Bybit is a Singapore-based crypto exchange that was founded in 2018. In only a few years, Bybit has gained over 2 million users, with over $12.5B derivatives trading volume (per 24h) – ranking #4 on the market.

Bybit provides multiple trading tools and features for crypto investors. Even though its spot trading services are not really competitive, it has gained an edge over other centralized exchanges thanks to its amazing futures trading platform.

Table of Contents

Where is Bybit located?

Bybit is based in Singapore and registered in the British Virgin Islands. It has various offices in Hong Kong and Taiwan. Nevertheless, users all over the world can access Bybit and use the platform at ease.

How does Bybit work?

As a cryptocurrency exchange, Bybit works in a similar way to any other CEX. The main flywheel of Bybit can be seen as:

Step 1: Bybit was released with some initial markets and assets.

Step 2: Bybit incentivized users to trade on their platforms. This can be done in multiple ways (Advertisement, Marketing, Incentive Program,…).

Step 3: It gains more users and trading volume.

Step 4: As a result, Bybit receives more revenue.

Step 5: Bybit grows in value and continues to attract more users and trading volume by introducing more markets and assets.

Bybit Reviews

Advantages

One of the fastest-growing crypto exchanges on the market.

Excel with its futures trading. Support up to 100x leverage.

Competitive trading fees.

High liquidity.

Quick and simple registration process.

Highly secure with numerous protection/insurance methods.

Top-tier trading engine with the ability to handle up to 100,000 transactions per second.

Disadvantages

Spot trading is not as attractive as futures trading, with only a limited number of spot markets.

Only 3 Fiat currencies (RUB, BRL, ARS) are supported for the deposit.

Not available in the U.S.

Bybit service zone

It services are available for the majority of the world, except for users in a few excluded jurisdictions, including the United States, mainland China, Singapore, Quebec (Canada), Ontario (Canada), North Korea, Cuba, Iran, Crimea, Sevastopol, Sudan, Syria, Donetsk, and Luhansk.

Key products of Bybit exchange

Spot Trading: The most basic function that every exchange must have. It is simply the direct buying and selling of different currencies, like BTC or ETH.

Margin Trading: Closely similar to Spot Trading. The only difference is that Margin Trading allows you to borrow more capital to leverage your position while Spot Trading does not.

Derivatives Trading: Financial contracts between two or more entities that have their values based on the performance of an underlying asset. On Bybit, this includes Inverse Perpetual (Futures), USDT (USDC) Perpetual, Options Contracts, and Leveraged Tokens.

Launchpad: A platform to conduct IEO (Initial Exchange Offering) for low and mid-cap crypto tokens.

Trading Bot: Provides a number of strategies, often automatically performed by bots, to make profits.

ByVotes: Bybit users can vote on the next coins to be listed on the exchange and earn airdrops.

Copy Trading: Make profits by copying strategies/trades from professional traders.

Bybit Savings: Earn passive income by depositing cryptocurrencies over a Fixed Term (a certain period of time) or Flexible Term (more diverse options), similar to earning savings via banks.

Dual Asset: A non-principal protected structured saving product with high yields, involving 2 different crypto tokens. The product has an optional callable feature designed to reduce the risk of the product in exchange for a lower yield.

Liquidity Mining: Provide liquidity to a pair of tokens on Bybit and earn yields through trading fees.

Launchpool: Stake and earn yields by temporarily locking up cryptocurrencies.

DeFi Mining: Earn yields by providing liquidity to Curve Finance (an AMM). Higher yields but higher risks.

NFT Marketplace: An NFT marketplace made originally by and for Bybit.

Charity: Donate cryptocurrencies to non-profit organizations.

Institutional Services: Sign up as an institution to receive special benefits.

Bybit Fees

Trading fees

It charges fees for spot and derivatives trading as follows:

Deposit and withdrawal fees

Similar to the majority of CEXs on the market, Bybit does not charge any deposit fees. However, there is a charge of withdrawal fees depending on the cryptocurrencies you’re withdrawing.

Other fees

There are some other fees for using its services.

NFT Marketplace fees: All sellers have to pay a 1% fee.

Leverage fees: 0.06% * leverage.

Funding fees: Funding rate * Position Value.

Bybit App Download

It has a mobile application on both iOs and Android. You can download their application using the links below:

iOs: apps.apple.com/us/app/bybit-app

Android: play.google.com/store/apps/bybit

How to open an account on Bybit Exchange

Step 1: Set up an account

In order to use Bybit Exchange, first you need to create an account. Go to their website via this link: https://coin98.xyz/bybit

Here you will have 2 options, to signup using either Email or Mobile Number. At the same time, you can signup using your Google Account directly.

Coin98 Insights will create a Bybit account using an Email as an example. Enter your mail address and password, then click on “Continue”.

Note that your password has to be between 8-30 characters, contains at least one uppercase letter, one lowercase letter, and a number.

Before creating an account, make sure that you are not a resident of the restricted countries or regions (shown in the picture). If you are not, click “No”.

A verification code of 6 digits will be sent to your email address. Enter the code to verify your account.

Your account has been created successfully.

Step 2: Complete identity verification

To open every feature of the Bybit platform, you need to complete identity verification.

On the main page, point to the human icon and click on “Account & Security”.

Click on “Verify now”.

First, you need to upgrade to Level 1. Level 2 will open up more features but is not really compulsory.

Click on “Upgrade”.

Choose your nationality, then click on “Next”.

Select a type of identity document, then upload pictures of it. Afterwards, click on “Next”.

Continue with the verification process. Follow the instructions and click on “I’m ready”.

The verification process will end after the face scan, which you will be notified of. Your submission will be reviewed by Bybit before your account can be upgraded to level 1.

Step 3: Enable 2FA (Two-factor authentication)

2FA, also known as Two-factor authentication, adds another security layer to your account. On Bybit, you can use either SMS authentication or Google Authenticator for 2FA. Coin98 Insights highly recommends the latter option as it is one of the most popular and secure methods for 2FA at the moment.

On the main page, point to the human icon and click on “Account & Security”.

Scroll down and click on “Settings”. Coin98 Insights will use Google Authenticator as an example.

First, you need to verify your identity using email. Click on “Send Verification Code” to receive the verification code, then enter it onto Bybit.

Follow the instructions to set up your Google Authenticator. You can also use Coin98’s article as a reference.

Learn more: How to set up Google Authenticator

When you are finished, click on “Confirm”. Coin98 Insights cannot leave an illustration here as it contains personal information.

Your account will be disconnected and you will need to log in again, but with the two-factor authentication this time.

How to use Bybit basically

How to deposit

To use it, first you need to deposit some funds into your account.

On the main page, point to “Assets” and select “Assets Overview”.

Click on “Deposit”.

Choose the token you want to deposit and the blockchain network you want to send it from. Coin98 Insights will take Coin98 with the BSC network as an example.

Click on “Acknowledge”.

Your deposit address will show up. Send the chosen token from the correct blockchain network to this address. When your transaction is finalized, your assets will appear on Bybit.

How to withdraw from Bybit exchange

To use it, first you need to deposit some funds into your account.

On the main page, point to “Assets” and select “Assets Overview”.

Click on “Withdraw”.

Choose the token you want to withdraw, enter your withdrawal address along with its network as well as the withdrawal amount. When all is done, click on “Submit”.

How to buy/sell crypto on Bybit exchange

There are various ways to buy or sell cryptocurrencies on Bybit. One of the easiest ways to buy crypto tokens on Bybit is through its Express feature. By using this feature, you can buy cryptocurrencies directly via various supported methods, like credit cards or bank transfers.

To use this service, on the main page, point to “Buy Crypto” and select “Express”.

Here you can choose the cryptocurrency to buy, the Fiat currency to buy it with, as well as the payment method. For example, you can buy USDT using VND through numerous ways: Credit Card, Bank Transfer, Momo, Zalopay, or third parties like GooglePay.

How to trade on Bybit Exchange

Spot Trading

On the main page, point to “Trade” and select “Spot Trading”.

The interface for spot trading will show up. Here you can buy and sell various crypto assets on Bybit’s order books.

Margin Trading

On the main page, point to “Trade” and select “Margin Trading”.

On the right side of the screen, click on “Enable Margin”.

Click on “Acknowledge & Activate Margin Trading.”

Continue after reading the 5 Margin Trading quizzes by clicking on “Acknowledge & Agree”.

The option for Margin Trading will now pop up on the right side of the screen. You can also access Margin Trading through Spot Trading as they use a mutual interface.

Note that on Bybit, only Bitcoin (BTC) and Ethereum (ETH) are supported for Margin Trading, with the maximum leverage of 3x.

Derivatives Trading

There will be multiple options for derivatives trading, and Coin98 Insights will take USDT Perpetual as an example. On the main page, point to “Derivatives” and select “USDT Perpetual”.

The interface for futures contracts will show up. On the right side of the screen, you can customize your Margin Mode (Cross, Isolated) and leverage (from 1x to a maximum of 100x).

Before actually getting started with derivatives trading, here are some tips on how to use leverage in Crypto in general and in futures particularly:

Adjust leverage according to the risk/reward.

Use stop-loss and take-profit to minimize loss and maximize returns.

Use leverage with technical analysis to take advantage of a small rally/sell-off rather than building a long-term position.

Leveraged Tokens

On the main page, point to “Trade” and select “Leveraged Tokens”.

Click on “Acknowledge & Enable Leveraged Tokens”.

The interface for spot trading will show up.

Trading Bot

On the main page, point to “Trade” and select “Trading Bot”.

Here you can create your own Trading Bot, or copy from other traders. Coin98 Insights will create a new one as an example. Scroll down and click on “Create Now”.

Here you are required to enter a few things:

Token pair: Choose the one that you want your Trading Bot to trade.

Price range: The grid bot will only operate in the upper and lower price bounds. If the market price falls outside this range, the grid bot will place no new order.

Number of grids: The higher the number, the smaller the price intervals. Please note that orders may be filled more frequently in this case.

Total investment: Total amount of funds you want to invest in your Trading Bot.

When all is done, click on “Create Now”.

Types of orders on BIT

There are 3 types of orders on BIT:

Limit Order: Allows users to buy or sell tokens at a predetermined price. If the market price does not reach the user’s set price, the order will not be executed.

Market Order: Is a more basic type of trade. Market Order allows users to immediately execute the order at the current market price. It is guaranteed that you can buy/sell your tokens instantly.

Conditional Order: Places a market or limit order when a specific price level is crossed.

How to earn

Bybit Savings

On the main page, point to “Earn” then click on “Bybit Savings”.

There will be multiple options for both Flexible Term and Fixed Term savings.

Enter the number of tokens you want to stake, tick on the checkbox “I have read and agreed to Bybit Terms of Services”, then click on “Stake Now”.

Dual Asset

On the main page, point to “Earn” and select “Dual Asset”.

Scroll down and you will see all the available options. Choose the strategy that suits you the most.

Click on “Select”.

Enter the number of tokens that you want to deposit, then click on “Submit”.

Liquidity Mining

On the main page, point to “Earn” and select “Liquidity Mining”.

Scroll down and you will see all the available options.

Enter the number of tokens that you want to use to add liquidity, either in pair or single-sided, then choose the leverage level (from 1x to 3x). Afterwards, click on “Add Liquidity”.

DeFi Mining

On the main page, point to “Earn” and select “DeFi Mining”.

All the options will show up. At the moment, only one option is available. Click on “Buy Now”.

Continue by clicking on “Buy Now”.

Enter the number of tokens that you want to stake, then click on “Purchase”. If you have not transferred some funds into your Earn Wallet, click on “Transfer”.

Launchpool

On the main page, point to “Earn” and select “Launchpool”.

At this moment, there are no available options on Launchpool, so Coin98 Insights cannot guide you further on this feature.

Launchpad

You can invest in promising projects from their early stages on Bybit’s launchpad. On the main page, point to “Trade” and select “Launchpad”.

On-going offers will show up. You can either commit BIT (the native token of Bybit) to earn a percentage of the token allocation, or commit USDT to gain a ticket in the lottery.

Coin98 Insights will take the former option as an example. Click on “Join now”.

Click on “Deposit Now (BIT)”. You need at least 50 BIT tokens to subscribe to token allocation, or 100 USDT to buy a lottery ticket.

How to use BIT NFT Marketplace

On the main page, click on “NFT”.

Click on “Agree” to continue.

Click on “Explore” to open its NFT Marketplace.

Here you will see all the currently on-sale NFTs on Bybit NFT Marketplace. You can buy any of them by pointing to the NFT and clicking on “Buy Now”.

Click on “Pay Now”, and you will be able to purchase the NFT.

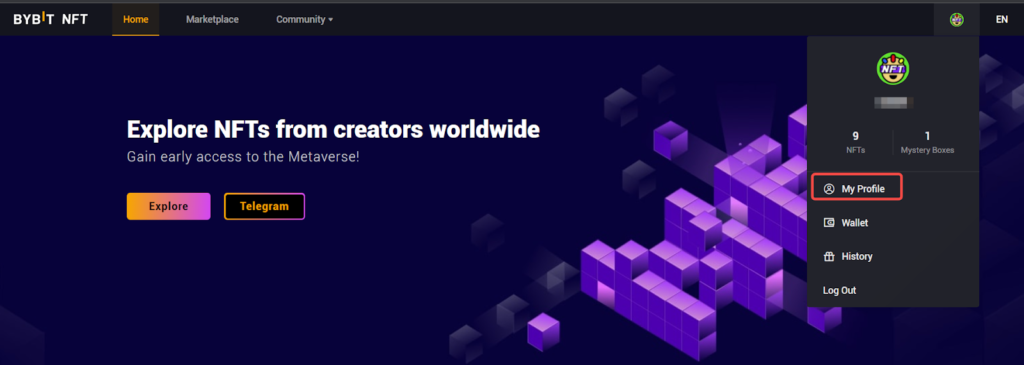

You can deposit your own NFTs into Bybit by pointing to the avatar icon at the top right corner of the screen, then clicking on “Deposit”.

It supports depositing NFT from 6 blockchain networks (Ethereum, BNB Smart Chain, Polygon, Solana, Tezos, Klaytn) and 4 web3 wallets (Metamask, Phantom, Temple, Kaikas).

FAQs about Bybit exchange

Is it safe and legit?

It is used globally by more than 2 million crypto users. Even though it has been operating for only 4 years, it has gained the trust from a large number of investors in order to achieve its spot today. Therefore, it is safe to say that the exchange is secure and legitimate.

Is Bybit legal in the U.S?

For some reason, BIT is not available in the U.S.

How to calculate Bybit’s funding rate

Its funding rate is calculated by the number of long position holders compared to the number of short position holders.

If long position holders outnumber, the funding rate will be positive, and long position holders will have to pay short position holders. This is to encourage more investors to open short positions (to earn funding fees) so that futures’ order books can be closely similar to spot’s order books.

On the opposite, if the number of short position holders surpasses that of long position holders, the funding rate will be negative, and long position holders will have to pay short position holders.

How to calculate Bybit liquidation price

The liquidation price is calculated based on your leverage. Spot trading means trading assets at 1x leverage, so there is no probability of liquidation.

For a 2x leverage, meaning you are doubling the order size, your order will be liquidated if the collateral value reduces by half (50%).

Similarly, for a 10x leverage order, for instance, you will be liquidated if the initial fund reduces by 10%. As for a 100x leverage, only a 1% loss is enough to liquidate your position.

How to use Bybit API

You can use Bybit API to check market data, process automated trading orders, etc.

On the main page, point to the human icon and click on “API”.

Click on “Create New Key”.

Here you can customize API key usage, API key permissions, IP access, etc. After completing the customization, click on “Submit”.

Enter the 2FA code, then click on “Confirm” to generate a new API key. Note that you should not expose your API key as others can use it to get access to your Bybit account.

How to get Bybit referral code

On the main page, point to the human icon and click on “Referral Program”.

Your Bybit referral code and referral link will show up on the screen. You can copy and send them to your friends to join Bybit’s referral program.

Conclusion

It is a Singapore-based crypto exchange that was founded in 2018. In only a few years, it has gained over 2 million users, with over $12.5B derivatives trading volume (per 24h) – ranking #4 on the market.

It provides multiple trading tools and features for crypto investors. Even though its spot trading services are not really competitive, it has gained an edge over other centralized exchanges thanks to its amazing futures trading platform.

However, the exchange still possesses a number of flaws: There are only a limited number of spot markets, only 3 Fiat currencies (RUB, BRL, ARS) are supported for the deposit, and it is not available in the U.S.

Disclaimer ||

The Information provided on this website article does not constitute investment advice ,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!

Leave feedback about this