Celestia uses a modular blockchain network to revolutionise the scalability and architecture of traditional blockchain systems. As the data over a blockchain increases, the data load increases. With excessive data, it becomes tougher to download and verify the ledger. It is critical to the security of any blockchain to ensure and inspect the ledger of transactions to verify it.

It allows developers to create their customised blockchain layer for enhanced speed, flexibility, and scalability. By separating execution from consensus, Celestia addresses the scalability challenges prevalent in conventional blockchain platforms.

It works in partnership with Polygon. Polygon and Celestia are two players in Ethereum’s rollup-centric roadmap. Polygon creates an ecosystem of tools to help developers easily create new blockchains and decentralised applications. At the same time, Celestia helps layer two rollups scale by providing off-chain data storage, consensus, and verification.

| KEY TAKEAWAYS: |

| — Traditional blockchains perform all of their key roles on one chain, often leading to compromises on scalability. — Celestia is a modular blockchain that acts as a data availability layer for rollups and layer 2 blockchains, making them much more scalable. — Though it has some competition, Celestia has piqued the interest of some major industry players as a potential solution to the blockchain scalability problem. |

Many will be familiar with the blockchain trilemma, as first coined by Ethereum co-founder Vitalik Buterin. It’s the idea that a blockchain strives for three primary features – decentralization, scalability, and security. The problem is that a blockchain’s success in addressing one of these features will inherently impact the others.

This stems from the monolithic structure of traditional blockchains. To explain, monolithic blockchains such as Bitcoin and Ethereum, handle execution, settlement, consensus, and data availability on the same blockchain.

There’s where the problem lies: as the amount of blockchain data increases, data availability becomes a major roadblock to the network’s scalability. To increase their throughput, they must compromise on either decentralization or security.

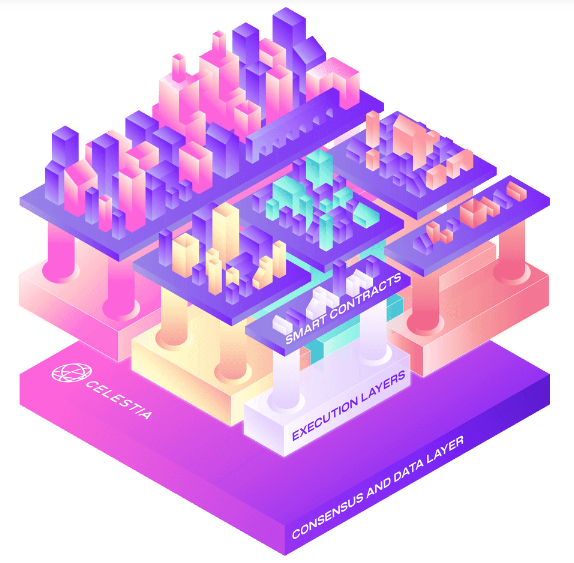

That’s where modular blockchains come in. Modular blockchains focus on only one task that a monolithic blockchain would handle, leaving the rest of the tasks for other chains. For example, Blockchain rollups are a prime example of modular blockchains: they only specialize in executing transactions and let their base chain handle the rest.

It is another type of modular blockchain. It focuses on carrying out consensus and data availability. But how does Celestia work and could it help solve the blockchain scalability problem?

Before we dive into Celestia and what it is, let’s first look at the reason it exists.

Table of Contents

The Origin of Celestia

It is based on Mustafa Al-Bassam’s 2019 whitepaper, LazyLedger. The concept behind Lazy Ledger is that the ledger abstains from computation or execution tasks and just acts as a data availability layer.

Al-Bassam subsequently decided to build a team to develop a crypto project based on his ideas and onboarded Ismail Khoffi and John Adler as co-founders. Ismail Khoffi was a core developer for the Cosmos ecosystem and John Adler worked with optimistic rollup technology. They rebranded the project as ‘Celestia’ in 2021, eventually launching the Celestia mainnet on October 31, 2023.

It has enjoyed the backing of some high-profile names in crypto such as Bain Capital Crypto, Coinbase Ventures, and Jump Crypto. The excitement around Celestia was further evidenced by its initial post-launch success. Indeed, after launching its mainnet on October 31, 2023, its native token, ‘TIA’, surged in price by 500% by mid-December.

In December 2023, Polygon Labs announced the integration of it with the Polygon Chain Development Kit (CDK). The integration now enables Polygon developers to use it as a plug-in component. It also teamed up with Optimism Labs to enable rollups built using the Optimism stack to use Celestia or any other blockchain as a data availability layer.

In February 2024, Celestia became the first external project to contribute to the Arbitrum Orbit protocol layer. Its integration now allows developers to use Celestia alongside Arbitrum AnyTrust as a data availability layer for Arbitrum rollups.

How Does Celestia Work?

Celestia’s approach to scalability hinges on several key factors:

- Modular Design: By dividing responsibilities between execution and consensus, it offers enhanced flexibility and scalability.

- Data Availability Sampling (DAS): This feature allows nodes to process only relevant transactions, reducing network load and enhancing efficiency. Using DAS technology, nodes that cannot download the entire blockchain data (called light nodes) sample only a tiny portion of the data to verify whether the block has been published.

- Security and Resource Efficiency: It uses technologies like DAS and fraud/validity proofs to provide robust security for light nodes with lower resource requirements. As those light nodes are easier to download and validate, the transactions can be validated easily and without requiring excessive resources enhancing both speed and security.

- Architecture: Drawing parallels with scalable and decentralised protocols, it supports many users without compromising decentralisation or security. Parallel decentralised networks do not interact with each other and thus their data does not need to be validated outside their sovereign networks. All those networks can independently verify their data.

Basically, it handles the work and data load by modularly separating the execution, settlement and consensus layers and distributing the resources as required by these respectively.

What is TIA coin?

Celestia debuted its native token, TIA, at a price of around $2 in October 2023, along with the mainnet launch.

TIA coin primarily serves three use cases. Celestia is a proof-of-stake (PoS) network, which means TIA plays a key role in keeping the network secure. TIA holders can stake the token to participate in the consensus mechanism and governance of Celestia. Developers can also use TIA to pay for using Celestia’s data availability services. Additionally, developers deploying Celestia-based rollups can use TIA as a gas fee token.

TIA has a total supply of one billion tokens, of which around 170 million are currently in circulation. Around 6% of the total supply (about 60 million TIA) was airdropped to developers, researchers, and key community participants. The token is designed to be deflationary, meaning that its overall supply will decrease over time.

How to Use Celestia (TIA) Crypto

Celestia’s native token, TIA, plays a vital role in its ecosystem. It is used for:

- Paying fees for Celestia’s data availability solutions

- Gas token and currency for Celestia-based rollups

- Staking in Celestia’s proof-of-stake mechanism

- Participation in decentralised governance

TIA Token Features

- Market Cap – $3,118,410,216

- Volume (24h) – $132,951,172

- Circulating Supply – 163,618,870 TIA

- Total Supply – 1,022,575,342 TIA

Celestia Use Cases and Applications

Celestia’s significance lies in its modular design and scalability solutions. It enables:

- Trust-minimised bridges and sovereign chains.

- High-throughput data availability for rollups and layer-two solutions.

- Easy deployment of custom blockchains by leveraging Celestia’s modular infrastructure.

Pros of Celestia

Accessibility

It focuses on transaction data availability, separating execution and settlement layers. Developers can experiment by deploying customized blockchains and applications with their own terms of execution and settlement.

Moreover, it makes deploying blockchains and rollups accessible by reducing the associated overhead. Storing and processing large amounts of data can be resource-intensive and costly. Thanks to data availability sampling, fewer resources are required to run a node.

Interoperability

It is interoperable with any layer 2 blockchain or rollup, irrespective of which mainnet it uses for settlement. It’s also compatible with many developer tools, from the Polygon CDK to the Optimism Stack. Regardless of whether a rollup uses Ethereum, Optimism, or Arbitrum for settlement, it can publish its transaction on it.

When layer 2 blockchains and rollups publish their transaction data on it, they must submit data availability proofs. These cryptographic proofs demonstrate that a particular data set exists and is available on the blockchain, without revealing the data itself. All layer 2 blockchains and rollups connected to it can verify each other’s data availability proofs. This gives these chains an indirect avenue of communication.

Cons of Celestia

Not Battle Tested

It is still in its nascent stages. As per the official documentation, Celestia is an “ambitious new technology”. It also warns users to expect “occasional instability or reduced performance.”

Potential technical glitches aside, it is still too early to ascertain the project’s long-term viability and potential for adoption. While Celestia’s modular blockchain is a unique solution to blockchain scalability, some monolithic blockchains like Solana are already efficient and cheap. In other words, it already has strong competition.

Why is Celestia’s collaboration with Polygon Labs significant?

Polygon and Celestia are two important players in Ethereum’s rollup-centric roadmap. The former creates an ecosystem of tools to help developers easily create new blockchains and decentralized applications. At the same time, the latter helps layer two rollups scale by providing off-chain data storage, consensus and verification.

On December 12, 2023, Polygon Labs announced that Celestia’s data availability solution will now be available to Polygon developers. The integration of Celestia’s DA solution with the Polygon Chain Development Kit (CDK) will help developers utilize and customize Celestia’s DA solution as an “easily-pluggable component.”

Several blockchain projects like OKX, Astar, Canto, Gnosis Pay, Plam, and IDEX already use the Polygon Chain Development Kit (CDK) to launch layer two chains on Ethereum.

“The ability to launch a high-throughput ZK-powered Ethereum Layer 2 as easily as deploying a smart contract will do for blockchain adoption what high-speed fiber did for Web2 applications,” said Polygon co-founder Sandeep Nailwal.

Celestia competitors: NEAR, Avail, and EigenDA emerge as rivals

Data availability solutions fit like a glove to Ethereum’s rollup-centric roadmap. It comes as no surprise that several Celestia rivals have come into the foray in recent weeks.

- NEAR DA

Near Foundation – the non-profit organization behind L1 blockchain NEAR – introduced the NEAR Data Availability Layer (NEAR DA) at its annual conference on November 8, 2023. Rollup solutions Starknet and Caldera are among the initial users of NEAR DA.

“It’s about reliability and integration with the Ethereum ecosystem. Supporting Ethereum L2s and high-quality projects launching app-chains,” said Near Foundation.

- Avail

Avail is a DA layer that was formerly known as Polygon Avail. Polygon Labs spun off Avail in March 2023. Polygon co-founder Anurag Arjun heads the project, and their team is based in Dubai, UAE.

Avail’s approach differs from Celestia’s as the former uses a consensus mechanism called BABE and GRANDPA, inherited from Polkadot’s blockchain protocol.

Avail is currently in testnet as of November 9, 2023.

- EigenDA

EigenDA is a DA layer being built on top of Ethereum by EigenLabs – the company behind Ethereum restaking solution EigenLayer.

EigenDA is specifically designed with the Ethereum ecosystem in mind. EigenDA aims to allow Ethereum L1 stakers and validators to support critical functions other than consensus by allowing them to perform validation tasks for DA layers like EigenDA.

EigenDA is expected to go to testnet in the fourth quarter of 2023.

Future of Celestia

Celestia’s future roadmap includes:

- Increasing block support and upgrading block size- Increase block support from 2MB at genesis to 8MB, upgradeable via on-chain governance. It aims at 1GB block support later.

- Support for pruning historical transaction data – Data which is already validated and verified creates a huge chunk of residue information. It looks forward to pruning the old data which is no longer necessary or needed. Thus keeping the enhanced scalability and adoption relevant for the future.

- Deployment to Ethereum Mainnet- Through several stages, it implements rollup-centric scaling, enhances privacy, and simplifies the protocol. By leveraging solutions like L2 rollups and smart contract wallets, Ethereum aims to achieve global scalability and become a powerful decentralised world computer, enabling widespread adoption. This is where the partnership between Polygon and Celestia becomes significant.

- Development of light nodes for smartphones- As deployment and use of resources are very efficient, the development of light nodes can happen on smartphones and does not require specially built, high-power hardware.

Celestia’s data accessibility

Blockchain is transparent and secure thanks to data availability. It’s the certainty that a network participant can download transaction data at any time to verify a block. In traditional blockchain, the problem is the need to download the full data to do so. This negatively affects scalability and decentralization.

It comes with a solution, called Data Availability Sampling (DAS). It relies on light nodes to check data availability based on samples, instead of an entire block. This is allowed by the 2-Dimensional Reed-Solomon coding scheme. The efficiency of this method is 99.999%. This method allows for improved scalability – the greater the number of light nodes, the greater the security and ability to increase the size of the entire network. Within the data availability (DA) layer, there are such layers as Full Storage storing all data; the Light Node described above, and the Bridge Node connecting the DA network to the consensus network.

In the context of Celestia’s operation, it is also worth mentioning Namespaced Merkle Trees (NMT), which, simply put, allow higher layers to download only the data that interests them. In practice, this means that a project can fetch the transaction info that matters to it, ignoring the data of another project. This can occur because the mentioned info is stored in a single space. There is then no need for bridging.

Is Celestia better than Ethereum?

It’s important to note that Ethereum is one of the most-established blockchains in the ecosystem. While many so-called ‘Ethereum killers’ have sprung up over the years, Ethereum continues to be the #2 most popular blockchain behind Bitcoin. It’s likely that Ethereum’s large existing user base gives it an advantage over competitors.

It’s likely that it will be very difficult for Celestia — or any other blockchain — to surpass Ethereum in terms of user base.

However, because it is a relatively new blockchain with a smaller market capitalization, it’s likely that it has more growth potential than Ethereum.

Does Celestia have an active user base?

As of May 2024, this network is seeing around $58 million in daily transaction volume. Meanwhile, networks like Ethereum have $11 billion in daily transaction volume.

While it’s possible that Celestia could grow to rival networks like Ethereum in the future, it’s reasonable to assume that much of the TIA token’s current value comes from speculation about the potential of modular blockchains.

Conclusion

In essence, Celestia (TIA) is not just another blockchain protocol; it’s a platform that reimagines the structure and potential of decentralised networks. Its modular architecture not only offers a more scalable, secure, and flexible foundation for the development of dapps, it paves the way for a new era of blockchain innovation.

As the blockchain landscape continues to evolve, TIA’s approach could become a blueprint for future networks, offering a viable solution to some of the most pressing challenges facing the industry today.

Disclaimer ||

The Information provided on this website article does not constitute investment advice ,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!

Leave feedback about this