Short for decentralized finance, DeFi is an umbrella term for peer-to-peer financial services on public blockchains, primarily Ethereum

DeFi (or “decentralized finance”) is an umbrella term for financial services on public blockchains, primarily Ethereum. you can do most of the things that banks support — earn interest, borrow, lend, buy insurance, trade derivatives, trade assets, and more — but it’s faster and doesn’t require paperwork or a third party. As with crypto generally, is global, peer-to-peer (meaning directly between two people, not routed through a centralized system), pseudonymous, a

Understanding DeFi: A Primer

DeFi, short for Decentralized Finance, is a revolutionary concept that aims to transform the traditional financial system by leveraging blockchain technology. Instead of relying on intermediaries like banks, DeFi platforms allow individuals to interact directly with each other for various financial services.

Key components of DeFi include:

- Cryptocurrencies: These serve as the digital currency for transactions within the DeFi ecosystem.

- Blockchain: This underlying technology ensures transparency, security, and immutability of transactions.

- Smart Contracts: These automate the execution of agreements, eliminating the need for intermediaries.

Common DeFi Services

- Lending and Borrowing: Users can lend their crypto assets to earn interest or borrow funds by using their assets as collateral.

- Decentralized Exchanges (DEXs): These platforms allow users to trade cryptocurrencies directly with each other without intermediaries.

- Yield Farming: This involves providing liquidity to DeFi platforms in exchange for rewards.

- Stablecoins: These cryptocurrencies are designed to maintain a stable price, often pegged to a fiat currency

Why is DeFi important?

DeFi takes the basic premise of Bitcoin — digital money — and expands on it, creating an entire digital alternative to Wall Street, but without all the associated costs (think office towers, trading floors, banker salaries). This has the potential to create more open, free, and fair financial markets that are accessible to anyone with an internet connection.

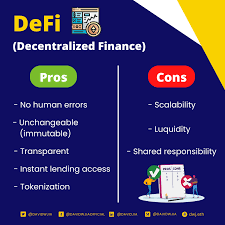

What are the benefits?

- Open: You don’t need to apply for anything or “open” an account. You just get access by creating a wallet.

- Pseudonymous: You don’t need to provide your name, email address, or any personal information.

- Flexible: You can move your assets anywhere at any time, without asking for permission, waiting for long transfers to finish, and paying expensive fees.

- Fast: Interest Rates and rewards often update rapidly (as quickly as every 15 seconds), and can be significantly higher than traditional Wall Street.

- Transparent: Everyone involved can see the full set of transactions (private corporations rarely grant that kind of transparency)

How does it work?

Users typically engage with DeFi via software called dapps (“decentralized apps”), most of which currently run on the Ethereum blockchain. Unlike a conventional bank, there is no application to fill out or account to open.

Here are some of the ways people are engaging with DeFi today:

- Lending: Lend out your crypto and earn interest and rewards every minute – not once per month.

- Getting a loan: Obtain a loan instantly without filling in paperwork, including extremely short-term “flash loans” that traditional financial institutions don’t offer.

- Trading: Make peer-to-peer trades of certain crypto assets — as if you could buy and sell stocks without any kind of brokerage.

- Saving for the future: Put some of your crypto into savings account alternatives and earn better interest rates than you’d typically get from a bank.

- Buying derivatives: Make long or short bets on certain assets. Think of these as the crypto version of stock options or futures contracts.

What are the downsides?

- Fluctuating transaction rates on the Ethereum blockchain mean that active trading can get expensive.

- Depending on which dapps you use and how you use them, your investment could experience high volatility – this is, after all, new tech.

- You have to maintain your own records for tax purposes. Regulations can vary from region to region.

Advantages of DeFi in the cryptocurrency world

DeFi has brought a revolution to the traditional financial system by offering services that are not controlled by any central authority such as banks or financial institutions.

Transactions are facilitated by smart contracts — self-executing contracts with the terms of the agreement directly written into code. This not only reduces costs and increases efficiency, but also democratizes the financial system by enabling anyone to create, execute, and validate transactions, irrespective of their location or financial status.

This has several advantages in the world of cryptocurrency. One of the key benefits is the democratization of finance. DeFi allows anyone with an internet connection to access financial products and services, removing geographic barriers and exclusionary practices often seen in traditional banking systems.

An estimated 1.7 billion adults globally do not have access to a bank account. DeFi can provide these individuals with access to financial services, such as savings and credit, which can lead to improved economic opportunities and financial security. This aspect of DeFi is not just transforming the financial landscape but also has the potential to contribute significantly to global economic equality.

Another major advantage is the potential for increased security and privacy. Since applications are built on blockchain technology, transactions are transparent and can be audited by anyone. This reduces the risk of fraud and corruption. In addition, since transactions are peer-to-peer, users have full control over their assets and personal information, unlike in traditional financial systems where banks and other institutions hold and control user data.

also offers more efficient and faster transactions. Traditional banking systems often involve lengthy processes and intermediaries which can slow down transactions. In contrast, operates round the clock, allowing instant, seamless transactions. This is particularly beneficial for cross-border transactions which can be slow and expensive in the traditional banking system.

Disadvantages of DeFi

Despite the numerous advantages, it’s important to acknowledge the potential downsides of in the realm of cryptocurrency.

One of the main disadvantages is the high level of technical expertise required to engage in DeFi practices. The complex nature of blockchain technology, smart contracts, and cryptocurrency can be daunting for beginners and less tech-savvy individuals. Without a comprehensive understanding of the mechanisms underlying DeFi, users are susceptible to making errors, which could lead to substantial financial losses.

Another major disadvantage of is the high number of risks associated with it. These include market volatility, smart contract failures, and hacking threats. Moreover, unlike traditional banking systems which offer insurance and consumer protection mechanisms, such safeguards are typically absent in the DeFi space. Therefore, users must bear the full risk of their investments.

Legal and regulatory uncertainties pose a critical challenge. Given the novelty of , many jurisdictions lack clear regulatory frameworks for it. This can lead to legal uncertainties and potential disputes.

As regulators worldwide are still grappling with how to manage and oversee this emerging field, there is a risk of future regulatory crackdowns that could impact the viability of certain projects.

The scalability issues of the Ethereum network, which hosts the majority of applications, also pose a significant challenge. High transaction costs and slow transaction speeds during peak periods could limit the usability and appeal of applications.

Features and Benefits of DeFi

, or Decentralized Finance, offers a new way to manage your money, cutting out traditional middlemen like banks. It utilizes blockchain technology to create a peer-to-peer financial network. Here’s a breakdown of key features and benefits:

Features:

- Decentralization: No central authority controls DeFi. Transactions are secured through cryptography and run on a distributed ledger.

- Permissionless: Anyone with an internet connection can access applications, promoting financial inclusion.

- Transparency: All transactions are publicly viewable on the blockchain, ensuring trust and immutability.

- Open Source: The underlying code for protocols is open for anyone to inspect and audit, fostering security.

Benefits:

- Accessibility: DeFi empowers anyone with a crypto wallet to participate in financial services, regardless of location or credit history.

- Innovation: DeFi fosters development of new financial products and services not limited by traditional institutions.

- Efficiency: Transactions are faster and cheaper compared to traditional finance due to automation via smart contracts.

- Potential for Higher Returns: DeFi offers opportunities for higher interest rates on borrowing and lending compared to traditional banks.

It’s important to remember that DeFi is still a developing field and comes with its own set of risks, such as high volatility and security vulnerabilities in smart contracts. Be sure to do your research before diving into DeFi.

Is DeFi Safe?

DeFi offers an exciting financial landscape, but safety is a crucial concern. Here’s a breakdown of DeFi’s security:

Risks:

- Smart Contract Bugs: Code vulnerabilities in DeFi’s self-executing contracts (smart contracts) can be exploited by hackers, leading to loss of funds.

- Rug Pulls: Malicious actors might create fake DeFi projects, steal invested funds, and disappear.

- Impermanent Loss: When supplying liquidity (providing funds to DeFi protocols), you might face impermanent loss due to price fluctuations.

- Complexity: DeFi can be intricate for beginners. Understanding the protocols and potential risks is crucial before investing.

Enhancing DeFi Safety:

- Code Audits: Reputable audits by security firms can help identify and fix vulnerabilities in smart contracts.

- Transparency: Look for projects with open-source code and active development communities for better oversight.

- Hardware Wallets: Store your cryptocurrencies in secure hardware wallets to minimize online hacking risks.

- Research & Due Diligence: Research projects thoroughly, understand their functionalities, and only invest what you can afford to lose.

Resources:

- DeFi Safety provides reviews on protocols to aid users.

DeFi isn’t inherently unsafe, but being aware of the risks and taking precautions is essential. By following safety practices and conducting thorough research, you can navigate the DeFi space with more confidence.

Disclaimer ||

The Information provided on this website article does not constitute investment advice,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!