Pyth Network is a blockchain-based oracle solution that helps provide real-world data to smart contracts.

Blockchains are designed to be insular, meaning that they are purposely shut off from other sources of information. This is done to ensure that on-chain data is as pure, provable, and correct as possible. While this model may guarantee trustless systems, it is impractical for more widespread adoption because it ignores the outside world that is becoming more connected every day.

Oracles were developed to solve this issue by bridging closed blockchain systems and the real world. These third-party systems create an infrastructure for accurate data transfer to-and-from smart contracts. The concept of blockchain oracles has existed almost since the origin of smart contracts themselves. Early efforts included Augur (a decentralized prediction market conceived in 2014) and Oraclize (which later rebranded to Provable Things). However, Chainlink quickly became the quintessential entry in the market, with its reliable price feeds for decentralized finance (DeFi) protocols.

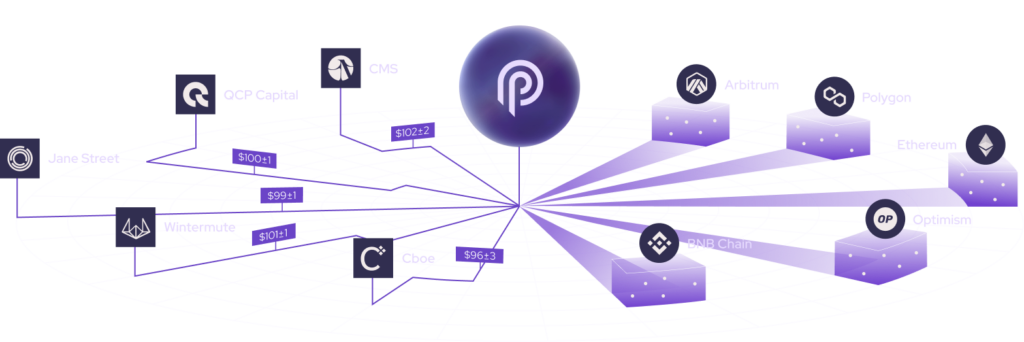

Launched in 2021, Pyth Network is an oracle originally designed for the Solana blockchain. It has become a multi-chain solution for providing pricing data to the DeFi space. Like Chainlink, Pyth serves the role of an oracle by providing real-world data to on-chain protocols, but its data providers are the main difference. Whereas Chainlink’s pricing data comes from node operators, Pyth’s comes from financial institutions.

PYTH is the network’s governance token, allowing holders to vote for changes to Pyth’s development.

Table of Contents

How was Pyth Network developed?

Pyth Network developed in an incubator program run by Jump Crypto, an arm of Jump Crypto Group, a large trading firm based in Chicago. This formative connection to traditional finance (TradFi) helped foster the relationships that the project uses to retrieve real-world data.

The team behind Pyth founded Douro Labs in 2023 to oversee the project’s development. Duoro is based in Porto, Portugal and led by Michael Cahill (CEO), Ciarán Cronin (COO), and Jayant Krishnamurthy (CTO). All three have backgrounds at Jump to go along with various experiences in finance and software engineering.

Since its inception, it has partnered with—and fundraised from—several large players in both the TradFi and crypto spaces. This includes Jump Trading, Virtu Financial, Multicoin Capital, CoinShares, and the now-defunct FTX and Alameda Research. Pyth launched as a Solana-based protocol in April 2021, and boasted almost 100 data providers by December 2023. In fact, one of the earliest data providers was Bitstamp, who joined in 2021.

By March 2024, Pyth could claim more than $5 billion in total valued secured (TVS) assets, accounting for nearly 10% of the oracles space behind projects such as Chainlink and Chronicle. Further, at that time nearly 10% of all Solana transactions were attributable to Pyth. Through the end of 2023 and into 2024, the development team also focused on making Pyth a cross-chain solution, allowing support for Arbitrum, Avalanche, Hedera, and many other blockchains.

The History of Pyth Network

Pyth was founded to provide high-quality pricing data to decentralized finance (DeFi) markets. It was first announced in April 2021 and incubated by Jump Trading, before forking off as an independent company in ‘23 (Douro Labs; Michael Cahill, Jayant Krishnamurthy, and Ciarán Cronin).

Pyth’s mainnet launched on Solana in August 2021, initially offering price feeds for over 30 crypto assets across Solana, Ethereum, and Terra blockchains. By the end of 2021, it had onboarded over 40 data providers.

In August 2022, Pyth launched its own proof-of-authority Pythnet blockchain, forked from Solana’s codebase. Through integration with Wormhole, Pyth expanded price feed support to eight networks by the end of 2022.

In November 2023, Pyth announced a retrospective airdrop of its PYTH governance token to active DeFi users, community members, and price feed-utilizing protocols. This airdrop coincided with the launch of Pyth’s on-chain governance system.

How does Pyth Network work?

Pyth is designed to be a highly accurate and efficient oracle, feeding asset pricing data (e.g., the prices of crypto assets such as BTC and ETH, as well as non-crypto assets like equities) into on-chain DeFi protocols. In this case, “accuracy” refers to the veracity of the asset prices provided by the network, and “efficiency” refers to high-frequency and low-latency updates. Put another way, Pyth aims to provide correct data to its end-users—smart contracts and the crypto traders who use them—as quickly as possible.

The network accomplishes this by using a two-participant system. Consumers are users of smart contracts that pull from Pyth’s pricing feeds, and they are charged a flat rate per request (“update”). Publishers are market participants like trading companies, exchanges, and other financial institutions who provide price data to the network and collect fees from consumers for this service. By using these first-party sources of data, rather than third-party aggregators, Pyth can promise speed and accuracy. However, the project has faced scrutiny because some see this as a form of centralization within the DeFi space.

The protocol’s Pythnet appchain (application blockchain) is a fork of Solana in which each publisher runs a validator on a Proof of Authority (PoA) network. Pythnet aggregates prices from all publishers, so each asset it lists has one reference price. These prices are then broadcast across blockchains through pre-existing cross-chain messaging protocols to on-chain contracts, allowing Pyth’s data to reach users on any number of networks. Furthermore, data is only transferred when users request (“pull”) it, which is more gas-efficient than other oracles that “push” data regardless of demand for it.

The network’s operation is underpinned by several key components and processes:

- Publishers

Entities like crypto exchanges and trading firms that supply frequent price updates for various financial assets. For example, an exchange might publish BTC/USD prices, while a trading firm could provide Tesla’s stock price. The effectiveness of Pyth Network depends on the precision and promptness of data from these publishers.

- Aggregation Algorithm

Pyth Network uses a sophisticated weighted median algorithm for data aggregation. This method calculates a median of the prices, giving more weight to publishers known for accuracy and higher staking amounts. This approach guards against manipulation, ensuring data integrity and reliability.

- Economic Incentives

Publishers are motivated to deliver high-quality data through rewards linked to the quality of their price feeds. They also gain a share of the data fees paid by users, aligning their interests with the network’s objective of accurate data provision.

- Real-Time Data Updates

A key feature is its rapid data refresh rate, vital for applications needing current information. This feature establishes Pyth Network as a leading solution for real-time financial data in the blockchain environment.

Pyth Network Pros and Cons

Pros

- Democratizes financial data

- Supports DeFi applications

- Decentralized and transparent

- Advanced technical framework

Cons

- Complexity and technical challenges

- Dependence on participant integrity

- Emerging technology risks

Pros Explained

Democratizes Financial Data: Pyth Network’s greatest strength is in making high-quality financial data accessible to a wider audience. This democratization breaks down traditional barriers, allowing individuals and small entities to access information previously available only to large financial institutions.

Supports DeFi Applications: By providing reliable data feeds, it becomes a crucial component for various DeFi applications. It enhances their efficiency and reliability, enabling more complex and varied financial products and services on the blockchain.

Decentralized and Transparent: The network’s decentralized nature ensures transparency and fairness in the financial sector. This transparency is crucial for trust and accountability in financial transactions and applications.

Advanced Technical Framework: Pyth Network’s sophisticated aggregation algorithms and rapid data refresh rates position it as a technically superior platform compared to its peers. This technical excellence is vital for real-time decision-making in financial markets.

Cons Explained

Complexity and Technical Challenges: Despite its advantages, the technical complexity of Pyth Network might pose a barrier to entry for some users. Understanding and effectively utilizing the network requires a certain level of technical expertise.

Dependence on Participant Integrity: The network relies heavily on the honesty and effectiveness of its participants. The accuracy and reliability of the data depend on the quality of information provided by publishers, which could be a point of vulnerability.

Emerging Technology Risks: Being a relatively new and evolving technology, Pyth Network faces risks associated with adoption and integration into existing systems. The network must continuously adapt to changing market dynamics and technological advancements.

Stakeholders in Pyth Network

Pyth Network revolves around three main stakeholder groups:

- Consumers: These are the users of the price feeds, mainly smart contracts and DeFi protocols. On Solana (Pyth v1), these feeds are free, while off-chain access via Pythnet (v2) incurs small fees.

- Publishers: They are responsible for publishing prices and are compensated with PYTH token rewards and a portion of data fees. They must stake PYTH tokens and risk being slashed for errors.

- Delegators: PYTH token holders who stake on price feeds, influencing publisher weights and earning insurance fees. They also face slashing risks if errors occur in the feeds they support.

What are $PYTH Tokens?

The PYTH token is the native cryptocurrency of Pyth Network. It plays a crucial role in coordinating the activities of various participants through crypto-economic incentives.

PYTH tokens are key to aligning the interests of different stakeholders in the network, such as publishers, consumers, and delegators.

In the Pyth Network ecosystem, these tokens are utilized in several important functions, including data staking, distribution of rewards, and governance. This makes them central to both the operational and strategic decision-making processes within the network.

How is the PYTH token used?

PYTH is used for governance of the Pyth Network.

Community members can obtain PYTH tokens to participate in votes that direct Pyth’s development, like setting fees, guiding rewards for data publishers, approving updates, and defining how assets are listed on the network.

Why Pyth Network is a Game-Changer Among Blockchain Oracles

The threefold model allows Pyth Network to address the limitations of traditional oracles by focusing on speed, coverage, and sourcing/quality of data:

– Low-Latency, High-Frequency Updates: While traditional oracles struggled with slow update times, Pythnet updates each Pyth Price Feed multiple times per second, ensuring that decentralized applications can access the most recent off-chain prices for every transaction. This approach provides a level of updates that was previously impractical.

– Price Feed Coverage and Multi-Chain Availability: Pyth’s technical capabilities enable it to scale to thousands of price feeds. Supported by Solana’s high-throughput and cost-effective transactions, Pyth Price Feeds are accessible on all Pyth-supported blockchains by default. This eliminates the need for individual deployments on each target chain, making Pyth a compelling oracle for launching new data feeds. Because of this, Pyth Network is able to support more than 40 blockchains at the time of writing.

– High-Resolution, High-Fidelity, Transparent Data: By focusing on “first-party” data, Pyth ensures accurate prices, as data providers actively participate in price discovery. The transparency of Pyth Network’s aggregation mechanism allows users to trace each data point back to the public keys of the data providers. This transparency, combined with the reputational alignment of data providers, reduces the risk of unfair tampering.

What PYTH Is Used For

The PYTH token’s single designated use case within the Pyth Network ecosystem is to facilitate on-chain governance voting for community proposals.

In order to participate in the governance voting process, (have your PYTH tokens count towards voting weights) tokens are locked up in Pyth’s staking program.

PYTH is a governance token for voting on proposals, and one can only vote if one locks their PYTH tokens

Maximum Total Supply: 10 billion PYTH tokens

Initial Circulating Supply at Launch: 1.5 billion PYTH

Token Unlocking Schedule: 85% of the total supply was initially locked, with a vesting period to gradually unlock tokens over 6, 18, 30, and 42 months following launch.

And tokens are distributed across various stakeholders like data providers, developers, community marketing and fundraising, early investors, etc. to “bootstrap and nurture” the Pyth ecosystem.

Token economics and distribution

There is a maximum total supply of 10 billion PYTH. The token was initially launched in November 2023 and saw 1.5 million PYTH entering the circulating supply, including an airdrop in which 90,000 wallets received 255 million PYTH. Tokens were set to be unlocked at 6- to 12-month intervals over the course of 3.5 years (ending in 2027), and of the total supply 52% were allocated to ecosystem growth, 22% to publisher rewards, 10% each to protocol development and private sales, and 6% directly to the community and through the initial launch.

Latest Pyth Network News

Pyth Network has recently garnered significant attention in the DeFi sector, particularly with a major token airdrop valued at $77 million, distributing 250 million PYTH tokens to early users.

This event significantly increased the protocol’s market capitalization, highlighting its growing importance and potential in the DeFi space.

Moreover, boasting over 300 real-time price data points across various asset classes, it is set apart from competitors like Chainlink with its exceptional refresh rate speed.

Recent project developments:

- Multi-Chain Expansion: A recent focus is expanding its reach across multiple blockchain platforms, enhancing its versatility and utility in the DeFi ecosystem. This expansion is a strategic move to integrate Pyth’s services with a broader range of blockchain networks and applications.

- Innovative Airdrop Campaigns: The recent airdrop campaign conducted by Backpack, which distributed PYTH tokens to 74,000 wallets, showcases the network’s innovative approach to community engagement and token distribution.

- Market Capitalization Growth: Following its launch, the PYTH token experienced significant market fluctuations, demonstrating the high interest and speculative nature surrounding new tokens in the DeFi space. Despite these fluctuations, its market valuation remains commendable, reflecting investor confidence in the project’s long-term potential.

- Governance and Token Supply Plans: Pyth Network plans to gradually increase its token supply, with inflation incentives released every six months to decentralize governance further. This approach aims to balance token distribution and ensure a decentralized governance structure for the network.

Key Takeaways

PYTH is a cryptocurrency project that aims to revolutionize data feeds for DeFi applications. The Pyth.network protocol provides a decentralized oracle solution that delivers real-time, high-fidelity market data to smart contracts on various blockchain networks.

- High-Fidelity Data Feeds: Delivering high-quality, real-time market data to DeFi applications. This data includes price information for various assets such as cryptocurrencies, traditional financial instruments, and commodities.

- Decentralized Oracle Network: Operates as a decentralized oracle network, which means that it relies on multiple independent data sources to provide accurate and reliable data to smart contracts. This approach helps mitigate the risk of data manipulation or inaccuracies.

- Integration with DeFi Platforms: Seamlessly integrate with existing DeFi platforms, allowing developers to access real-time market data directly within their smart contracts. This integration enables a wide range of DeFi applications, including decentralized exchanges, lending protocols, and derivatives platforms.

- Community Governance: Decisions regarding protocol upgrades, changes, and improvements are made through a governance process (of users and stakeholders), ensuring that the network remains transparent and adaptable to the evolving needs of the ecosystem.

- Scalability and Efficiency: Designed to handle large volumes of data and transactions without compromising performance. This scalability is essential for supporting the growing demand for real-time market data within the DeFi space.

PYTH aims to facilitate reliable market data in decentralized finance, providing users and developers with the data they need to build innovative and secure applications.

Conclusion

- Pyth Network is an oracle that provides real-world pricing data for crypto and non-crypto assets to blockchain-based smart contracts.

- As it was founded and incubated by those with a background in traditional finance (TradFi), Pyth has close links to TradFi institutions and uses these links to supply its pricing data.

- Pythnet is a fork of Solana that allows “consumers” to pull data from “publishers” for a fee, creating an efficient data economy.

Disclaimer ||

The Information provided on this website article does not constitute investment advice ,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!