Fantom [FTM ] is a smart contract-enabled blockchain platform aiming to address the decentralization, security and scalability tradeoffs many blockchains face.

These three elements are commonly referred to as the “blockchain trilemma,” meaning a focus on two has often required a tradeoff on the other. Fantom aims to overcome these tradeoffs and make improvements across all three with its innovative proof-of-stake (PoS) consensus mechanism known as Lachesis.

The native token of the Fantom network is FTM. It is used for staking, voting on crucial decisions, making payments and covering transaction fees.

What is Fantom?

Fantom (FTM) is a blockchain platform that provides infrastructure for decentralized applications (dApps) and smart contracts. The platform is built on a unique consensus mechanism that enables high transaction speeds without compromising decentralization or security. Additionally, Fantom is modular in design, allowing for various applications, including financial services, supply chain management, gaming, and more. With a strong team of developers, partners, and a growing user community, Fantom is considered a promising blockchain project.

Summary of Fantom

- Fantom (FTM) is a smart-contract platform that aims to solve the scalability challenges of other blockchains with its Lachesis consensus mechanism.

- FTM is the native token of the Fantom network. It is used for staking, voting, making payments and covering transaction fees on Fantom.

- Fantom has become a popular network because of its focus on scalability, allowing developers to build dApps and run smart contracts while also offering a native token (FTM) for staking and making payments.

Table of Contents

Why is Fantom valuable?

Fantom solves the scalability problems plaguing many traditional blockchains through its high-speed consensus mechanism, Lachesis. Lachesis is leaderless, offers finality, and provides Asynchronous Byzantine Fault Tolerance which allows the chain to scale without compromising on security.

Lachesis also improves transaction settlement; sending FTM on the network takes one second to clear and costs fractions of a penny to process.

Developers can also build dapps and run smart contracts on Fantom.

Currently, dozens of projects have deployed dapps on the network from application providers to protocols supporting Fantom’s work in the decentralized finance (DeFi) space. These include 1inch for cross-chain swaps, SushiSwap — one of the largest decentralized exchanges, BitGem and Bitlootbox NFTs and Travala — a travel booking service accepting cryptocurrency.

Finally, FTM tokens have a variety of uses on the network, including:

- Staking: Fantom operates on a proof-of-stake model, meaning the network relies on users locking up their FTM tokens to become validators. Owners can stake their tokens in this way to earn rewards paid in FTM.

- Governance: The decentralized nature of Fantom means that owning and staking FTM tokens allows holders to vote on crucial decisions about the platform’s future.

- Payments: Users can send FTM over the Fantom network quickly and more cost effectively compared to other blockchain networks.

- Fees: FTM tokens can be used to cover network fees for transacting tokens and deploying smart contracts on the Fantom blockchain.

How does Fantom work?

The Fantom network was built around four core principles:

- Modularity: Fantom’s modular architecture makes it highly customizable. For instance, users can easily port Ethereum-based decentralized applications (dApps) to the Fantom mainnet, which is powered by Opera – the open-source blockchain developed by Fantom to power its network.

- Scalability: Applications built on Fantom are independent of each other, meaning the performance and stability of one application is not affected by traffic on the wider network.

- Open source: Anyone can run a node and customize the underlying code of the Fantom protocol, which has been shared on Github.

- Security: Fantom (FTM) is secured by the Lachesis consensus mechanism, which the Fantom team says is faster, more secure and more scalable than the Classical and Nakamoto consensus systems.

Fantom (FTM) Advantages

Fantom (FTM) is a blockchain platform designed for decentralized applications (dApps) and smart contracts. It aims to address the challenges of scalability, security, and speed that plague some other blockchains. Here are some of the advantages of Fantom FTM:

- High transaction speeds: Fantom uses a unique consensus mechanism called Lachesis which allows for fast transaction processing times – typically under a second. This is much faster than platforms like Ethereum.

- Scalability: Fantom is designed to be scalable, meaning it can handle a large number of transactions without sacrificing speed or performance.

- Interoperability: Fantom is interoperable with other blockchains, meaning that dApps built on Fantom can interact with dApps built on other platforms.

- Energy efficiency: Fantom is a Proof-of-Stake (PoS) blockchain, which is significantly more energy efficient than Proof-of-Work (PoW) blockchains like Bitcoin.

- Modular architecture: Fantom’s modular design allows for a wide variety of applications to be built on the platform, including DeFi, supply chain management, and gaming.

It’s important to note that there are also some potential drawbacks to Fantom, such as the fact that the network is currently relatively centralized compared to some other blockchains. However, the advantages listed above make Fantom an attractive option for developers and users looking for a fast, scalable, and secure blockchain platform.

Fantom (FTM) Disadvantages

Here are some of the disadvantages to consider about Fantom (FTM):

- Less Established: Compared to giants like Ethereum, Fantom is a younger platform with a smaller user base and lower Total Value Locked (TVL) in its DeFi applications. This translates to less adoption and potentially less liquidity for FTM tokens.

- Centralized Validation: While Fantom is working towards decentralization, its current consensus mechanism relies on a set of validators chosen by the core team. This raises concerns about censorship and control compared to fully decentralized blockchains.

- Risk of Bugs and Security Issues: As with any new technology, Fantom is still under development and there’s a chance of undiscovered bugs or security vulnerabilities. This can be a risk for users who store funds or assets on the platform.

- Competition: The blockchain space is crowded with established players and rising stars. Fantom needs to keep innovating and attracting developers to stand out in the long run.

Who Created Fantom FTM and Why?

Fantom FTM was created by the Fantom Foundation, though there are some key figures worth mentioning:

- Dr. Ahn Byung Ik: A South Korean computer scientist is credited with the initial concept behind Fantom. He aimed to address scalability limitations in existing blockchains, particularly Ethereum.

- Michael Kong: Currently the CEO of the Fantom Foundation, Michael Kong played a significant role in the project’s development since its founding in 2016.

- Andre Cronje (advisor): Though not a founder, Andre Cronje, the mind behind the popular DeFi project Yearn Finance, served as an advisor and is credited with influencing Fantom’s development towards a multi-chain system.

The driving force behind Fantom’s creation was the need for a faster, more scalable, and secure platform for building decentralized applications (dApps). Existing blockchains, especially Ethereum at the time, were struggling with slow transaction times and high fees. Fantom aimed to solve these issues by introducing its unique Lachesis consensus mechanism and a focus on developer-friendly features.

The creation of Fantom FTM involved a team effort led by the Fantom Foundation. Here’s a breakdown of the key players and motivations:

- Concept (2018): Dr. Ahn Byung Ik, a computer scientist from South Korea, is credited with the initial idea for Fantom. He saw the limitations in scalability faced by existing blockchains, particularly Ethereum, and envisioned a faster and more efficient platform.

- Development and Leadership (2016 onwards): Michael Kong, who currently serves as CEO of the Fantom Foundation, played a crucial role in developing the project since its founding in 2016.

- Advisor and Multi-Chain Influence: While not a founder, Andre Cronje, the creator of the prominent DeFi project Yearn Finance, served as an advisor for Fantom. His influence is credited with shaping Fantom’s development towards becoming a multi-chain system, allowing for communication and interaction with other smart contract networks.

Motivation: The core motivation behind Fantom’s creation was the need for a blockchain platform that could overcome the limitations of existing ones. Specifically, the focus was on:

- Scalability: Existing blockchains, particularly Ethereum at the time, were struggling with handling a large volume of transactions, leading to slow speeds and high fees. Fantom aimed to be a more scalable solution.

- Speed: Faster transaction processing times were a key goal. Fantom’s Lachesis consensus mechanism was designed to achieve this.

- Security: Maintaining a secure platform for building decentralized applications (dApps) was another crucial aspect.

The Lachesis consensus mechanism explained

Fantom offers many features common to other cryptocurrency networks such as smart contracts, dApp deployment and transaction settlement. However, its Lachesis consensus mechanism is unique in the way it solves the scalability problems of existing blockchains.

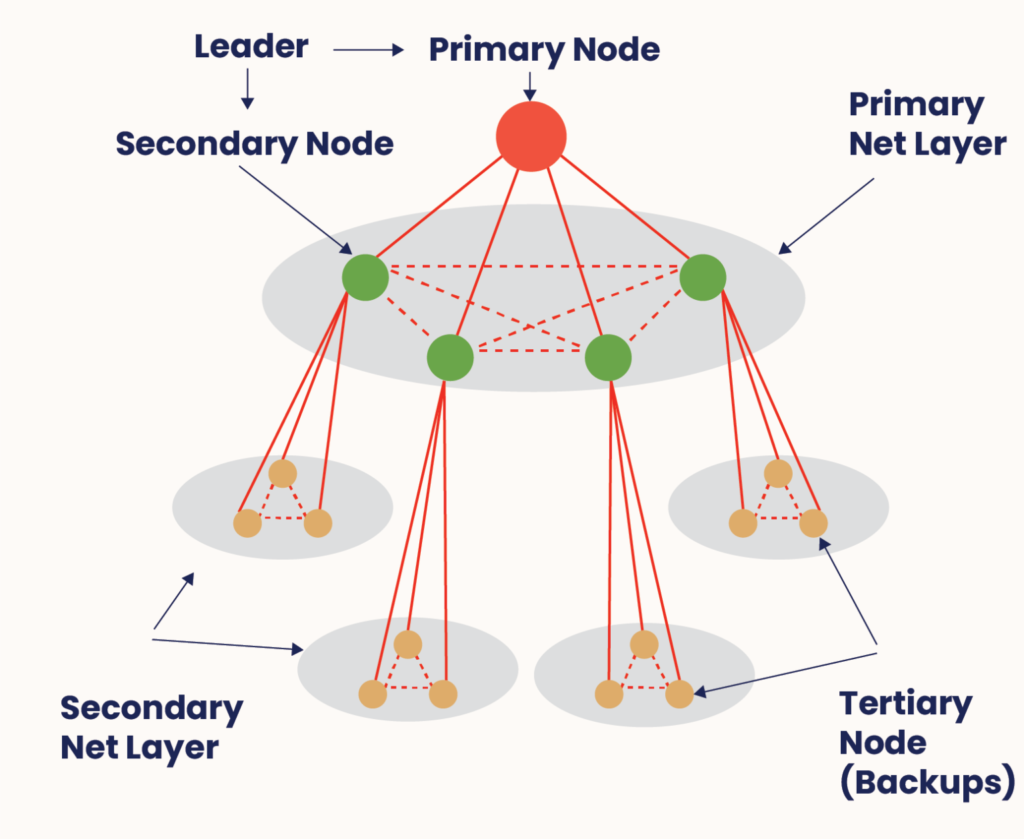

There are three main features of Lachesis:

- Finality: There’s no waiting for blockchain confirmations when sending FTM to another person, making transaction settlements significantly faster than most blockchains.

- Leaderless: Unlike traditional PoS protocols that often have fewer validators (leaders) to process transactions, Lachesis is leaderless. Being leaderless improves network security because the fate of the network does not rest with a select group of people who can make mistakes, take selfish actions or be influenced by attackers.

- Asynchronous Byzantine Fault Tolerance (aBFT): Nodes can reach honest consensus, even if some act maliciously, and regardless of how many do so. Asynchrony ensures all nodes don’t have to reach an agreement simultaneously.

Asynchronous Byzantine Fault Tolerance (aBFT) Explained

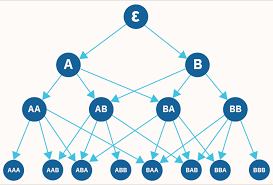

aBFT improves on Byzantine Fault Tolerance (BFT), which is based on the Byzantine Generals Problem.

As the problem goes, multiple generals struggle to organize a coordinated attack on a city because they are located at different points. Direct communication is impossible so they communicate over insecure channels, leading to trust issues between them. Messages can be intercepted or the generals themselves can choose to act dishonestly.

The generals in the example are the computer nodes on a decentralized network. This example describes a problem decentralized networks face — how to get participants with asymmetric information to agree on an outcome.

Byzantine Fault Tolerance (BFT) offers a solution. It lets nodes agree on the timing and order of transactions without needing to trust each other. This allows participants to arrive at a fair consensus even if some nodes act maliciously, by deciding to delay transactions for example. In short, a BFT system can still function if all nodes aren’t working as they should.

However, one problem with traditional BFT mechanisms is if the number of malicious nodes in the network is equal to or greater than one third of all nodes on the network, nodes in the network will not be able to reach an honest consensus.

aBFT removes this upper limit so a fair consensus can be reached even if more than a third of the nodes act maliciously. Messages can be lost or indefinitely delayed as aBFT assumes honest nodes’ messages will eventually go through. The network can still function with fewer operational nodes.

How Does Lachesis Work In Fantom?

While DAG allows swift validation of transactions, Lachesis provides security to the multiple chains deployed within the ecosystem.

But what is Lachelis?

For processing transactions and creating new blocks, blockchain needs some method to validate entries into a distributed database and keep the database secure. This validation method is called the consensus mechanism.

Fantom blockchain uses a “Lachesis Protocol” to achieve consensus. Lachesis, in turn, uses an Asynchronous Byzantine Fault Tolerant (aBFT) algorithm to attain high-performance data storage.

To better understand this complex terminology, let’s take a marketing team as an example.

Lachesis Protocol Example

- There is a marketing department in the company. The department has four leaders. Each leader has team members. All four want to build a successful campaign for the company. It means: that the goal is the same for all.

- They must send each member to the other company to figure out how to beat their rival. Still, this strategy has a problem: members could be drawn away by a higher salary, which would damage the whole campaign.

- One or two of these team leaders can also decide to change their minds at any time, disrupting the whole strategy.

So, how can you successfully execute this campaign without any compromise?

This example depicts a decentralized network or blockchain, with each team leader representing a node in the network.

Decentralization allows total independence, which might lead to rule-breaking.

And again, how can you secure a stable network and fair consensus among nodes?

The Byzantine Fault Tolerance (BFT) algorithm fixes this. It ensures a transparent, trustless network, even with malicious activities. Network nodes agree on transaction timing and block generation. Byzantine Fault Tolerance allows the network to reach a fair consensus even if a 1/3 of nodes block transactions.

Asynchronous Byzantine Fault Tolerance (aBFT) improves BFT by removing the time limit on delayed messages and allowing them to be lost entirely.

VERDICT: To understand how Fantom works, it is important to note that Fantom has employed Lachesis aBFT consensus protocol that can extend to multiple layers within the system. As a result, you need only 1–2 seconds to confirm a transaction. It’s a highly scalable protocol that ensures fast and high security on the Fantom network.

What Is Fantom Opera?

To fully understand how the Fantom network operates, it is necessary to refer to its mainnet too, which is called Opera.

A mainnet is an independent blockchain with its own network, technology, and protocol. It’s the outcome of a blockchain project, with cryptocurrencies or tokens with monetary value available to the public.

- Opera is an environment to build decentralized applications. It is fully permissionless and open-source. Powered by Fantom’s aBFT consensus algorithm, it leverages its speed and fast finality.

- Finality is the assurance or guarantees that cryptocurrency transactions cannot be altered, reversed, or canceled after they are completed.

The Opera chain was created by the Fantom Foundation to fix the problems of older blockchains.

Earlier, blockchains used mechanisms with probabilistic finality, which meant that transactions took a long time to complete. For example, Bitcoin’s average finality time (when the next block is mined and published) is about 60 minutes. Even though Ethereum is faster, the average time it takes to reach a final state is still 6 minutes. The Opera chain, on the other hand, can conclude in about one to two seconds.

It is a great result!

Is Fantom An Ethereum Killer?

When you read about Fantom’s impressive features and fast speeds, you may wonder: is Fantom an Ethereum killer?

Two main factors might lead to this consequence:

- See, Fantom is faster and can handle more transactions than Ethereum. Its transaction fee is only about a penny, much less than Ethereum’s. On the other hand, Ethereum’s gas fee is notoriously expensive and can quickly reach a hundred pounds at peak times. All of these things suggest that Fantom has a better chance of being used by a large number of people than Ethereum does.

- Fantom is also compatible with the Ethereum Virtual Machine (EVM). You can easily copy and paste things you’ve made on Ethereum and host them on Fantom.

Disclaimer ||

The Information provided on this website article does not constitute investment advice,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!