Ether (ETH) can be used as a peer-to-peer ‘permissionless’ digital currency similar to Bitcoin. This means you don’t rely on an intermediary like a bank or payment provider. Instead, you’re free to send and receive ETH to whoever you want – whenever you want – without asking for permission (as long as you’re using a self-custody wallet like the Bitcoin.com Wallet app). And just like with Bitcoin, this is done pseudonymously, meaning your identity isn’t directly tied to your digital wallet.

It is also the currency used to pay for the resources of the Ethereum network. At the simplest level, this works nearly identically to Bitcoin. To send one ETH to your friend, for example, you must attach a fee which is paid in it. The fees goes to validators, who are network participants that ensure transactions are processed in accordance with the rules of the protocol.

However, the Ethereum network can do more than just move its around. That’s because Ethereum is designed to be a type of shared computer that is capable of, in theory, any type of computation. Seen thus, it is the fuel needed to power the computer. This means that whenever you want to use applications built on Ethereum, you’ll need to pay fees in it.

Table of Contents

Smart Contracts and Decentralized Applications (dApps)

Smart contracts are self-executing contracts with the terms of the agreement between buyer and seller being directly written into lines of code. They run on the Ethereum blockchain, automatically executing transactions and enforcing agreements when predefined conditions are met, without the need for intermediaries. This technology enables the creation of decentralized applications (dApps), which operate on a peer-to-peer network of computers rather than a single centralized server.

DApps built on it can serve a wide range of purposes, from financial tools and games to complex data management systems. The use of ETH as a form of payment for executing these smart contracts ensures that developers and users can transact and interact with dApps in a secure and decentralized manner. Learn about smart contracts and how applications are built on Ethereum.

DeFi (Decentralized Finance)

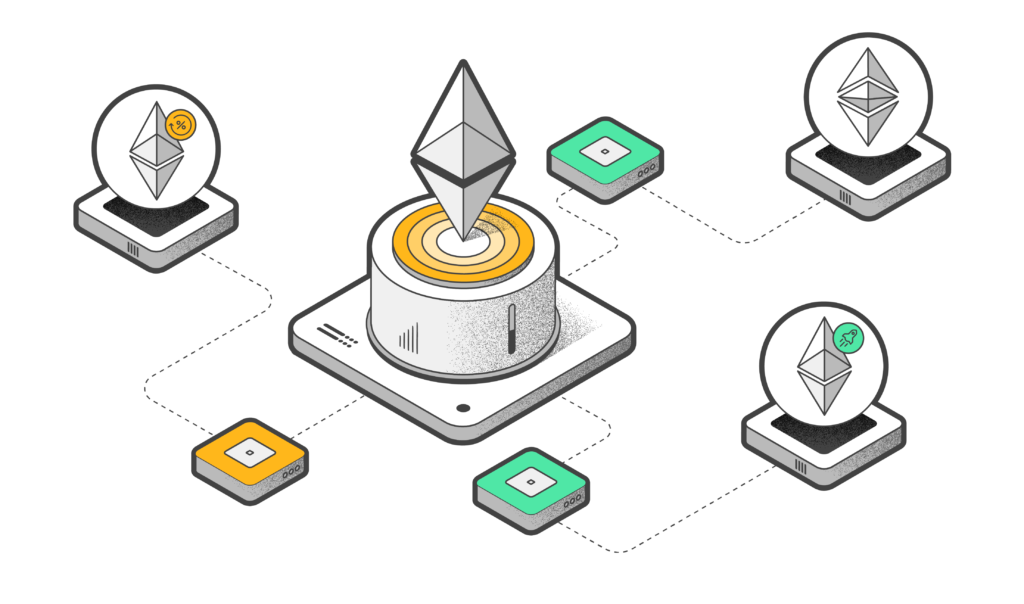

Decentralized Finance, or DeFi, represents a shift from traditional, centralized financial systems to peer-to-peer finance enabled by decentralized technologies built on the Ethereum blockchain. DeFi platforms allow users to lend, borrow, trade, and earn interest on their crypto assets without relying on traditional banks or financial institutions. These services are accessible to anyone, anywhere, as long as they have access to the internet and ETH to pay for transaction fees. The openness and accessibility of DeFi could potentially democratize access to financial services, offering greater inclusivity compared to the conventional financial system. It plays a crucial role in this ecosystem by facilitating transactions, executing smart contracts, and serving as collateral for various DeFi protocols.

What can you do with DeFi?

DeFi offers a vast array of financial services, including:

- Lending and Borrowing: Borrowers can access loans from lenders in a DeFi platform, often at competitive interest rates compared to traditional banks.

- Yield Farming: DeFi allows users to earn interest on their cryptocurrency holdings by depositing them into liquidity pools.

- Decentralized Exchanges (DEXs): Users can trade cryptocurrencies directly with each other on DEXs, eliminating the need for centralized exchanges.

- Insurance: DeFi offers innovative insurance products built on smart contracts, potentially providing more accessible and transparent coverage.

Benefits of DeFi

- Transparency and Immutability: Transactions on DeFi platforms are recorded on a public blockchain, ensuring transparency and immutability of financial data.

- Accessibility: DeFi removes barriers to entry, potentially offering financial services to anyone with an internet connection and a crypto wallet.

- Reduced Fees: By cutting out intermediaries, DeFi platforms can often offer lower fees compared to traditional financial services.

- Innovation: DeFi fosters innovation in financial products and services due to its open and permissionless nature.

NFTs (Non-Fungible Tokens)

Non-Fungible Tokens (NFTs) are unique digital assets that represent ownership or proof of authenticity of a wide range of tangible and intangible items, from art and music to virtual real estate and collectibles. Unlike cryptocurrencies such as Bitcoin or even ETH, which are fungible and can be exchanged on a one-to-one basis, each NFT has a distinct value and cannot be exchanged on a like-for-like basis. It’s blockchain supports the creation and trading of NFTs through its smart contract functionality, with ETH being used to buy, sell, or mint these digital assets. The NFT market has exploded in popularity, highlighting Ethereum’s role in pioneering new forms of digital ownership and the monetization of digital content.

How do NFTs Work?

NFTs reside on blockchains, which are distributed digital ledgers that track ownership transparently and securely. When a digital asset is turned into an NFT (often called “minting”), it’s linked to a unique identifier on the blockchain. This identifier tracks ownership and verifies its authenticity.

Benefits and Potential of NFTs

- Ownership and Authenticity: NFTs provide a clear and verifiable record of ownership for digital assets, tackling issues of piracy and fraud.

- Empowering Creators: Artists and creators can monetize their work directly through NFTs, fostering a new avenue for income generation.

- Digital Scarcity: NFTs create a sense of scarcity for digital assets, similar to how physical collectibles derive value from limited availability.

- New Investment Opportunities: NFTs are opening doors for new investment opportunities in the digital art and collectibles markets.

Staking and Ethereum 2.0

With the transition to Ethereum 2.0 and the shift from Proof of Work (PoW) to Proof of Stake (PoS), staking has become a central element of the network’s security and consensus mechanism. In PoS, ETH holders can lock up a portion of their tokens as a stake in the network, essentially acting as validators who propose and validate blocks of transactions.

Staking ETH not only helps secure the network but also allows stakeholders to earn rewards in proportion to their staked amount. This shift aims to reduce the network’s energy consumption significantly, making it more sustainable while increasing its scalability and security. As it continues to evolve, staking becomes an attractive option for users looking to contribute to the network’s security and earn rewards, thereby strengthening the ecosystem. Learn more about Ethereum 2.0.

Ethereum 2.0 leverages staking to achieve a more secure and efficient network. Here’s how it works:

- Validators: To become a validator on Ethereum 2.0, you need to stake 32 ETH. This stake acts as collateral, ensuring validators behave honestly. Validators are responsible for verifying transactions and adding new blocks.

- Rewards: Validators who perform their duties correctly earn rewards in the form of new ETH. These rewards incentivize participation and secure the network.

Benefits of Staking in Ethereum 2.0

- Security: A larger number of validators with staked ETH makes the network more resistant to attacks.

- Scalability: PoS is generally considered more scalable than PoW, potentially enabling it to handle more transactions per second.

- Energy Efficiency: Staking requires significantly less energy compared to mining with PoW.

- Earning Rewards: Staking provides a way for users to earn passive income on their it holdings.

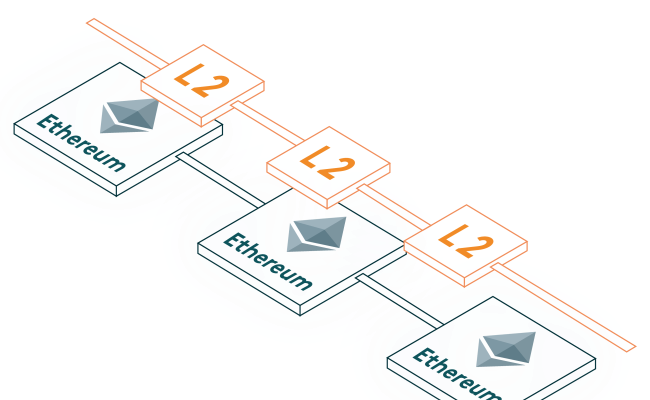

Layer 2 Scaling Solutions

As the Ethereum network has grown in popularity, so too have the demands on its capacity, leading to higher gas fees and slower transaction times during peak periods. Layer 2 scaling solutions, such as rollups and state channels, offer a way to handle transactions off the main Ethereum blockchain (Layer 1), while still ensuring the security and decentralization of the network. These solutions allow for faster and cheaper transactions by batching or processing them on a separate layer, then recording the final state on the main blockchain.

It remains integral to these operations, as transactions within these Layer 2 solutions often require it for fees or collateral. By leveraging these technologies, it aims to significantly increase its transaction throughput without sacrificing security or decentralization, making it more accessible and usable for everyday applications. Learn more about Ethereum layer-2 solutions

The Ethereum Virtual Machine (EVM)

The Ethereum Virtual Machine (EVM) is the heart of the Ethereum network, acting as a global, decentralized computing engine. The EVM interprets and executes the smart contracts written in Ethereum’s programming languages, such as Solidity. It ensures that every Ethereum node runs the same instructions, maintaining the blockchain’s integrity and consensus. It is used as “gas” to power these operations, compensating for the computational resources required to execute transactions and smart contracts. This mechanism prevents spam on the network and allocates resources efficiently. The flexibility and power of the EVM have enabled developers to build a wide array of decentralized applications, pushing the boundaries of what can be achieved with blockchain technology. Learn more about the Ethereum Virtual Machine.

The Ethereum Virtual Machine (EVM) is the engine that powers smart contracts on the Ethereum blockchain. It’s a decentralized virtual computer running on every Ethereum node across the globe. This virtual machine ensures consistent and secure execution of smart contracts written in languages like Solidity.

What does the EVM do?

The EVM plays a critical role in the Ethereum network by:

- Executing smart contracts: The EVM acts as a runtime environment for smart contracts, processing and carrying out the instructions they contain.

- Maintaining network state: It keeps track of the current state of the Ethereum blockchain, including account balances and application data.

- Enforcing security: The EVM operates like a sandboxed environment, ensuring code execution happens securely without affecting the underlying system.

Token Standards and ERC-20 Tokens

Token standards on the Ethereum blockchain, particularly the ERC-20 standard, have been instrumental in the widespread adoption of Ethereum for creating digital assets. ERC-20 defines a common list of rules that Ethereum tokens must adhere to, allowing for seamless interaction with smart contracts, decentralized applications, and other tokens. This standardization has facilitated the growth of a vibrant ecosystem of tokens serving various purposes, from representing digital currencies and assets to governance tokens that grant holders voting rights in decentralized protocols. ETH itself is used for transaction fees and gas costs when interacting with these tokens, reinforcing its position as the foundational currency of the Ethereum ecosystem.

Token Standards: Ensuring Compatibility

Think of token standards like a universal language for tokens on a blockchain. They define a set of rules and functions that tokens must adhere to. This ensures compatibility between tokens and allows them to interact seamlessly with wallets, exchanges, and other applications within the blockchain ecosystem.

ERC-20: The King of Fungible Tokens

Among various token standards, ERC-20 stands out as the most popular for creating fungible tokens on the Ethereum blockchain. Fungible tokens are essentially interchangeable, like dollar bills. Each ERC-20 token is identical to another of the same type, and they can be easily traded or exchanged for one another.

What Makes ERC-20 Special?

ERC-20’s widespread adoption can be attributed to several factors:

- Simplicity: The ERC-20 standard offers a well-defined and easy-to-understand set of functions, making it developer-friendly for creating new tokens.

- Interoperability: ERC-20 tokens are compatible with a wide range of Ethereum wallets, exchanges, and decentralized applications (DApps). This allows for smooth integration and easy trading.

- Versatility: ERC-20 tokens can represent various assets, including utility tokens (used within a specific DApp), security tokens (representing ownership in a real-world asset), and even stablecoins (pegged to a fiat currency).

How ERC-20 Works

The ERC-20 standard defines core functionalities such as:

- Total Supply: Specifying the total number of tokens ever created.

- BalanceOf: Checking the balance of a specific account’s tokens.

- Transfer: Sending tokens from one account to another.

- Approve: Granting permission for a third-party to transfer tokens on your behalf (useful for interacting with DApps).

Learn more about ERC-20 tokens.

Future Developments and Upcoming Projects

The Ethereum network is continuously evolving, with a robust roadmap of future developments aimed at enhancing its scalability, security, and functionality. Upcoming projects include further improvements to the consensus layer, the introduction of more advanced sharding mechanisms, and continued development of Layer 2 scaling solutions. These initiatives promise to make Ethereum more accessible, efficient, and sustainable, potentially lowering gas fees and increasing transaction throughput.

As these developments unfold, ETH will remain central to the network’s operations, serving as the primary currency for transaction fees, staking, and participating in the decentralized finance (DeFi) and non-fungible token (NFT) ecosystems. The ongoing growth and innovation within the Ethereum community highlight its commitment to maintaining its position as a leading platform for decentralized applications and smart contracts.

Disclaimer ||

The Information provided on this website article does not constitute investment advice ,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!

Leave feedback about this