BlackRock is the largest asset manager in the world. Controlling more than $8 trillion in assets under management (AUM), BlackRock is the world’s largest shadow bank. In addition, they own the iShares franchise of investment funds and other proprietary investment vehicles.

There are so many reasons you should know about BlackRock. It’s a giant financial company that helps people and organisations manage and invest their money. It’s one of the biggest investment management firms in the world with over $10 trillion in assets under management (AUM), including their recently launched Spot Bitcoin ETF – IBIT, which gives institutions and traditional investors access to Bitcoin price. So what exactly is BlackRock?

Table of Contents

What is BlackRock and what does it do?

BlackRock is one of the world’s largest investment management companies. It helps individuals, institutions, and governments invest their money in various assets like stocks, bonds and real estate. BlackRock offers a wide range of investment products and services, including mutual funds, exchange-traded funds (ETFs), and investment advisory services. Additionally, BlackRock provides risk management and technology solutions to its clients. Overall, BlackRock plays a significant role in the global financial markets by helping investors through diversified and well-managed investment portfolios.

History of BlackRock

BlackRock’s history dates back to 1988 when it was founded as a risk management and fixed-income institutional asset manager by Larry Fink, Robert S. Kapito, and others. Initially operating under the name Blackstone Financial Management, it became BlackRock in 1992.

In 1994, BlackRock launched its first fixed-income fund, paving the way for expansion into other investment products and services. Throughout the 1990s and early 2000s, it grew through strategic acquisitions and partnerships, including the acquisition of Merrill Lynch Investment Management in 2006, which significantly expanded its asset management capabilities.

After the global financial crisis in 2008, BlackRock played a crucial role in managing troubled assets and providing advisory services to governments and financial institutions. This solidified its position as a leading player in the investment management industry.

In the following years, BlackRock continued to expand globally, offering a diverse range of investment products and services tailored to the needs of institutional and individual investors. Today, it is the world’s largest asset manager, managing trillions of dollars in assets on behalf of clients worldwide. In fact, on Jan 5, 2024, BlackRock made headlines with its entry into the cryptocurrency market. Despite its historical focus on traditional asset classes, BlackRock launched the Spot Bitcoin ETF (IBIT), marking its entry into the world of cryptocurrencies.

Who owns Blackrock?

BlackRock is a publicly traded company, so it is owned by its shareholders. The largest shareholders are typically institutional investors, mutual funds, and other asset management firms. Additionally, it’s co-founders, Larry Fink and Robert S. Kapito, along with its employees, also hold significant ownership stakes in the company.

How does BlackRock differ from other investment firms?

BlackRock stands out for its scale, global reach, and diverse range of investment products and services. It also leverages technology and data analytics to drive investment decisions and risk management.

Blackrock Vs. Vanguard: what’s the difference?

BlackRock and Vanguard are both prominent investment management firms, but they differ in key aspects. BlackRock is the world’s largest asset manager, offering a diverse range of investment products and services, including mutual funds, ETFs, and risk management solutions.

Vanguard, on the other hand, is known for its low-cost index funds and a client-owned structure, which means its investors effectively own the company. While both firms aim to help clients achieve their financial goals, it tends to offer a broader range of investment options, while Vanguard emphasises simplicity and cost-effectiveness through its index fund offerings. It is important to note that past performance is not indicative of future results, and investors should consider their own risk tolerance and investment goals when choosing between these firms.

How to trade BlackRock shares (BLK.US) online – steps

Before you learn how to start trading BlackRock shares online, you need to understand what CFDs are. Contracts for Difference (CFDs) are financial derivatives that allow traders to speculate on the price movements of assets without owning them. One key benefit is the ability to profit from both rising and falling markets. However, trading CFDs carries a high level of risk and may not be suitable for all investors. The value of your investment could fluctuate, and you may lose more than your initial investment.

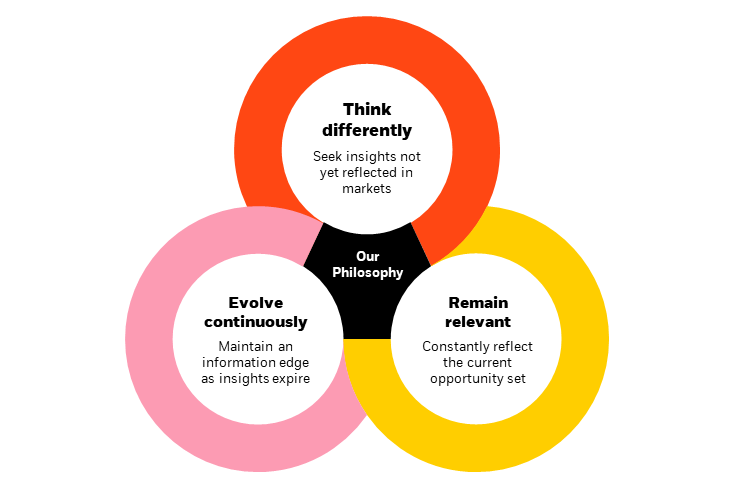

What is BlackRock’s investment philosophy?

BlackRock focuses on long-term investing, diversification, and risk management. It emphasises the importance of understanding clients’ needs and delivering tailored investment solutions.

5. How can individuals invest in BlackRock?

Individuals can invest in BlackRock indirectly through mutual funds or exchange-traded funds (ETFs) that include BlackRock-managed assets. Additionally, it shares (BLK.US) are publicly traded on stock exchanges and through CFD brokers such as Skilling, allowing investors to trade the shares online.

What Does BlackRock Own?

BlackRock (BLK 0.19%) is a leading global investment management firm. The company ended 2023 with a jaw-dropping $10 trillion of assets under management (AUM). These assets run the gamut from shares in large publicly traded companies, single-family homes, and critical infrastructure assets like pipelines. The company manages these assets on behalf of retail, institutional, and exchange-traded fund (ETF) clients.

There is a lot of misunderstanding about what it does and the companies it owns. At its core, it is in the asset management business, meaning it manages assets on behalf of the clients who own those assets. So, while it’s funds hold significant stakes in some of the largest companies in the world, the investors in those funds actually own the equity interests in those companies — not BlackRock.

It is a massive company with significant assets on its balance sheet ($123 billion at the end of 2023). However, direct equity investments from its balance sheet into other companies it doesn’t own were only $9.7 billion. In addition, while BlackRock will seed new funds with balance sheet capital and co-invest in others, they’re relatively small investments.

To help address some of the misconceptions about BlackRock, here’s a look at some of the companies it actually owns and a peek at what it might buy next. Understanding what it owns and does will help investors better understand the company and determine whether they want to invest money in its stock.

What companies does BlackRock own?

BlackRock has acquired several companies over the years to expand its investment management capabilities. Here’s a look at some of the companies it now owns:

1. Merrill Lynch Investment Management

The company bought Merrill Lynch Investment Management in 2006 to expand its retail and international investment management capabilities. It paid $9.7 billion for the business, creating one of the largest investment management firms with almost $1 trillion in assets under management (AUM) at the time.

2. Barclays Global Investor

BlackRock bought the investment management arm of British bank Barclays (BCS 1.7%), Barclays Global Investor (BGI), in 2009 for $13.5 billion. The transformational transaction created the world’s biggest asset manager, doubling BlackRock’s AUM to $2.7 trillion.

As part of the deal, it acquired the popular exchange-traded fund (ETF) platform iShares. The platform now manages more than $3.3 trillion in AUM across 1,400 ETFs. Its largest ETF is the iShares Core S&P 500 ETF (NYSEMKT), with more than $450 billion in AUM in early 2024. It was the second-largest ETF in the world by AUM in early 2024.

3. First Reserve Infrastructure Funds

Blackrock bought the equity energy infrastructure franchise of First Reserve for an undisclosed sum in 2017. The acquisition of First Reserve Infrastructure Funds expanded the BlackRock Real Assets platform to $36.5 billion in client assets.

4. Kreos Capital

It bought private debt manager Kreos Capital for a reported $400 million in 2023. The company is a leading provider of growth and venture debt funding for companies in the healthcare and technology sectors. The acquisition bolstered it’s leading global credit asset management capabilities while enhancing its ability to provide clients with private market investment products and solutions.

5. eFront

The investment management firm bought eFront in 2019 for $1.3 billion. The acquisition helped strengthen it’s technology platform.

6. Aperio Group

The company bought Aperio in 2021 for about $1.1 billion. Aperio is a pioneer in customizing tax-optimized index equity separately managed accounts (SMAs). It builds and manages personalized public equity portfolios for clients.

Other investments

In addition to wholly owned companies, it has made several strategic minority investments, including:

- Acorns: The company invested in the microinvesting app in 2018. It has expanded the partnership and its investment over the years, and it is now an anchor investor in Acorns.

- iCapital: BlackRock increased its stake in the leading technology platform for alternative investments in 2020. It’s the largest minority investor in the company.

What companies could BlackRock buy in the future?

BlackRock is an active acquirer. It routinely makes tactical acquisitions to expand its investment management platform. The company has reached agreements to acquire two more companies in 2024:

- SpiderRock Advisors: BlackRock agreed to buy the remaining equity interest in SpiderRock Advisors in early 2024 after initially making a minority investment in 2021. SpiderRock enhances the company’s ability to offer personalized SMAs, one of the fastest-growing product segments in the U.S. wealth industry.

- Global Infrastructure Partners (GIP): The company agreed to buy leading infrastructure fund manager GIP in early 2024 for $12.5 billion, including $3 billion in cash. The transaction will create a market-leading, multi-asset class infrastructure investing platform with more than $150 billion of AUM.

Even after closing those deals, it has significant financial flexibility to acquire other companies. It ended 2023 with $8.7 billion of cash on its balance sheet against $7.9 billion of debt, helping support its strong bond ratings of AA-/Aa3. It expects to fund the GIP deal with additional debt, which it can easily manage. It will still have a lot of financial flexibility to make acquisitions, especially since it can also use its shares as currency to fund deals, as it’s doing to finance the bulk of the GIP acquisition.

Given that the company has already made two investments in early 2024, it could be a while before it makes its next deal because it will need to spend some time integrating the GIP transaction. However, when the company is ready to make another deal, it has the financial flexibility to continue buying companies.

It has a well-defined strategy for inorganic investments. It will make tactical acquisitions to build out its platform capabilities and make strategic minority investments in companies it could seek to acquire.

As the slide shows, it has made several acquisitions to bolster its alternative investment (i.e., private equity, private credit, real estate, venture capital, and infrastructure) capabilities. That continued in 2024 with the agreement to buy GIP. Seeing the investment manager acquire more companies in the alternative investment space wouldn’t be a surprise.

The expected growth in AUM by the alternative investments sector is a major catalyst driving that view. According to a forecast by Preqin, the alternatives industry will add $8 trillion in AUM by 2028, growing to $24.5 trillion. It expects the private credit sector to double to $2.8 trillion in AUM by 2028. The turmoil in the banking sector is causing many smaller banks to pull back on lending (especially for commercial real estate), opening the door for private credit funds to fill in the gaps.

It could capitalize on the growth in alternatives by acquiring a company like Carlyle Group (CG -0.74%) or Apollo Global Management (APO -0.89%) to better compete against leading alternative asset managers Blackstone (BX -0.55%), Brookfield Asset Management (BAM -1.33%), and KKR (KKR 0.02%). Apollo has an asset management business with $651 billion in AUM and a retirement services company (Athene). It’s the leader in alternative credit, investment-grade alternative credit, and U.S. annuity sales. Meanwhile, Carlyle Group ended 2023 with $426 billion in AUM across private equity, private credit, and investment solutions.

Another factor driving the growth in alternatives is retail investors, especially high-net-worth individuals. They are increasingly allocating more of their portfolio to alternative investments. That could lead BlackRock to seek to acquire a more technology-focused startup catering to retail investors like CrowdStreet, EquityMultiple, Fundrise, or YieldStreet. These companies offer private real estate, private credit, venture capital, and other alternative investment opportunities to individual investors. The company could start by making a strategic minority investment in the space, eventually leading to an acquisition.

That has been a path the company has taken in the past. It made a minority investment in SpiderRock in 2021 and then agreed to acquire the remaining stake in 2024. It has several strategic minority investments, including iCapital and Acorns. The company increased its stake in iCapital in 2020 to become its largest minority investor and has done the same with Acorns. It could eventually acquire the remaining interests in those companies.

How does BlackRock mitigate risk?

Multi asset funds help mitigate risk by diversification.

When a fund invests in different sectors or asset classes, it’s considered to be ‘diversified’. The key benefits of diversification are:

- Investments are spread over a broad range of strategies, styles, sectors and geographic regions

- Diversification can help cushion the impact of market moves which can be more severe when investing in a single asset class, and

- To enhance the potential for investing in the best-performing asset class, while reducing the impact of the worst-performing asset class.

- Investors should note that a diversified portfolio is still exposed to the risk of capital loss.

What is BlackRock’s fund management fee?

It charges a small annual percentage to manage the funds that they offer, this will vary depending on the type of fund and how actively the fund is managed. This is normally a fraction of a percent (for example they charge 0.22% for the Balanced Consensus Fund). They take this percentage from the value of your investment.

It is already taken into account when you see your returns, or the advertised average annual return (see ‘average annual return’ below). For example, if you see an 8% return, the fund will have actually grown by 8.22%, but it takes 0.22% of that growth to manage the fund, so you get an 8% return in total. It’s also true if your fund decreases in value.

For transparency, any fees taken by the fund manager will be made visible to you in your Quarterly Valuation report.

The fund management fees for the MyMap range (Expert Managed) of funds offered through ChipX are 0.17% and for the specialist funds are as follows:

- Clean Energy (iShares Global Clean Energy UCITS ETF): 0.65%

- Healthcare Innovation (iShares Healthcare Innovation UCITS ETF): 0.40%

- Emerging Markets (BlackRock Emerging Markets Fund): 0.97%

The bottom line on companies BlackRock owns

There are a lot of misconceptions about the companies BlackRock owns. The investment manager is often one of the top shareholders of many large U.S. companies. However, it manages those shares on behalf of clients in its ETFs and other investment products that are the actual equity owners in the companies and other assets BlackRock manages. It owns a few companies, such as investment management and technology platforms. Learning about what BlackRock owns and how it makes money can help investors gauge whether it’s a good stock to buy and hold for the long term.

Disclaimer ||

The Information provided on this website article does not constitute investment advice ,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!

Leave feedback about this