Sei stands out as the first parallelized EVM blockchain, merging Ethereum’s leading development framework with Solana’s high performance. It prioritizes reliability, security, and high throughput and has been live on the mainnet since August 2023, and claims it has consistently been finalizing blocks at 390ms, making it the fastest layer 1 blockchain.

Sei

Recognizing the limitations current Layer 1 blockchains impose on trading apps, such as speed, scalability, and reliability issues, Sei aims to resolve these by offering specialized infrastructure. This infrastructure is built to cater specifically to the needs of trading applications to offer seamless user experiences.

At the core of Sei’s protocol improvements are several features. The Twin-Turbo consensus, for instance, enhances block propagation and transaction ordering. This approach is intended to significantly reduce the time validators take to receive a block, thereby streamlining the consensus process.

Table of Contents

Furthermore, it introduces advanced parallelization techniques, optimizing both transaction and block processing for maximum efficiency. These features make Sei a potential platform for a wide range of trading-related applications, from decentralized finance (DeFi) to non-fungible tokens (NFTs) and gaming. With its ability to process transactions concurrently and its integration of a native price oracle for accurate asset pricing, Sei could revolutionise the trading experience in the web3 space.

Sei v2

The Sei v2 upgrade, proposed by Sei Labs in October 2023, will make it the first parallelized EVM blockchain. This upgrade aims to combine the benefits of Ethereum and Solana, resulting in a hyper-optimized execution layer that benefits from the tooling and mindshare around the EVM. The proposal suggests using optimistic parallelization to support processing more transactions per second.

Sei

It is an extremely fast and high throughput Layer 1 blockchain, as well as the first parallelized EVM blockchain, serving as a potential scaling approach for the broader Ethereum ecosystem. This blockchain is structured to prioritize reliability, security, and high throughput, which are crucial for the efficient functioning of any kind of DApps built on Sei.

Addressing the limitations of current Layer 1 and Layer 2 infrastructures, Sei aims to solve the “Exchange Trilemma” faced by exchange apps, which struggle to simultaneously achieve decentralization, scalability, and capital efficiency. Sei’s approach is tailored to cater to the unique requirements of exchange applications, such as speed, throughput, and protection against front-running.

Sei Goal

This focus makes it an optimal choice for not only traditional trading platforms but also for gaming economies, NFT marketplaces, social trading apps, DeFi, and DEXs. With features like the fast time to finality, built-in parallelization, Twin-Turbo consensus, and automatic order bundling, Sei provides infrastructure that aims to enhance the user experience and performance of trading applications. By concentrating on trading, Sei addresses a core blockchain use case, attracting a wide range of Web3 applications and developers to its ecosystem.

How does Sei Work?

It is composed of different software components that all work with each other to support the blockchain. Some of these components are tied to the consensus layer, and others are tied to the execution layer.

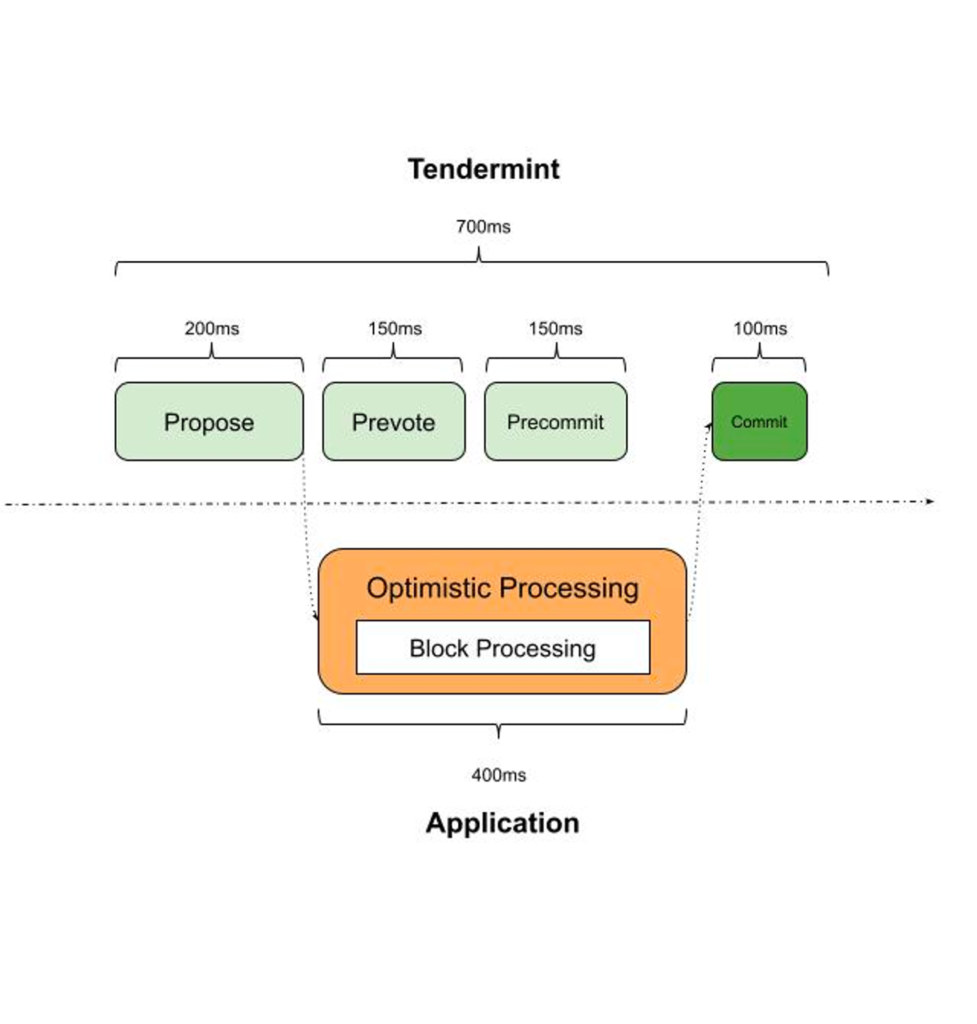

This blockchain introduces the Twin-Turbo consensus mechanism, which is an advanced approach to block propagation and transaction ordering. This mechanism significantly reduces the time validators spend waiting to receive and process blocks. It optimizes the steps involved in the consensus process, including prevote, precommit, and commit phases, leading to quicker finalization of transactions.

transactions

Unlike traditional methods where block processing starts after the pre-commit step, it initiates an optimistic processing of the first block proposal. This means validators start processing a block as soon as they receive it, writing the candidate state to a cache. If the block is accepted, the cached data is committed; if rejected, the cache is discarded. This approach speeds up transaction processing considerably.

More

A key feature of Sei is its ability to process transactions in parallel. This is achieved through advanced parallelization in both the DeliverTx and EndBlock phases of block processing. By processing multiple transactions simultaneously, Sei improves its throughput and overall performance.

It integrates a native order matching engine within its infrastructure, facilitating efficient and decentralized order matching for trading applications. This engine allows DEXs to deploy their order books at the chain level, offering features like frequent batch auctions and uniform clearing prices to prevent front-running and ensure fair transactions

transactions

The matching engine in Sei is designed to be flexible and asset-agnostic, enabling decentralized exchanges to decide how to represent assets. This feature provides versatility in handling different types of trading assets, including tokens and NFTs.

Sei V2 is set to change the execution layer to support optimistic parallelization and optimized state storage. It will also introduce a new component to support EVM smart contracts. These contracts will benefit from the changes made to consensus and parallelization and will be able to interact with existing Cosmwasm smart contracts.

Why is Sei v2 Unique?

The specialization behind it allows it to efficiently handle the specific requirements of trading platforms, NFT marketplaces, DeFi infrastructure, social or gaming DApps, such as high throughput, low latency, and optimised order book management, which are crucial for a smooth and efficient trading experience.

By implementing parallel transaction processing, it aims to dramatically increase transaction throughput. This is essential for trading applications that demand high-performance capabilities to handle large volumes of transactions efficiently.

support

The infrastructure of Sei is fine-tuned to support the unique needs of decentralised exchanges, such as deep liquidity and rapid execution. This optimization ensures that DEXs built on Sei can offer a competitive trading experience comparable to centralised exchanges. It balances scalability with security, ensuring that the platform can handle a high volume of trading activities without compromising the integrity and security of the network.

And there are four major advancements in Sei v2

- Backwards compatible EVM:

Sei integrates Geth to offer full EVM bytecode compatibility, enabling developers to utilize the extensive array of Ethereum tools like MetaMask, Foundry, Remix, and Hardhat. With Sei v2, developers can now deploy audited smart contracts from EVM compatible blockchains without any code modifications, further enhancing the building experience on Sei. - Optimistic parallelization:

Unlike blockchains like Solana that offer optional parallelization. Sei automatically parallelizes smart contracts, eliminating the need for developers to manually handle this process. This approach enables the chain to support parallelization effortlessly, without requiring developers to define any dependencies, streamlining the development experience. - SeiDB:

SeiDB improvements to the storage layer by splitting state commitment and state storage. This division is designed to decrease block processing time and reduce state bloat, facilitating a quicker setup for new full nodes. Moreover, it prevents state bloat, boosts state read/write performance, and simplifies the synchronization process for running new nodes, enabling them to catch up with the network more efficiently. These enhancements collectively aim to optimize network performance and accessibility. - Sei v2:

Sei v2 enhances interoperability with existing chains, ensuring seamless composability between EVM and other execution environments supported on the platform. This advancement opens up avenues for top developers from the Cosmos ecosystem to collaborate effortlessly with leading Ethereum builders, fostering a unified development environment that leverages the strengths of both platforms.

Sei’s Solution

This is where Sei steps in to offer its innovative solution. Through its Twin Turbo consensus mechanism powered by the Cosmos SDK and Tendermint Core, the platform looks to provide decentralized trading apps with the required speed or throughput, security, capital efficiency, and decentralization required for optimal performance.

Under the hood, Sei’s mission is to provide users with the seamless user journey most Web2 applications provide without sacrificing trustless and permissionless transactions for all.

The platform is unlike many general-purpose and sector-specific blockchains. For instance, when placed side-by-side with Bitcoin, Ethereum, and even the Solana blockchains, Sei outpaces all of them.

Bitcoin has a transaction finality of 60 minutes, while Ethereum boasts six minutes despite its migration to the proof-of-stake (PoS) consensus mechanism.

Solana, on the other hand, has 2.5 seconds in its belt. This Network claims to offer a lightning pace in its transactions and offers 500 milliseconds (ms) in transaction finality. This makes it a highly scalable protocol for fast-paced digital asset trading.

Decentralized exchange platforms are also bugged with several challenges. Two of the most popular are front-running and maximal extractable value (MEV), previously called miner extractable value.

Front-Running

Front-running involves placing a transaction in a queue in anticipation of a future trade. This system is exploited by miners and full node operators who possess insight into pending transactions. By strategically placing trades, they aim to profit based on a pending trade.

Maximal Extractable Value (MEV)

MEV is a measurement of the potential profit attainable by a miner if they decide to include, exclude, or re-arrange how transactions are validated and included in the blocks they produce.

This blockchain duly addresses these two systems using the Tendermint Core mechanism.

Who’s Behind the Sei Project?

The first thing to know about this project is that Sei Labs, the development team contributing to the ecosystem, initially planned on running it as a scaling solution on Ethereum.

However, issues around a centralized sequencer system and limited throughput caused by Ethereum saw Sei utilize the Cosmos SDK and Tendermint Core mechanisms to launch as a layer-1 protocol.

The faces behind this blockchain are Jeffrey Feng, Dan Edlebeck, and Jayendra Jog. Edlebeck was the developer behind the well-known Cosmos-based Exidio and Sentinel.

The other co-founders and team members previously held prestigious positions in traditional tech and finance landscapes.

It is not alone in its race to engineer a more scalable DEX application ecosystem for decentralized trading. It has attracted some of the biggest names in conventional venture capital tech firms and decentralized ecosystems.

Some popular names are Jump, Distributed Global, Multicoin, Asymmetric, Flow Traders, ForeSight, and others who have come together in two strategic fundraising events to push $30 million into the blockchain.

What is the Sei Ecosystem?

This ecosystem represents a comprehensive and specialised environment built around this blockchain. This ecosystem encompasses various components and stakeholders, each contributing to its unique functionality and appeal.

● DEXs and NFT marketplaces – At the core of this ecosystem are decentralised exchanges that leverage Sei’s specialised trading infrastructure. These builders benefit from its high throughput, low latency, and built-in order-matching engine, offering a trading experience that competes with centralised platforms in terms of efficiency and user experience.

● Highlighting the diversity and ingenuity within the Sei ecosystem, several featured dApps have emerged as trailblazers. Astroport, Compass Wallet, Fin Wallet, and Seiyans lead the charge in redefining decentralized finance (DeFi), trading solutions, and meme community spirit.

Pyth, Pallet Exchange, WeBump, Dagora NFT marketplace, and Flipside stand out for their innovative approaches in data provision, asset management, social engagement, and analytics, respectively. These builders are deploying remarkable applications in the Sei ecosystem, showcasing the breadth and depth of possibilities in blockchain and crypto utilities.

What is the SEI Token?

The SEI token plays a pivotal role within the SEI ecosystem, acting as the fundamental unit of value and utility that interconnects various components and functionalities of the network. It operates as a decentralized “Proof of Stake” blockchain, powered by this token. This token serves several functions on the network:

- Network Fees: Pay for transaction fees on the Sei blockchain.

- DPoS Validator Staking: It holders have the option to delegate their holdings with validators or stake SEI to run their own validator to secure the network.

- Governance: It holders can engage in future governance of the protocol.

- Native Collateral: It can be used as native asset liquidity or collateral to applications built on the Sei blockchain.

What Does Sei Aim to Solve?

It has an edge over its competitors largely due to the issues it aims to tackle. For one, it discovered the following:

- General-purpose layer-1 blockchains were not suited for DEX platforms to thrive, hence why their growth has been stunted.

- It is impossible to build a fast-paced order book model engine on a general-purpose blockchain due to high network congestion from competing needs from dApps.

- Lastly, a large chunk of general-purpose blockchains has limited throughput, making it impossible for DEX platforms to compete with their centralized counterparts.

A Scalable Template for Trading of All Types

It is not only focused on permissionless value exchange between users in a peer-to-peer (P2P). It goes beyond that. The platform is focused on providing a specific infrastructure for various dApps and DEX platforms to trade.

This makes it a sector-specific layer-1 blockchain. Given its laser focus on trading, it has been able to craft a blockchain network that provides application-specific capabilities. This will meet the unique needs of every DeFi, DEX, NFT, and GameFi protocol.

Performance-Centric

Prior to the launch of the PoS algorithm, the proof-of-work (PoW) only offered enhanced security with limited throughput and zero interoperability. Sei aims to address this situation and seeks to improve all blockchain throughput without compromising security and interoperability across the entire ecosystem of DeFi tools.

The platform’s focus on boosting blockchain performance has seen it launch on Cosmos blockchain, which is renowned for its scalability and high efficiency.

With its transition to an already efficient PoS system like the Cosmos SDK, it boasts a transaction finality score of 500ms. This figure significantly surpasses that of most DEX platforms involved in trading numerous digital assets and is on par with several centralized exchanges in terms of speed.

Moreso, it claims to have 22,000 transactions per second (TPS), which is blazingly fast.

Enhanced Security

Security in the DeFi space has been a cause of concern for many. Several dApps have seen hundreds of millions wiped off their portfolio despite using secured layer-1 protocols like BNB Chain and Ethereum.

Given this, this blockchain utilizes frequent batch auctioning systems, which tackle the MEV and front-running problems.

Being Interoperable

Interoperability allows multiple blockchains to transfer data and information amongst themselves and allows them to talk and communicate with one another.

It brings this concept into reality and has partnered with renowned blockchain protocols like Axelar to maximize this possibility. Due to this, DeFi protocols, DEX, and dApps efficiently transfer liquidity amongst themselves, bridge, and even facilitate seamless communication with one another.

Where to Buy SEI Tokens?

This token is actively traded on leading exchanges such as Binance, Bybit, DigiFinex, Bitrue, and Bitget, offering investors a range of choices for buying and selling.

To purchase this token, follow these steps:

- Account Creation: Register an account on the selected cryptocurrency exchange. This involves providing the necessary information and completing any required verification procedures.

- Deposit Funds: After creating an account, deposit funds into the exchange wallets. This can be done using fiat currency or other cryptocurrencies, depending on the supported deposit methods of the exchange.

- Purchase SEI: Once funds are deposited, navigate to the trading platform, locate the Sei trading pair, and execute buy orders to acquire these tokens seamlessly.

Is It a Good Investment?

This token is a promising short-term investment, thanks to favorable market conditions, solid underlying fundamentals, and its valuable utilities within the blockchain space.

One of its major selling points is its trading-centric blockchain, which prioritizes fast transactions, low fees, and features tailored to support trading activities.

Notably, this network’s compatibility with Ethereum Virtual Machine (EVM) allows seamless integration with protocols initially devised for Ethereum, expanding the token’s appeal.

Following the successful paths of Solana and Avalanche, the network showcases a thriving non-fungible token hub where users can engage in this token trades. Noteworthy projects within this hub include SeiSpirits and SeiyanNF

Disclaimer ||

The Information provided on this website article does not constitute investment advice ,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!