What Is the Secondary Market?

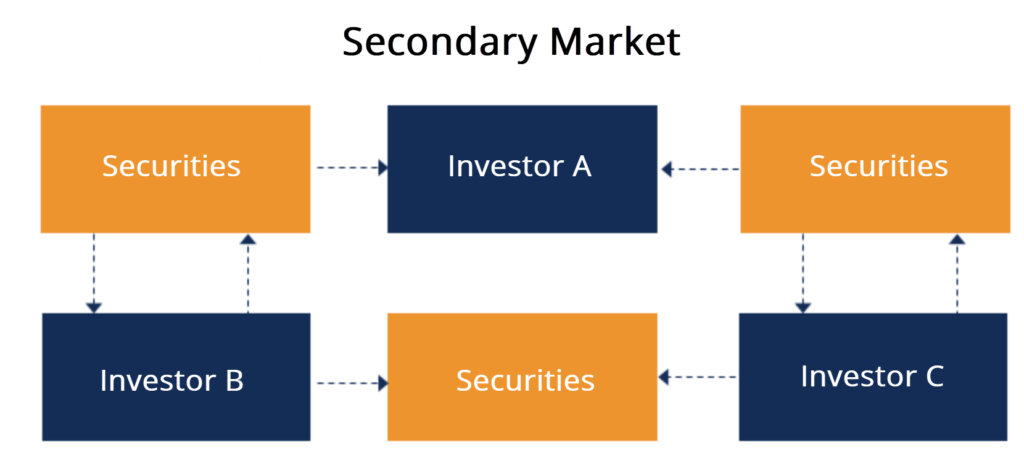

The secondary market is where investors buy and sell securities. Trades take place on the secondary market between other investors and traders rather than from the companies that issue the securities. People typically associate the secondary market with the stock market. National exchanges, such as the New York Stock Exchange (NYSE) and the NASDAQ, are secondary markets. The secondary market is where securities are traded after they are put up for sale on the primary market.

KEY TAKEAWAYS

- The secondary market provides investors and traders with a place to trade securities after they are put up for sale on the primary market.

- Investors trade securities on the secondary market with one another rather than with the issuing entity.

- Through massive series of independent yet interconnected trades, this market drives the price of securities toward their actual value.

- This market provides liquidity to the financial system and allows smaller traders to participate.

- The stock market and over-the-counter markets are types of secondary markets.

Table of Contents

Secondary Market Meaning

The meaning of secondary market is in the form of and refers to the financial markets where securities, such as shares and bonds, are bought and sold after they have been issued in the primary market. Primary markets are where newly issued securities are sold to the public for the first time. Secondary market examples include stock exchanges (BSE, NYSE, NSE) and over-the-counter (OTC) markets.

The Function of Secondary Market

This market functions allow investors to buy and sell securities among themselves without the involvement of the issuing company. Intermediaries such as brokers and dealer market play a key role in matching buyers and sellers, and facilitating the transaction process. Trading mechanisms in this markets can take the form of auctions, where buyers and sellers compete to match their orders, or continuous trading, where trades are executed based on a set of predetermined rules. These are some of the main function of secondary markets.

How the Secondary Market Works

As noted above, securities are bought and sold by investors among one another on the secondary market after they are first sold on the primary market. As such, most people call the secondary market the stock market.

Transactions that occur on the secondary market are termed secondary simply because they are one step removed from the transaction that originally created the securities in question. For example, a financial institution writes a mortgage for a consumer, creating the mortgage security. The bank can then sell it to Fannie Mae on the secondary market in a secondary transaction.

Though stocks are one of the most commonly traded securities, there are also other types of secondary markets. For example, investment banks and corporate and individual investors buy and sell mutual funds and bonds on secondary markets. Entities such as Fannie Mae and Freddie Mac also purchase mortgages on a secondary market.

This markets are important for several reasons. First, they provide liquidity to investors. Having a centralized location allows trades to take place with a large number of traders while ensuring that the value of securities isn’t lost as investors buy and sell securities. It also gives small traders a chance to participate in the market.

Importance of a Secondary Market

This market is important for several reasons:

- This market helps measure the economic condition of a country. The rise or fall in share prices indicates a boom or recession cycle in an economy.

- This market provides a good mechanism for a fair valuation of a company.

- This market helps drive the price of securities towards their genuine, fair market value through the basic economic forces of supply and demand.

- This market promotes economic efficiency. Each sale of a security involves a seller who values the security less than the price and a buyer who values the security more than the price.

- This market allows for high liquidity – stocks can be easily bought and sold for cash.

Types of Secondary Markets

Stock Market

The stock market is made up of centralized exchanges that allow buyers and sellers to come together to trade stocks and other assets. There is no contact that takes place between each party—physical or otherwise. Most trading takes place electronically. Traders must abide by the rules and regulations set forth by the appropriate regulatory bodies, such as the Securities and Exchange Commission (SEC) in the United States.

Examples of stock markets include the NYSE and Nasdaq in the U.S., as well as the London Stock Exchange (LSE), the Hong Kong Stock Exchange, the Bombay Stock Exchange, and the Frankfurt Stock Exchange.

Over-the-Counter (OTC) Market

The over-the-counter (OTC) market involves the trading of stocks, bonds, and other financial assets. But rather than take place over a centralized exchange, trades occur through broker-dealer networks. As such, these assets aren’t traded on an exchange. Stocks on the OTC market are normally those of smaller companies that don’t meet listing requirements.

OTC markets include the:

- OTCQX: This is the top-tier marketplace. The stocks of companies on the OTCQX must trade over $5.

- OTCQB: This is the mid-tier market for OTC securities. It is called the Venture Market and has a high number of developing companies available for trade.

- Pink Sheets: The Pink Sheets allow investors to trade securities of companies that can’t meet the listing requirements for major exchanges. Most of the stocks listed are penny stocks.

The number of secondary markets that exist always increases as new financial products become available. Several secondary markets may exist in the case of assets such as mortgages. Bundles of mortgages are often repackaged into securities such as Ginnie Mae pools and resold to investors.

Secondary Market vs. Primary Market

It is important to understand the distinction between the secondary market and the primary market. When a company issues stock or bonds for the first time and sells those securities directly to investors, that transaction occurs on the primary market.

Some of the most common and well-publicized primary market transactions are initial public offerings (IPOs). During an IPO, a primary market transaction occurs between the purchasing investor and the investment bank underwriting the IPO. Any proceeds from the sale of shares of stock on the primary market go to the company that issued the stock, after accounting for the bank’s administrative fees.

If these initial investors later decide to sell their stake in the company, they can do so on the secondary market. Any transactions on the secondary market occur between investors, and the proceeds of each sale go to the selling investor, not to the company that issued the stock or to the underwriting bank.

Primary market prices are often set beforehand, while prices in this market are determined by the basic forces of supply and demand. If the majority of investors believe a stock will increase in value and rush to buy it, the stock’s price will typically rise. If a company loses favor with investors or fails to post sufficient earnings, its stock price declines as demand for that security dwindles.

Secondary Market: Exchanges and OTC Market

1. Exchanges

Securities traded through a centralized place with no direct contact between seller and buyer. Examples are the New York Stock Exchange (NYSE) and the London Stock Exchange (LSE).

In an exchange-traded market, securities are traded via a centralized place (for example, the NYSE and the LSE). Buys and sells are conducted through the exchange and there is no direct contact between sellers and buyers. There is no counterparty risk – the exchange is the guarantor.

Exchange-traded markets are considered a safe place for investors to trade securities due to regulatory oversight. However, securities traded on an exchange-traded market face a higher transaction cost due to exchange fees and commissions.

2. Over-the-counter (OTC) Markets

No centralized place where securities are traded. In the over-the-counter market, securities are traded by market participants in a decentralized place (e.g., the foreign exchange market). The market is made up of all participants in the market trading among themselves. Since the over-the-counter market is not centralized, there is competition between providers to gain a higher trading volume for their company.

Prices for the securities vary from company to company. Therefore, the best price may not be offered by every seller in an OTC market. Since the parties trading on the OTC market are dealing with each other, OTC markets are prone to counterparty risk.

Instruments in Secondary Market

Here are the vital this market instruments:

- Fixed Income Instrument: Instruments form part of investments that guarantee fixed income in the form of regular payments. Example: Debentures and bonds

- Corporate Bond: These are tradable debt securities issued by corporations, such as Apple or Amazon.

- Government Bond: These are tradable debt securities issued by governments, such as US Treasuries.

- Variable Income Instrument: Investments made in these instruments do not guarantee a fixed, regular income. Instead, the returns vary based on the market fluctuations. Example: equity and derivatives.

- Futures: These are contracts that obligate buyers and sellers to buy or sell assets at a predetermined price and time in the future.

- Options: These are contracts that give buyers the right but not the obligation to buy or sell assets at a predetermined price and time in the future.

- Hybrid Instrument: Instruments offer both fixed and variable returns on investments. For example, a convertible debenture.

Aftermarkets Participants of Secondary Market

- Investors: These are individuals or institutions that buy and sell securities in secondary markets for investment purposes.

- Brokers: These participants in secondary markets are intermediaries that facilitate trades between buyers and sellers in secondary markets, charging fees or commissions for their services.

- Market Makers: These are intermediaries that provide liquidity to aftermath markets by buying and selling securities on their own account.

- Regulators: These are government agencies that oversee and regulate secondary markets to ensure they operate fairly and efficiently.

Features of Secondary Market

This market is pivotal for stock market liquidity, empowering traders to transact freely. Investors benefit by easily selling and buying securities within market hours.

- Liquidity: Enables seamless buying and selling in the stock market.

- Price Discovery: Determines a security’s fair market value through supply and demand dynamics.

- Transparency: Prominent in stock exchanges, ensuring all participants access price information.

- Accessibility: Online brokerages, such as Alice Blue, facilitate easy entry for retail investors.

- Market Orders: Provides flexibility with various order types, like limit and stop orders, enhancing trading strategies.

Benefits of Secondary Market

Here are some of the advantage of secondary markets:

- Liquidity: Secondary capital markets enable investors to quickly buy or sell securities, enhancing the liquidity of financial assets.

- Price Discovery: This market facilitate the determination of market prices for securities, reflecting the supply and demand of the assets.

- Risk Reduction: This market enable investors to diversify their portfolios and hedge against risks, reducing the overall risk of their investments.

- Capital Formation: This market enable companies to raise capital by issuing securities to investors, funding their growth and expansion.

Risks and Challenges of Aftermarkets

Here are some of the disadvantages of secondary markets:

- Market Volatility: This market can be volatile, leading to fluctuations in the prices of securities.

- Insider Trading: Insider trading involves the use of non-public information to gain an unfair advantage in the market.

- Market Manipulation: Market manipulation involves the deliberate attempt to artificially influence the price of securities.

- Systemic Risk: Systemic risk refers to the risk of a widespread financial system collapse due to the failure of a major institution or event.

Examples of Secondary Market Transactions

Various example of secondary market transactions include:

- Stock Trading: Investors acquire shares of publicly traded companies like Apple or Amazon from other investors on the New York Stock Exchange (NYSE) or in other examples of stock markets. These shares, initially issued in an IPO, are now actively traded on the secondary market.

- Bond Trading: Investors purchase corporate bonds, such as those from Microsoft or Coca-Cola, from other investors in the bond market. These bonds, initially issued to raise capital, are actively traded in the aftermath market.

- Mutual Fund Investment: Investors buy shares of mutual funds like Fidelity or Vanguard from other investors in the secondary market. These funds, diversified across securities like stocks and bonds, are actively traded in the aftermath market.

- Options Trading: Investors acquire call options on stocks like Tesla or Facebook from other investors in the options market. These call options provide the right, though not the obligation, to buy the underlying stock at a specified price within a set timeframe.

- Futures Contract Trading: Investors purchase futures contracts on commodities like crude oil or gold from others in the futures market. These contracts obligate investors to buy or sell the underlying commodities at a predetermined price on a specified future date.

Are the Secondary and Stock Market the Same?

Most people consider the stock market to be this market. This is where securities are traded after they are issued for the first time on the primary market. For instance, Company X would conduct its initial public offering on the primary market. Once complete, its shares are available to trade on the secondary market. Major stock exchanges like the NYSE and Nasdaq are these markets.

Who Are the Major Players in the Secondary Market?

The key participants in the secondary market are the broker-dealers who facilitate trades, investors who initiate buy and sell activity, as well as any intermediaries, such as banks, financial institutions, and advisory service companies.

Why Is the Secondary Market Important?

This market is where securities are traded after they go through the primary market. It is a key part of the financial system, providing liquidity to the market. It also allows traders with a centralized location where they can make trades. Investors who deal with large and small volumes of trades have the ability to participate in the market.

Learn more: https://gemini.google.com/app

The Bottom Line

When you buy and sell stocks, bonds, or other securities, you’re participating in the secondary market, which most of us consider to be the stock market. This market is an important part of the financial system because it gives investors like you a place to conduct your financial transactions. It also provides much-needed liquidity to the market. But don’t confuse it with the primary market. This is where companies and other entities go to offer the first-round of securities before they become available to the general public.

Disclaimer ||

The Information provided on this website article does not constitute investment advice ,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!

Leave feedback about this