Non-Fungible Tokens Traditionally, cryptocurrencies like Bitcoin are fungible, meaning that every one unit of BTC is exactly the same as another unit of BTC and they can be exchanged for one another with no further considerations. Fungibility is one of the fundamental properties of traditional currencies too, like the USD. But in some use cases, tokens might be non-fungible, most commonly when they are used as digital proof-of-ownership of underlying assets.

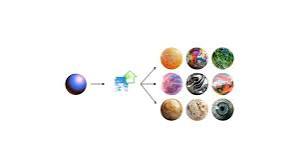

Non-Fungible Tokens For example, NFTs can be used to represent digital art: at one point, an extremely popular Ethereum-based blockchain game CryptoKitties associated its tokens with unique images of cartoon cats and allowed users to trade those cats by exchanging the corresponding tokens.

Another prominent example is the tokenization of real-world assets like equity or commodities to make them tradable digitally — in this case, tokens represent unique assets and are thus non-fungible.

Non-Fungible Tokens More rarely, a token may become non-fungible by losing its fungibility property as a result of known past activity. For example, if a certain amount of Bitcoin — fungible by default — is used to pay for illegal goods or fund illegal activities and the overall network becomes aware of it, that Bitcoin becomes less- or non-fungible, as it is unlikely to be accepted by exchanges and other service providers.

Non-fungible tokens, also known as NFTs, are a type of digital asset built on blockchain technology. Unlike cryptocurrencies like Bitcoin or Ethereum, which are fungible (meaning one unit is identical to another), NFTs are unique and irreplaceable.

Here’s a breakdown of NFTs:

- Uniqueness: Each NFT has a unique identifier stored on a blockchain, a digital ledger that ensures authenticity and ownership. This makes them perfect for representing digital collectibles, artwork, or other unique items.

- Digital Ownership: When you own an NFT, you own the digital representation of the underlying asset, not necessarily the physical asset itself (though some NFTs can represent physical ownership).

- Applications: NFTs are used for a wide range of applications, including:

- Digital Art and Collectibles: NFTs are a popular way to buy, sell, and trade digital artwork, music, and other collectibles.

- In-Game Items: Some games allow players to own and trade unique in-game items as NFTs.

- Virtual Real Estate: NFTs can represent ownership of virtual land or parcels within metaverse platforms.

- Event Tickets: Even event tickets can be tokenized as NFTs, offering new possibilities for ticketing and access control.

Benefits of NFTs:

- Security and Transparency: Blockchain technology ensures the authenticity and ownership history of NFTs.

- Proof of Ownership: NFTs provide a verifiable way to prove ownership of digital assets.

- New Revenue Streams: Artists and creators can leverage NFTs to sell their work directly to collectors and earn royalties on future sales.

- Enhanced Fan Engagement: NFTs can be used to create new forms of fan engagement and offer exclusive experiences.

Things to Consider:

- Market Volatility: The NFT market is still relatively new and volatile. The value of an NFT can fluctuate significantly.

- Environmental Impact: The energy consumption of some blockchains used for NFTs has raised environmental concerns.

- Technical Complexity: Understanding and using NFTs can involve some technical knowledge of blockchain technology and cryptocurrency wallets.

Non-Fungible Tokens By understanding these core concepts, you’ll gain a better grasp of what NFTs are and the potential they hold for the digital future.

The term “token” has a few different meanings depending on the context. Here are the most common interpretations:

1. Cryptocurrency Token:

In the realm of cryptocurrency, a token is a digital unit of value that exists on a blockchain network. Unlike Bitcoin (BTC) or Ethereum (ETH), which are considered cryptocurrencies themselves, tokens are built on top of existing blockchains. They represent various utilities or functions, depending on the specific project or protocol. Here are some common types of cryptocurrency tokens:

- Utility Tokens: Grant access to a specific service or platform within a blockchain ecosystem. (e.g., tokens used to pay for transaction fees on a decentralized network)

- Security Tokens: Represent ownership in a real-world asset or project, such as stocks, bonds, or even real estate.

- Non-Fungible Tokens (NFTs): Unique digital assets that represent ownership of digital or physical collectibles (e.g., digital artwork, trading cards, virtual land).

2. Physical Token:

In some cases, “token” can refer to a physical object used as a substitute for currency. These tokens might be:

- Casino Tokens: Used instead of cash in casinos to gamble.

- Vouchers or Coupons: Represent a specific value that can be redeemed for goods or services.

- Commemorative Coins: Physical tokens created to celebrate an event or occasion.

3. General Meaning:

More generally, a token can represent something that stands for or gives access to something else. Here are some examples:

- Security Token: A small physical object used for identification or access control (e.g., security key for two-factor authentication).

- Ticket or Receipt: A physical token representing proof of purchase or entitlement to something.

To understand the specific meaning of “token” in a particular context, you’ll need to consider the surrounding information. Non-Fungible Tokens for instance, if you’re reading about a new project on the Ethereum blockchain, the token mentioned likely refers to a cryptocurrency token used within that project.

![The Potatoz NFT Collection: An Essential Guide[2024]](https://cdatacap.com/wp-content/uploads/2024/06/Picsart_24-06-01_23-24-49-237-551x431.jpg)

Leave feedback about this