The derivatives space has always been a tough market to target for DeFi protocols, with the difficulty in acquiring sufficient liquidity to create a sustainable and sufficiently efficient market for traders on-chain. Additionally, a poor user experience often leaves traders seeking the easier option of centralized exchange (CEX) trading. Top centralized derivatives exchanges like Binance are pushing over $80 billion in volume daily, while the total decentralized derivatives market sees around $10 to $20 billion in daily trading volume.

However, there are now numerous innovative derivatives protocols seeking to gain more market share. One of which is Aevo. The protocol offers a suite of DeFi products brought together in a synergistic manner to bring both liquidity and a user-friendly user experience to sophisticated derivative traders on-chain.

But before looking at it, we must first dive into Ribbon Finance, Aevo’s predecessor.

Table of Contents

What Is Ribbon Finance?

It started its journey as Ribbon Finance, a structured products platform on Ethereum, Avalanche, BNB Smart Chain and Solana. Ribbon Finance specialized in options vaults where users earned yield from their assets derived from option premiums sold on the platform. This included vaults for popular assets such as stETH, RETH, USDC, WBTC, AVAX and many more.

Source: Ribbon Finance

At its peak, Ribbon Finance held more than $300 million in total value locked (TVL) in their vaults across their supported chains.

What Is Aevo?

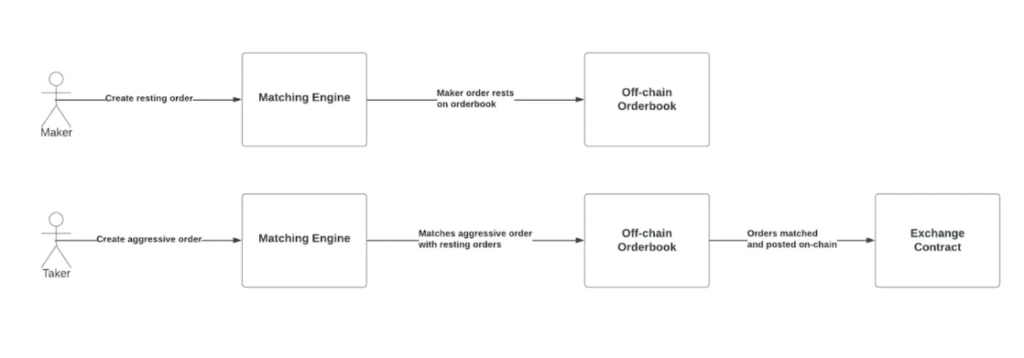

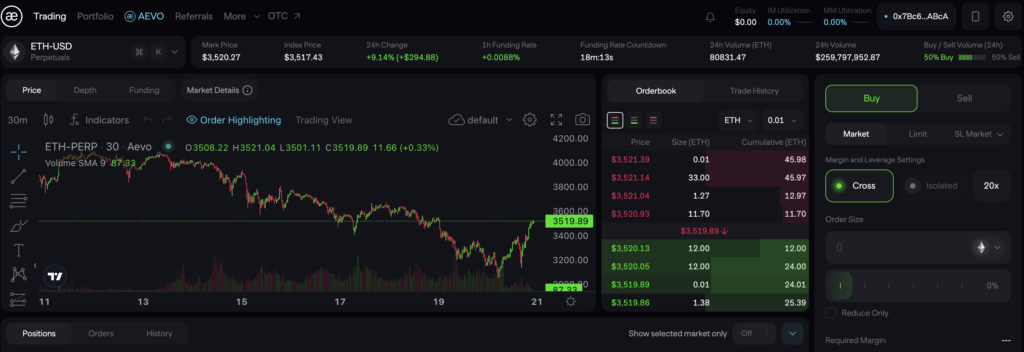

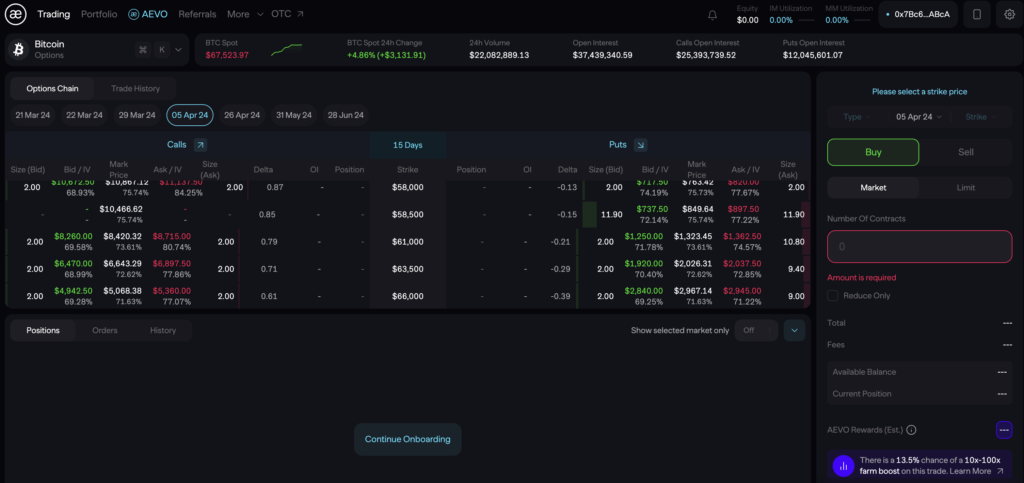

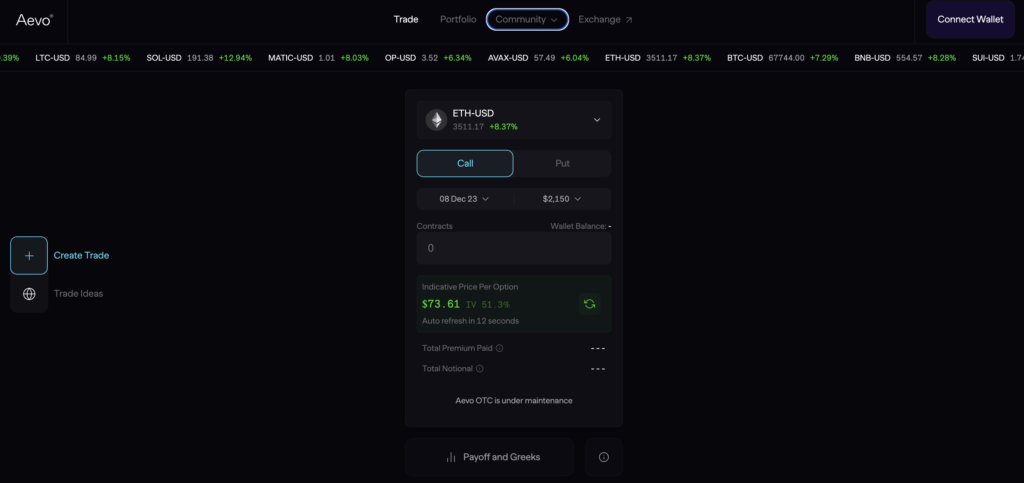

First launched in June 2023, it is a decentralized exchange (DEX) for options and perpetual contracts launched by the team behind Ribbon Finance. The exchange supports an off-chain orderbook style DEX with on-chain settlements, for options on BTC and ETH and perpetual contracts on a selected range of popular tokens with up to 20x leverage.

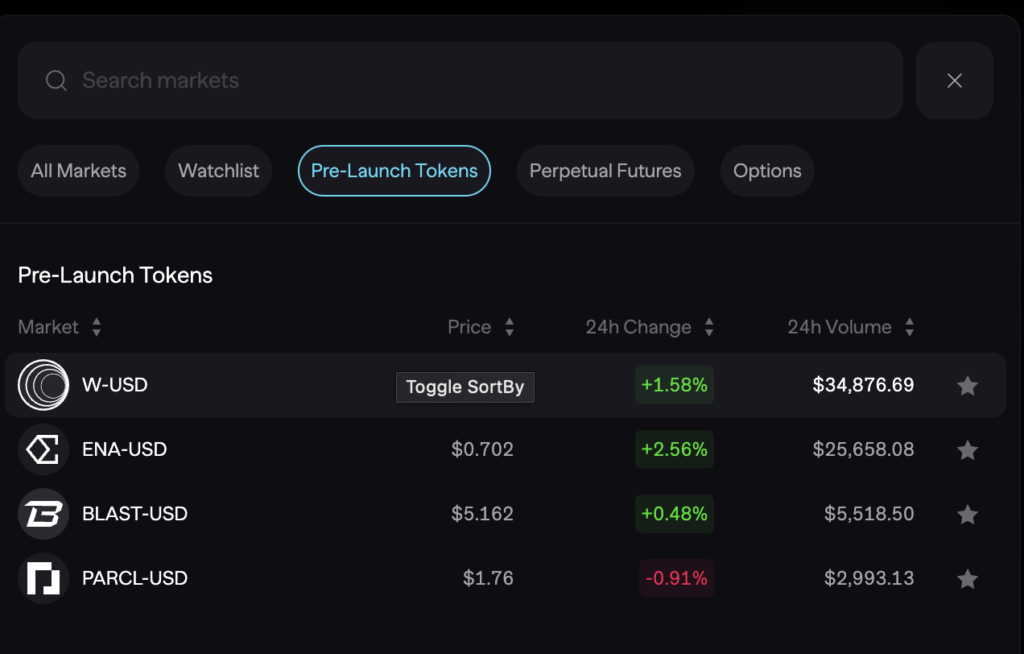

One of its most popular products is its Pre-Launch Futures product, which enables users to trade and speculate on the value of upcoming token launches. This has driven a large amount of volume to it, especially with the product covering some of the most hyped recent launches, including JUP, DYM, STRK, BLAST and many more. As these tokens eventually launch, the Pre-Launch Futures contracts convert to regular perpetual contracts to allow users to continue trading and speculating on the token prices.

Source: Aevo Twitter (link)

Another feature of this which differentiates it from many other similar DEXs is its native yield-bearing stablecoin, aeUSD. When users deposit USDC onto Aevo, their deposit is placed with MakerDAO to generate yield. In return, they receive aeUSD, a yield-bearing stablecoin to trade with on Aevo. As such, even while users are not trading on the platform, they earn a yield of 4.75% annually on their stablecoin balances. This move alone attracted more than 20,000 new users to the platform, doubling its TVL in the same period.

It currently holds just over $92 million in TVL and has processed $25.5 billion in trading volume on the exchange since its launch.

How does Aevo Work?

The term “Aevo” can refer to two different things:

- Aevo System for Orthodontics: This is a device used to accelerate orthodontic treatment with braces or clear aligners. It uses low-intensity pulsed ultrasound (LIPUS) technology. Here’s how it works:

- The Aevo System mouthpiece is applied daily to your teeth and braces/aligners.

- Low-power ultrasound waves are delivered through the mouthpiece to the bone surrounding your teeth.

- This LIPUS treatment is believed to stimulate bone remodeling, which helps your teeth move faster.

- You typically use this System for 20 minutes a day as part of your regular orthodontic routine.

- Aevo Cryptocurrency Exchange: This is a decentralized exchange (DEX) focused on derivatives like options and perpetual contracts. It leverages a custom Layer 2 solution to combine the security of Ethereum with faster transaction speeds. Here’s a simplified explanation:

- Off-chain Order Matching: Orders are placed and matched off the blockchain for efficiency.

- On-chain Settlements: Trades are ultimately settled on the Aevo L2 blockchain, ensuring security and transparency.

- Native Token: This token is used for governance, staking for fee discounts and rewards, and potentially other functionalities within the Aevo ecosystem.

The Aevo Tech Stack

The exchange runs on its own Layer-2 blockchain, an Ethereum Virtual Machine (EVM) compatible Optimistic rollup.

The Aevo L2 is built on the OP Stack by the Optimism team, while concurrently leveraging Celestia for its data availability needs. Due to the use of Celestia, the Aevo L2 has been able to significantly reduce fees for data storage, which are passed on to it users in the form of lowered gas fees.

Source: Aevo Twitter (link)

While the exchange is currently the only decentralized application running on the chain, this team has announced plans to open the chain up to other developers in the future, as they seek to build an entire ecosystem around the exchange.

The Ribbon-Aevo Merge

In July 2023, the team announced plans for a merger between Ribbon Finance and Aevo, with both protocols being combined under the Aevo brand. This was passed shortly in a governance vote in a near unanimous vote by RBN token holders.

As part of the merger, Ribbon’s options will be settled on this exchange, driving consistent volume to the exchange. Besides fuelling the exchange with the required liquidity for option trading, the merger also enables more synergistic products to be designed and built on top of the new combined architecture.

The AEVO Token and Tokenomics

As part of the merger between Ribbon Finance and Aevo, existing RBN tokens will be converted to these tokens at a 1:1 ratio. Additionally, RBN token holders who had originally staked their RBN as vote-escrowed RBN (veRBN) can now unstake without any penalties too.

Since this token is migrated from the RBN token, much of the tokenomics will remain the same. The largest holder of RBN is still the Aevo DAO Treasury. As part of the move towards this token launch, 45% of tokens in the treasury will be utilized as follows:

- Airdrop (up to 16%) – An airdrop will be distributed to reward users who participated in the Farming Program launched by Aevo in early February as well as before the launch of the program.

- Liquidity Management (up to 9%) – These tokens will be used to manage liquidity of this token on both decentralized and centralized exchanges.

- Community Growth (up to 5%) – Tokens will be used for community events as well as bounties.

- Future DAO Spending (16%) – This amount will be reserved for future expenses. Payments to the team will also come from this allocation.

Aevo’s Features

The following are the features of Aevo:

Aevo Exchange

This exchange is the main feature of it. It uses the CLOB system, which makes its trading mechanism similar to a centralized exchange. This exchange is also equipped with features such as order book, market depth, and various technical analysis tools to enhance the user experience.

Perpetuals and options are the two derivative products traded on the Exchange. Aevo has supported 72 crypto pairings containing large, medium, and small-cap cryptos for perpetual. As for options, there are currently only two types of crypto, BTC and ETH.

It also has a feature called Pre-Launch Token Futures. It is a financial product that allows users to trade the anticipated value of a new token before it is listed on an exchange.

The feature seeks to capitalize on speculative interest in new projects. It also gives traders early exposure to potential market-mover assets. Once the tokens are traded on exchanges, the Pre-Launch Token Future will turn into a perpetual future.

Pintu Academy has prepared an article that goes deeper into the Initial DEX Offering.

Aevo Vault

Another its feature is Aevo Vault, an automated derivatives strategy that uses smart contracts to generate yield. There are two types of vaults in Aevo: Theta Vaults and Earn Vaults.

- Theta Vaults

Theta Vaults allows users to execute European-style put or call options. The main difference between European-style and American-style options is their settlement. In the European-style, settlement can only be exercised on the contract expiry date. Each option contract in Theta Vaults expires seven days after the vault is created.

- Earn Vaults

An Earn Vault is designed to maximize the strategy by combining lending and exotic options exposed to short-term volatility in the market. This strategy can potentially boost the yield earned. This type of vault can be complementary to a Theta Vault, potentially delivering better overall yields. Earn Vaults also offers a principal protection feature.

Aevo OTC

It is an on-chain altcoin options trading solution against institutional-grade liquidity providers. It uses a request-for-quote (RFQ) mechanism with a dynamic on-chain margin system.

Users can trade across weekly, biweekly and monthly maturities on 13 different coins. The list of coins will rotate monthly depending on the market’s most popular coins.

Binance Launchpool and Token Launch

Binance announced the launchpool for this token on March 6, as the 48th launchpool project. Users can stake BNB or FDUSD in separate pools for five days to farm for these tokens, with the pools opening on March 8. Once the pool closes on March 13, depositors will receive their respective token allocations from a pool of 45 million AEVO tokens, or 4.5% of the total supply. At the same time, the token will go live on the exchange for trading.

How Does Pre Launch Futures Work?

Its Pre-Launch Token Futures allow users to trade on the projected value of tokens before their official market debut. This product caters to speculators interested in new projects, offering early access to potential market influencers. Here’s an overview of how these futures operate:

- Initial Margin and Leverage: Traders must provide a 50% initial margin, enabling up to 2x leverage. This feature is crucial for managing the speculative risks associated with pre-launch tokens.

- Maintenance Margin: Set at 48%, this margin requirement ensures traders maintain their positions despite market fluctuations, reducing the risk of sudden liquidations.

- Position Limits: Positions are capped at $50,000 to limit risk and prevent excessive exposure to any single asset.

- Contract Characteristics: These futures do not rely on an index price or funding payments, emphasizing their speculative nature until the token is launched.

- Fees: Contracts incur a 25 basis points taker fee, a 10 basis points maker rebate, and a 5% liquidation fee, designed to encourage liquidity and manage risk effectively.

- Settlement: Settlement occurs in USDC when the token starts trading on external exchanges like Binance, aligning the speculative trade with the token’s market value at launch.

Its Pre-Launch Token Futures offer traders early opportunities to profit from new tokens, highlighting the platform’s innovation and leadership in crypto trading.

Aevo Tokenomics

Its tokenomics are built around the $AEVO token, a rebranded version of the previous $RBN token, following the governance proposal RGP-33. The distribution strategy focuses on enhancing platform growth, liquidity, and community engagement:

- 16% of $AEVO for Incentives: Aimed at boosting user engagement and liquidity through airdrops and marketing campaigns, managed by the Growth & Marketing Committee.

- 9% for Token Liquidity: To ensure stable liquidity on both decentralized and centralized exchanges, managed by the Treasury and Revenues Management Committee.

- 5% for Community Growth: Allocated for community events and bounties to encourage active participation, overseen by the Growth & Marketing Committee.

- 16% Reserved: Set aside for future DAO needs, with 2% annually allocated to Aevo Project Contributors.

With the launch of $AEVO, an incentive campaign will reward holders and stakers, featuring enhanced farming boosts and a structured reward system to foster a vibrant community. Staking $AEVO or $RBN grants sAEVO, offering exclusive benefits like voting rights and access to special initiatives, reinforcing Aevo’s commitment to decentralized governance and active community involvement.

Aevo Founders

It was founded by Julian Koh and Ken Chan, whose vision has garnered significant support from top-tier crypto investors, including Paradigm, Dragonfly Capital, and Coinbase Ventures.

The development team consists of experts from leading companies and financial institutions such as Coinbase, Kraken, and Goldman Sachs, and alumni from esteemed universities like Stanford, MIT, and Cornell. This diverse expertise ensures that Aevo remains at the forefront of DeFi innovation.

Aevo Pros and Cons

There seem to be two main products or services referred to by it:

- AEVO Innovate: This appears to be a software platform, potentially for project management or communication. Based on a limited amount of reviews found online, the pros seem to be:

- Streamlined communication and collaboration

- Centralized platform for discussions, file sharing, and updates Cons are difficult to find from user reviews, but it’s always wise to consider pricing and the specific features you need before choosing any software.

- Aevo cryptocurrency exchange: This is a decentralized exchange (DEX) focused on derivatives trading. Here’s a breakdown of pros and cons:

Pros:

- Focus on derivatives: Offers perpetual futures contracts, options trading, and a unique OTC options marketplace for larger trades.

- Strong backing: Supported by well-regarded venture capital firms.

- Technology: Uses a custom layer 2 blockchain for scalability and fast transactions.

- Potential for growth: Relatively new with a low initial market cap, suggesting room for price increase (if the project succeeds).

Cons:

- Newcomer: Limited track record compared to established DEXs.

- Marketing: May not have the brand recognition of competitors.

- Tokenomics: Relatively high token inflation rate, which could dilute the value of your holdings over time.

- Userbase: May have a smaller, less active user base compared to larger exchanges.

AEVO Token Potential

The DEX perpetual sector is getting more competitive by the day as protocols in this sector become more prevalent. It will compete with competitors such as GMX, dYdX, Gains Network, etc.

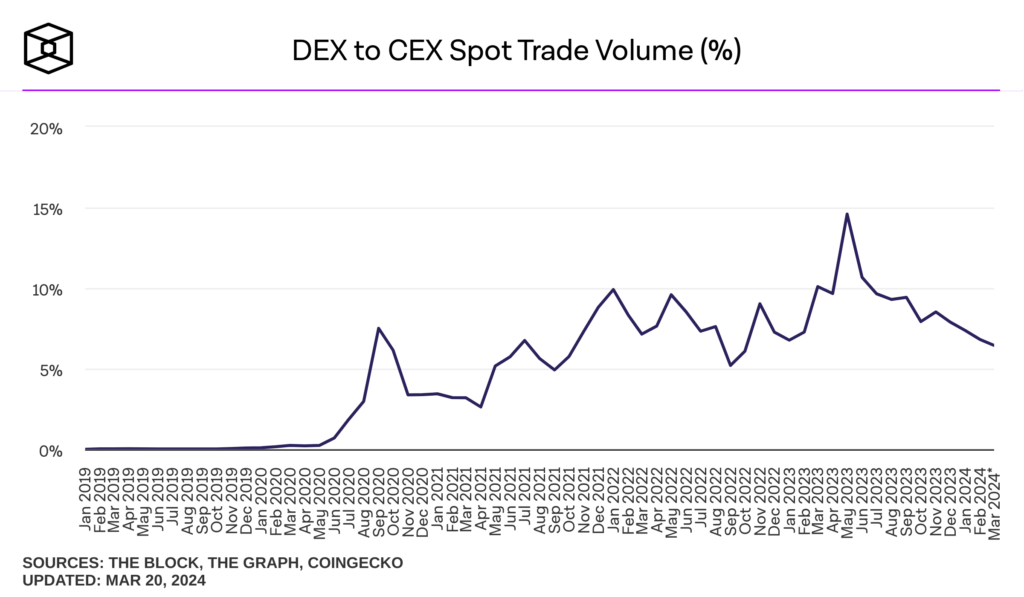

On the one hand, perpetual trading is in high demand, given its potential to generate profits even in bearish conditions. Moreover, the leverage feature also attracts retail or institutional traders who aim higher returns. Unfortunately, perpetual trading transactions are currently still predominantly done on CEX.

Despite the decline, the chart above shows increased spot trading volume transactions on DEX against CEX. If the trading volume on DEX goes back up, then it is likely that the same will happen in perpetual trading. As more traders switch from CEX to DEX for perpetual trading, the number of users and transactions on Aevo could increase. Thus, the valuation of AEVO will also be increased.

Bottom Line

Aevo stands out as a leading decentralized exchange, offering robust and secure trading for derivatives such as options and perpetual contracts. With its advanced Layer 2 technology and Pre-Launch Token Futures, Aevo provides a unique blend of speed, security, and early market access.

Supported by a team industry veterans and significant backing, It is at the forefront of DeFi innovation, making it a top choice for traders looking to leverage the future of decentralized finance.

Disclaimer ||

The Information provided on this website article does not constitute investment advice ,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!

Leave feedback about this