Stablecoins are a type of cryptocurrency that is pegged to fiat currencies or commodities. Historically, stablecoins have helped traders earn trading profits more conveniently by allowing them to interact significantly less with traditional banks each time they place a trade.

What is TrueUSD (TUSD)?

TrueUSD, or TUSD for short, is one of several well-known fiat-collateralised stablecoins in the world. Although its current market capitalisation is not as significant as the top 50 cryptocurrencies (as of Aug ‘21), when it comes to stablecoins, the brand matters more.

What makes TrueUSD so special that it’s worth your attention? This article will give an overview of TUSD, what it is, how it is used, and how it works.

Key takeaways

- TrueUSD (TUSD), is a type of cryptocurrency that has its value pegged to an external asset (such as gold, or in this case the U.S. Dollar), this type of crypto is known as a stablecoin.

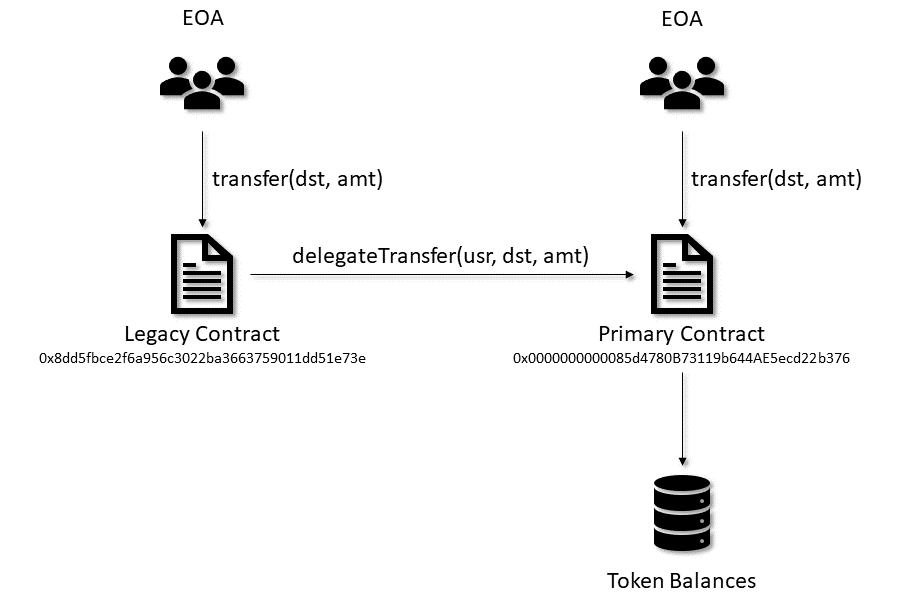

- TUSD is a crypto token based on Ethereum’s ERC-20 standard and has its value pegged 1:1 with the U.S. Dollar. The token is distributed via a TrustToken platform smart contract.

- TrueUSD uses a Proof of Reserve system to ensure that the amount of circulating TUSD tokens match the reserve assets, keeping the value stable. To achieve this requires a third party to audit TrustToken’s bank accounts to ensure the reserves match the outstanding tokens.

New to stablecoins? Read our guide on stablecoins and how they work.

Table of Contents

How Does TrueUSD Work?

TrustToken team doesn’t collect the money itself but it has organized publicly audited smart contracts for this purpose to build trust with the people. TrustToken team can’t access the investors’ dollars at any stage. TrustToken has shared details of escrow accounts on its official website.

The users can send U.S Dollars to these accounts to receive the TUSD. Once the funds are added to an escrow account, the platform will automatically mint TUSD of the equal amount. The TUSD tokens are instantly burnt once a token holder redeems U.S dollars. Thus, TrueUSD’s value is maintained over time.

The users need to verify their identity by submitting a KYC form at one of the TrueUSD’s trust partners before they could access these services. The escrow company initiates a request to release an equal amount of funds after verifying the funds.

TrueUSD’s smart contract generates the required tokens and transfers them to the provided wallet. The users can then use these tokens to buy other cryptocurrencies or hold them as assets. A reverse procedure is conducted whenever a user wants to convert TUSD into USD.

The user sends the tokens to the smart contract and the fiat currency is transferred to the user’s account through the trust company. The users need to pay 0.1% of the total transaction amount at the time of purchasing or redeeming the TrueUSD tokens. Similarly, a 0.1% fee is charged when TrueUSD tokens are transferred between different Ethereum wallets.

Benefits of TrueUSD

TrueUSD is considered a better alternative to Tether because it eliminates the need to deal with an intermediary to buy the cryptocurrency.

Legal Protection – TrueUSD is directly associated with the escrow accounts and the TrustToken organization publishes monthly auditing reports of these accounts to keep everyone aware of their total reserves.

Full Collateral – Unlike Tether and other USD-backed stablecoins, TrustToken can’t issue new TUSD tokens unless an equal amount of U.S Dollars are added to the escrow account. Smart contracts create and burn TUSD tokens according to the user’s request.

Instant Redemption – Whenever a user wants to redeem U.S Dollars, he/she can send TUSD tokens to the smart contract and the fiat currency will be added to his/her account within a few minutes. However, the minimum withdrawal amount is $10,000.

Regular Attestations – Armanino LLP, a renowned auditing firm, attests to the reports of escrow accounts on a monthly basis, and the reports are publicly published by TrustToke

What makes TrueUSD different from Tether, USD Coin, and others?

Like other fiat-backed stablecoins, TrueUSD is also backed 1-to1 by US dollars which are deposited into an account. TrueUSD is a kind of debt certificate that gives the holder the right to redeem it for US dollars.

However, the mechanics of the issuance and redemption for TrueUSD is different from the two most popular stablecoins, Tether and USD Coin.

For both cases, the USD reserve is controlled by the company, Tether, Ltd. and Circle, respectively. The companies have absolute control over how they want to allocate the deposited funds based on their profit/risk tolerance.

On the other hand, the US dollars that are backing TrueUSD are held in several escrow accounts. This means that none of the members of TrustToken (the issuer of TUSD) can ever touch the deposited US dollars.

Also read: What is Tether (USDT)?

Why are escrow accounts used for TrueUSD?

The use of escrow accounts is one part of a solution that will completely eliminate intermediaries. TrustToken recognises that using escrow accounts isn’t the ultimate goal. TrustToken published a post on Medium about this.

“We recognize that escrow accounts aren’t the endgame for decentralized money and tokenized asset management, but the trust and escrow industry already work well for the management and distribution of assets.”

Implying from the blog post, there may be less reliance on escrow accounts in the future when traditional banks are more comfortable with using smart contracts.

“So until banks allow smart contract signatures, we’re building on one of the best-known, frequently-tested systems for bank account management: escrow accounts.”

In keeping with good practices of a stablecoin issuer, TrustToken also releases monthly attestations by Armanino LLP, through a Proof of Reserve. The interesting part about TrueUSD is that it is the only stablecoin in the world with real-time auditing.

What keeps TrueUSD pegged to the US dollar?

Although TrustToken has never explicitly stated the detailed breakdown of the assets in TUSD’s reserve, the involvement of escrow accounts meant that possibly TUSD is fully backed by USD cash.

Without full control of the reserve, however, it is still unclear as to how TrustToken is able to profit from TUSD operations.

Regardless, TrustToken has many other businesses apart from tokenizing US dollars, such as tokenizing commodities, stocks, bonds, and artwork.

As the market for stablecoins matures, the company may be doing the right thing by significantly reducing third-party risks that could threaten the “true” US dollar peg of TUSD.

Related: What are stablecoins and how do they work?

How do people get TrueUSD (TUSD)?

If not through an exchange, TrueUSD can be purchased directly from the official website after completing a know-your-customer / anti-money laundering (KYC/AML) protocol.

- A user who wants to convert US dollars to TUSD sends a wire to any one of the multiple escrow accounts.

- The escrow account then automatically sends a signal to TrustToken.

- TrustToken activates its Ethereum smart contract to mint TUSD, which is sent to the user’s wallet address.

- The reverse will apply if a user wants to redeem TUSD; TUSD is sent to the smart contract of TrustToken to be “burned”.

- TrustToken then sends a signal to the escrow account to wire the appropriate amount of US dollars to the user.

Although relying on centralised financial systems (like the escrow account), the process of minting and redemption relies less trust on the issuing company. This is different from Tether and USD Coin.

In the case of Tether, users cannot buy them directly from Tether, Ltd. Instead, minted Tethers are purchased exclusively by Bitfinex crypto exchange, which then distributes the token. Circle uses a more direct route as users can buy USDC directly from Circle.

How does TrueUSD compare with Tether and USD Coin?

From looking at each of the three business models, we can make a few deductions that are self-evident:

- Tether, as the biggest stablecoin is dominant among crypto traders. With no way of directly purchasing Tethers, the stablecoin may not see much mainstream adoption.

- USD Coin acts like a bank and digital payment system, which may see greater mainstream adoption for businesses.

- TrueUSD has a more idealistic approach to tokenizing real-world assets; it can be attractive to investors looking to lend TUSD with very low risk. It is also better understood compared to algorithmic or crypto-collateralised stablecoins like Dai, so we can expect institutional investors to be confident about adopting it.

TrueUSD also has a great potential for worldwide adoption, as TrustToken had issued stablecoins pegged to other currencies — TAUD for Aussie dollars, TGBP for British pounds, THKD for HK dollars, and TCAD for Canada dollars.

TUSD Reserves:

Real-time Attestations

In an effort to enhance the transparency and trustworthiness of stablecoins, TrueUSD has taken a significant step forward by integrating Chainlink’s Proof of Reserve (PoR). This move positions TUSD as the first USD-backed stablecoin to incorporate a real-time and programmatically controlled minting system and ensures uninterrupted, on-chain verification of off-chain USD reserves.

The reserve data for TUSD is meticulously compiled by an independent, U.S.-based, industry-specialized accounting firm, The Network Firm LLP (TNF). This accounting entity is responsible for aggregating all reserve data specific to U.S. Dollars held in financial institutions and delivering the updated information in real-time.

Furthermore, on Dec. 25, 2023, TUSD announced an engagement with leading accounting firm Moore Hong Kong to provide daily attestation services and reports for its reserves starting in late January 2024. MooreHK is part of Moore Global, a renowned accounting and consulting firm with over 100 years of experience. The Network Firm, a specialized accounting and audit technology firm in the crypto industry, will collaborate with MooreHK to provide state-of-the-art technical support. This collaboration is part of TUSD’s globalization initiative and commitment to transparency, setting a high standard for transparency in the stablecoin ecosystem.

With Chainlink PoR, TUSD’s smart contract is designed to verify that the total supply of the stablecoin does not exceed the actual U.S. dollars held in reserve before any new token issuance occurs. This confirmation process is embedded in the smart contract’s code, offering a transparent and independent approach to verifying TUSD’s asset backing.

TUSD’s enhanced transparent reserves reporting is accessible across 11 blockchain networks, including major ones like Ethereum and BNB Smart Chain and on over 70 cryptocurrency exchanges. Interested users and institutions can view the public results of TUSD’s audits online.

TUSD Ecosystem

Exchanges

The TrueUSD ecosystem stands out with its significant trading volumes on key cryptocurrency exchanges, underscoring its growing adoption and the trust it has garnered among traders.

According to recent data, TrueUSD’s 24-hour trading volume hovers between $100 million USD and up to over $2 billion USD on select trading days. This surge can be attributed to Binance’s robust support of TUSD, when it introduced a zero-fee discount to trade BTC/TUSD pair. The robust standing of TUSD on exchanges is also reflected by its presence on HTX, OKX, Bybit and KuCoin. These platforms are home to a substantial share of the TUSD liquidity, catering to a varied demographic of traders who depend on its reputation for stability and the advantages of a USD-backed asset.

In terms of popular trading pairs, TUSD can be traded against all major cryptocurrencies. For instance, on Binance, the trading pairs of TUSD with Bitcoin (BTC), Ethereum (ETH), Binance Coin (BNB), Solana (SOL) and others generate trading volume in the millions.

The surge of TrueUSD is not just reflected in its volume but also in its utility across financial operations on exchanges. From standard trading to futures contracts and margin trading, TUSD features prominently across several trading applications.

Chains

TrueUSD (TUSD) takes a blockchain-agnostic approach. As of the latest report from October 2023, here is how TrueUSD is distributed across the blockchain networks:

TRON

Leading the pack with the highest number of TUSD tokens, TRON accommodates an impressive 2,610,951,828 TUSD, benefitting from fast transactions and low fees that are attractive for both users and developers.

Ethereum

Hosting a substantial portion of the TUSD supply, Ethereum supports 703,196,784 TUSD, making it a dominant chain for TrueUSD users who leverage its robust smart contract capabilities and vast ecosystem.

BNB Smart Chain

With Binance’s sprawling ecosystem, the native BNB Smart Chain holds 30,130,364 TUSD, showcasing the appeal of Binance’s internal market and DApp environment.

BNB Beacon Chain

Another component of the Binance ecosystem, the BNB Beacon Chain includes 145,016 TUSD in its roster.

Furthermore, TrueUSD trades on layer-one and layer-two chains like Avalanche, Fantom, Polygon, Arbitrum and Optimism.

DeFi

TrueUSD has also made strides in DeFi. On PancakeSwap, one of the most popular AMMs on the BNB Smart Chain, TUSD has been incorporated to enable users to trade directly with other stablecoins. The trading pair TUSD/USDT sees significant trading volume of over $5 million USD per day. Furthermore, TUSD is available on leading AMM decentralized exchange Curve Finance, with the crvUSD/TUSD trading pair seeing almost $1 million in 24 trading volume and $4.2 million in liquidity.

Partnerships

TrueUSD has also broadened its reach and utilization through strategic partnerships.

One of the standout collaborations is with IvendPay, a payment system that integrates cryptocurrencies into retail point of sale (POS) systems. It enables consumers to pay with digital assets in everyday transactions. This partnership signifies a remarkable step towards mainstream crypto adoption and showcases TrueUSD’s commitment to utility and convenience. This alliance allows TUSD to be accepted at a wide range of vending machines and POS terminals serviced by IvendPay globally and makes TUSD exchangeable for real goods and services.

In addition, TrueUSD has partnered with Travala, a renowned travel service platform that brings utility to TUSD holders in the travel and tourism sector. This collaboration enables customers to book over two million hotels and accommodations worldwide with TrueUSD, especially leveraging the TRC-20 protocol for payments. It aligns with TrueUSD’s mission to provide real-world applications for its stablecoin by facilitating seamless travel experiences paid with cryptocurrency.

Travala.com offers a streamlined approach to travel and vacation bookings, demonstrating the practical value of TUSD within the tourism industry. Additionally, UQUID, a prominent Web3 shopping platform, has integrated TUSD payments, providing users with access to a diverse array of products, including gift cards and clothing, totaling over 120 million items. Within the expansive Web3 freelancing landscape, HYVE, as the largest marketplace, has embraced TUSD as a versatile payment method, thereby enhancing its applicability in the job market. Moreover, the NOWPayments platform plays a crucial role by supporting physical merchants in incorporating TUSD as a preferred payment option, contributing to its widespread adoption in various commercial transactions.

Through these partnerships, TrueUSD demonstrates its active role in fostering the adoption of cryptocurrencies in everyday life. With IvendPay and Travala, TrueUSD customers have the advantage of using a stable and trusted digital currency for a range of transactions, from quick retail purchases to planning international travel, offering glimpses into the future of finance.

These partnerships evidence TrueUSD’s efforts to cement its place for everyday use cases, indicating TUSD’s potential for continued growth and integration into global commerce and lifestyle choices.

Why would an investor buy TrueUSD or other stablecoins?

Stablecoins don’t appreciate in value as they are pegged to real-world assets. This doesn’t stop investors from “investing” in stablecoins, just as they would in foreign currencies. After all, the US dollar is still currently the world’s reserve currency.

Some people would even hedge their country’s currency by investing in more stable currencies, such as British pounds, Canada dollars and Aussie dollars — each can be tokenized by TrustToken.

However, another reason to invest in TrueUSD is that it is also quite popular among DeFi applications, such as for liquidity pools and peer-to-peer lending, which allows investors to earn high-interest rates.

With a near-zero risk of having liquidity problems, TrustToken can theoretically issue as much TUSD as demanded by users and can supply exactly the same amount of dollars that TUSD holders demand. This feature is what makes TUSD attractive to investors large and small.

Disclaimer ||

The Information provided on this website article does not constitute investment advice ,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!

Leave feedback about this