Definition

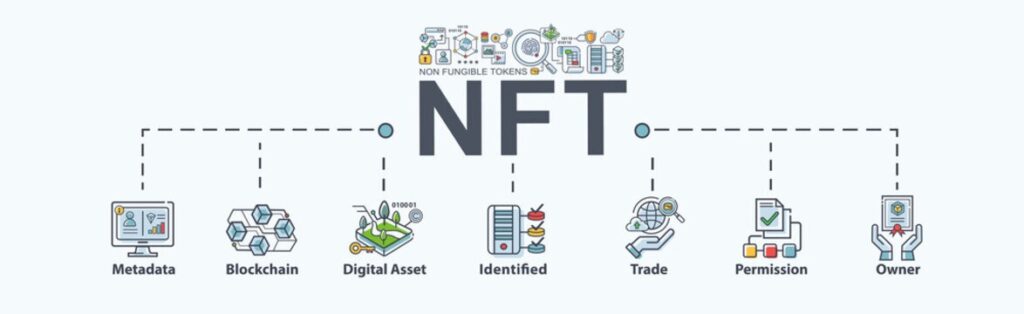

NFTs (or “non-fungible tokens”) are a special kind of crypto asset in which each token is unique — as opposed to “fungible” assets like Bitcoin and dollar bills, which are all worth exactly the same amount. Because every NFT is unique, they can be used to authenticate ownership of digital assets like artworks, recordings, and virtual real estate or pets.

In February 2021, a 10-second video by an artist named Beeple sold online for $6.6 million. Around the same time, Christie’s announced that it would be selling a collage of 5,000 “all-digital” works by the Wisconsin-based artist, whose real name is Mike Winkelmann. It was put on a virtual auction block with a starting price of $100 — and on March 11 it sold for a staggering $69 million.

Beyond the high prices, there was one other fact that observers found fascinating. In exchange for their money, collectors who buy Beeples don’t receive any physical manifestation of the artwork. Not even a framed print. What they do get is an increasingly popular kind of cryptoasset called an NFT — short for non-fungible token.

Each Beeple piece is paired with a unique NFT — a token attesting that each owner’s version is the real one. “We are in a very unknown territory,” Christie’s contemporary art specialist Noah Davis told Reuters. “In the first 10 minutes of bidding we had more than a hundred bids from 21 bidders and we were at a million dollars.”

Table of Contents

Why are NFTs important?

You can think of NFTs as being kind of like certificates of authenticity for digital artifacts. They’re currently being used to sell a huge range of virtual collectibles, including:

- NBA virtual trading cards

- Music and video clips from EDM stars like Deadmau5

- Video art by Grimes

- The original “nyan cat” meme

- A tweet by Dallas Mavericks owner and entrepreneur Mark Cuban

- Virtual real estate in a place called Decentraland

Bitcoin

As Bitcoin and other crypto has boomed in popularity over the last year, NFTs have also soared — growing to an estimated $338 million in 2020. Each NFT is stored on an open blockchain (often Ethereum’s) and anyone interested can track them as they’re created, sold, and resold. Because they use smart contract technology, NFTs can be set up so that the original artist continues to earn a percentage of all subsequent sales.

Along the way, NFTs have raised fascinating philosophical questions about the nature of ownership. Wondering why digital artifacts that can be endlessly copied and pasted have any value at all? Proponents would point out that most kinds of collecting isn’t based on inherent value. Old comic books were produced for pennies’ worth of ink and paper. Rare sneakers are often made out of the same materials as worthless ones. Some paintings hang in the Louvre, others end up in thrift shops.

As the collector who sold the $6.6 million Beeple piece noted, you can take a nice picture of the Mona Lisa, but it’s not the Mona Lisa. “It doesn’t have any value because it doesn’t have the provenance or the history of the work,” said the Beeple fan. “The reality here is that this is very, very valuable because of who is behind it.”

What does “non-fungible” mean?

Every bitcoin is worth as much as every other bitcoin. NFTs, on the other hand, are all unique. “Fungibility” refers to goods or assets that are all the same and can be swapped interchangeably. A dollar bill is another perfect example — each is worth exactly one dollar.

Concert tickets, by contrast, are non-fungible. Even if every Radiohead ticket is the same price, they aren’t directly exchangeable. Each represents a specific seat and a specific date — no other ticket will have those exact characteristics.

Where do you buy or sell NFTs?

Digital-artwork NFTs are mostly sold on specialized marketplaces like Coinbase NFT, a web3 social marketplace for NFTs, and Zora, Rarible, and Opensea. If you’re more interested in games and sports collectibles, developers like Dapper Labs have created experiences including NBA Top Shot (virtual trading cards) and Cryptokitties (a Pokemon-ish digital-cat collecting app that actually was the first NFT hit in late-2017). Online games including Gods Unchained are starting to use NFTs to sell in-game assets like weapons or cosmetic upgrades. Real estate in new virtual worlds is sold via markets including Decentraland and The Sandbox.

You can also buy or sell some NFTs directly via a compatible crypto wallet.

How do NFTs work?

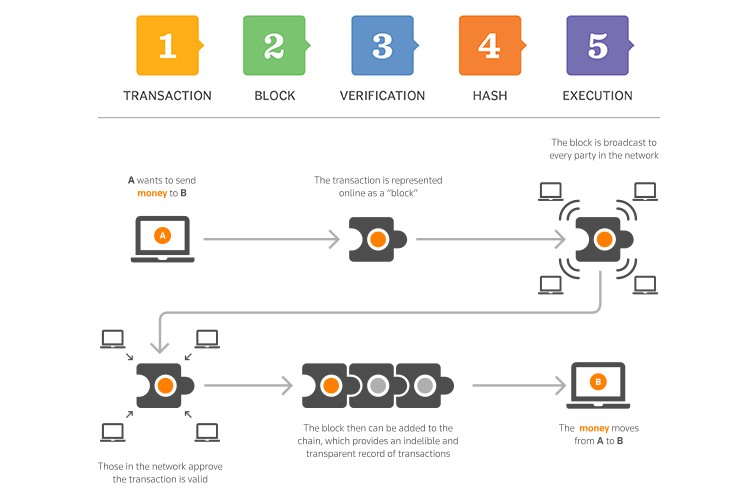

If you’re interested in DeFi, you might have heard of the ERC-20 standard, which allows anyone to create a token compatible with the Ethereum blockchain. Those are “fungible” tokens. Most non-fungible tokens are built using the ERC-721 and ERC-1155 standards, which allow creators to issue unique cryptoassets via smart contract. Because each NFT is stored on a blockchain, there is an immutable record starting with the token’s creation and including every sale. (Some NFT-focused developers have also built their own alternative blockchains, including Dapper Lab’s Flow.)

NFTs exist on a blockchain, which is a distributed public ledger that records transactions. You’re probably most familiar with blockchain as the underlying process that makes cryptocurrencies possible.

Specifically, NFTs are typically held on the Ethereum blockchain, although other blockchains support them as well.

An NFT is created, or “minted” from digital objects that represent both tangible and intangible items, including:

- Grafic art

- GIFs

- Videos and sports highlights

- Collectibles

- Virtual avatars and video game skins

- Designer sneakers

- Music

Even tweets count. Twitter co-founder Jack Dorsey sold his first ever tweet as an NFT for more than $2.9 million.

Essentially, NFTs are like physical collector’s items, only digital. So instead of getting an actual oil painting to hang on the wall, the buyer gets a digital file instead.

They also get exclusive ownership rights. NFTs can have only one owner at a time, and their use of blockchain technology makes it easy to verify ownership and transfer tokens between owners. The creator can also store specific information in an NFT’s metadata. For instance, artists can sign their artwork by including their signature in the file.

What Are NFTs Used For?

Blockchain technology and NFTs afford artists and content creators a unique opportunity to monetize their wares. For example, artists no longer have to rely on galleries or auction houses to sell their art. Instead, the artist can sell it directly to the consumer as an NFT, which also lets them keep more of the profits. In addition, artists can program in royalties so they’ll receive a percentage of sales whenever their art is sold to a new owner. This is an attractive feature as artists generally do not receive future proceeds after their art is first sold.

Art isn’t the only way to make money with NFTs. Brands like Charmin and Taco Bell have auctioned off themed NFT art to raise funds for charity. Charmin dubbed its offering “NFTP” (non-fungible toilet paper), and Taco Bell’s NFT art sold out in minutes, with the highest bids coming in at 1.5 wrapped ether (WETH)—equal to $3,723.83 at time of writing.

Nyan Cat, a 2011-era GIF of a cat with a pop-tart body, sold for nearly $600,000 in February. And NBA Top Shot generated more than $500 million in sales as of late March. A single LeBron James highlight NFT fetched more than $200,000.

Even celebrities like Snoop Dogg and Lindsay Lohan are jumping on the NFT bandwagon, releasing unique memories, artwork and moments as securitized NFTs.

Examples of NFTs

Perhaps the most famous use case for NFTs is that of cryptokitties. Launched in November 2017, cryptokitties are digital representations of cats with unique identifications on Ethereum’s blockchain. Each kitty is unique and has a different price. They “reproduce” among themselves and create new offspring with other attributes and valuations compared to their “parents.”

Within a few short weeks of their launch, cryptokitties racked up a fan base that spent millions in ether to purchase, feed, and nurture them.

Much of the earlier market for NFTs was centered around digital art and collectibles, but it has evolved into much more. For instance, the popular NFT marketplace OpenSea has several Non-fungible token categories:

- Photography: Photographers can tokenize their work and offer total or partial ownership. For example, OpenSea user erubes1 has an “Ocean Intersection” collection of beautiful ocean and surfing photos with several sales and owners.

- Sports: Collections of digital art based on celebrities and sports personalities.

- Trading cards: Tokenized digital trading cards. Some are collectibles, while others can be traded in video games.

- Utility: NFTs that can represent membership or unlock benefits.

- Virtual worlds: Virtual world Non-fungible tokens grant you ownership of anything from avatar wearables to digital property.

- Art: A generalized category of Non-fungible tokens that includes everything from pixel to abstract art.

- Collectibles: Bored Ape Yacht Club, Crypto Punks, and Pudgy Panda are some examples of NFTs in this category.

- Domain names: NFTs that represent ownership of domain names for your website(s)

- Music: Artists can tokenize their music, granting buyers the rights the artist wants them to have.

Benefits of NFTs

Perhaps the most apparent benefit of NFTs is market efficiency. Tokenizing a physical asset can streamline sales processes and remove intermediaries. Non-fungible tokens representing digital or physical artwork on a blockchain can eliminate the need for agents and allow sellers to connect directly with their target audiences (assuming the artists know how to host their NFTs securely).

Investing

Non-fungible tokens can also be used to streamline investing. For example, consulting firm Ernst & Young developed an NFT solution for one of its fine wine investors—by storing wine in a secure environment and using NFTs to protect provenance.9

Real estate can also be tokenized—a property could be parceled into multiple sections, each containing different characteristics. For example, one of the sections might be on a lakeside, while another is closer to the forest. Depending on its features, each piece of land could be unique, priced differently, and represented by an NFT. Real estate trading, a complex and bureaucratic affair, could then be simplified by incorporating relevant metadata into a unique NFT associated with only the corresponding portion of the property.

Non-fungible tokens can represent ownership in a business, much like stocks—in fact, stock ownership is already tracked via ledgers that contain information such as the stockholder’s name, date of issuance, certificate number, and the number of shares. A blockchain is a distributed and secured ledger, so issuing Non-fungible tokens to represent shares serves the same purpose as issuing stocks. The main advantage to using Non-fungible tokens and blockchain instead of a stock ledger is that smart contracts can automate ownership transferral—once an NFT share is sold, the blockchain can take care of everything else.

Security

Non-fungible tokens are also very useful in identity security. For example, personal information stored on an immutable blockchain cannot be accessed, stolen, or used by anyone who doesn’t have the keys.

NFTs can also democratize investing by fractionalizing physical assets. Fractionalized ownership through tokenization can extend to many assets. For instance, a painting need not always have a single owner—tokenization allows multiple people to purchase a share of it, transferring ownership of a fraction of the physical painting to them.

Concerns About Non-Fungible Tokens

While there are numerous benefits for creators, owners, investors, and other interested parties, there are several issues that should concern you if you’re considering investing or minting Non-fungible tokens.

The token represents ownership via hashed metadata and matching key pairs generated by your wallet. The image, video, music, or other digitized item can be copied and circulated without your permission using various techniques. It’s very easy to copy an image by right-clicking on it and saving it. The person who does this to a tokenized digital asset is pirating the asset because there is established ownership. However, it is up to the owner to locate and file charges against the multitudes of people who might do this.

Non-fungible tokens are also very limited by their liquidity. They attract a specific audience of collectors or buyers because they are much more specific than cryptocurrencies. If you find yourself holding an NFT you no longer want, it might be difficult to find a buyer if that type is no longer popular.

How Does NFT Make Money?

It depends on what the Non-fungible token represents. If it is tokenized real estate, the Non-fungible token would be exchanged for the property’s market value, which, if it has appreciated, would generate a return for the seller. If the Non-fungible tokens were an image of a monkey in a hat, it would depend on that specific token’s market value. If its price had increased since it was last purchased, a seller would earn a profit.

What Is the Point of Having NFTs?

Non-fungible tokens can be valuable to the right person. To an investor, they might appreciate in value. To a collector, they might just be a collection they want to keep. Another person might only want to own it, yet another might consider it memorabilia of a specific moment they treasure.

How Is an NFT Different from Cryptocurrency?

Non-fungible tokens stands for non-fungible token. It’s generally built using the same kind of programming as cryptocurrency, like Bitcoin or Ethereum, but that’s where the similarity ends.

Physical money and cryptocurrencies are “fungible,” meaning they can be traded or exchanged for one another. They’re also equal in value—one dollar is always worth another dollar; one Bitcoin is always equal to another Bitcoin. Crypto’s fungibility makes it a trusted means of conducting transactions on the blockchain.

Non-fungible tokens are different. Each has a digital signature that makes it impossible for Non-fungible tokens to be exchanged for or equal to one another (hence, non-fungible). One NBA Top Shot clip, for example, is not equal to EVERYDAYS simply because they’re both NFTs. (One NBA Top Shot clip isn’t even necessarily equal to another NBA Top Shot clip, for that matter.)

What can you do with NFTs once you buy them?

Good question! Some people display their digital artworks on large monitors. Some buy virtual real estate (via NFT, of course) in which they’re able to build virtual galleries or museums. You can also roam virtual worlds like Decentraland and check out other people’s collections. For some fans, the appeal is in the buying and selling — much like any other asset class. (The collector who sold the $6.9 million Beeple paid less than $70,000 for it in October 2020).

More and more mainstream artists have also gotten involved in the space — especially from the world of music. In early March, Nashville band Kings of Leon announced their next album would arrive in the form of multiple Non-fungible tokens. Depending on which a fan buys, various perks will be unlocked — like alternate cover art, limited-edition vinyl, and even a “golden ticket” to a VIP concert experience.

Disclaimer ||

The Information provided on this website article does not constitute investment advice ,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!