Bitcoin SV (BSV) stands for “Bitcoin Satoshi Vision.” The Bitcoin SV cryptocurrency emerged from a hard fork of Bitcoin Cash (BCH), itself a fork of Bitcoin (BTC). The split occurred in November 2018 and was primarily driven by differences in opinions over the direction and technology of Bitcoin Cash.

What Is Bitcoin SV (BSV)?

Bitcoin SV aims to restore the original Bitcoin protocol and design as envisioned by Satoshi Nakamoto, the pseudonymous creator of Bitcoin. This includes maintaining a stable protocol and scaling massively to support large transaction volumes.

Bitcoin SV’s approach prioritizes scalability through larger blocks, aiming to remain true to Satoshi Nakamoto’s original vision for Bitcoin as outlined in the Bitcoin whitepaper. However, its larger block size and centralized development approach have sparked debates about decentralization, security, and the true vision of Bitcoin.

Key Takeaways:

- Created after a hard fork from Bitcoin Cash, Bitcoin SV (BSV) has a much larger block size than either Bitcoin (BTC) or Bitcoin Cash (BCH).

- Its larger block size makes it more energy efficient, enhances its ability to scale and enables it to process transactions swiftly at a low cost.

- BSV can be bought as a USDT Perpetual contract on Bybit.

Table of Contents

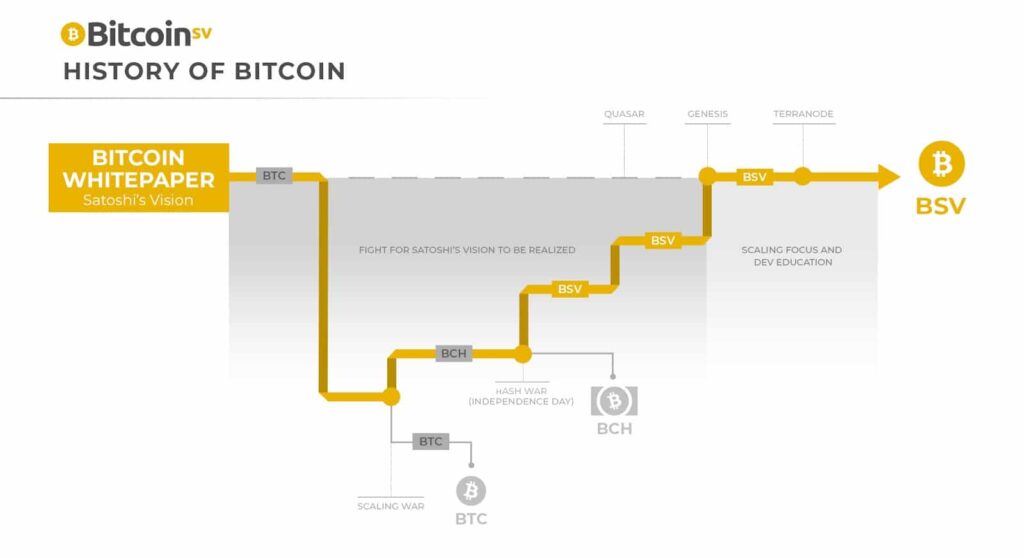

History of Bitcoin SV

Bitcoin SV (BSV) emerged from a hard fork of the Bitcoin Cash (BCH) blockchain in November 2018. Let’s delve into the history:

Roots in Bitcoin Cash:

- Bitcoin Cash itself was created in 2017 through a hard fork of the Bitcoin (BTC) blockchain. The primary reason for the fork was a disagreement over scalability. Bitcoin Cash aimed to address limitations in the number of transactions the Bitcoin network could process per second.

The Birth of BSV:

- The Bitcoin Cash community itself wasn’t monolithic. In 2018, another disagreement arose regarding the “true vision” of Bitcoin.

- Craig Wright, an Australian entrepreneur who claims to be Satoshi Nakamoto (Bitcoin’s pseudonymous creator), advocated for a return to the original Bitcoin protocol design.

- This viewpoint clashed with the direction of the Bitcoin Cash development team.

The Hard Fork:

- The differing visions culminated in a hard fork of the Bitcoin Cash blockchain on November 15, 2018. This resulted in two separate blockchains:

- Bitcoin Cash ABC (BCH): The original Bitcoin Cash chain continued under this name.

- Bitcoin SV (BSV): This new chain, championed by Craig Wright and his company nChain, aimed to adhere more closely to Satoshi Nakamoto’s original vision for Bitcoin.

Key Distinctions:

- BSV’s core tenet is to follow a “bigger block” approach. They believe significantly larger block sizes will be necessary to scale Bitcoin and handle a massive transaction volume. Bitcoin Cash had already increased the block size, but BSV proposes much larger blocks.

- BSV also intends to enable smart contracts on its blockchain, similar to Ethereum. This capability is not currently available on the original Bitcoin blockchain.

Current Status:

- Bitcoin SV remains a controversial figure in the cryptocurrency space. Craig Wright’s claims of being Satoshi Nakamoto are widely disputed.

- Despite its ambitions, BSV has yet to achieve widespread adoption compared to Bitcoin or Ethereum.

How Is Bitcoin SV Different From Bitcoin and Bitcoin Cash?

One of the most significant technical differences between Bitcoin SV and its predecessors is its block size limit. BSV initially increased the block size limit to 128 MB and later to 2 GB. This contrasts with Bitcoin’s 1 MB and Bitcoin Cash’s 32 MB. The larger block size can facilitate more transactions per block, offering greater scalability and lower transaction fees than Bitcoin and Bitcoin Cash blockchains.

How Does Bitcoin SV Work?

Bitcoin SV, like Bitcoin, uses a Proof of Work consensus mechanism to secure its network. Transactions are verified and added to the Bitcoin SV blockchain through mining, similar to Bitcoin. Miners compete to solve complex cryptographic puzzles, and the first to solve them gets to add a new block of transactions to the chain.

BSV aims to restore and lock the original Bitcoin protocol. The idea is to provide a stable protocol, similar to how the internet protocol hasn’t changed much over decades. This stability is intended to make it easier for developers to build on the BSV platform without worrying about significant protocol changes.

BSV also promotes its blockchain for a variety of applications like data storage, smart contracts, and enterprise solutions, capitalizing on its larger block size for higher data throughput.

Who Created Bitcoin SV (BSV)?

The main figures behind the creation of Bitcoin SV were:

1. Craig Wright: An Australian computer scientist, Wright is one of the most prominent figures associated with Bitcoin SV. He has claimed to be Satoshi Nakamoto, the pseudonymous creator of Bitcoin, although this claim is highly controversial and widely disputed in the cryptocurrency community.

2. nChain: A blockchain research and development company, nChain has played a significant role in the development of Bitcoin SV. Craig Wright is associated with nChain and has been a driving force in its direction.

3. CoinGeek: Owned by Calvin Ayre, a billionaire entrepreneur, CoinGeek was a major supporter of the Bitcoin SV fork. Ayre is known for his significant investment in Bitcoin SV mining operations and has been a vocal advocate of BSV.

The creation of Bitcoin SV was driven by ideological and technical disagreements within the Bitcoin Cash community. The BSV faction advocated for a return to Satoshi Nakamoto’s original vision for Bitcoin, which included significantly larger block sizes to enable more transactions per block and keep transaction fees low. They also aimed to restore certain technical characteristics of the early Bitcoin protocol that had been altered in subsequent updates.

The dispute over these differences led to the hard fork that split Bitcoin Cash into two separate blockchains and cryptocurrencies: Bitcoin Cash (BCH) and Bitcoin SV (BSV). Since the fork, Bitcoin SV has pursued its own path, with its community and developers focusing on its unique goals and technical features.

What Is Bitcoin SV Used for?

Bitcoin SV (BSV) is a versatile blockchain technology with various applications, including:

1. Digital Currency: BSV coin enables peer-to-peer transactions without intermediaries. The Bitcoin SV network offers lower transaction fees due to the larger block size.

2. Payment Processing: The Bitcoin SV blockchain facilitates merchant services and micropayments due to high transaction volume capacity.

3. Data Management and Storage: The Bitcoin SV network provides a secure and immutable data ledger. It is suitable for enterprise-level applications like supply chain management and identity verification.

4. Smart Contracts and Tokens: The Bitcoin SV chain supports token creation and smart contract automation.

5. Development Platform: Bitcoin SV allows building and deploying decentralized applications (dApps). As a result, it encourages the development of innovative blockchain solutions.

6. Speculative Investment: The BSV coin can be used for trading and investment, with price speculation in the crypto market.

How to Earn Bitcoin SV Coin

Earning Bitcoin SV (BSV) can be done through:

> Mining BSV: Validate transactions and secure the blockchain using specific hardware. You can also join a mining pool to combine computational power and share rewards.

> Staking BSV through Mining Pools: Stake your existing BSV holdings on mining pools for a share of mining rewards.

> Accepting BSV as Payment: Accept BSV for business services or goods.

> BSV Faucets: Complete simple tasks or captcha on cryptocurrency faucets to earn small amounts of BSV.

> Content Creation: Earn BSV through platforms that pay in cryptocurrency or set up BSV donations for your content.

> Trading and Investment: Buy low and sell high on cryptocurrency exchanges.

> BSV Community and Development Projects: Contribute to the BSV ecosystem for potential bounties or incentives.

Energy Requirements of BSV and BTC

The original Bitcoin blockchain requires a tremendous amount of energy for mining. In 2021, the Bitcoin network reportedly consumed an annual average of 130 terawatt hours (TWh) of energy, comparable to the energy consumption of the Netherlands. As it’s anticipated that Bitcoin’s energy consumption per transaction will only rise over time, many observers have raised concerns about the sustainability and environmental impact of the network.

On the other hand, Bitcoin SV is a much greener technology because it requires less energy due to its larger block sizes and less congested network.

Energy Requirements of BSV and BCH

While Bitcoin Cash also features a larger block size than Bitcoin itself, the fact that its block size is still capped affects not only its transaction speed and cost, but also the energy efficiency of the blockchain.

On the other hand, with its unbounded block size, Bitcoin SV has the theoretical capacity to accommodate an unlimited number of transactions within a single block. Consequently, its energy efficiency will improve as the volume of network transactions increases.

Bitcoin SV Support for Smart Contracts

NFTs and smart contracts, supported by blockchain technology, are making waves in the crypto world as they allow diverse interactions with blockchains, giving birth to the rise of decentralized finance (DeFi), GameFi and SocialFi. The original Bitcoin protocol doesn’t effectively support smart contracts, but the Bitcoin SV network does, thanks to its Bitcoin Script protocol that enables its smart contract function. This is a critical difference between the two networks. It could also be one of the biggest reasons BSV might one day surpass BTC in value.

Bitcoin SV Tokenomics

BSV is the native token of this network that is used for the transfer of value within the network. The users also pay transaction fees in the form of BSV tokens. With a circulating supply of 19.2 million tokens, BSV has a market cap of $1 billion.

It has a maximum supply of 21 million tokens that will be released over time. BSV ranks among the 50 best cryptocurrencies in terms of market cap.

Transaction Fees and Speed for BSV and BTC

Because of its large block sizes, the Bitcoin SV network can theoretically support over 50,000 transactions per second (TPS), though in actuality its peak is closer to 3,000 TPS. Compared to that, Bitcoin’s peak transaction throughput is only around 7 TPS. This feature gives BSV the power to finalize transactions almost instantly.

Bitcoin SV also has exceptionally low transaction fees of less than $0.01. Over the past decade, we’ve seen transaction fees as high as $62 for one transaction on the Bitcoin blockchain.

That’s because during the bull market, at times of network congestion, fees would go through the roof and transactions would get stuck for days in the Bitcoin blockchain. Bitcoin SV’s less-congested mempool, along with its lower transaction costs, make Bitcoin SV an ideal blockchain for daily microtransactions.

Is BSV a Good Investment?

Bitcoin SV’s main competitor, Bitcoin, remains the world’s most popular cryptocurrency. It’s nearly impossible to beat Bitcoin in terms of branding and image. But as a medium of crypto payment, Bitcoin SV can potentially outperform many other cryptocurrencies, including Bitcoin Cash.

The value of BSV is predicted to rise in the next few years because of its solution to the scalability issue, a problem plaguing not only Bitcoin but many blockchains in the crypto world. Since Bitcoin SV can process transactions quickly and requires low transaction fees of less than half a cent, it could even be a real competitor to credit card companies that charge high fees.

Also, Bitcoin SV is energy efficient and considered a green technology, so it’s expected to appeal to the masses — as compared to Bitcoin — as the world grows increasingly environmentally conscious.

Overall, Bitcoin SV’s key features — high security, ability to scale, fast transaction speed and smart contract ability — allow it to be an enterprise blockchain with myriad uses in diverse industries ranging from healthcare to video gaming. Governments will also find it beneficial to leverage Bitcoin SV for various initiatives that help their citizens. For instance, VXPASS, the COVID-19 vaccine card provider built on the BSV blockchain, has worked with the World Health Organization (WHO) and World Bank to help multiple African countries implement vaccine administration and verification via blockchain.

Bitcoin SV Price Prediction

Bitcoin SV is priced at $74.20 as of Jan 92, 2023, which is 84.85% lower than its all-time high of $489.75 on Apr 16, 2021 and 246.25% higher than its all-time low of $21.43 on Jun 10, 2023.

Since late December 2023, Bitcoin SV has undergone a swift price surge, soaring over 100% in just one day and jumping from $48.51 on Dec 27, 2023 to $97.83 on Dec 28, 2023. This bullish momentum persisted through the beginning of 2024, fueling the anticipation surrounding the potential approval of a spot Bitcoin ETF. Its price fell slightly from January 3–8, 2024, bottoming out at $72.80, but rose again to reach a resistance level of around $90.

Price prediction experts hold a long-term bullish outlook on the BSV token. CryptoNewsZ forecasts conservative growth for BSV, foreseeing its price rising to $112.19 in 2025 and $365.33 in 2030. Meanwhile, DigitalCoinPrice is highly optimistic on BSV and predicts it will climb to $194.02 in 2025 and exceed $500 by 2030.

How to Buy BSV?

To buy Bitcoin SV (BSV), follow these steps:

1. Select a Cryptocurrency Exchange: Choose an exchange such as KuCoin that lists BSV, considering factors like security, trading fees, and regulatory compliance.

2. Account Creation and Verification: Sign up on the chosen exchange and complete the Know Your Customer (KYC) process.

3. Deposit Funds: Add fiat money or cryptocurrency to your exchange account through methods like bank transfers, cards, or crypto transfers.

4. Purchase BSV: Buy BSV by selecting it from the list of cryptocurrencies and specifying the amount. On KuCoin, you can easily find the BSV/USDT trading pair on the spot market, and exchange for BSV with USDT easily.

5. Transfer BSV to a Secure Wallet: For security, move your BSV to a private crypto wallet you control.

6. Implement Security Measures: Use strong passwords, enable two-factor authentication (2FA), and be cautious of scams.

7. Stay Updated on Regulatory Compliance: Understand your country’s tax implications and regulations related to crypto transactions.

Conclusion

In conclusion, Bitcoin SV (BSV) represents a distinctive branch of the Bitcoin family tree, striving to adhere closely to what its supporters believe to be Satoshi Nakamoto’s original vision for Bitcoin. It distinguishes itself with significantly larger block sizes aimed at scaling transaction capacity and reducing fees, thereby facilitating a broader range of transactions and applications.

While it shares the core principles of blockchain technology and decentralized ledger systems with its predecessors, BSV’s emphasis on protocol stability, scalability, and utility for enterprise applications sets it apart. Despite the controversies surrounding its origins and key figures, particularly Craig Wright, Bitcoin SV continues to foster a unique ecosystem within the cryptocurrency world.

Disclaimer ||

The Information provided on this website article does not constitute investment advice ,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!