One of a number of emerging DeFi cryptocurrencies, Aave is a decentralized lending system that allows users to lend, borrow and earn interest on crypto assets, all without middlemen.

Running on the Ethereum blockchain, it instead is a system of smart contracts that enables these assets to be managed by a distributed network of computers running its software.

This means Aave users do not need to trust a particular institution or person to manage their funds. They need only trust that its code will execute as written.

At its core, the Aave software enables the creation of lending pools that enable users to lend or borrow 17 different cryptocurrencies including ETH, BAT and MANA.

Like other decentralized lending systems on Ethereum, Aave borrowers must post collateral before they can borrow. Further, they can only borrow up to the value of the collateral they post.

Borrowers receive funds in the form of a special token known as an aToken, which is pegged to the value of another asset. This token is then encoded so lenders receive interest on deposits

A borrower may post collateral in DAI, for example, and borrow in ETH. This allows a borrower to gain exposure to different cryptocurrencies without owning them outright.

It can also introduce additional features, such as instant loans, and other forms of issuing debt and credit that take advantage of the unique design properties of blockchains.

Table of Contents

Who are the founders of AAVE?

Aave was founded by Stani Kulechov in 2017. Stani Kulechov envisioned a decentralized lending protocol that could overcome the limitations of traditional finance and provide more efficient lending and borrowing services. Aave initially launched as ETHLend, focusing on peer-to-peer lending using Ethereum-based smart contracts. However, the project later evolved into Aave, a comprehensive DeFi protocol offering a wide range of financial services beyond lending.

How has Aave changed since its inception?

Since its inception, Aave has undergone significant developments and expansions:

- Introduction of the Aave Protocol:It introduced its protocol in 2020, offering an enhanced and versatile lending and borrowing platform powered by Ethereum smart contracts.

- Launch of Aave V2: It launched its second version (V2) in 2020, introducing several improvements, including better user experience, increased efficiency, and additional features such as flash loans and stable-rate borrowing.

- Integration of Polygon (formerly Matic): It integrated with the Polygon network in 2021 to leverage its scalability solutions, reducing transaction costs and enhancing the user experience for its users.

- Adoption of Governance Token: It introduced its governance token, AAVE, in 2020, allowing token holders to participate in the decision-making process regarding the protocol’s development and governance.

- Expansion of Assets and Markets: It continually adds support for new assets and markets, expanding its offerings beyond Ethereum-based assets to include various tokens and stablecoins.

Adoption and partnerships

Discuss the levels of adoption it has achieved, alongside any notable partnerships or collaborations. Aave’s adoption has grown steadily, with its protocol becoming a cornerstone of the DeFi ecosystem:

- Increased Usage: It has experienced a surge in usage, with its total value locked (TVL) reaching billions of dollars, reflecting the growing demand for decentralized lending and borrowing services.

- Integration with DeFi Platforms: It has integrated with various DeFi platforms, enabling seamless interoperability and expanding its reach within the decentralized finance landscape.

- Partnerships and Collaborations: While it operates as a decentralized protocol, it has formed partnerships with other DeFi projects, blockchain platforms, and financial institutions to foster innovation and accelerate the adoption of decentralized finance.

How does It work?

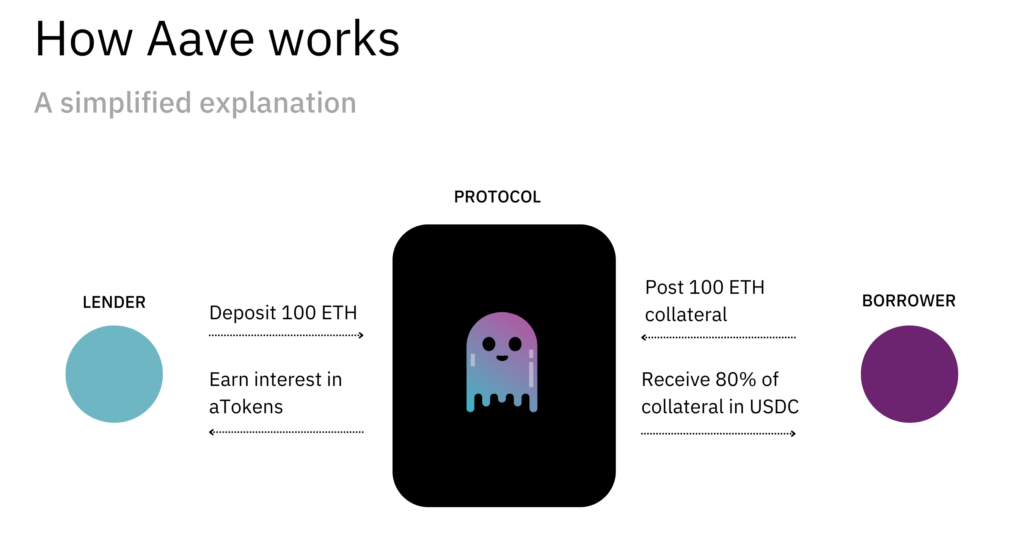

Aave is perhaps best described as a system of lending pools.

Participants deposit funds they wish to lend, which are then collected into a liquidity pool. Borrowers may then draw from those pools when they take out a loan. These tokens can be traded or transferred as a lender wishes.

To facilitate this activity, Aave issues two types of tokens: aTokens, issued to lenders so they can collect interest on deposits, and AAVE tokens, which are the native token of it.

This cryptocurrency offers holders several advantages. For instance, it borrowers don’t get charged a fee if they take out loans denominated in the token. Also, borrowers who use it as collateral get a discount on fees.

Its owners can further look at loans before they are released to the general public if they pay a fee in it. Borrowers who post it as collateral can also borrow slightly more.

The data firm Nomics has a more extensive list of its features.

Aave Lending

To lend crypto on it, users can connect a digital wallet to the platform and search through a list of assets that support deposits. Deposits offer a fixed annual percentage yield (APY) that is paid out in the same asset in which it is deposited. For example, if a user deposits Ether (ETH), the interest is paid out in ETH.

The Aave exchange offers access to several cryptocurrencies, including:

- Ether (ETH)

- Dai (DAI)

- Aave (AAVE)

- U.S. Dollar Coin (USDC)

- Tether (USDT)

Supplying crypto to it adds your tokens to liquidity pools, which are used for lending to other borrowers. The interest rate paid by borrowers goes to the lending pools, with a percentage of those fees being paid out to depositors.

FAST FACT

Because it lending is a decentralized protocol, all transactions happen directly on the blockchain, and users will need to pay network fees (known as gas fees) to deposit or withdraw funds. When lending, users can withdraw funds at any time, as well as any interest earned.

Aave Borrowing

To borrow crypto on this platform, users will need to first supply crypto on the platform as collateral. Once the collateral is deposited into the liquidity pools, users actually earn interest on these deposits.

Once funds are deposited, users can search through the supported crypto assets to borrow, and Aave automatically calculates how much they can borrow. Because each crypto asset has different characteristics, Aave dynamically calculates the available amount based on the value of the deposited crypto, the value of the asset, and the volatility of the asset. Once the crypto is chosen, users can confirm the transaction, and the crypto will be deposited into their connected wallet.

All its loans are overcollateralized, meaning that the value of the assets deposited will always exceed the value of the crypto loan. Aave limits borrowing to protect lenders and liquidity providers from losing money if the loan collateral drops in value. Collateral that has a higher volatility will have a lower LTV than more stable assets.

Loans have no time line to be repaid, but repayment must be in the same form as the cryptocurrency that was borrowed. This means that if a user borrows $100 worth of USDT, they will need to pay it back in USDT (plus interest).

Flash Loans

It allows certain loans, called “flash loans,” to be instantly issued and settled. These loans require no upfront collateral and happen almost instantly.

Flash loans take advantage of a feature of all blockchains, which is that transactions are only finalized when a new bundle of transactions, known as a block, is accepted by the network.

Adding each new block takes time. On Bitcoin, that interval is roughly 10 minutes. On Ethereum, it’s 13 seconds. An Aave flash loan therefore takes place in that 13-second period.

The flash loan works like this: A borrower can request funds from Aave, but they must pay back those funds, and a 0.09% fee, within the same block. If the borrower doesn’t do this, the entire transaction is cancelled, so that no funds were ever borrowed.

As a result, it doesn’t take a risk and neither does the borrower.

A borrower may wish to use a flash loan to take advantage of trading opportunities or maximize profits from other systems built on Ethereum. It’s possible to swap different cryptocurrencies in an automatic way using flash loans to generate trading profits.

Note: Flash loans have been combined to execute attacks on lending systems built on Ethereum, sometimes successfully stealing hundreds of thousands of dollars worth of deposits.

Liquidation

If the value of the collateral for a crypto loan on Aave drops below a certain LTV, the platform can automatically pay back part of the loan through liquidation. This process involves selling up to 50% of the pledged collateral to pay back the loan and bring the LTV back within the limits of the loan agreement.

Liquidations are processed by “liquidators,” which are users that can repay the loan and claim the collateral (plus a 5% bonus).

How are Aave (AAVE) tokens created and distributed?

Its native governance token, AAVE, plays a crucial role in the protocol’s governance and operation:

- Token Distribution: These tokens were initially distributed through a liquidity mining program and a token sale. A total supply of 16 million AAVE tokens was allocated for distribution, with a significant portion reserved for ecosystem incentives, protocol development, and community grants.

- Governance and Staking: This token holders have governance rights, enabling them to vote on proposals and decisions related to the protocol’s development and parameters. Additionally, it holders can stake their tokens to participate in governance and receive rewards in the form of protocol fees and incentives.

What are the main use cases of Aave?

It offers several primary use cases within the DeFi ecosystem:

- Lending: Users can lend their assets to earn interest, providing a passive income stream on their holdings.

- Borrowing: Users can borrow assets against their collateral, enabling them to access liquidity without selling their assets.

- Flash Loans: Its flash loan feature allows users to execute complex financial transactions without upfront capital, facilitating arbitrage, collateral swaps, and other advanced strategies.

Real-world adoption of Aave

Aave’s protocol has garnered significant adoption across various sectors and industries:

- DeFi Platforms: It is widely integrated with other DeFi platforms, serving as a fundamental building block for decentralized financial applications and services.

- Institutional Adoption: Its protocol has attracted interest from institutional investors and traditional finance players seeking exposure to decentralized finance and yield-generating opportunities.

Risks of Aave

It is an automated protocol that allows users to borrow funds after pledging their own crypto assets as collateral. But as with any lending platform, there are a few risks involved:

Liquidation risk: If the pledged collateral is a volatile crypto asset (such as ETH), and the value drops too far, then the ETH may get liquidated. This is a very undesirable result, as it means that the ETH is sold off after a price drop.

No insurance: It does not offer insurance on its platform, so user funds are not protected. As with other decentralized crypto platforms, there is no Federal Deposit Insurance Corp. (FDIC) insurance, and lost funds or crypto sent to the wrong address will not be reimbursed.

Crypto volatility: Cryptocurrency is inherently volatile, and using crypto assets to pledge collateral for a loan can lose a user a significant amount of money.13 First, the funds are locked into the contracts and cannot be accessed until the loan is paid off. Second, the rules for required liquidations mean losing those funds when the value drops.

Liquidity risk: While it lists the available liquidity for each cryptocurrency on the platform, users that deposit crypto may not be able to withdraw funds if the liquidity drops too far. This means that they would need to wait until more crypto is deposited by other users to be able to withdraw funds.

How to Use Aave

To use it, people can log into the web app, connect a digital wallet, and deposit crypto onto the platform. Once the funds are deposited, users can choose from a list of supported cryptocurrencies to borrow against the collateral deposited.

As mentioned, it is an automated platform governed by smart contracts, which means loans are handled instantaneously. Once a loan is confirmed, the crypto will deposit into a user’s digital wallet. There are no monthly payments required, but the loan will accrue interest. Loans must be paid back in the cryptocurrency borrowed.

Is Aave safe?

Aave is a secure crypto protocol that is protected by the decentralized network of Ethereum nodes and staked Aave tokens to protect the blockchain network. That being said, Aave relies heavily upon smart contracts, which are programs designed to handle all the transactions on the platform. These contracts could be compromised, and hackers could gain access to the funds on the platform. In particular, Aave Flash Loans were used in 2022 to drain more than $80 million in Ether (ETH) into a hacker’s wallet, though Aave was not technically compromised in the attack.

What are Aave’s fees?

It has several fees on the platform, including borrowing fees and network fees:

- Aave loan fees: It loans have variable-rate and fixed-rate fees, charging from 2% to 30%+ annual percentage yield (APY) or more.

- Flash Loan fees: Flash Loans charge a 0.09% fee per transaction.

- Network fees: Also known as gas fees, it requires network fees to be paid on all transactions. These fees are for node operators and validators on the Ethereum network.

How does Aave pay interest?

Interest paid to lenders is collected from Aave borrowers via loans. As the interest on the loans is paid, lenders that have deposited crypto into an Aave liquidity pool earn some of that interest back in the form of the crypto deposited.

What future developments are planned for Aave?

Its future roadmap includes several developments and initiatives:

- Ecosystem Expansion: It aims to expand its ecosystem by integrating with additional blockchain networks and scaling solutions to improve accessibility and user experience.

- Protocol Enhancements: It continues to enhance its protocol with new features, optimizations, and security enhancements to maintain its position as a leading decentralized lending platform.

- Community Governance: It prioritizes community governance, empowering token holders to shape the protocol’s future through decentralized decision-making processes.

The Bottom Line

Aave is a decentralized crypto lending platform that lets users borrow and lend crypto. It uses smart contracts to automate the process. It specializes in overcollateralized loans that require users to deposit crypto worth more than the amount that they wish to borrow. This protects lenders from losing money due to loan defaults and gives Aave the ability to liquidate the collateral if it drops too much in value.

It uses an Ethereum-based protocol, and has a native crypto token, AAVE, that can be traded on most crypto exchanges or staked in this platform to earn interest. The platform’s smart contracts could be compromised, and hackers could gain access to the funds held by it.

Disclaimer ||

The Information provided on this website article does not constitute investment advice ,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!

Leave feedback about this