Renzo In June 2023, EigenLayer introduced the concept of restaking to the Ethereum DeFi community. ETH restaking builds upon the well-known concept of ETH liquid staking, by enabling the staking of ETH liquid staking derivative (LSD) tokens to secure other protocols or even chains through a shared security model. EigenLayer initially kicked off with a guarded launch capped at 3,200 tokens for each of the three selected ETH LSD tokens: Lido’s stETH, Rocketpool’s rETH and Coinbase’s cbETH.

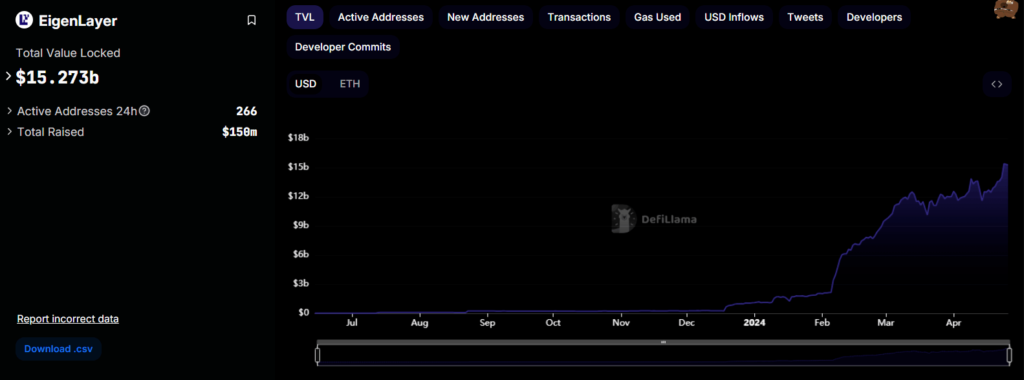

Since then, EigenLayer has reopened for deposits several more times, today holding a whopping $15.3 billion, or 4.9 million ETH tokens, in total value locked (TVL), placing EigenLayer only second in TVL ranking to Lido.

However, EigenLayer staking came with its own drawbacks too. Depositors were subjected to a seven day withdrawal period from EigenLayer to ensure the security of the protocol and the projects secured by it. As such, EigenLayer depositors once again faced the issue of locked liquidity, just as Ethereum stakers faced before the rise of ETH LSDs.

Enter ETH liquid restaking.

A new sector emerged with the success of EigenLayer to tackle this issue, forming the ETH liquid restaking market which now holds almost $10 billion in TVL. As one of the early projects to launch in this sector, Renzo Protocol today holds more than $3.3 billion in TVL alone.

What Is Renzo?

Renzo emerged in early December 2023 to build on the innovation of EigenLayer, forming one of the early ETH liquid restaking projects. Renzo was designed to be a liquid restaking token (LRT) and strategy manager for EigenLayer to promote the widespread adoption of restaking and EigenLayer.

In essence, Renzo sought to be the primary on-ramp/off-ramp for Ethereum restakers, as well as balance risk and reward across the range of Actively Validated Services (AVSs) on EigenLayer to achieve the best restaking strategy for Renzo’s depositors.

How Does Renzo Work?

Users can deposit ETH, WETH, stETH or wBETH directly to Renzo to receive Renzo’s liquid restaking token, ezETH. Points are earned by simply holding ezETH, with 1 ezPoint being earned for every ezETH held per hour. Additional boosts are also granted for early participation and referrals.

EzETH is a yield-bearing token, which accrues rewards directly to the token, thereby reflecting it in its price. As EigenLayer achieves mainnet and more AVSs build on EigenLayer, ezETH holders can expect rewards to accrue in ETH, USDC and native tokens of the respective AVSs being secured by EigenLayer.

Although there is a seven day withdrawal period on Renzo as well, liquidity is provided for the ezETH token against WETH for users who wish to acquire liquidity quickly.

Since Renzo runs its own Beacon chain validator nodes, users who stake with Renzo do not need to wait for EigenLayer deposits to reopen. As such, this allowed Renzo to quickly gain popularity and TVL among the restaking crowd as it allowed them to bypass EigenLayer’s deposit caps.

As gas on Ethereum mainnet began to heat up with the bull market going into full swing, Renzo further expanded with the help of interoperability layer, Connext Network, to five other chains including the Binance Smart Chain, and popular L2 chains, Arbitrum, Linea, Base and Mode.

Additionally, Renzo has integrations with several DeFi applications and chains including Pendle, Zircuit, Gearbox, Morpho and many more. These integrations enable users to further leverage their restaking positions, earning them boosted ezPoints in the process or rewards from point programs on other projects.

The leading ETH liquid staking protocol, as of June 27th, 2024, is most likely Lido Finance. Here’s why:

- Market Share: Lido boasts the largest market share for ETH liquid staking, with its Lido Staked ETH (stETH) token being the most widely used and traded LSD (liquid staking derivative).

- Security and Decentralization: Lido is considered a secure and battle-tested protocol with a focus on decentralization.

- Wide Ecosystem Integration: stETH is integrated into numerous DeFi applications and wallets, promoting its usability.

- Established Reputation: Lido has a strong reputation within the blockchain community.

Here are some resources for further information:

- Lido Finance: https://lido.fi/

- Top Liquid Staking Protocols on Ethereum: https://www.kucoin.com/earn/eth2

Alternatives to Lido:

While Lido is the leader, there are other ETH liquid staking protocols to consider, each with its own advantages and disadvantages. Here are a couple of options:

- Rocket Pool: A decentralized protocol offering liquid staking and node infrastructure. It focuses on permissionless participation and aims for broader distribution of staking rewards. (Check out https://rocketpool.net/)

- StakeWise: Another decentralized liquid staking protocol with a focus on security and low fees. (Visit https://www.stakewise.io/)

Important Considerations:

- Research is Key: Before choosing any liquid staking protocol, thoroughly research its features, security measures, and potential risks.

- Understand the Risks: Liquid staking introduces additional complexities compared to traditional staking. Make sure you understand the risks involved, such as smart contract vulnerabilities and potential liquidity issues.

Leave feedback about this