The world’s first widely-adopted cryptocurrency. With Bitcoin, people can securely and directly send each other digital money on the internet.

Bitcoin was created by Satoshi Nakamoto, a pseudonymous person or team who outlined the technology in a 2008 white paper. It’s an appealingly simple concept: bitcoin is digital money that allows for secure peer-to-peer transactions on the internet.

- Unlike services like Venmo and PayPal, which rely on the traditional financial system for permission to transfer money and on existing debit/credit accounts, bitcoin is decentralized: any two people, anywhere in the world, can send bitcoin to each other without the involvement of a bank, government, or other institution.

- Every transaction involving Bitcoin is tracked on the blockchain, which is similar to a bank’s ledger, or log of customers’ funds going in and out of the bank. In simple terms, it’s a record of every transaction ever made using bitcoin.

- Unlike a bank’s ledger, the Bitcoin blockchain is distributed across the entire network. No company, country, or third party is in control of it; and anyone can become part of that network.

- There will only ever be 21 million bitcoin. This is digital money that cannot be inflated or manipulated in any way.

- It isn’t necessary to buy an entire bitcoin: you can buy just a fraction of one if that’s all you want or need.

Key Questions

What is BTC?

BTC is the abbreviation for bitcoin.

Is Bitcoin cryptocurrency?

Yes, bitcoin is the first widely adopted cryptocurrency, which is just another way of saying digital money.

Is there a simple bitcoin definition?

Bitcoin is a decentralized digital currency used for encrypted, peer-to-peer transactions without needing a central bank

What’s the price of bitcoin?

The current price of Bitcoin can be found on Coinbase’s website.

Is Bitcoin an investment opportunity?

Like any other asset, you can make money by buying BTC low and selling high, or lose money in the inverse scenario.

At what price did Bitcoin start?

One BTC was valued at a fraction of a U.S. penny in early 2010. During the first quarter of 2011, it exceeded a dollar. In late 2017, its value skyrocketed, topping out at close to $20,000, and Bitcoin ended up topping $64,899 in November 2021.

Bitcoin is a decentralized digital currency used for encrypted, peer-to-peer transactions without needing a central bank

Bitcoin Basics

Since Bitcoin’s creation, thousands of new cryptocurrencies have been launched, but bitcoin (abbreviated as BTC) remains the largest by market capitalization and trading volume.

- Depending on your goals, bitcoin can function as

– an investment vehicle

– a store of value similar to gold

– a way to transfer value around the world

– even just a way to explore an emerging technology

- Bitcoin is a currency native to the Internet. Unlike government-issued currencies such as the dollar or euro, Bitcoin allows online transfers without a middleman such as a bank or payment processor. The removal of those gatekeepers creates a whole range of new possibilities, including the potential for money to move around the global internet more quickly and cheaply, and allowing individuals to have maximum control over their own assets.

- Bitcoin is legal to use, hold, and trade, and can be spent on everything from travel to charitable donations. It’s accepted as payment by businesses including Microsoft and Expedia.

- Is bitcoin money? It’s been used as a medium of exchange, a store of value, and a unit of account—which are all properties of money. Meanwhile, it only exists digitally; there is no physical version of it.

Who created Bitcoin?

To really grasp how bitcoin works, it helps to start at the beginning. The question of who created bitcoin is a fascinating one, because a decade after inventing the technology—and despite a lot of digging by journalists and members of the crypto community—its creator remains anonymous.

- The principles behind Bitcoin first appeared in a white paper published online in late 2008 by a person or group going by the name Satoshi Nakamoto.

- This paper wasn’t the first idea for digital money drawing on the fields of cryptography and computer science—in fact, the paper referred to earlier concepts—but it was a uniquely elegant solution to the problem of establishing trust between different online entities, where people may be hidden (like bitcoin’s own creator) by pseudonyms, or physically located on the other side of the planet.

- Nakamoto devised a pair of intertwined concepts: the bitcoin private key and the blockchain ledger. When you hold bitcoin, you control it through a private key—a string of randomized numbers and letters that unlocks a virtual vault containing your purchase. Each private key is tracked on the virtual ledger called the blockchain.

When Bitcoin first appeared, it marked a major advance in computer science, because it solved a fundamental problem of commerce on the internet: how do you transfer value between two people without a trusted intermediary (like a bank) in the middle? By solving that problem, the invention of bitcoin has wide-ranging ramifications: As a currency designed for the internet, it allows for financial transactions that range across borders and around the globe without the involvement of banks, credit-card companies, lenders, or even governments. When any two people—wherever they might live—can send payments to each other without encountering those gatekeepers, it creates the potential for an open financial system that is more efficient, more free, and more innovative. That, in a nutshell, is bitcoin explained.

Bitcoin creates the potential for an open financial system that is more efficient, more free, and more innovative.

How Bitcoin works

Unlike credit card networks like Visa and payment processors like Paypal, bitcoin is not owned by an individual or company. Bitcoin is the world’s first completely open payment network which anyone with an internet connection can participate in. Bitcoin was designed to be used on the internet, and doesn’t depend on banks or private companies to process transactions.

One of the most important elements of Bitcoin is the blockchain, which tracks who owns what, similar to how a bank tracks assets. What sets the Bitcoin blockchain apart from a bank’s ledger is that it is decentralized, meaning anyone can view it and no single entity controls it.

Here are some details about how it all works:

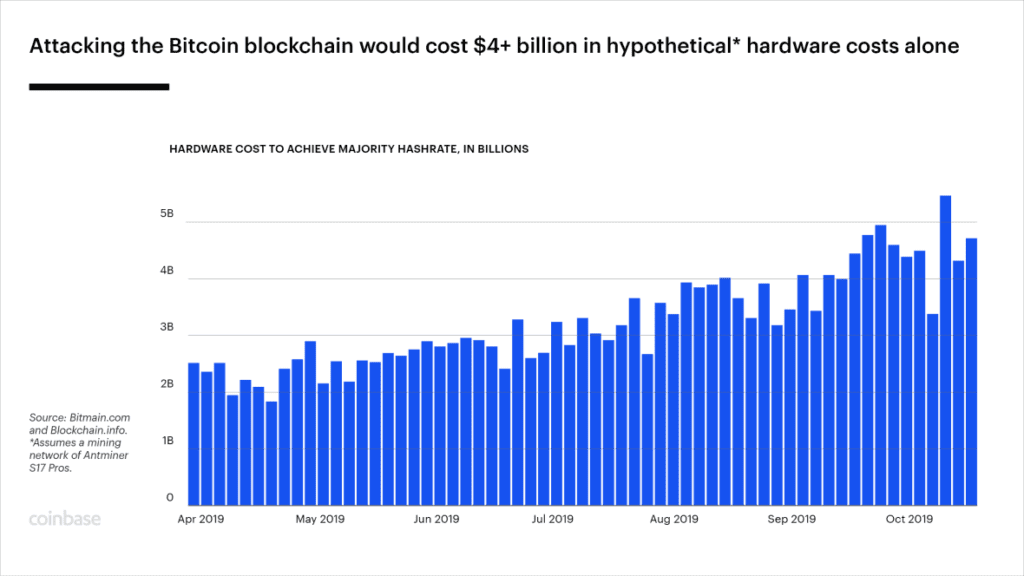

- Specialized computers known as ‘mining rigs’ perform the equations required to verify and record a new transaction. In the early days, a typical desktop PC was powerful enough to participate, which allowed pretty much anyone who was curious to try their hand at mining. These days the computers required are massive, specialized, and often owned by businesses or large numbers of individuals pooling their resources. (In October 2019, it required 12 trillion times more computing power to mine one bitcoin than it did when Nakamoto mined the first blocks in January 2009.

- The miners’ collective computing power is used to ensure the accuracy of the ever-growing ledger. Bitcoin is inextricably tied to the blockchain; each new bitcoin is recorded on it, as is each subsequent transaction with all existing coins.

- How does the network motivate miners to participate in the constant, essential work of maintaining the blockchain—verifying transactions? The Bitcoin network holds a continuous lottery in which all the mining rigs around the world race to be the first to solve a math problem. Every 10 min or so, a winner is found, and the winner updates the Bitcoin ledger with new valid transactions. The prize changes over time, but in May 2020, the reward for each winner of this raffle went from 12.5 bitcoin per block to 6.25, and in 2024, with the halving, this reward further dropped from 6.25 to 3.125 as a mechanism to increase scarcity.

- At the beginning, a bitcoin was technically worthless. At the end of 2019, it was trading at around $7,500, and in November 2021, it topped $64,000. As bitcoin’s value has risen, its easy divisibility (the ability to buy a small fraction of one bitcoin) has become a key attribute. One bitcoin is currently divisible to eight decimal places (100 millionths of one bitcoin); the bitcoin community refers to the smallest unit as a ‘Satoshi.’

- Nakamoto set the network up so that the number of bitcoin will never exceed 21 million, ensuring scarcity. As of December 2023, there were around 1,4 million bitcoins still available to be mined. The last blocks will theoretically be mined in 2140.

Cryptocurrencies and traditional currencies share some traits — like how you can use them to buy things or how you can transfer them electronically — but they’re also different in interesting ways. Here are a few highlights.

Bitcoin is the world’s first completely open payment network which anyone with an internet connection can participate in.

Key question

How does bitcoin have value?

Essentially the same way a traditional currency does – because it’s proven itself to be a viable and convenient way to store value, which means it can easily be traded for goods, services, or other assets. It’s scarce, secure, portable (compared to, say, gold), and easily divisible, allowing transactions of all sizes.

How to get Bitcoin

The easiest way to buy bitcoin is to purchase it through an online exchange like Coinbase. Coinbase makes it easy to buy, sell, send, receive, and store bitcoin without needing to hold it yourself using something called public and private keys.

However, if you choose to buy and store bitcoin outside of an online exchange, here’s how that works.

- Each person who joins the bitcoin network is issued a public key, which is a long string of letters and numbers that you can think of like an email address, and a private key, which is equivalent to a password.

- When you buy bitcoin—or send/receive it—you get a public key, which you can think of as a key that unlocks a virtual vault and gives you access to your money.

- Anyone can send bitcoin to you via your public key, but only the holder of the private key can access the bitcoin in the “virtual vault” once it’s been sent.

- There are many ways to store bitcoin both online and off. The simplest solution is a virtual wallet.

- If you want to transfer money from your wallet to a bank account after selling your bitcoin, the Coinbase app makes it as easy as transferring funds from one bank to another. Similar to conventional bank transfers or ATM withdrawals, exchanges like Coinbase set a daily limit, and it may take between a few days and a week for the transaction to be completed.

The easiest way to buy bitcoin is to purchase it through an online exchange like Coinbase.

Key question

What’s the difference between Bitcoin and Blockchain?

All bitcoin transactions and public keys are recorded on a virtual ledger called the blockchain. The ledger is effectively a chronological list of transactions. This ledger is copied—exactly—across every computer that is connected to the bitcoin network, and it is constantly checked and secured using a vast amount of computing power across the globe. The blockchain concept has turned out to be powerful and adaptable, and there are now a wide variety of non-cryptocurrency-related blockchains that are used for things like supply-chain management. The ‘Bitcoin Blockchain’ specifically refers to the virtual ledger that records bitcoin transactions and private keys.

How to use Bitcoin

Back in 2013, a bitcoin enthusiast named Laszlo Hanyecz created a message-board post offering 10,000 BTC – which then was worth around $25 – to anyone who would deliver two pizzas to his Jacksonville, Florida, home. As the legend goes, those two pizzas, which another bitcoin early-adopter bought from a local Papa John’s, marked the first successful purchase of non-virtual goods using bitcoin. Thankfully it’s a lot easier to use bitcoin these days!

- It’s simple: Transactions using BTC aren’t that different from those using a credit or debit card, but instead of being asked to enter card info, you’ll simply be entering the payment amount and the vendor’s public key (similar to an email address) via a wallet app. (When transacting in person using smartphones or tablets, often a QR code will pop up to simplify the process – when you scan the code, your wallet app will automatically enter the pertinent information.)

- It’s private: One of the benefits of paying with bitcoin is that doing so limits the amount of personal information you need to provide. The only time you need to share your name and address is if you’re purchasing physical goods that need to be shipped.

- It’s flexible: As to what you should do with your bitcoin, that depends completely on your personal interests. Here are some ideas:

- You can sell it for cash using an exchange or a Bitcoin ATM.

- You can spend it online or in brick-and-mortar retailers as you would any other currency by using a Bitcoin debit card.

- You can hold on to some or all of it as part of your investment and savings strategy.

- You might choose to that is close to your heart (check out).

- And if you have a serious budget and unfulfilled astronaut dreams? Richard Branson’s Virgin Galactic happily accepts BTC in exchange for the opportunity to blast off on one of its forthcoming space-tourism missions.

Due to the cryptographic nature of the Bitcoin network, bitcoin payments are fundamentally more secure than standard debit/credit card transactions.

What makes Bitcoin a new kind of money?

Bitcoin is global. You can send it across the planet as easily as you can pay with cash in the physical world. It isn’t closed on weekends, doesn’t charge you a fee to access your money, and doesn’t impose any arbitrary limits.

Bitcoin is irreversible. Bitcoin is like cash, in the sense that transactions cannot be reversed by the sender. In comparison, credit cards, conventional online payment systems, and banking transactions can be reversed after the payment has been made—sometimes months after the initial transaction—due to the centralized intermediaries that complete the transactions. This creates higher fraud risk for merchants, which can lead to higher fees for using credit cards.

Bitcoin is private. When paying with bitcoin, there are no bank statements, or any need to provide unnecessary personal information to the merchant. Bitcoin transactions don’t contain any identifying information other than the bitcoin addresses and amounts involved.

Bitcoin is secure. Due to the cryptographic nature of the Bitcoin network, bitcoin payments are fundamentally more secure than standard debit/credit card transactions. When making a bitcoin payment, no sensitive information is required to be sent over the internet. There is a very low risk of your financial information being compromised, or having your identity stolen.

Bitcoin is open. Every transaction on the Bitcoin network is published publicly, without exception. This means there’s no room for manipulation of transactions (save for a highly unlikely 51% attack scenario) or changing the supply of bitcoin. The software that constitutes the core of Bitcoin is free and open-source so anyone can review the code.

Bitcoin is safe. In more than ten years of existence, the bitcoin network has never been successfully hacked. And because the system is permissionless and open-sourced, countless computer scientists and cryptographers have been able to examine all aspects of the network and its security.

Where does Bitcoin come from?

Bitcoin is virtually ‘mined’ by a vast, decentralized (also referred to as ‘peer-to-peer’) network of computers that are constantly verifying and securing the accuracy of the blockchain. Every single bitcoin transaction is reflected on that ledger, with new information periodically gathered together in a “block,” which is added to all the blocks that came before.

Advantages And Disadvantages

Any financial instrument whose value fluctuates in response to changes in demand or external shocks is a high-risk investment. Despite the risk-bearing characteristic and investment objective, approximately 14% of the US population deals in cryptocurrencies.

Some advantages of investing and dealing in Bitcoins include the following:

- Ease of transactions

The original Bitcoin whitepaper defines it as a digital peer-to-peer currency which makes instantaneous transactions. Unlike payment networks like PayPal and Visa, Bitcoins incur very low transaction surcharges. The absence of an intermediary reduces waiting periods and makes Bitcoin transactions hassle-free. Bitcoin can be used for everyday transactions devoid of double-spending.

- Anonymity and decentralisation

Alphanumeric cloaks hide Bitcoin users’ identities and prevent illegitimate access. Although transactions are visible through connecting data points, Bitcoins enable a pseudonymous account that can safeguard user information. Unlike physical money, bitcoins do not have regulatory authority, implying that financial records are encrypted.

- Value appreciation

Owing to the limited supply of Bitcoins since its beginning and its increasing usage, Bitcoins have appreciated. Unlike fiat money, the value of Bitcoins fluctuates with every transaction. However, the cryptocurrency bubble of 2021-2022 saw an enormous rise in Bitcoin’s value.

- Security and free from market forces

Unlike fiat money transactions prone to cyber-attacks and fraudulent activities, Bitcoins are encrypted and immune to seizure. Every Bitcoin transaction is visible on an openly distributed ledger, making unauthorised changes difficult. Additionally, the non-reversibility and inability to change the owner’s address make duplicating or stealing Bitcoins almost impossible.

- Tax-free and zero transaction costs

Most countries do not levy taxes on Bitcoin returns. Since third-party applications cannot intercept such transactions, it isn’t easy to implement a stable taxation policy. Every Bitcoin transaction implies a contribution to the network and sharing the burden of authorisation, which makes transaction costs negligible.

Disadvantages of Bitcoins

Disadvantages of Bitcoins

Despite the positive quirks and features that make Bitcoin a highly coveted transaction mode, its questionable acceptance and absence of regulations restrict its usage. Please consider the following pointers before analysing whether it’s worth investing in Bitcoins.

Some disadvantages of investing in Bitcoins include the following:

- Volatility

The volatile nature of cryptocurrencies depends on factors like limited supply, increasing market demand, investor sentiment, etc. The limited supply and growing demand make its value very susceptible to fluctuations. Uncertainty and possible security breaches make Bitcoin investment a risky one.

- Absence of regulations

Although potential investors consider the absence of government regulations a determining factor, its decentralisation makes it devoid of legal protection. The decentralised nature of Bitcoins can also affect owners of multiple units if a portion of the investors chooses to opt-out.

- Irreversibility and limited usage

The irreversibility of Bitcoins adds to their unregulated and anonymous nature. Any accidental payment cannot be traced and therefore is risky. While investors generally store cryptocurrency units in crypto wallets, losing access to such wallets can mean incredible losses. Hence, Bitcoin does not find application in most secured networks as a means of transaction. Bitcoin payments require a third party, unlike cash, debit, or credit card payments.

- Uncertain future

While several nations like El Salvador have accepted Bitcoin as a regular payment mode, many countries have barred its usage. The economic shock posed by the Covid-19 pandemic has forced countries like Qatar, China, Turkey, North Macedonia, Egypt, Iraq, and Bangladesh to get into Bitcoins. Despite Bitcoin being legal in Russia, transactions involving Bitcoins are banned.

- Technical flaws and a deflationary effect

Since Bitcoins is a relatively newer concept, the blockchain network has innumerable flaws and loopholes. It further explains its acceptance in general transactions. The limitation in the total number of Bitcoins available strains the existing Bitcoins and raises their value. A future surge in spending on Bitcoins may arise, potentially destabilising the economy.

Disclaimer ||

The Information provided on this website article does not constitute investment advice,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!

Leave feedback about this