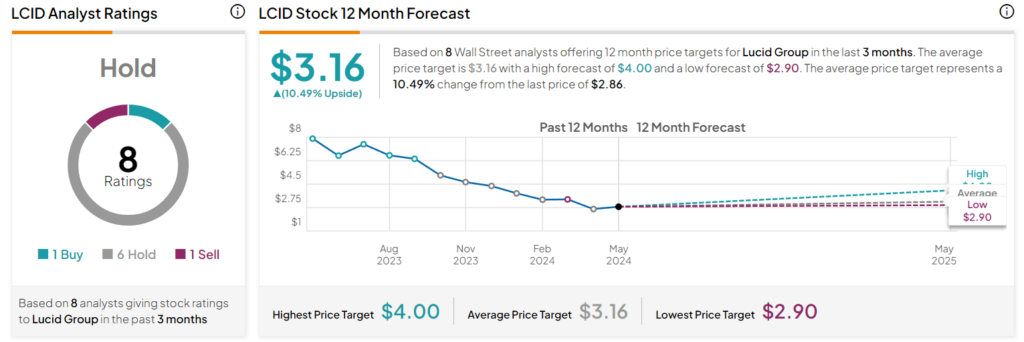

In such a context, eight Wall Street experts have shared over the past three months their prognoses for the price of Lucid shares in the next 12-month period, with six of them recommending a ‘hold,’ one voting for a ‘buy,’ and one suggesting a ‘sell,’ as per TipRanks data on May 31.

At the same time, these analysts have offered their LCID price targets for the following year, averaging at $3.16, which would suggest an upside of 10.49% if they are correct, with the lowest LCID price target at $2.9 (+1.4%), and the highest price looking at $4 (+39.86%).

Specifically, one of the experts is RBC Capital analyst Tom Narayan, who, on May 16, projected that Lucid stocks would trade at the price of $3 per share, cutting the LCID price target from the previous $6 but pointing out that:

“Focus is on demand for the Gravity SUV, which management believes has 6x TAM vs its sedans. Further, the company was able to secure $1B in financing from an affiliate of PIF, bringing liquidity to $5B at the end of Q1.”

In early May, Needham analyst Chris Pierce reiterated his ‘hold’ recommendation for his company’s clients without providing a fixed price for the next 12 months but supporting the neutral view by arguing that:

“We continue to be believers in LCID’s best in class technology driving industry leading efficiency (LCID vehicles combine higher mileage ranges with lower kWh battery pack sizes vs OEM peers), but we also continue to see low absolute delivery numbers, limiting fixed cost absorption driving financial statement losses and driving further capital needs.”

Lucid stock price analysis

For now, the price of Lucid shares stands at $2.86, which reflects a negative change of 1.04% in the last day but an increase of 1.97% over the past week, whereas on its monthly chart, it is recording an 8.97% gain, according to the most recent information retrieved on May 31.

All things considered, LCID stock, indeed, seems like a ‘hold’ at the moment, at least until things become clearer in terms of the company’s future plans, as well as the success of its electric SUV, which is why doing one’s own research is critical when investing.

What is Wall Street ?

Wall Street can refer to two things:

- Literally, it is a street in Lower Manhattan, New York City. It runs for eight blocks between Broadway and the East River. The area was originally a Dutch settlement and the wall referred to in the street’s name is a reference to a wall that was built by the Dutch to protect the settlement from Native Americans.

- Figuratively, “Wall Street” is used as a metonym to refer to the financial markets of the United States, the American financial services industry, or New York-based financial interests. This usage arose because so many important financial institutions are headquartered on or near Wall Street. The New York Stock Exchange (NYSE), for instance, is located on Wall Street. The NYSE is the world’s largest stock exchange by total market capitalization.

So, depending on the context, “Wall Street” could refer to a physical location or to the financial industry in general.

Features and Benefits of Wall Street Stocks?

Wall Street stocks, referring to shares of ownership in publicly traded companies listed on major U.S. exchanges like the New York Stock Exchange (NYSE) , offer several features and benefits for investors.

Features:

- Liquidity: Wall Street stocks are generally highly liquid, meaning they can be easily bought and sold on an exchange. This allows investors to enter and exit positions quickly with minimal impact on the stock price.

- Dividends: Some companies distribute a portion of their profits to shareholders in the form of dividends. These payments can provide investors with a steady stream of income.

- Capital appreciation: The primary benefit of owning stocks is the potential for capital appreciation, or an increase in the stock price over time. As a company grows and becomes more profitable, its stock price is likely to rise as well.

Benefits:

- High potential returns: Historically, stocks have offered higher returns than other asset classes, such as bonds or savings accounts. This makes them an attractive option for investors seeking to grow their wealth over the long term.

- Portfolio diversification: Investing in Wall Street stocks allows investors to diversify their portfolios, which can help to reduce risk. By spreading their investments across different companies and sectors, investors can lessen the impact of any single company’s poor performance.

- Ownership stake: When you own shares of a company’s stock, you are essentially buying a piece of ownership in that company. This gives you a stake in its success and allows you to benefit from its growth.

It’s important to remember that investing in stocks also comes with inherent risks. Here are some things to consider:

- Market volatility: Stock prices can fluctuate significantly in the short term. Investors must be prepared for the possibility of losing money on their investments.

- Company risk: The success of your investment is tied to the success of the company you invest in. If a company performs poorly, its stock price could decline.

- Economic risk: A weak economy can lead to a decline in stock prices across the board.

Overall, Wall Street stocks offer a unique combination of features and benefits that can be attractive to investors seeking to grow their wealth over the long term. However, it’s important to carefully consider the risks involved before investing.

Summary

Wall Street analysts are cautiously optimistic about Lucid’s stock price for the next 12 months. Here’s a summary:

- Average Price Target: Analysts predict an average price target in the range of $3.22 to $3.82, which translates to a potential increase of 23% to 44% from the current price (around $2.65 as of July 2nd, 2024).

- High and Low Estimates: There’s some variation in predictions, with the high reaching $5.00 and the low at $2.90.

- Overall Sentiment: The consensus rating leans towards “Hold” with no strong buy or sell signals.

Key Takeaways:

- Potential for moderate growth, but not a guaranteed return.

- Some analysts see significant upside, while others are more conservative.

- More research is recommended before making any investment decisions.

Leave feedback about this