Buffett’s profits this year is almost the same as what an average Bitcoin trader has generated in 2024.

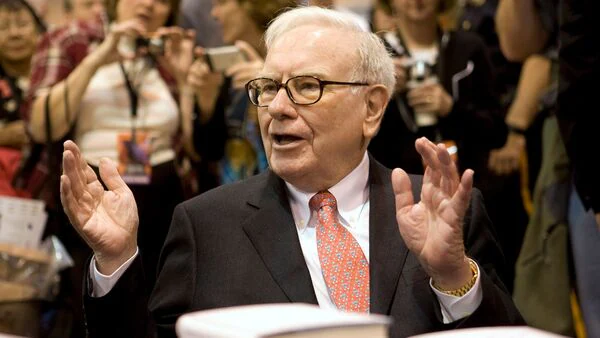

Warren Buffett’s Berkshire Hathaway reaching a market cap of $1 trillion is indeed a noteworthy milestone, underscoring its massive scale and financial influence. For context, this valuation brings Berkshire Hathaway’s market capitalization close to the total market value of Bitcoin, which often fluctuates around that range.

Berkshire Hathaway’s diversified investments in various industries, from insurance to technology, have contributed to its substantial valuation. On the other hand, Bitcoin’s market cap is driven by its status as a digital asset and its speculative nature. The comparison highlights how traditional investments and emerging digital assets can both reach impressive market valuations, albeit through very different mechanisms and business models.

Berkshire Hathaway

**1. Overview:

- Founded by Warren Buffett and Charlie Munger, Berkshire Hathaway is a multinational conglomerate holding company. Its diverse portfolio includes significant stakes in well-known companies and fully owned subsidiaries across various industries such as insurance (Geico, General Re), utilities (BNSF Railway), consumer goods (Duracell), and technology (Apple).

**2. Market Capitalization:

- Berkshire Hathaway’s market cap crossing $1 trillion reflects its vast and diverse investments. The company’s value is supported by its consistent financial performance, strong management, and the ability to acquire and manage high-quality businesses.Warren

**3. Investment Strategy:

- Warren Buffett’s investment philosophy focuses on buying businesses with strong fundamentals, competitive advantages, and capable management. This long-term value investing approach has significantly contributed to Berkshire’s growth.

Bitcoin

**1. Overview:

- Bitcoin, created by the pseudonymous Satoshi Nakamoto in 2009, is the first and most well-known cryptocurrency. It operates on a decentralized network using blockchain technology, which ensures security and transparency in transactions.Warren

**2. Market Capitalization:

- Bitcoin’s market cap fluctuates significantly due to its volatile nature. It often approaches or surpasses $1 trillion, reflecting both high investor interest and market speculation. Bitcoin’s value is driven by factors such as its perceived scarcity, adoption as a digital asset, and macroeconomic conditions.

**3. Investment and Usage:

- Bitcoin is considered both a store of value and a speculative investment. Unlike traditional assets, its price can be highly volatile due to market sentiment, regulatory news, technological developments, and broader economic trends.Warren

Comparative Insights:

**1. Stability vs. Volatility:

- Berkshire Hathaway’s valuation is underpinned by stable, real-world business operations and consistent financial performance. In contrast, Bitcoin’s value is subject to extreme fluctuations and speculative trading, making it a more volatile asset.

**2. Revenue Generation:

- Berkshire Hathaway generates revenue through its diverse businesses and investments, providing a more predictable income stream. Bitcoin does not generate revenue; its value is based on market demand and supply dynamics.

**3. Investment Approach:

- Investing in Berkshire Hathaway often appeals to those looking for long-term growth through traditional business models and financial stability. Bitcoin attracts investors seeking high-risk, high-reward opportunities in the emerging digital asset space.Warren

The comparison of Berkshire Hathaway’s market cap with the entire Bitcoin market underscores the significant scale of both traditional and digital financial markets. While they operate on different principles, their market valuations reflect their impact and importance in the financial world.

Berkshire Hathaway

**1. Company Overview:

- Founded: 1839 (as a textile manufacturing company); restructured by Warren Buffett in 1965.

- Headquarters: Omaha, Nebraska, USA.

- Business Model: Conglomerate holding company with a diversified portfolio.

- Key Subsidiaries:

- Insurance: Geico, General Re

- Utilities: BNSF Railway, Berkshire Hathaway EnergyWarren

- Consumer Goods: Duracell, Fruit of the Loom

- Technology Investments: Significant stake in Apple Inc.

**2. Market Capitalization:

- As of recent updates, Berkshire Hathaway’s market cap has surpassed $1 trillion. This makes it one of the largest companies by market value globally.

**3. Financial Performance:

- Revenue: Diverse streams from various sectors, including insurance premiums, railway transport, energy sales, and consumer goods.

- Net Income: Generally high, reflecting the profitability of its diverse investments.Warren

- Share Price: The Class A shares (BRK.A) are famously expensive, often trading at hundreds of thousands of dollars per share, reflecting its long-term value growth.

**4. Investment Strategy:

- Value Investing: Focus on acquiring companies with strong fundamentals, good management, and competitive advantages.

- Long-term Horizon: Investments are made with a view toward long-term growth and stability.

**5. Leadership:

- Warren Buffett: Chairman and CEO, known for his value investing prowess.

- Charlie Munger: Vice Chairman, Buffett’s long-time partner and key advisor.Warren

Bitcoin

**1. Overview:

- Created: 2009 by the pseudonymous Satoshi Nakamoto.

- Technology: Operates on a decentralized blockchain network.

- Purpose: A digital currency designed as a peer-to-peer system for transactions without the need for intermediaries.

**2. Market Capitalization:

- Value Fluctuations: Bitcoin’s market cap often approaches or exceeds $1 trillion, though it can vary widely based on market conditions.

- Total Supply: The maximum supply of Bitcoin is capped at 21 million coins, which adds to its scarcity value.Warren

**3. Price Volatility:

- Historical Price Movements: Bitcoin is known for its extreme price volatility. It has experienced significant price swings, influenced by factors like regulatory news, technological developments, macroeconomic trends, and market sentiment.

- Recent Trends: Prices have ranged from under $1 in its early years to over $60,000 at its peak.

**4. Investment Appeal:

- Digital Gold: Often compared to gold as a store of value.

- Speculative Investment: Attracts investors looking for high-risk, high-reward opportunities.

- Adoption: Increasingly accepted as a form of investment and in some cases as a means of payment.Warren

**5. Risks and Challenges:

- Regulatory Risks: Governments and financial regulators globally are still developing frameworks for cryptocurrencies.

- Security Risks: While blockchain technology is secure, cryptocurrency exchanges and wallets can be targets for cyberattacks.

- Market Sentiment: Bitcoin’s price can be heavily influenced by investor sentiment, news events, and market speculation.

Comparison:

**1. Nature of Asset:

- Berkshire Hathaway: Traditional, diversified investment holding company with tangible business operations.

- Bitcoin: Digital asset with no underlying business operations, valued based on market perception and speculative demand.Warren

**2. Revenue Generation:

- Berkshire Hathaway: Generates revenue from a wide array of business activities and investments.

- Bitcoin: Does not generate revenue; its value is purely market-driven.

**3. Market Dynamics:

- Berkshire Hathaway: Stable, influenced by the performance of its investments and broader economic conditions.

- Bitcoin: Highly volatile, influenced by market speculation, regulatory news, and technological developments.

**4. Investment Stability:

- Berkshire Hathaway: Generally seen as a stable investment with long-term growth potential.

- Bitcoin: Viewed as a speculative investment with potential for high returns but also high risk.Warren

In summary, Berkshire Hathaway and Bitcoin represent two very different approaches to wealth accumulation and investment. Berkshire Hathaway’s strength lies in its diversified, stable business operations, while Bitcoin offers a high-risk, high-reward investment opportunity driven by technological innovation and market speculation.

Frequently Asked Questions (FAQ)

About Berkshire Hathaway

**1. What is Berkshire Hathaway?

- Berkshire Hathaway is a multinational conglomerate holding company led by Warren Buffett. It owns a diverse range of businesses and holds significant investments in other companies, including Geico, BNSF Railway, and Apple Inc.

**2. When was Berkshire Hathaway founded?

- The original company was founded in 1839 as a textile manufacturer. Warren Buffett took control of it in 1965, transforming it into the diversified conglomerate it is today.

**3. What is Berkshire Hathaway’s business model?

- Berkshire Hathaway operates as a holding company, acquiring and managing a diverse range of businesses. It generates revenue through its subsidiaries and investments, which span various industries, including insurance, utilities, and consumer goods.Warren

**4. Who are the key people behind Berkshire Hathaway?

- Warren Buffett is the Chairman and CEO, and Charlie Munger is the Vice Chairman. Both are renowned for their value investing strategies.

**5. How is Berkshire Hathaway’s stock structured?

- Berkshire Hathaway has two classes of shares: Class A (BRK.A) and Class B (BRK.B). Class A shares are significantly more expensive and represent a larger ownership stake compared to Class B shares, which were created to make the stock more accessible to smaller investors.

**6. What is the investment strategy of Berkshire Hathaway?

- The company follows a value investing approach, focusing on acquiring businesses with strong fundamentals, good management, and competitive advantages. Buffett and Munger aim for long-term growth and stability.Warren

About Bitcoin

**1. What is Bitcoin?

- Bitcoin is a decentralized digital currency that operates on a peer-to-peer network using blockchain technology. It was created by an anonymous person or group known as Satoshi Nakamoto and was launched in 2009.

**2. How does Bitcoin work?

- Bitcoin transactions are recorded on a public ledger called the blockchain. The network is maintained by miners who validate and add transactions to the blockchain. Bitcoin operates without a central authority, relying on cryptographic principles for security.

**3. What is the total supply of Bitcoin?

- The total supply of Bitcoin is capped at 21 million coins. This limited supply is designed to create scarcity and mimic the characteristics of precious metals like gold.

**4. Why is Bitcoin’s price so volatile?

- Bitcoin’s price is highly volatile due to factors such as market speculation, regulatory news, technological changes, macroeconomic trends, and investor sentiment. The market for Bitcoin is still relatively young compared to traditional assets.Warren

**5. How can I buy Bitcoin?

- Bitcoin can be purchased through cryptocurrency exchanges using traditional currencies. Popular exchanges include Coinbase, Binance, and Kraken. You can also acquire Bitcoin through peer-to-peer platforms or Bitcoin ATMs.

**6. What are the risks associated with investing in Bitcoin?

- Risks include high price volatility, regulatory uncertainty, security vulnerabilities related to exchanges and wallets, and potential for loss of investment. It’s important to do thorough research and understand these risks before investing.

**7. Is Bitcoin a good investment?

- Whether Bitcoin is a good investment depends on individual risk tolerance, investment goals, and market conditions. It’s often seen as a speculative asset and may not be suitable for all investors. Diversifying investments and seeking financial advice can help manage risks.Warren

**8. How is Bitcoin different from traditional currencies?

- Bitcoin operates on a decentralized network without a central authority, unlike traditional fiat currencies issued by governments. It uses cryptographic technology for transactions and has a fixed supply limit, whereas traditional currencies can be printed or minted by central banks.

Comparing Berkshire Hathaway and Bitcoin

**1. How does Berkshire Hathaway’s market cap compare to Bitcoin’s?

- Berkshire Hathaway’s market cap recently surpassed $1 trillion, which is comparable to the total market value of Bitcoin, though Bitcoin’s market cap can fluctuate significantly.

**2. What are the main differences between investing in Berkshire Hathaway and Bitcoin?

- Berkshire Hathaway: Offers a diversified, stable investment with a focus on long-term growth through business operations and investments.

- Bitcoin: Represents a high-risk, high-reward investment driven by market speculation and technological innovation, without underlying business operations.

**3. Which is considered a safer investment: Berkshire Hathaway or Bitcoin?Warren

- Generally, Berkshire Hathaway is considered safer due to its diversified business model and stable revenue streams. Bitcoin is highly volatile and speculative, making it riskier.

This FAQ provides a snapshot of Berkshire Hathaway and Bitcoin, highlighting their key characteristics and differences.

Here’s a detailed look at the advantages and disadvantages of investing in Berkshire Hathaway and Bitcoin:

Berkshire Hathaway

Advantages:

- Diversified Holdings:

- Advantage: Berkshire Hathaway owns a broad range of businesses and investments, reducing the risk associated with any single industry or company. This diversification helps stabilize returns and manage risk.

- Example: Its portfolio includes insurance companies, utilities, consumer goods, and technology investments.Warren

- Proven Management:

- Advantage: Led by Warren Buffett and Charlie Munger, Berkshire Hathaway benefits from the expertise of two highly regarded investors known for their long-term, value-oriented investment strategies.

- Example: Buffett’s track record of successful investments and capital allocation is a significant advantage.

- Stable Revenue Streams:

- Advantage: The company generates revenue from its diverse subsidiaries and investments, providing a more stable income compared to single-sector investments.

- Example: Revenue from its insurance operations, such as Geico, provides a steady cash flow.

- Long-term Growth Potential:

- Advantage: Berkshire Hathaway’s investment strategy focuses on acquiring companies with strong fundamentals, offering the potential for long-term capital appreciation.

- Example: Investments in high-growth companies like Apple have contributed to its overall growth.Warren

- Reinvestment of Earnings:

- Advantage: Profits are often reinvested into new acquisitions or investments, potentially leading to further growth and value creation.

- Example: Acquisitions like Burlington Northern Santa Fe (BNSF) railroads and the energy sector have expanded its business empire.

Disadvantages:

- High Share Price:

- Disadvantage: The high price of Class A shares (BRK.A) makes them less accessible to average investors, although Class B shares (BRK.B) offer a more affordable alternative.

- Example: Class A shares can trade for hundreds of thousands of dollars each.

- Dependence on Management:

- Disadvantage: The company’s success is closely tied to the leadership of Buffett and Munger. Concerns about their eventual succession can impact investor confidence.

- Example: The departure of key management could affect the company’s performance and strategy.

- Limited Exposure to Tech Sector:

- Disadvantage: While Berkshire Hathaway has some investments in technology, its portfolio is more heavily weighted towards traditional industries, potentially missing out on high-growth tech opportunities.

- Example: It’s less involved in cutting-edge technologies compared to pure tech-focused companies.

- Complexity of Holdings:

- Disadvantage: The diverse range of investments can make it challenging for investors to fully understand the company’s operations and financials.

- Example: Analyzing the performance of multiple subsidiaries and investments can be complex.

Bitcoin

Advantages:

- Potential for High Returns:

- Advantage: Bitcoin has experienced significant price increases over its history, offering the potential for substantial capital gains for early investors.

- Example: Bitcoin’s price has surged from less than $1 in its early days to over $60,000 at its peak.

- Decentralization and Security:

- Advantage: Bitcoin operates on a decentralized network using blockchain technology, which enhances security and transparency in transactions.

- Example: Transactions are verified by a distributed network of miners, reducing the risk of fraud.

- Scarcity and Inflation Hedge:

- Advantage: With a capped supply of 21 million coins, Bitcoin is designed to be scarce, which can potentially serve as a hedge against inflation and currency devaluation.

- Example: Bitcoin’s fixed supply contrasts with fiat currencies that can be printed in unlimited quantities.

- Growing Adoption:

- Advantage: Increasing acceptance of Bitcoin by institutional investors, corporations, and even some governments can enhance its legitimacy and value.

- Example: Companies like Tesla and institutional investors like MicroStrategy have added Bitcoin to their portfolios.

- Global Accessibility:

- Advantage: Bitcoin can be accessed and used by anyone with an internet connection, making it a global financial asset.

- Example: It provides financial inclusion for people in regions with limited access to traditional banking services.

Disadvantages:

- Price Volatility:

- Disadvantage: Bitcoin’s price is highly volatile, with significant fluctuations that can result in substantial gains or losses.

- Example: The price can swing dramatically based on market sentiment, regulatory news, or macroeconomic factors.

- Regulatory Risks:

- Disadvantage: The regulatory environment for cryptocurrencies is still evolving, and future regulations could impact Bitcoin’s value or usability.

- Example: Governments might impose restrictions or bans on Bitcoin trading or usage.

- Security Risks:

- Disadvantage: While the blockchain itself is secure, Bitcoin holders face risks from cyberattacks, hacking, and theft, particularly if they do not use secure storage methods.

- Example: Exchange hacks and phishing attacks can lead to loss of Bitcoin.

- Lack of Intrinsic Value:

- Disadvantage: Unlike traditional investments, Bitcoin does not generate income or have underlying physical assets, making its value primarily speculative.

- Example: Bitcoin’s value is driven by market demand and sentiment rather than tangible business operations or revenue.

- Environmental Concerns:

- Disadvantage: Bitcoin mining requires significant computational power and energy consumption, leading to environmental concerns.

- Example: The energy-intensive nature of mining has led to criticism regarding its carbon footprint.

Summary

- Berkshire Hathaway offers stability, diversification, and proven management but has high share prices and is dependent on key leaders.

- Bitcoin provides high potential returns, decentralization, and growing adoption but comes with high volatility, regulatory risks, and security concerns.

Investors should carefully consider their risk tolerance, investment goals, and preferences when evaluating these options.