Kava is a software protocol that uses multiple cryptocurrencies to allow its users to borrow and lend assets without the need for a traditional financial intermediary.

In this way, Kava is considered one of a number of emerging decentralized finance (DeFi) projects. However, whereas most DeFi projects run on Ethereum, Kava is instead built on Tendermint Core, a design decision its team argues adds additional functionality.

Users of its platform lock cryptocurrencies into smart contracts on Kava so that they can borrow loans denominated in USDX, one of the native cryptocurrencies of the Kava lending platform.

Kava leverages a feature in the Cosmos ecoystem called zones to manage the crypto assets it accepts, which then run in programs on independent networks. This allows the project to broaden the number of crypto assets borrowers can use to include XRP, BNB and Bitcoin, among others.

By collateralizing cryptocurrencies to mint USDX, users receive weekly rewards in the form of KAVA, Kava’s main utility cryptocurrency.

The total amount of KAVA users receive is dependent on the type of collateral used and how much USDX a user mints. As an example, minters using BNB as collateral receive a share of the 74,000 KAVA that the platform issues weekly.

If you wish to receive regular updates from the Kava team, including announcements on newly listed assets, you can bookmark the Kava blog.

Key takeaways:

- Kava is an herbal remedy that people take to help with stress and anxiety.

- Research on the benefits and risks of kava has had mixed findings.

- Most people can safely take kava in limited amounts. But there’s a small risk of potentially serious side effects, including liver problems.

Table of Contents

How Does Kava Work?

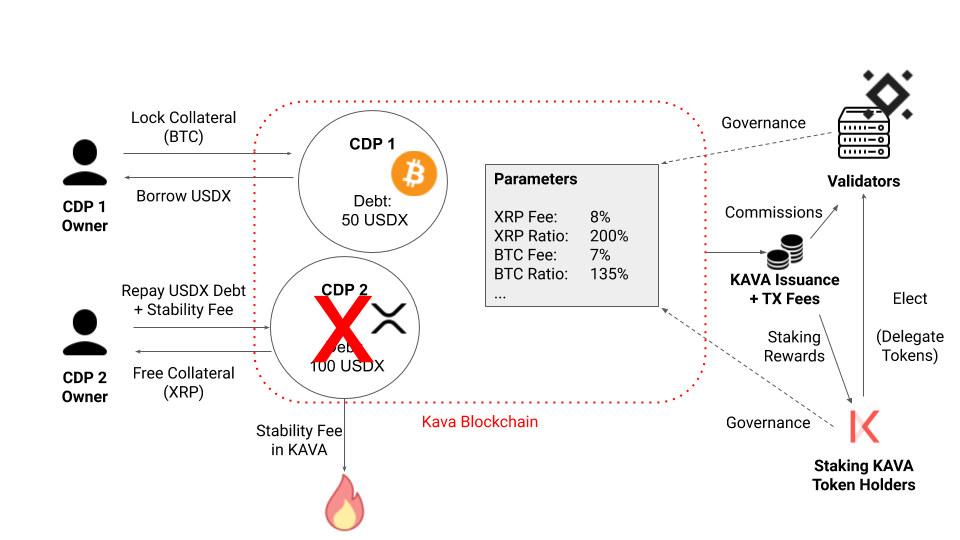

Kava allows users to lock assets in special smart contracts and borrow USDX.

On the back-end, this creates what is called a collateralized debt position (CDP), a contract designed to ensure the value of USDX remains pegged to the U.S. dollar.

To set up a CDP, users:

- Deposit crypto – Users can connect their wallets to deposit cryptocurrencies.

- Create a CDP – Kava locks the deposited cryptocurrency in a smart contract.

- Create USDX – Users are issued USDX loans based on the value of the CDP.

- Close a CDP – Users repay the debt plus a fee to unlock their collateralized crypto.

- Withdraw crypto – Once the crypto is returned to the user, Kava burns the USDX.

What is kava used for?

Kava for anxiety and stress relief are among the most common reasons that people take it. Other traditional uses of kava include:

- Pain relief

- Relaxation

- Sacred ritual purposes

Scientists are also studying kava’s effects for its potential uses in treating inflammation, brain-related conditions, and cancer. But these are new areas of research.

Short-term kava benefits

The research on kava’s benefits and safety has been mixed. But as a natural remedy for anxiety, there’s more evidence to support kava’s use than with other herbs and supplements.

Kava may help with short-term stress and worry, especially if a particular situation is the root cause. Kava may also help with symptoms of anxiety during menopause. But it’s probably less helpful for long-term or generalized anxiety. Keep in mind that there’s no data on the safety of using kava as a long-term treatment for anxiety.

Kava side effects

Many people assume that herbal remedies like kava don’t have side effects because they come from nature. But that’s not always the case. Here are some of kava kava’s possible side effects:

- Headache

- Dizziness

- Sleepiness

- Feeling down or depressed

- Diarrhea

- Numbness in the mouth, throat, or tongue

Kava interactions

Although it’s unusual to experience serious side effects when taking kava by itself, there’s potential for kava to interact with other substances and medications. Talk with a healthcare professional or pharmacist before taking kava with:

- Alcohol

- Medications that cause drowsiness, like sedatives

- Medications that affect the liver, like acetaminophen (Tylenol)

- Anxiety medications, like benzodiazepines

- Muscle relaxants

- Medications used to treat Parkinson’s disease

- Medications that are similar to dopamine as well as those that block dopamine, like haloperidol (Haldol)

- MAOIs (monoamine oxidase inhibitors)

The potential risks of these interactions include liver damage and coma. And, keep in mind, this isn’t a complete list of substances with which kava might interact.

The Kava Roadmap

Kava’s current roadmap is laid out by the KavaDAO and the Kava Strategic Vault, which sets forth milestones for the Kava ecosystem. Current initiatives underway have been decided via governance proposals from the KavaDAO, and voted upon by KAVA token holders.

Initiatives from the Kava Strategic Vault include:

- Smart Contract Interaction

- Infrastructure Improvements

- Scaling Initiatives

- Vault Diversification

- Strategic Developer Funding

- Cross-Chain Funding

The Kava Team

Kava’s team is led by Brian Kerr (CEO) and Scott Stuart (Product Manager). The team is composed of developers, designers, engineers, marketing & operations professionals working on the Kava Ecosystem. To learn more about the Kava team, more info can be found here.

What is kava root?

Kava root is the part of the kava plant used to create kava drinks and tea. You grind up the kava root, which contains the active ingredient, kavalactones (in fact, kavalactones represent 3-20% of the weight of the root).

Collateralization Ratio

You can think of the collateralization ratio as the mechanism that helps protect the protocol from volatility that would reduce the value of the collateral.

On Kava, USDX is over-collateralized, meaning that borrowers must deposit an amount that is higher than the value of USDX minted by the protocol. The ratio of debt-to-collateral is then used to calculate the liquidation price.

For example, a collateralization ratio of 200% would mean that a user will get $50 in USDX when they supply $100 in collateral. If the debt-to-collateral value drops below a specified threshold, the collateral held in smart contracts will be put up for auction and the collateral left will be returned to the users.

Why is Kava Unique?

This token is unique because it offers a secure and scalable, multi-chain, layer one blockchain, with seamless interoperability between two of the most popular Web3 blockchain ecosystems, Ethereum and Cosmos.

The token also has a unique set of incentives to onboard developers and builders creating DApps for the platform and ecosystem. Kava Rise is Kava’s $750 million Developer Incentive Program provides the funding to onboard developers.

Platform revenues are split between developers and validators verifying the blockchain’s transactions and staking these tokens. It plans to distribute 62.5 percent of newly minted KAVA tokens to developers creating DApps on Ethereum and Cosmos for the Kava blockchain. This makes Kava truly one of the first builder-owned blockchain networks.

Pros and Cons

Pros

- Cross-chain interoperability: Its ability to connect different blockchains allows for a wider range of assets and users.

- Decentralized Finance (DeFi) focus: It offers various DeFi services, including lending, borrowing, and staking, providing opportunities for users to earn rewards.

- USDX stablecoin: Backed by multiple assets, USDX offers a stable store of value within the token ecosystem.

- Potential for growth: As a relatively new project, it has the potential for significant growth and increased token value.

Cons

- Market volatility: Like all cryptocurrencies, its price is subject to significant fluctuations.

- Regulatory uncertainty: The cryptocurrency industry faces regulatory challenges, which could impact Kava.

- Competition: It competes with other DeFi platforms, which may limit its growth potential.

- Technical risks: As with any blockchain project, there are inherent technical risks, such as smart contract vulnerabilities.

The Kava Ecosystem

Because of its Developer Incentive program, Kava’s ecosystem is pretty active, with over 125 DApps currently available for its users. Popular DApps like Curve Finance, Sushi Trident, Kava Mint, Kava Lend, and Kava Earn, offer DeFi solutions and opportunities to earn on the Kava blockchain.

For developers, this token has a Discord, and any developer can submit a project to Kava Rise for funding, the project’s Github is available and documentation is also freely available. Those looking to build on it can reach out to the Kava community for support and advice at any step in the process.

It is a decentralized blockchain platform that combines the speed and interoperability of Cosmos with the developer power of Ethereum. This unique architecture allows for the creation of a robust and versatile ecosystem.

Key Features of the Kava Ecosystem

- Cross-chain interoperability: It can connect to multiple blockchains, expanding its potential for asset integration and user base.

- DeFi focus: The platform offers a range of decentralized financial services, including lending, borrowing, and staking.

- USDX stablecoin: Its stablecoin, USDX, provides a stable store of value within the ecosystem.

- EVM compatibility: Its support for Ethereum Virtual Machine (EVM) allows for compatibility with Ethereum-based applications and developers.

- Cosmos SDK integration: Leveraging the Cosmos SDK provides Kava with scalability and security benefits.

Core Components of the Kava Ecosystem

- KAVA token: The native cryptocurrency of the platform, used for governance, staking, and transaction fees.

- USDX stablecoin: A stablecoin pegged to the US dollar, providing a stable store of value.

- Decentralized exchange: Facilitates the trading of various cryptocurrencies within the ecosystem.

- Lending and borrowing platform: Allows users to lend and borrow crypto assets against collateral.

- Staking: Enables users to stake their tokens to secure the network and earn rewards.

Benefits of the Kava Ecosystem

- Diversified DeFi offerings: It provides a comprehensive suite of DeFi services, catering to a wide range of user needs.

- Interoperability: By connecting to other blockchains, it can access a broader range of assets and users.

- Security: Built on the Cosmos SDK, it benefits from a robust security framework.

- Scalability: The platform’s architecture allows for efficient handling of increased transaction volume.

Challenges and Opportunities

While it offers promising features, it also faces challenges such as market volatility, regulatory uncertainty, and competition from other DeFi platforms. However, the potential for growth and innovation within its ecosystem remains significant.

Kava Ecosystem Partners

- Ripple

- Cosmos

- Stakewith.us

- IOSG Venture

- Cosmostation

- Lemniscap

- Token Research Group

- Dokia Capital

- SNZ

- Coil

- Arrington XRP Capital

- Digital Asset Fund

- Chainlayer

- InfStones

- Node Team

- Figment Networks

What is the KAVA Token?

It is a multi-purpose utility and governance token. This token holders have voting rights to weigh in on decisions made around governance proposals put forth by the KavaDAO (Decentralised Autonomous Organisation).

This token holders also have the ability to earn 3-20 percent rewards in this token by staking or running a validator node to secure the network and verify transactions. Kava Validators can also earn fees and stability fees from users closing CDPs. Validators can also earn fees from users who delegate their KAVA for staking.

Functions of KAVA Token:

- Governance: This token holders have a say in the platform’s decision-making process. They can participate in voting on protocol upgrades, parameter changes, and other important matters.

- Staking: Users can stake their tokens to secure the network and earn rewards. Staking is essential for maintaining the platform’s stability and security.

- Incentives: It is used to incentivize users to participate in various DeFi activities within the ecosystem, such as lending, borrowing, and trading.

- Payment: It can be used to pay transaction fees on the Kava network.

Additional Points:

- Dual-Purpose Token: It is considered a dual-purpose token as it serves both governance and utility functions.

- Inflationary: This token has an inflationary supply, meaning the total amount of this token increases over time. This is a common mechanism in Proof-of-Stake (PoS) systems to reward validators and incentivize network participation.

What Gives Kava Value?

This token value is determined by the strength and relevancy of its technology, technical capacity, use case, and mainstream use. The intrinsic value of Kava is directly tied to its technology and utility. However, the intrinsic value of Kava often doesn’t coincide with the market value of KAVA tokens.

The price of this token is closely related to the effects of the volatile crypto market, which is why its price can often vary greatly with radical price changes within short periods. KAVA price is also affected by the activity of the dev team, developments, roadmap updates, upgrades, partnerships, new features, mergers, and in the case of it, by adding support for more cryptocurrencies.

Its value in the sense of technical capacity and real-life value is what could ultimately push the mainstream use of the Kava lending platform along with the expansion and development of DeFi.

How Many Kava (KAVA) Coins Are There in Circulation?

There are currently 1,082,856,222 KAVA in circulation out of a total of No data KAVA. In order to pay staking rewards, the total supply of KAVA is not limited. Kava is thus described as an inflationary cryptocurrency, which means that its supply increases over time. The annual inflation rate varies from a floor of 3% when a large amount of KAVA is staked to a ceiling of 20% when a small amount of it is staked.

The number of these coins in circulation multiplied by the current price in the market equals the market cap. The market cap dictates the rank of it in comparison with other cryptos in the market, and also determines its market share and dominance.

Other Technical Data

This token is the native token of its lending platform and is a dual-purpose token that is used for network governance and staking. Kava holders have ownership of the Kava protocol and voting rights on system changes and parameter changes, depending on the amount of these tokens they have.

This token holders can also have their own staking nodes, while only 100 nodes can earn rewards directly from the protocol as validators.

The total supply of KAVA coins may not be finite, but the system regulates the supply by burning this token periodically.

Is Kava safe?

The token platform has implemented several security measures to mitigate these risks.

Security Measures of Kava

- Proof of Stake (PoS) consensus mechanism: This mechanism requires token holders to stake their KAVA to validate transactions, making the network more secure and resistant to attacks.

- Regular security audits: It conducts regular security audits to identify and address potential vulnerabilities.

- Cosmos SDK: Built on the Cosmos SDK, it benefits from the security features of this robust framework.

Risks to Consider

- Market volatility: The cryptocurrency market is highly volatile, and the price of it can fluctuate significantly.

- Smart contract risks: While Kava has implemented measures to secure its smart contracts, vulnerabilities can still exist.

- Regulatory uncertainty: The regulatory landscape for cryptocurrencies is constantly evolving, which could impact it.

Conclusion

This token is a pivotal component of the Kava ecosystem, offering a blend of utility and governance. As a dual-purpose token, it empowers holders to participate in network governance while also providing incentives for staking and other DeFi activities.

This platform, with its cross-chain interoperability and DeFi focus, presents a unique opportunity for users to leverage the benefits of multiple blockchains. This token plays a crucial role in facilitating these interactions and driving the ecosystem’s growth.

However, it’s essential to remember that the cryptocurrency market is highly volatile. The value of this token, like any other cryptocurrency, can fluctuate significantly. Potential investors should conduct thorough research and consider the inherent risks before making investment decisions.

Ultimately, the success of this token is closely tied to the overall development and adoption of the Kava ecosystem. As the platform continues to evolve and attract more users, the demand for it could potentially increase, impacting its value.

Disclaimer ||

The Information provided on this website article does not constitute investment advice ,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!