KLAY is the default and native token used on the Klaytn blockchain. KLAY is primarily used as the utility token for all platform transactions as well as all other blockchain applications on the network.

Since its inception, the crypto industry has witnessed the birth of thousands of crypto assets. Each crypto asset has its own blockchain infrastructure. These blockchain infrastructures can be of four types: private, public, consortium, or hybrid. Typically, the type of blockchain determines the use cases for blockchain. Moreover, the talent required to build these solutions is rare and in high demand (not to mention the capital required).

Therefore, it’s a mammoth task to build your own blockchain. But, it’s obvious that there are a lot of benefits to be reaped from blockchain technology for businesses all around the world. Klaytn (KLAY) is one such blockchain platform that is making it possible for businesses to build their own blockchains and conduct their businesses on them. Let’s understand what Klaytn is and how it enables enterprises!

So, What is Klaytn?

Klaytn is a business-oriented public blockchain project that enables businesses to build and customise their own service-oriented blockchains. These mini blockchains are called service chains and they run autonomously as subnetworks. Moreover, Klaytn is a hybrid chain that combines the best public (decentralised data and distributed governance) and private blockchains (low latency and high scalability). Using this hybrid infrastructure, Klaytn provides a user-friendly blockchain experience. The service chains built on Klaytn has the same capabilities as the hybrid Klaytn chain viz., high performance, scalability, and productivity.

The service chains built on top of the KLAY architecture are flexible and easy to customise. Therefore, they can accommodate any kind of web service. For instance, financial services, insurance, buying and selling, merchandise, outsourcing, etc. However, with the exception of gambling and financial speculation.

Table of Contents

A brief history of Klaytn

Klaytn’s story began with KaKao, a renowned publicly traded technology company headquartered in South Korea.

Led by Yeo Min-Soo who acts as CEO, Kakao is known for a variety of services, one of which is the deployment of a mobile messaging application popularly known as ‘KaTalk’, specifically for smartphones operated by the Kakao corporation.

However, owing to its multifaceted business nature, Kakao’s attention was drawn to the cryptocurrency industry in 2017, around the time Bitcoin and other altcoins were experiencing a major bullish race.

Kakao couldn’t resist the urge to participate, especially given the growing interest from the likes of Facebook, and other players in the corporate world. As a result, the company went on to develop its own cryptocurrency, resulting in the creation of Klaytn.

Along the line, Kakao, like most other corporate bodies to have ventured into the crypto business, was also faced with several backlashes, and setbacks, with the heaviest of them coming from the country’s financial regulators. A close example would be Facebook, which also had a bulk of regulatory challenges at the pivotal stage of its LIBRA project.

Having scaled several hurdles, Kakao eventually achieved its crypto endeavors as it finally launched Klaytn in mid-2019. The majority of the success, however, was made possible with the help of its blockchain-based subsidiary, GroundX which played a very instrumental role in the eventual launch of the Klaytn blockchain.

Who Is Behind Klaytn?

KLAY was created by GroundX, a South Korean blockchain company founded by Jaesun Han. Before moving on to corporate roles, Han was a postdoctoral researcher at the Korea Advanced Institute of Science and Technology (KAIST), where he conducted research into distributed computing.

In 2007, Han founded NexR, a Korean-based company providing enterprise-level big data and cloud computing services across a wide range of industries. He initially stayed on as CEO after NexR was acquired by Korea Telecom, but left to co-found FuturePlay, a tech accelerator, and investment firm, in 2014. He left FuturePlay in 2018 to found GroundX, for which he currently serves as CEO.

Kakao’s global public blockchain project

GroundX is a subsidiary of Kakao, a South Korean Internet giant with significant investments across media, finance, and transportation. The company is best known for the KakaoTalk messaging app, which boasts over 50 million monthly active users and is installed on 93% of Korean phones.

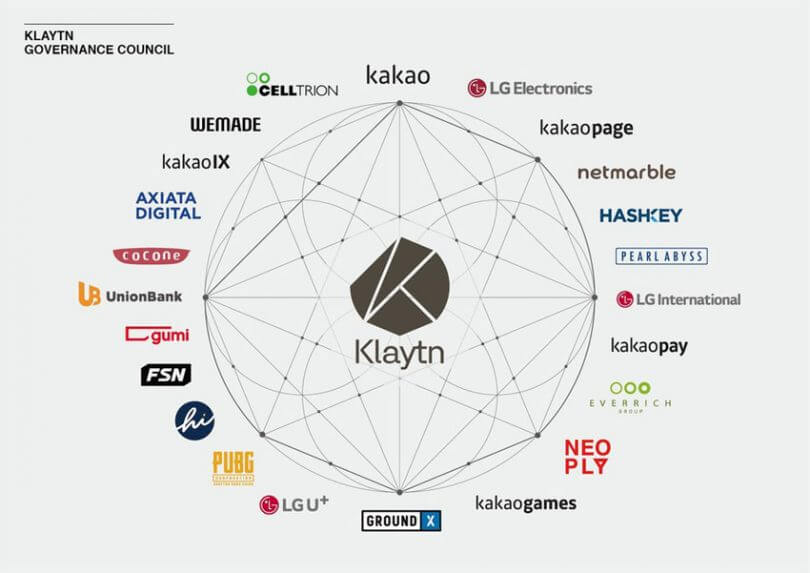

The project is managed by the KLAY Governance Council, an alliance of traditional and crypto organizations responsible for operating the consensus of the node network and driving ecosystem growth. Council members also participate in key technical decisions regarding account structures, transaction fee policies, and contribution metrics. The council includes notable names such as LG Electronics and MakerDAO.

Source: Klaytn Website

Klaytn’s inception and the way forward

KLAY was founded by KaKao, a publicly-traded company in South Korea. KaKao is the brain behind South Korea’s most popular messaging application KaKaoTalk. In addition to that, KaKao also has an incredibly successful taxi-hailing app and an online bank. In 2017, KaKao’s attention was drawn to the crypto industry due to the major bullish run of crypto assets. This led to the creation of Klaytn in 2019 with major help from its blockchain-based subsidiary, GroundX. The company had to face a lot of backlash and hurdles just like how Meta (formerly Facebook) did with their LIBRA project.

Since its inception, it has been able to gain a lot of traction. In 2019 alone it amassed more than 40 initial service partners. Currently, the number stands at around 150 service partners. Klaytn has gained momentum cutting across a wide spectrum of industries ranging from healthcare to entertainment and finance, among others. However, over the past few years, the Klaytn foundation has done a bit of course correction and wants to focus more heavily on metaverse projects. It has rebranded itself as an “open-source public blockchain for all who wish to build, work and play in the metaverse”. The next phase of Klaytn will deliver the performance, decentralisation, scalability, and interoperability…that are needed for building a metaverse economy.

How does Klaytn work?

To begin with, the Klaytn ecosystem addresses its service chains as blockchain applications (BApps). Now, since Klaytn is a business-focused blockchain, it substitutes the Proof-of-work (POW) and Proof-of-stake (POS) consensus mechanism with an enhanced version of Instabul Byzantine Fault Tolerance (IBFT). IBFT is a scaling consensus mechanism that addresses scaling concerns in order to enable the widespread adoption of blockchain technology at an enterprise level. This enables Klaytn to fully offer its hybrid infrastructure. However, Klaytn still allows beginners to employ the POS consensus mechanism via limited validators.

Moreover, the KLAY blockchain uses Ethereum Virtual Machine and functions closely like the Ethereum network. However, it works at a much faster pace processing four thousand unique transactions in a second while using one-tenth the gas price of Ethereum.

Along with that, it also offers a DX offering that allows for sharing data across service chains. Thus, helping the chains become interoperable. In addition to that, the transaction fees on the platform are predictable and low. This makes it easier for enterprises to adopt blockchain technology. Given that Klaytn is focused on enterprises, the governance on the platform is delegated to a board of Multinational corporations and organisations. As such, voting and proposing for improvements and activities are done by enterprises instead of token holders.

The Klaytn Token: A Snapshot

The KLAY token is the native token used on the Klaytn blockchain. The primary purpose of the token is to act as a utility token for all transactions and BApps. The KLAY coin is used to pay for creating and running BApps on the platform. The Klaytn ecosystem also has a reward mechanism called the Klaytn Improvement Reserve. Its purpose is to positively compensate the developers or participants that help the network’s growth or report bugs. The mode of compensation remains the KLAY token which can be used to buy services on the platform. The KLAY Improvement Reserve can also be used to incentivise participants which in turn helps in the growth of the platform.

Advantages and Disadvantages of KLAY

Klaytn is a useful tool for the creation and seamless operation of metaverse infrastructure, however, the project is not without its drawbacks.

Pros

The KLAY project makes it incredibly easy to create and build complex software using blockchain technology. Play-to-earn games, cryptocurrency wallets, and cryptocurrency exchanges are among the blockchain platforms that can benefit from Klaytn’s extensive tool kit. Examples of projects that are currently linked to Klaytn include MiR4, Metamask, Binance, and Opensea.

KLAY also helps foster innovative ideas, as its comprehensive tool kit makes the creation of the software much easier.

Cons

The major disadvantage that comes with Klaytn is the heavy competition it faces. The Klaytn network is still a relatively new project, and developers might opt for much more familiar names, such as Decentraland.

KLAY Price History

KLAY performed steadily in February before surging several times over the next few months. The token went from $0.54 on February 7 to $2.21 on May 7, representing a rise of roughly 320% over 3 months. After reaching its all-time high of $4.20 on March 30, Klaytn’s price has since corrected, decreasing by 47%.

Source: TradingView

Klaytn’s rise seems to largely be following the trend of the current bull market. Though the project is continuing at a steady pace, most of its partnerships and applications have been limited to the Korean market. This may indicate that Klaytn is being propelled more by Kakao’s business connections than the ecosystem’s own value.

KLAY is currently ranked #34 by market cap. At the moment, roughly 2.46 billion KLAY is in circulation. For each new block generated on the network, the new KLAY and sum of all transaction fees used in that block are aggregated and distributed across three separate accounts. The Klaytn Governance Council receives 34%, the blockchain consensus receives 54%, and the Klaytn Improvement Reserve receives 12%.

Klaytn BApp Ecosystem

Unlike other blockchain systems that address their hosted services as decentralised applications (DApps), Klaytn, on the other hand, addresses its service chains as Blockchain applications (BApps).

According to Klaytn’s official website, BApps are “first-class citizens in KLAY’s world” and are referred to as such because, unlike on other host blockchains, are not obligated to run decentralised web services on the service chain. Hence the availability of the option to employ POS consensus mechanism as a beginner.

Regardless, both centralised and decentralised BApps can benefit from Klaytn’s public mainnet as well as its blockchain-enabled transparency and security. For reference, these BApps are earlier referred to as ISPs which as of 2020 had grown to about 12 dozen on the Klaytn’s mainnet.

What consensus mechanism does KLAY use?

KLAY uses Istanbul Byzantine Fault Tolerance (BFT) as part of its hybrid consensus algorithm, which combines proof-of-work (PoW) and proof-of-stake (PoS).

In a PoW system, miners compete to solve complex mathematical problems in order to validate transactions and add them to the blockchain. This process requires a lot of computational power, and the miner who solves the problem first is rewarded with a certain amount of the cryptocurrency associated with the blockchain.

In a PoS system, on the other hand, validation of transactions is based on the amount of cryptocurrency that a user holds, rather than their computational power. Users who hold a large amount of the cryptocurrency are more likely to be chosen to validate transactions and add them to the blockchain, and they are rewarded with a share of the transaction fees for their work.

KLAY’s hybrid consensus algorithm combines the strengths of both PoW and PoS by using PoW for initial block validation and PoS for final block confirmation. This allows Klaytn to process transactions faster and more efficiently, while still maintaining a high level of security.

Istanbul Byzantine Fault Tolerance (BFT) is a consensus algorithm that is used to ensure the integrity and consistency of data on a blockchain. It is designed to be resistant to “Byzantine faults,” which are errors or malfunctions that can occur in a distributed system, such as a network of computers. Istanbul BFT is a consensus algorithm that allows nodes to come to a consensus on the state of the ledger, even if some nodes are experiencing errors or malfunctioning.

Istanbul BFT works by allowing nodes to communicate with each other and vote on the validity of transactions. If a sufficient number of nodes agree on the validity of a transaction, it is added to the ledger. If there is not enough agreement, the transaction is rejected. This process helps to ensure that only valid transactions are added to the ledger and that the ledger remains consistent and accurate.

Istanbul BFT is used by Ethereum and Klaytn. It is relatively fast and efficient, and it is resistant to a wide range of faults and errors.

In KLAY’s updated Istanbul BFT, three nodes “talk” to each other to instantly verify and reach a consensus on the generated block. The three types of nodes are Consensus Nodes (CN), Proxy Nodes (PN), and Endpoint Nodes (EN). Core Cell Operators manage CNs and block generation.

Klaytn governance

As you would expect of an enterprise-focused blockchain, KLAY delegated the governing activities to a board that consists of multinational businesses and organisations, instead of adopting the common method employed by most of the host blockchain where token holders can participate in the network’s governance.

Source | | KLAYTN Governance Council

On the other hand, the governing council members on Klaytn’s board are in charge of proposing, and voting for or against any improvements and activities within the network. These board members also get to oversee the activities of their node networks or simply put, service chains.

Ultimately, the governing board members are responsible for the growth and development of the platform’s ecosystem.

Klaytn Improvement Reserve (KIR)

KLAY Improvement Reserve, or KIR, is the platform’s reward mechanism through which developers or participants who positively contribute to the network’s growth can be compensated.

Specifically, when a governing board member submits a proposal towards the growth of the overall network, or perhaps, one that improves its user experience, they can be incentivised for their contribution via the KIR protocol.

In addition, KIR also allows partners to seamlessly integrate innovative smart contract-based applications at a reasonable speed, and predictable fees.

What Is the Future for KLAY?

KLAY has taken a more generalist approach to blockchain development. While other projects seek to gain dominance in a specific niche (such as media delivery or NFTs), Klaytn is looking to attract applications from all parts of the crypto space. By delivering on both accessibility and interoperability, Klaytn is developing a platform targeted at users and enterprises with little crypto experience.

A key advantage that Klaytn has over its competitors is credibility. While traditional companies may have concerns about teams with few corporate credentials, GroundX is owned by a highly established company with a wealth of experience and resources. The token’s governance structure is directly controlled by participating companies, many of which are leading names in the crypto and tech industries.

KLAY has built a strong network of partnerships in South Korea, but so far has not had much success breaking out of its home region. However, the project has been making some strides. It has recently established relationships with other crypto projects such as Chainlink (LINK) for DeFi/DEX oracle applications and Dai (DAI) to develop KlaytnDai (KDAI), a derivative stablecoin.

Conclusion

The Klaytn blockchain is a public blockchain that seeks to enable enterprises to build their own semi-blockchains to conduct their businesses. So far Klaytn has garnered a lot of traction from multiple industries. However, going forward their focus is on enabling metaverse businesses. The native token of the platform is called KLAY token and is used for transaction fees and as a reward.

Disclaimer ||

The Information provided on this website article does not constitute investment advice ,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!

Leave feedback about this