Definition

Technically, “Crypto Tokens” is just another word for “cryptocurrency” or “crypto asset.” But increasingly it has taken on a couple of more specific meanings depending on context. The first is to describe all cryptocurrencies besides Bitcoin and Ethereum (even though they are technically also tokens). The second is to describe certain digital assets that run on top of another cryptocurrencies’ blockchain, as many decentralized finance (or DeFi) tokens do. Tokens have a huge range of potential functions, from helping make decentralized exchanges possible to selling rare items in video games. But they can all be traded or held like any other cryptocurrency.

“Token” is a word that you hear a lot in cryptocurrency. In fact, you might hear Bitcoin described as a “crypto token” or something similar, because — technically — all crypto assets can also be described as tokens. But the word has increasingly taken on two specific meanings that are common enough that there’s a good chance you’ll encounter them.

- A “token” often refers to any cryptocurrency besides Bitcoin and Ethereum (even though they are also technically tokens). Because Bitcoin and Ethereum are by far the biggest two cryptocurrencies, it’s useful to have a word to describe the universe of other coins. (Another word you might hear with virtually the same meaning is “altcoin.”)

- The other increasingly common meaning for “token” has an even more specific connotation, which is to describe crypto assets that run on top of another cryptocurrency’s blockchain. You’ll encounter this usage if you become interested in decentralized finance (or DeFi). While a cryptocurrency like Bitcoin has its own dedicated blockchain, DeFi tokens like Chainlink and Aave run on top of, or leverage, an existing blockchain, most commonly Ethereum’s.

- Tokens in this second category help decentralized applications to do everything from automate interest rates to sell virtual real estate. But they can also be held or traded like any other cryptocurrency.

Understanding Crypto Tokens

Crypto tokens are digital assets built on top of blockchains, often used for specific purposes within a particular blockchain ecosystem. Here’s a breakdown to help you understand them better:

The Difference from Cryptocurrency:

- Cryptocurrency: Think of it as a digital cash (e.g., Bitcoin, Ethereum). Its main purpose is to be a medium of exchange, just like traditional currencies.

- Crypto Token: A broader category. Tokens represent various things like access to a service, voting rights in a project, or even ownership of digital assets. They can be used for investment or utility within a specific blockchain project.

How Crypto Tokens Work:

- Built on Existing Blockchains: Unlike cryptocurrencies like Bitcoin that have their own blockchains, tokens typically leverage existing blockchains like Ethereum. This makes them more efficient and faster to develop.

- Smart Contracts: These are self-executing contracts stored on the blockchain. They dictate the rules and functions of a token, automating tasks and ensuring trustless interactions.

Types of Crypto Tokens:

- Utility Tokens: Grant access to a specific service or functionality within a blockchain project. (e.g., tokens for using decentralized storage or gaming platforms)

- Security Tokens: Represent ownership in a real-world asset security (like stocks or bonds) that’s tokenized on a blockchain.

- Non-Fungible Tokens (NFTs): Unique digital assets that represent ownership of digital or real-world items. (e.g., digital art, collectibles, virtual land)

Benefits of Crypto Tokens:

- Efficiency: Tokens can facilitate faster and more secure transactions compared to traditional systems.

- Innovation: They enable new business models and applications within the blockchain ecosystem.

- Fundraising: Projects can raise capital by issuing tokens during Initial Coin Offerings (ICOs).

Things to Consider:

- Volatility: The value of crypto tokens can be highly volatile and speculative.

- Regulation: The regulatory landscape surrounding crypto tokens is still evolving.

- Scams: Be cautious of fraudulent projects offering tokens. Thorough research is crucial before investing.

By understanding crypto tokens, you can explore the potential they hold for various sectors and make informed decisions if you choose to interact with them.

History of Crypto Tokens

Although there were cryptocurrencies that forked from Bitcoin and Ethereum previous to the 2017 ICO boom, the first recognized ICO and token was Mastercoin. Mastercoin was created by J.R. Willet and announced on January 2012 via Bitcoin Forum. He titled his whitepaper “The Second Bitcoin Whitepaper.”

Mastercoin was one of the first projects to describe using layers to enhance a cryptocurrency’s functionality. The project linked the value of Mastercoin to Bitcoin’s value and explained how the project would use the funds to pay developers to create a way for users to make new coins from their Mastercoins.

The ICO Boom

Between 2012 and 2016, crypto token creation and ICO increased until 2017—token offerings skyrocketed as investors seemed to become aware of them and the possible increase in value they promised. Developers, businesses, and scammers began creating tokens rapidly in attempts to take advantage of the fund-raising boom—so much so that regulatory agencies began issuing alerts to investors warning them about the risks of ICOs.

How Crypto Tokens Work

Crypto or cryptography refers to the various encryption algorithms and cryptographic techniques that safeguard crypto tokens and currencies, such as elliptical curve encryption, public-private key pairs, and hashing functions. Cryptocurrencies, on the other hand, are virtual currencies on a blockchain. These systems that allow for secure online payments and the storing of value.

Crypto tokens are transactional units created on top of existing blockchains by blockchain companies or projects. They are created using standard templates like that of the Ethereum network. Such blockchains work on the concept of smart contracts or decentralized applications, wherein the programmable, self-executing code is used to process and manage the various transactions that occur.

Blockchain Basics:

Imagine a shared record-keeping system like a giant, secure spreadsheet everyone can see but no one can change. Information is grouped into blocks, chained together chronologically. Cryptography ensures data security and tamper-proof records. There’s no central authority, making it decentralized and resistant to manipulation. Transactions are verified by the network using mechanisms like proof of work.

Crypto Tokens Explained:

- Built on Existing Blockchains: Unlike cryptocurrencies with their own blockchains (e.g., Bitcoin), tokens typically leverage existing blockchains like Ethereum. This makes them more efficient and faster to develop.

- Smart Contract Powered: Smart contracts are self-executing programs stored on the blockchain. They dictate the rules and functions of a token, automating tasks and ensuring secure interactions without a middleman.

How Tokens Interact:

- Issuing Tokens: A project or organization creates a crypto token for a specific purpose within its blockchain ecosystem. This could be to raise funds, provide access to a service, or represent ownership of something.

- Initial Coin Offering (ICO): This is a common method for projects to raise capital by selling newly created tokens to investors. Investors use cryptocurrencies like Bitcoin or Ethereum to purchase the project’s tokens.

- Wallets and Exchanges: Crypto tokens are stored in digital wallets, similar to how you store cryptocurrency. You can buy and sell tokens on cryptocurrency exchanges.

- Utility within a Blockchain Project: The way tokens are used depends on their specific purpose. Here are some common examples:

- Utility Tokens: Used to access services or functionalities within a blockchain project (e.g., tokens to pay for storage on a decentralized cloud platform or in-game currency for a blockchain-based game).

- Security Tokens: Represent ownership of a real-world asset security (like stocks or bonds) that’s been tokenized on a blockchain. These can potentially streamline traditional investment processes.

- Non-Fungible Tokens (NFTs): Unique digital certificates of ownership for digital or real-world items (e.g., digital art, collectibles, virtual land in a metaverse).

In essence, crypto tokens are like special tools built on top of blockchains to serve specific purposes within a project’s ecosystem. They offer efficiency, innovation, and new funding mechanisms, but come with inherent risks like volatility and scams. By understanding how they work, you can make informed decisions about interacting with them.

Why are tokens important?

Given that you’ll come across the word a lot while researching cryptocurrencies, it’s useful to understand some common connotations. But besides the big-picture definitions in the section above, there are also some categories of crypto assets that actually have “token” in their name. Here are a few examples of those:

- DeFi tokens A new world of cryptocurrency-based protocols that aim to reproduce traditional financial-system functions (lending and saving, insurance, trading) has emerged in recent years. These protocols issue tokens that perform a wide variety of functions but can also be traded or held like any other cryptocurrency.

- Governance tokens These are specialized DeFi tokens that give holders a say in the future of a protocol or app, which (being decentralized) don’t have boards of directors or any other central authority. The popular savings protocol Compound, for example, issues all users a token called COMP. This token gives holders a vote in how Compound is upgraded. The more COMP tokens you have, the more votes you get.

- Non-Fungible Tokens (NFTs) NFTs represent ownership rights to a unique digital or real-world asset. They can be used to make it more difficult for digital creations to be copied and shared (an issue anyone who has ever visited a Torrent site full of the latest movies and video games understands). They’ve also been used to issue a limited number of digital artworks or sell unique virtual assets like rare items in a video game.

- Security tokens Security tokens are a new class of assets that aim to be the crypto equivalent of traditional securities like stocks and bonds. Their main use case is to sell shares in a company (very much like the shares or fractional shares sold via conventional markets) or other enterprises (for instance, real estate) without the need for a broker. Major companies and startups have been reported to be investigating security tokens as a potential alternative to other methods of fundraising.

Tokens have a wide range of functions, from facilitating decentralized exchanges to enabling the sale of rare items in video games. They can be traded and held like any other cryptocurrency. While the term token is often used to describe various crypto assets, it has increasingly gained two specific meanings that are commonly encountered. Understanding the different connotations and categories of tokens is important when researching cryptocurrencies. Some examples of crypto assets with token in their name include

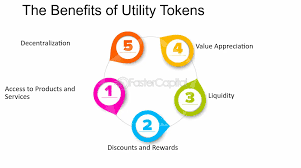

Features and Benefits of crypto tokens

Crypto tokens boast a range of features and benefits that contribute to their growing significance in the blockchain world. Here’s a breakdown of the key points:

Features:

- Built on Blockchains: Unlike cryptocurrencies with their own blockchains (e.g., Bitcoin), tokens leverage existing ones like Ethereum. This makes them more efficient and faster to develop.

- Smart Contract Powered: Smart contracts, self-executing programs on the blockchain, dictate how tokens function. They automate tasks and ensure trustless interactions within a project’s ecosystem.

- Variety of Types: Tokens cater to diverse purposes. Here are some common types:

- Utility Tokens: Provide access to specific services or functionalities within a blockchain project (e.g., tokens for cloud storage or online games).

- Security Tokens: Represent ownership of a real-world asset security (like stocks or bonds) that’s tokenized on a blockchain.

- Non-Fungible Tokens (NFTs): Unique digital certificates of ownership for digital or real-world items (e.g., digital art, collectibles, virtual land).

Benefits:

- Efficiency: Tokens can streamline transactions compared to traditional systems. They often operate faster and with lower fees due to the inherent efficiencies of blockchains.

- Innovation: Crypto tokens open doors to new business models and applications within the blockchain ecosystem. They can revolutionize industries by enabling novel ways of interacting and exchanging value.

- Fundraising: Projects can raise capital by issuing tokens during Initial Coin Offerings (ICOs). This approach allows for faster and potentially more democratic fundraising compared to traditional methods.

- Enhanced Security: Blockchain technology provides a secure foundation for tokens. Transactions are cryptographically secured, and smart contracts can automate processes to minimize human error and fraud.

- Fractional Ownership: Tokens can represent fractional ownership of assets, making them more accessible to a wider range of investors compared to traditional asset classes.

Additional Considerations:

- Volatility: The value of crypto tokens can fluctuate significantly, making them a speculative investment.

- Regulation: The regulatory landscape surrounding crypto tokens is still evolving, meaning potential changes in regulations could impact their use.

- Scams: Fraudulent projects offering tokens do exist. Thorough research is crucial before investing in any crypto token.

By understanding these features and benefits, you can gain a better grasp of the potential crypto tokens hold for various sectors. Remember, careful research is essential before considering any investment in crypto tokens due to the inherent risks involved.

Is crypto token Safe?

The safety of crypto tokens depends on several factors, and it’s important to understand the risks before investing or using them. Here’s a breakdown:

Potential Risks:

- Volatility: Crypto tokens can be highly volatile, meaning their prices can fluctuate significantly. This makes them a risky investment, and you could potentially lose a substantial amount of money.

- Scams: Unfortunately, the crypto space is susceptible to scams. Fraudulent projects might lure investors with unrealistic promises or exploit loopholes in smart contracts to steal funds.

- Exchange Hacks: Crypto tokens are stored on exchanges, which can be vulnerable to hacking attacks. If an exchange gets hacked, your tokens could be stolen.

- Regulatory Uncertainty: Regulations surrounding crypto tokens are still evolving. Changes in regulations could impact the value and utility of tokens.

- Technical Risks: Bugs or weaknesses in the underlying blockchain technology or smart contracts could lead to security vulnerabilities or unexpected outcomes.

Safety Measures:

- Research Thoroughly: Before investing in any crypto token, conduct in-depth research about the project, the team behind it, and the token’s utility. Look for reputable projects with well-defined white papers and a transparent development process.

- Use Secure Storage: Store your crypto tokens in a secure wallet, ideally a hardware wallet that offers better protection against hacks compared to online wallets.

- Invest Cautiously: Only invest what you can afford to lose, given the inherent volatility of crypto tokens. Consider them a high-risk investment.

- Stay Updated: Keep yourself informed about the latest developments in the crypto space, including regulatory changes and security vulnerabilities.

Overall:

Crypto tokens offer exciting possibilities, but they come with inherent risks. By understanding these risks and taking appropriate precautions, you can approach them with more informed decisions. Remember, never invest in something you don’t fully understand.

Summary of Crypto tokens

are like digital tools built on existing blockchains to serve specific purposes. Here’s a quick recap to solidify your understanding:

- Think of them as app-specific currencies: Unlike cryptocurrencies aiming to be a medium of exchange (like Bitcoin), tokens have various functionalities within a blockchain project’s ecosystem.

- Variety of flavors: There are different types of , each with its own use case. Common ones include:

- Utility tokens: Grant access to services or features within a blockchain project (e.g., to play a game or store data).

- Security tokens: Represent ownership of a real-world asset like stocks or bonds, but on a blockchain.

- NFTs (Non-Fungible Tokens): Unique digital certificates of ownership for digital or real-world items (e.g., digital art, collectibles).

Key Features:

- Built on existing blockchains: Leverage established blockchains like Ethereum for efficiency and faster development.

- Smart contract powered: Smart contracts automate tasks and govern how tokens function within a project.

Benefits:

- Efficiency: Transactions involving tokens can be faster and cheaper compared to traditional systems.

- Innovation: enable new business models and applications within the blockchain space.

- Fundraising: Projects can raise capital by issuing tokens during Initial Coin Offerings (ICOs).

- Security: Blockchain technology provides a secure foundation for , and smart contracts can minimize fraud.

- Fractional Ownership: Tokens can represent fractional ownership of assets, making them more accessible to investors.

Things to Consider:

- Volatility: Crypto can be risky investments due to their fluctuating prices.

- Scams: Be wary of fraudulent projects offering tokens. Do your research!

- Regulation: The regulatory landscape for crypto tokens is still evolving.

- Security Risks: Exchange hacks and vulnerabilities in smart contracts can pose threats.

Crypto tokens offer a glimpse into the future of various industries. By understanding the potential and the risks involved, you can make informed decisions about interacting with them.

Disclaimer

The Information provided on this website article does not constitute investment advice,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!

Leave feedback about this