THORChain (RUNE) is a decentralized cross-chain liquidity protocol that allows users to swap assets between blockchain networks.

One of the most significant innovations to come out of the decentralized finance (DeFi) space is the automated market maker (AMM) model. AMMs allow crypto users to deposit a specific ratio of cryptocurrencies to a so-called liquidity pool. Participants then use these pooled funds to execute trades, with the pooled cryptocurrencies acting as the trading pair.

DeFi protocols like Uniswap and Balancer use liquidity pools to let users swap assets in a peer-to-peer, decentralized manner. However, the majority of AMMs only allow trades to take place within a single blockchain network, such as Ethereum.

THORChain provides a solution in the form of a decentralized exchange (DEX) based on the Cosmos software development kit (SDK). Its AMM-based protocol provides the backend technology needed to swap cryptocurrencies between blockchains that were previously non-interoperable.

The RUNE token powers the THORChain network. RUNE is used as a pairing token that accompanies each asset in the platform’s liquidity pools. As such, RUNE serves as the second token that users deposit in the liquidity pool to execute trades against, driving both its utility and value on the network. RUNE is also used to pay for fees, provide a basis for governance and secure the THORChain network.

How was Thorchain Created?

Thorchain was originally a small project at the Binance Hackathon 2018. Then a team of mostly anonymous developers continued researching Thorchain technology after the event ended.

The team needs the technology in Cosmos to create a cross-chain asset exchange DEX. They include Tendermint, Cosmos SDK, and Threshold Signature Scheme (TSS).

The team finally developed a DEX built on the Thorchain protocol, Instaswap. The product was then demonstrated at the Cosmos Hackathon in Berlin.

In 2019, Thorchain made an Initial Dex Offering (IDO) on Binance and successfully raised 1,5 million US dollars.

In April 2021, Thorchain released its temporary mainnet, the Multi-chain Chaos Network (MCCN). After 4 years of development, Thorchain officially released its mainnet in June 2022.

How does THORchain work?

THORChain supports an ecosystem of products and services that integrate the network’s cross-chain infrastructure. Platforms like THORSwap — the first multichain DEX using THORChain’s network as a front-end interface — use THORChain to facilitate cross-chain swaps. THORSwap allows users to choose which two assets they want to swap and the protocol automatically calculates the fees based on network activity.

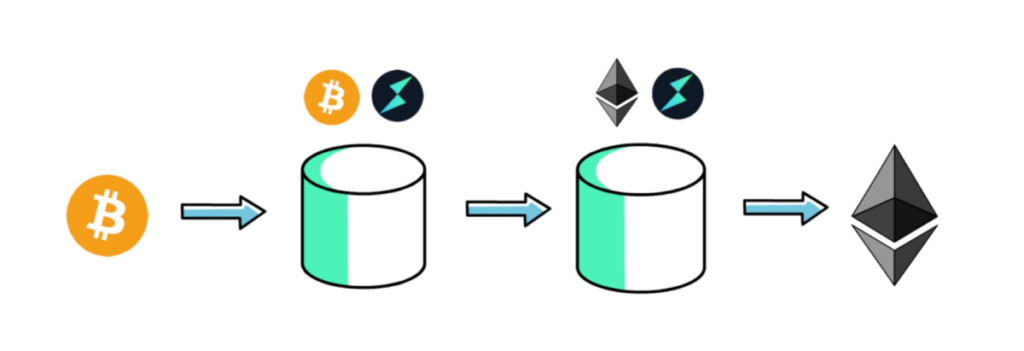

Swaps occurring on THORChain are made possible by the network’s use of a continuous liquidity pool (CLP) in which RUNE is used as an intermediary for every swap.

When any 2 assets are swapped on THORChain, they are actually swapped between 2 different pools. This is because each liquidity pool on THORChain pairs RUNE with the available assets. For example, if a THORChain user wanted to exchange USDT for ETH, they would first trade their USDT for RUNE on one pool before trading their RUNE for ETH in the next pool.

The THORChain state machine swaps one asset for RUNE, then moves it to a second pool and swaps RUNE for the user’s desired asset. This is accomplished without the user ever needing to convert their crypto into or take custody of RUNE.

With THORChain’s CLP liquidity model, the protocol is able to respond to fluctuating liquidity demand.

Additionally, there are four main roles for THORChain participants:

- Liquidity providers (LPs): LPs provide assets to liquidity pools in return for block rewards and swap transaction fees. Rewards are calculated based on the pool’s activity and the share of the LP’s tokens represented within the pool.

- Swappers: Swappers are the user base who trade between various crypto assets on THORChain.

- Traders: THORChain relies on arbitrage traders who seek out assets that are either undervalued or overvalued on THORChain as compared to their market prices on other exchange platforms. Arbitrageurs rebalance liquidity pools by either buying or selling assets across multiple exchanges until those assets’ prices in the pool reflect their current market price.

- Node operators: Node operators bond a set amount of RUNE to support the network and participate in THORChain’s proof-of-stake consensus mechanism. These operators are instructed to remain anonymous and are rotated in and out of the network based on their reliability in a process called “churning.”

CORE OBJECTIVES OF THORCHAIN

- Cross-Chain Liquidity: At its core, Thorchain’s main objective is to provide decentralized liquidity across different blockchain networks. This addresses a significant challenge in the DeFi space – liquidity fragmentation due to the isolated nature of various blockchain ecosystems. By allowing for direct trading of assets from different chains, Thorchain effectively bridges these isolated islands, creating a more fluid and cohesive DeFi landscape.

- Decentralized Trading: Thorchain enables users to trade cryptocurrencies from various blockchains in a fully decentralized manner. Thorchain operates without a central authority unlike centralized exchanges, reducing counterparty risks and enhancing user security.

- Permissionless Access: True to the ethos of decentralization, Thorchain offers permissionless access. This means anyone can participate in the network without needing approval from a governing body. This feature is vital in promoting financial inclusion and accessibility in cryptocurrency.

- Improved User Experience: Thorchain is designed to offer a seamless user experience, catering to crypto-novices and seasoned traders. Simultanizing the cross-chain trading process lowers the entry barrier for users new to the DeFi space while providing the advanced features experienced users demand.

- Network Security and Sovereignty: Thorchain places a high priority on security and network sovereignty. It employs robust security protocols to protect the network and its users’ assets. It aims to establish a trustless environment where users can transact with peace of mind.

UNIQUE TECHNOLOGICAL INNOVATIONS

- THORChain’s Asgardex: Asgardex is Thorchain’s decentralized exchange interface, showcases the platform’s focus on user experience. It allows users to easily perform cross-chain swaps and interact with the liquidity pools, all within a user-friendly and intuitive interface.

- Synthetic Assets: Thorchain introduces the concept of synthetic assets, which are representations of real assets on other blockchains. This feature allows users to trade assets native to one chain on another, significantly expanding trading possibilities and enhancing market liquidity.

- Automated Price Discovery: Unlike many DeFi platforms that rely on external oracles for price information, Thorchain incorporates an automated price discovery mechanism within its liquidity pools. This innovation reduces reliance on external data sources, minimizing the risks associated with oracle manipulation.

CORE SECURITY PROTOCOLS OF THORCHAIN

- Multi-Layered Security Architecture: THORChain employs a multi-layered security approach. This includes network security, application security, and smart contract audits. Each layer is fortified to prevent vulnerabilities at different levels of the platform.

- Consensus Security: THORChain uses a modified Byzantine Fault Tolerance (BFT) consensus mechanism, known for its resilience against attacks. Validators in the network are required to bond RUNE tokens, creating a financial disincentive against malicious behavior.

- Automated Security Checks: The network incorporates automated security checks and monitoring systems that continuously scan for anomalies and potential threats. This proactive approach helps in the early detection and mitigation of risks.

- Decentralized Network of Nodes: By operating a decentralized network of nodes, THORChain reduces the risk of centralized points of failure. This decentralization enhances the network’s overall security, making it more resilient to attacks.

- Regular Security Audits and Updates: THORChain undergoes regular security audits from reputable third-party firms. These audits are crucial in identifying and addressing potential vulnerabilities. The platform also ensures that it is updated regularly to incorporate the latest security enhancements.

BENEFITS OF THORCHAIN’S CROSS-CHAIN SWAPS OVER OTHER DEFI PLATFORMS

- True Interoperability: Unlike many DeFi platforms that are confined to a single blockchain, THORChain’s cross-chain swaps bridge multiple networks, fostering true interoperability in the DeFi ecosystem.

- Increased Liquidity: By enabling the pooling of assets from various blockchains, THORChain enhances the overall liquidity available for trading. This increased liquidity leads to better price stability and less slippage during transactions.

- Decentralization and Security: THORChain maintains a high level of decentralization and security in its swap process. The absence of intermediaries reduces the risk of censorship and central points of failure.

- Enhanced User Experience: Users enjoy a seamless trading experience without the need to manage multiple wallets or use centralized exchanges as intermediaries. This simplifies the process of trading across different blockchains.

- Reduced Dependency on External Oracles: THORChain’s mechanism for price discovery is internal, relying on the liquidity in its pools rather than external oracles. This reduces exposure to oracle manipulation and enhances the integrity of pricing.

- Permissionless Access: Anyone can access THORChain’s cross-chain swap feature without needing permission, which aligns with the ethos of open and inclusive finance.

What Is the RUNE token?

RUNE is Thorchain’s native asset powering the THORChain network. Its maximum supply is 500 million units, of which 330 (66%) are already in circulation (September 2022). Initially, the token was built as a BEP-20 type token for the BNB chain. However, it currently runs as a native token on its own chain.

RUNE has many use cases and serves for different activities within the THORChain ecosystem. Below are the main activities.

- Governance: RUNE token holders can vote with their liquidity. Specifically, holders can vote for a new asset listing process, to delist a liquidity pool, or to change the parameters of the network;

- Staking: Staking RUNE earns users votes on governance proposals and fees from trading. In fact, a large part of the swap fees go to the stakers;

- Bonding: THORChain, being a Proof of Stake blockchain, is secured and maintained by node operators who bond a huge amount of RUNE. These nodes are computers that validate swaps and create pools for assets and receive rewards in exchange;

- Rewards: Block rewards and swap fees are paid to liquidity providers and node operators in RUNE on a set emission schedule. RUNE can also be used to pay for gas fees;

- Trading: RUNE is the base asset pair for all pools, so this means that it is used in all exchanges that take place within the THORChain ecosystem. Each liquidity pool requires the tokens to be paired with RUNE. Whether the user deposits, BTC, ETH or something else, these tokens will always be paired with RUNE, making this crypto indispensable for anyone wishing to deposit one or more assets on this ecosystem.

The issue of RUNE follows an exponential downward curve: high inflation in the first months, which then decreases more and more. This factor, together with a limited supply, acts as an anti-inflation mechanism, and therefore,could potentially make RUNE a good long-term store of value.

Why buy RUNE?

RUNE is used by participants in the THORChain network who act as liquidity providers, node operators and more. Those who wish to participate in arbitrage trading on THORChain may also want to hold RUNE to take advantage of any possible arbitrage opportunities that arise from imbalances in THORChain liquidity pools.

Crypto traders may also see interoperability between chains as a driver of value for individual cryptocurrencies like RUNE. Speculative traders may even choose to hold RUNE purely on the basis that prices might increase in the future as the platform develops additional functions for the token.

THORCHAIN’S POSITION IN THE CRYPTOCURRENCY SPACE

Thorchain is not just another DeFi platform; it’s a pioneering project aiming to reshape how assets are exchanged in the crypto world. By enabling efficient and secure cross-chain transactions, Thorchain addresses a critical pain point in cryptocurrency: the lack of interoperability between blockchains. This positions Thorchain as a key player in the ongoing evolution of the DeFi sector, potentially driving more widespread adoption of cryptocurrency by making it more accessible and user-friendly.

Advantages of Thorchain (RUNE)

- Exchange Cross-chain Crypto Assets.

Thorchain’s technology allows users to exchange crypto assets cross-chain easily and quickly.

- Pool with One Type of Asset

LPs can manually enter a pool with one type of asset. Half of the deposited asset, e.g. BTC, will still be converted into RUNE to keep the LP’s position balanced with both assets. Also, if someone deposits RUNE only, half of it will be converted into BTC in the pool.

- No Oracle.

Thorchain differentiates itself from most DEXs by eliminating often centralized oracles. Instead, Thorchain uses “arbitrage traders” to keep asset prices accurate within the liquidity pool.

If the price of a token is too low, traders will buy and sell it on other DEXs for a profit, while if the price is too high, they will buy from other DEXs and sell on Thorchain. It automatically balances the market without compromising decentralization, and arbitrage traders are incentivized to ensure asset prices stay consistent by using the price difference between DEXs.

- Liquidity

Thorchain’s structure helps avoid LP liquidation. Liquidation occurs when there are too many trading pools for a particular coin. Since each pool is paired with a RUNE inside the DEX, the number of pools needed is much less. This strategy is ideal for investors as it helps centralize liquidity.

- Low Transaction Fees

Thorchain users enjoy low fees compared to the current rates on the Ethereum network. The fees charged to users consist of a fixed Outbound Fee and a Liquidity Fee that fluctuates according to demand. Some of these fees will be returned as rewards to Validators and liquidity providers.

THORChain Vaults, keeping tokens safe

The operating scheme of the THORChain DEX is a bit different from what we see in other DEXes. First of all, we have two types of vaults:

- Asgard TSS Vaults, are the gateway vaults with large committees (27 of 40) accepting trades. They are in charge of receiving the assets that will be exchanged.

- Yggdrasil vaults, are the output vaults with a 1 of 1 scheme, and are responsible for outputting assets from the system.

RUNE Token

RUNE is a Thorchain platform token that has an essential role in the Thorchain ecosystem. Here are some of the functions of RUNE:

- Security

In the Thorchain ecosystem, the RUNE token staking process is called bonding. You must bond 1 million RUNE to run the role of a validator. RUNE is kept as collateral so that validators work in line with the system and avoid mistakes that result in losing that collateral.

- Liquidity

In Thorchain’s liquidity pool, every token is paired with RUNE. It is important to create the liquidity needed in the asset swap process.

- Rewards

Validators and liquidity providers receive rewards in RUNE tokens.

Conclusion

Thorchain allows users to exchange crypto assets cross-chain with ease. Users can exchange assets from various blockchains without asset wrapping or pegging, thus ensuring a direct and transparent exchange.

Although developed by a mostly anonymous team, Thorchain provides open access to the entire community (Thorchads) through various communication channels and platforms. The Thorchain community can follow the project’s development, contribute, provide feedback, and participate in decision-making through forums, social media, and other communication channels.

Disclaimer ||

The Information provided on this website article does not constitute investment advice ,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!

Leave feedback about this