Flow is a blockchain network designed to support NFT collectibles and decentralized games. Dapper Labs, the creator of Flow, realized in 2017 that the current generation of blockchains can’t handle the swiftly increasing demand for Non-fungible tokens (NFTs).

Ethereum is the leading blockchain network that supports NFT collectibles but it only handles a limited amount of transactions at a time.

That’s why the Ethereum blockchain halted in 2017 when CryptoKitties (Created by Dapper Labs), one of the first NFT projects, was launched on this network. Dapper Labs decided to create its own blockchain network rather than waiting for Ethereum’s update.

Key Takeaways

- It is a Proof of Stake (PoS) blockchain explicitly designed for scalable Non-Fungible Token (NFT) use cases, enabling the creation and trading of digital assets.

- Dapper Labs developed this blockchain to address the issue of blockchain congestion, focusing on gaming and interactive experiences.

- It uses a unique proof of stake consensus mechanism involving four types of nodes: consensus, verification, execution, and collection, which work together for efficient transaction validation.

- It supports upgradeable smart contracts that can be enhanced and amended before finalization, maintaining atomic, consistent, isolated, and durable (ACID) transactions.

- Dapper Labs, the creator of Flow, has formed partnerships with various high-profile brands, including UFC, CNN, Dr. Suess, Samsung, Ubisoft, and Warner Music Group.

Table of Contents

What is FLOW?

Flow is a decentralized network designed for decentralized apps like NFT marketplaces and large-scale decentralized games. It solves the scalability issue without involving any sharding techniques. Unlike other blockchain networks, it can quickly complete transactions with a very low transaction fee.

Thus, it proves to be a great choice for NFT collectibles and decentralized games. It solves a few bigger problems found in major blockchain networks.

Improved Scalability

Ethereum is the most popular platform that can host NFT collectibles. But it can’t handle large-scale projects because it can only process 12-15 transactions per second. Flow, on the other hand, can process 1,000 transactions per second. And after the next update, it will have the ability to complete 10,000 transactions per second.

Another benefit of this network is that it uses a Proof-of-Stake consensus mechanism to complete the transaction process securely. Thus, it adds new blocks to the network faster than other networks.

Reduced Costs

The transaction fee on the Ethereum blockchain can be as high as $20 depending on the network’s availability. Flow only charges 0.000001 Flow tokens as a transaction fee. The users also need to pay 0.001 FLOW tokens for account creation. Still, its overall fee is a lot less than Ethereum.

Flexibility

The Ethereum users can’t make any changes to the smart contract once it’s executed. It enables users to introduce the beta version of the smart contract before it’s completely executed. The smart contract authors can update the code with time. The participants can continue working while the code is being updated.

However, if the authors have locked the smart contract, they won’t be able to change it at all.

Brief History of Flow

The flow was launched by Dapper Labs in 2019. The company raised around $11 million during its first funding round led by investor giant A16z. In October 2020, the company raised around $18 billion by selling these tokens on CoinList. Over the years, Dapper Labs has signed deals with major brands like NBA, Ubisoft, UFC, and Warner Music Group.

In late 2020, Dapper Labs gained a lot of reputation with the rising popularity of NBA Top Shot. Another funding round was carried out in early 2021 when the company raised $305 million for the development of blockchain-based games. As a result, the total valuation of Dapper Labs was raised to $2.6 billion.

Here’s a glimpse into their development:

Flow (Psychology):

- 1970s: Hungarian psychologist Mihály Csíkszentmihályi embarks on a quest to understand the optimal experiences reported by artists, athletes, and other high achievers.

- 1975: Csíkszentmihályi coins the term “Flow” to describe the state of complete absorption and energized focus individuals experience during these optimal moments.

- 1990s: Csíkszentmihályi publishes his seminal work, “Flow: The Psychology of Optimal Experience,” bringing the concept to a wider audience.

- Present Day: It remains a vital concept in positive psychology, with applications in education, work performance, and personal well-being.

Flow (Blockchain Platform):

- 2014: Dapper Labs, the company behind CryptoKitties, begins development on a blockchain platform specifically designed for games and digital collectibles.

- 2018: This blockchain platform is launched, offering a multi-role architecture and a focus on scalability and user experience.

- 2019: Major companies like Warner Music Group and the NBA partner with Dapper Labs to explore the potential of it for digital collectibles and blockchain-based games.

- Present Day: This platform continues to evolve, attracting developers and users with its focus on NFTs and dApps in the gaming and entertainment industry.

The Intersection:

While the psychological concept of it predates the blockchain platform by decades, there’s an interesting potential intersection. Understanding the psychology of it could be valuable for designing dApps and games that encourage users to enter states of focused engagement. Conversely, this platform could potentially facilitate experiences that promote it states in users who interact with its applications.

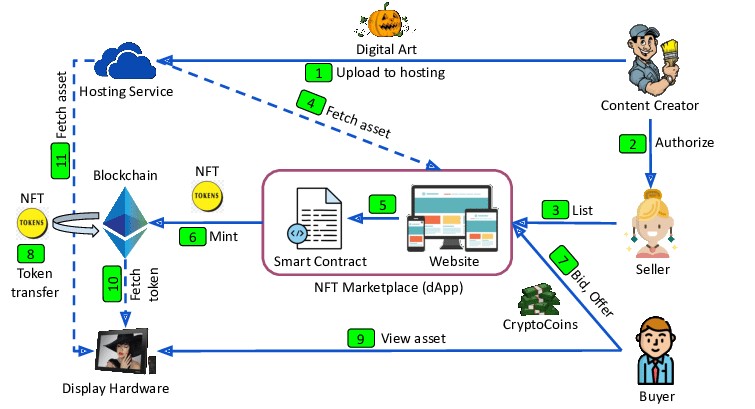

How Does Flow Work?

If you are familiar with how blockchains operate, then you know that they are generally made up of nodes that store the entire state of the currency’s history and verify all transactions.

Flow, by contrast, aims to create many subdivisions of its network to allow for the total work to be split across nodes, with each node only validating a subset of the transactions.

Architecture

To do this, the Flow blockchain employs a multi-node, multi-role architecture.

Put another way, it has divided the validation stages of a transaction into four different categories, dividing the responsibilities of each node:

- Collection Nodes – Enhance network connectivity and data availability for dapps

- Consensus Nodes – Decide the presence and order of transactions

- Execution Nodes – Perform computation associated with each transaction. These nodes do not have any decision making powers

- Verification Nodes – Double check the work done by the Execution Nodes.

Its creators argue this level of specialization allows each node to participate in the validation of every transaction, while splitting tasks to increase efficiency.

Developer tools

Today, in addition to NBA Top Shot and CryptoKitties, there are many products launching on it. Smart contracts on the Flow blockchain are written in Flow’s native language, Cadence.

Its team has created a website as a learning tool for developers who have never built blockchain applications to familiarize themselves with Cadence.

Another unique feature of this blockchain is that developers can release their dapp in beta, while updating the code as problems arise. Users will be alerted to these changes as they are interacting with the software.

Once the authors submit the final version of the code, it then becomes immutable, meaning that it cannot be changed again.

The Flow token

This token is the native cryptocurrency of the Flow network. The token serves as a reward system for users contributing to the network’s security and maintenance. It is also used to pay transaction fees and store (digital) value.

It utilizes a Proof of Stake (PoS) consensus mechanism where users stake tokens to validate and secure the network. By staking these tokens, users act as validators on the network and earn rewards in exchange for their contributions to network security. These rewards are distributed among validators based on the number of tokens they have staked.

The Technology Behind FLOW

The technology behind the Flow blockchain enables scalable and fast transactions while keeping the network secure and reliable. Key elements of it include:

- Corda: A unique core supporting multiple parallel chains instead of a single chain. Each parallel chain can be specifically designed to support different types of assets and applications, making the blockchain versatile and flexible.

- Proof of Stake consensus mechanism: Users stake FLOW tokens to validate and secure the network. Validators earn rewards in exchange for validating transactions and securing the network.

- Smart contracts: These allow the creation of programmable and decentralized applications on the network, enabling developers to build complex applications like decentralized marketplaces, identity verification, or financial instruments.

- Non-fungible tokens (NFTs): These can be used to create and trade unique digital assets, leading to the development of popular applications like NBA Top Shot, where users can buy and sell unique digital collectibles.

- Cadence: The programming language used to write smart contracts on this network.

- FLOW token: The native cryptocurrency of the Flow network used for payments, validator rewards, value storage, and dApps on this network.

Flow’s NFT Ecosystem

It hosts a number of NFT projects that are dominating the crypto industry.

CryptoKitties

The CryptoKitties participants can store their digital collectibles on this network. It offers lower transaction fees while introducing a number of new features that aren’t available on Ethereum.

VIV3 NFT Marketplace

VIV3 is an NFT marketplace that was launched in January 2021. This marketplace is dedicated to supporting digital artists and content creators. It displays the artwork of famous artists Ben Mauro and Anne Spalter.

NBA Top Shot

NBA Top Shot is one of the most popular NFT projects of all time. NBA Top Shot was originally launched on the Flow blockchain. The users can trade and store their favorite collectibles on this network. NBA Top Shot has more than 600 users including Tyrese Haliburton, Mark Cuban, and other celebrities.

Benefits of Flow

Some advantages of it that make it popular include:

- Popularity of popular applications like Cryptokitties & NBA Top Shot

- User-friendly and accessible for beginners

- High-quality partnerships with companies like Samsung, NBA, and Warner Music Group

- Integration with the sports and entertainment industry

- Developers can upgrade their smart contracts

Drawbacks of Flow

Investors should consider the following disadvantages:

- Complex technology that may deter developers

- Strong dependence on the NFT market

- Risk of centralization due to influential large investors

Understanding the Token Economy

The total supply of FLOW tokens is capped at 1.37 billion. A significant portion of these tokens are allocated to various stakeholders, including the team behind Flow, investors, and the community. The remaining tokens are gradually released into circulation through mechanisms like staking rewards and network fees.

Trading and Value:

This token can be traded on various cryptocurrency exchanges. The price of it fluctuates based on market forces, including supply and demand, overall market sentiment towards blockchain technologies, and the success of this platform itself.

The Importance of FLOW:

This token serves as the lifeblood of the Flow ecosystem. It incentivizes participation, secures the network, and potentially fuels future governance mechanisms. As the Flow platform evolves and attracts more users and developers, the value and utility of this token are likely to grow alongside it.

Additional Considerations:

It’s important to remember that the cryptocurrency market is inherently volatile. Investing in these tokens carries inherent risks, and you should always conduct your own research before making any investment decisions.

Who is the founder?

The founder of Flow is Dapper Labs, the company behind the CryptoKitties blockchain game. Under the leadership of founders Roham Gharegozlou, Dieter Shirley, and Mikhael Naayem, the team developed it as a platform for blockchain-based games and digital collectibles.

Flow Tokenomics

Flow is the native token of the Flow network that is used to process transactions within the network. This token holders can also participate in the validation process by staking their holdings. With a circulating supply of 1 billion tokens, it has a market cap of $2.47 billion. It ranks among the 40 best cryptocurrencies in terms of market cap.

This token is trading at $2.4 as of May 5, 2022. It reached an all-time high of $42.948 on April 5, 2021.

Its tokenomics refers to the design and distribution of this token within the Flow blockchain ecosystem. It encompasses aspects like the total supply, allocation of tokens, and how the token is used to incentivize participation and secure the network.

Key Aspects of Flow Tokenomics:

- Total Supply: There’s a fixed total supply of 1.37 billion FLOW tokens. This capped supply helps to control inflation and potentially increase the value of the token over time.

- Token Distribution: The initial distribution of this token is divided among various stakeholders:

- Team & Investors: A portion is allocated to the team behind it and early investors who helped fund the project’s development.

- Ecosystem Reserve: A significant amount is reserved for the Flow Foundation, which supports the growth of the Flow ecosystem through grants and programs.

- Staking Rewards: A portion is allocated for staking rewards, incentivizing users to lock up their tokens and contribute to network security.

- Community & Public Sale: A portion is made available through public sales and community initiatives, allowing broader participation in the ecosystem.

FLOW Token Utility:

The FLOW token serves several purposes within the Flow ecosystem:

- Transaction Fees: Users pay transaction fees in it when interacting with the network, such as transferring tokens, deploying smart contracts, or using dApps. These fees go towards rewarding validators who secure the network.

- Staking: Users can stake their FLOW tokens to earn rewards and contribute to the security of the network. Validators with a larger stake have a higher chance of being selected to process transactions and receive rewards.

- Governance (Future Potential): As this ecosystem matures, this token holders may be granted governance rights. This could involve voting on proposals that impact the platform’s development and direction.

- Utility Token (Limited Use): In some cases, this token can be used within dApps built on this platform for specific actions or in-game purchases. However, this utility is not as widespread as transaction fees or staking.

Future of Flow

Flow represents a significant advancement in blockchain technology, offering a scalable and developer-friendly platform for building decentralized applications and digital assets. With its innovative architecture, security features, and diverse use cases, it is poised to drive the mainstream adoption of blockchain technology across industries, revolutionizing how we interact with digital assets and decentralized applications. As the ecosystem continues to evolve, it remains at the forefront of innovation, empowering developers and users alike to participate in the decentralized future.

This blockchain is also being used by a number of other companies, including:

- Animoca Brands

- Ubisoft

- Warner Music Groupexclamation

Conclusion

Flow is one of the most popular crypto projects as it provides support for NFTs and decentralized games. It uses a proof-of-stake consensus protocol while incorporating a multi-role, multi-nodes infrastructure. It processes transactions faster than other networks and the transaction fee is as low as 0.000001 Flow tokens. If you need more information about how Flow netowrk works, feel free to reach out to us.

Disclaimer ||

The Information provided on this website article does not constitute investment advice ,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!

Leave feedback about this