Zilliqa is a software that seeks to incentivize a global, distributed network of computers to run a blockchain platform that aims to increase user scalability through sharding.

In this way, Zilliza is one of a number of competing blockchain aiming to grow an ecosystem of decentralized applications (dapps) and cryptocurrencies, such as Ethereum, Tron and EOS.

To differentiate itself from others, Zilliqa uses a sharding process which splits its infrastructure into several interconnected blockchains to support more transactions.

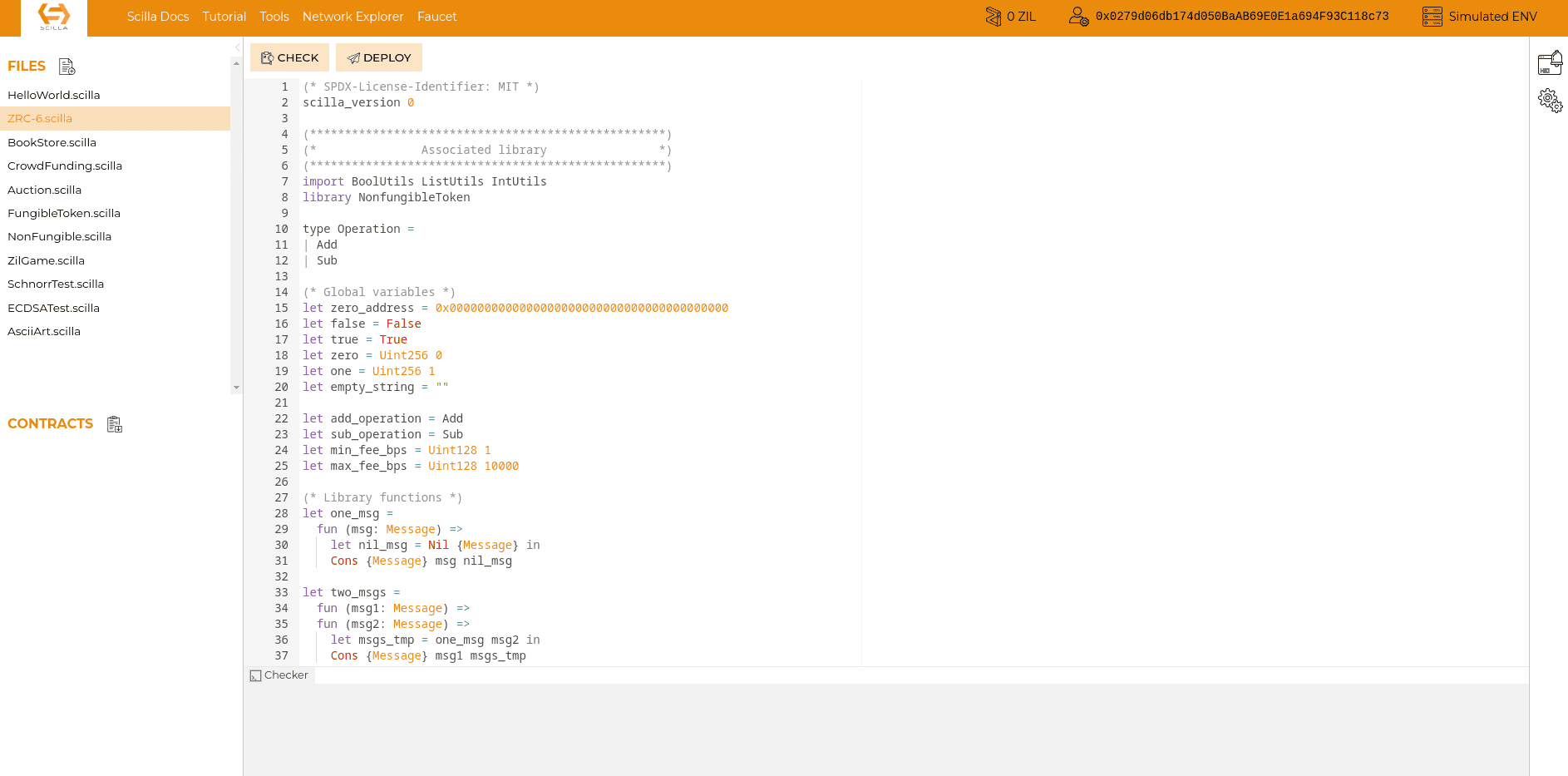

Zilliqa also launched Scilla, a native programming language that focuses on security and enables developers to write and launch customizable dapps intended to replicate real world services.

To achieve all of these features, the network’s native cryptocurrency, ZIL, is used to execute programs, send transactions, and incentivize actors that support the network.

For more regular updates from the Zilliqa team, you can bookmark Zilliqa’s Blog, which includes new releases, newsletter updates, and partnership announcements.

Table of Contents

Zilliqa Brief History

Zilliqa was introduced as a blockchain thesis project by the National University of Singapore. Its white paper was written by Loi Luu and Prateek Saxena. Xinshu Dong, Jia Yaoqi, and Amrit Kumar co-founded this project.

The project was officially launched in 2017. Zilliqa’s team raised around $22 million during the initial coin offering in 2017. The team introduced the custom programming language, Scilla, in May 2018. The testnet was launched in November 2018 and the mainnet finally went live in January 2019.

How Does Zilliqa Work?

The Zilliqa network offers many features common to other cryptocurrency networks such as smart contracting, transaction settlement, and token issuance.

Developers can use its proprietary language, Scilla, to run custom programming logic (smart contracts) and design new programs (decentralized applications) to offer a variety of products and services.

While this system is complex in implementation, Zilliqa is ultimately designed to execute smart contracts and confirm network transactions in a scalable and efficient manner.

Sharding

Unlike other blockchain networks, Zilliqa uses a sharded architecture for transaction processing. The transaction processing speed of the blockchain networks is significantly affected once the usage grows. Zilliqa tries to address this problem by dividing its network into small groups of nodes known as shards.

No matter how big the network grows, its transaction speed won’t be affected because the shards are designed to process the transactions in parallel. Zilliqa even supports micro-payments on its network because it doesn’t require any confirmation for the processed transactions.

Sharding eliminates transaction backlogs, network congestion, and scalability issues. Thus, it helps with keeping the transaction fee as low as possible. Currently, the users need to pay around 0.1ZIL tokens to complete a transaction.

The network participants have the power to increase or decrease the transaction fee depending on the user demand, transaction volume, and the market price of ZIL.

Shard Layer – Shard Layers are used to process small pieces of larger blocks. The node operators of these layers can quickly verify the transactions as they only need access to a limited amount of data.

DS Layer – This layer randomly chooses node operators to create a single block with the microblocks collected from different shards. These node operators can make final decisions on individual blocks because they have direct access to the main blockchain.

Proof of Work and PBFT, the consensus within Zilliqa

Of course, splitting the network makes organizing work between all its parts complex, and to solve that problem, Zilliqa uses a solution that is both innovative and proven. First of all, Zilliqa’s consensus algorithm uses two tools that we already know:

- Proof of Work or Proof of Work. In this case, Zilliqa relies on the ETHhash algorithm, the same one that once supported Ethereum mining, and in which you can participate openly with a GPU miner.

- Proof of Stake using a Practical Byzantine Fault Tolerance (PBFT) model

This hybrid scheme allows Zilliqa to use Proof of Work (PoW) to establish node identities and prevent Sybil attacks, and at the same time, achieve consensus within each shard using PBFT, ensuring fast transaction finality and low energy footprint.

However, with the arrival of Zilliqa V2, some changes are coming to this system that will affect the Proof of Stake part of ZIL. The change, more than anything, will provide greater speed to ZIL, since the PBFT algorithm will be changed to Fast-HotStuff, the latter is a derivative of HotStuff, a BFT algorithm that has given life to blockchain projects such as Diem/Libra and Aptos, for example. name a few. Either way, this will be a huge step forward in Zilliqa’s scalability, because Fast-HotStuff can easily handle over 100k transactions per second, compared to the 10k that PBFT can safely handle.

Practical Byzantine Fault Tolerance

ZIL syncs the distributed network of nodes with the help of a governance mechanism called Practical Byzantine Fault Tolerance (pBFT). The users need to stake their ZIL tokens to become node operators.

The Practical Byzantine Fault Tolerance adds a microblock into a transaction block after getting confirmation from all the members of a particular shard. Thus, the rewards are equally distributed among the users who have participated in the validation process.

Scilla, a tailored language for Zilliqa

Another important part of how ZIL works is its programming language, Scilla. Scilla (acronym for Smart Contract Intermediate-Level LAnguage) is a programming language of smart contracts that has been developed specifically for the Zilliqa blockchain. Scilla is a functional language inspired by OCaml (which is also a very secure and formally verifiable language), making it suitable for formal verification and security of smart contracts on the Zilliqa blockchain.

Thanks to this, developers have taken special care not only when creating structures that facilitate the development of smart contracts, but they have maintained a high level of security in their implementation, thus preventing small errors from becoming real catastrophes for decentralized applications. that are deployed. This has made it possible to eliminate certain known vulnerabilities directly at the language level, making applications less prone to attacks.

In addition to this, Scilla is developed along with the formalization of its semantics and its integration into the Coq testing assistant. Coq is an advanced tool for mechanized testing of program properties, based on type-dependent theory. It has been successfully used to implement certified compilers, concurrent and distributed applications, including blockchains

Governance

ZIL gives governance rights to its community members. It means the community members have complete control over deciding the future of the network. However, they need to have governance ZIL (gZIL) tokens in their wallets to propose or vote for new changes within the network.

Every gZIL token represents one vote. So, the voting power of a community member is determined based on the gZIL tokens they hold. The token holders can also earn rewards by staking their gZIL tokens. gZIL tokens can be purchased from popular crypto exchanges.

The ZIL token

ZIL is the Zilliqa native token and is used to execute smart contracts, reward miners and staking. In addition, it acts as a medium of exchange to cover the costs of transactions on the network. Users can participate in the governance of the platform by staking ZIL, giving them voting power in ecosystem decisions.

The tokenomics of this cryptocurrency is made up of several key aspects:

Initial Distribution of ZIL Token

- The initial launch of the ZIL token occurred on August 31, 2017.

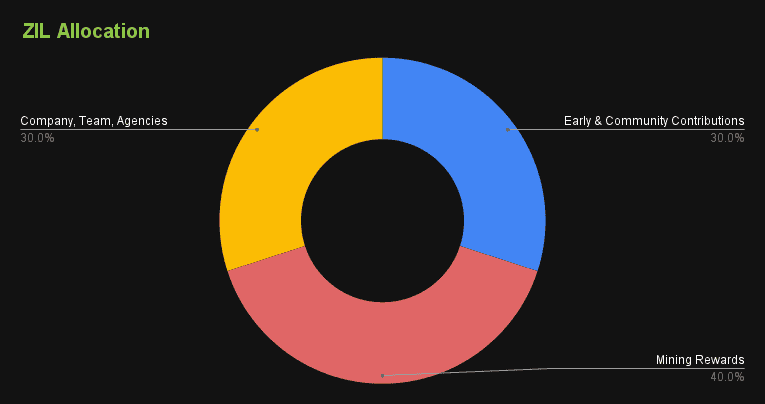

- The initial distribution of ZIL is divided as follows:

- 30.00% is allocated to Early and Community Contributions.

- 40.00% is allocated to Mining Rewards.

- 30.00% is allocated to the Company, Team and Agencies.

- Maximum Supply and Emission Schedule:

- The maximum supply of ZIL is limited to 21.000.000.000 tokens.

- Zilliqa has followed an inflationary issuance model since its genesis.

- ZIL supply is expected to be fully purchased by June 2029.

In short, ZIL is used to pay transaction fees and the execution of smart contracts on the Zilliqa network. Additionally, users can stake their ZIL tokens to become node operators, validating transactions and maintaining network security. Its tokenomics reflects a focus on scalability, security, and active community participation.

Projects built on Zilliqa

All this development behind ZIL has meant that more than 250 projects have a space on the Zilliqa blockchain as their home. Applications ranging from Web3 games, to decentralized finance (DeFi) applications, to the metaverse. Prominent projects like ZilSwap, a decentralized exchange platform, and various applications in the NFT space, are just a few examples of Zilliqa’s broad utility as a blockchain.

In fact, some notable projects built on the Zilliqa platform include:

- XSGD: A stablecoin backed by Singapore dollars.

- UnstoppableDomains: Offers decentralized domains on the Zilliqa blockchain.

- Moonlet: A cryptocurrency wallet for Zilliqa and other networks.

- Carbon – A well-known staking platform based on Zilliqa.

ZIL continues to innovate and expand its ecosystem. Improvements in performance and security are expected with the arrival of Zilliqa V2, as well as the development of new dApps and services by the community. In conclusion, Zilliqa is presented as a robust and cutting-edge solution in the world of blockchains, offering superior performance and a focus on security and scalability. With a strong community and a very active development team.

Zilliqa Tokenomics

ZIL is the native token of the Zilliqa network that is used for the transfer of value. The users can also stake their ZIL tokens to become node operators. They then receive ZIL tokens as a reward for validating transactions.

With a circulating supply of 13 billion tokens, ZIL has a market cap of $484.7 million. It has a maximum supply of 21 billion tokens that will be released in the form of rewards. ZIL ranks among the 100 best cryptocurrencies in terms of market cap.

What Makes Zilliqa Unique?

ZIL is often referred to as an Ethereum killer because it supports the development of decentralized applications and smart contracts. Unlike Ethereum, Zilliqa can process thousands of transactions per second because it incorporates the sharding technique to fix the scalability issue.

Zilliqa network consists of a set of blockchains that are running in parallel. The verification process takes place on the parallel chains while the final block is updated on the main blockchain.

Scilla (Smart Contract Intermediate-Level Language)

ZIL uses a custom programming language, Scilla, for the creation of decentralized apps and Defi services. The purpose of using a custom programming language is to secure smart contracts from hacking attempts. The developers can easily identify security vulnerabilities using this language.

It ultimately helps them with creating safe and secure smart contracts. Zilliqa network uses this language to ensure the overall security of the network because smart contracts hold valuable digital assets and they’re irreversible.

ZILHive

ZILHive is one of the main components of the Zilliqa network that is designed to streamline the mass adoption of blockchain. This feature is designed to assist the developers gradually so they may successfully launch their projects on the blockchain.

Zilliqa Goals

Zilliqa’s main goal is to overcome the scalability issues faced by other cryptocurrencies such as Bitcoin and Ethereum. To do this, it seeks to provide a viable solution for applications that require high performance, such as games, financial services and advertising. Zilliqa focuses on being a secure and efficient platform for developers and companies looking to build dApps and decentralized services.

ZIL achieves this by making use of sharding to process large numbers of transactions in parallel, allowing for a high volume of transactions per second. In addition, it currently incorporates a hybrid consensus mechanism that combines Proof of Work (PoW) and Byzantine Fault Tolerance (BFT), which guarantees security and efficiency.

Additionally, thanks to the use of the Scilla programming language, Zilliqa manages to provide its users and developers with advanced options for the development of decentralized applications (dApps), with extensive optimization for the security of smart contracts.

Is There Anything Special About Zilliqa?

ZIL’s creators claim their product is the first public blockchain to utilize a sharded architecture fully. Furthermore, they claim that Zilliqa can compete with conventional centralized payment methods like VISA and Mastercard due to its high throughput and transaction rates.

As a result of its sharded architecture and hybrid consensus process, ZIL has the potential to become the decentralized cryptocurrency of choice for developers who seek a solution for large-scale organizations in the financial sector, gaming, marketing, and other industries.

Along with these characteristics, ZIL is coded in a custom language called Scilla, which is meant to enhance the network’s overall security automatically.

Zilliqa’s worth

Besides acting as a medium of trade and a store of value, ZIL can also be staked for a return on investment. Zilliqa holders who commit some of their shares can vote on how the Zilliqa ecosystem is run, with the weight of each voter’s vote according to the amount of zilliqa staked.

Because there is a fixed number of tokens in circulation, the value of ZIL can’t fall due to unrestrained inflation.

Approximately How Many Zilliqa Coins Are Currently in Flow?

There are presently 15,032,795,975 ZIL in circulation out of the total quantity of ZIL.

Before launching, ZIL created 60% of the entire supply and allocated a portion of it as follows: 10% was set aside for Anquan Capital, 12% was set aside for Zilliqa Research, and 5% was set aside for present and prospective Zilliqa employees. Mining will produce the residual 40% of zilliqa price.

After ten years after the blockchain’s inception, the Zilliqa development team predicts that all the currencies will be mined and the mining incentives will have dwindled to nothing.

Differential Data

The ZIL team has teamed with Chainlink to facilitate the integration of oracles, increasing the network’s access to real-world data. With the help of these oracles, intelligent contracts can pull information from external sources, such as other blockchains or real-world occurrences.

Besides providing an extra layer of safety, the oracles’ decentralized approach also offers the benefit of being more convenient. There is no single point of failure or attack because several network nodes deliver the data.

By incorporating Chainlink, the Zilliqa design team hopes to expand the blockchain platform’s usability to include decentralized marketplaces, trading systems, and other asymmetric encryption financial services. Although ZIL’s specialized Chainlink adapter primarily uses recent market prices, it may also be used to acquire data on other variables of interest, such as currency exchange rates, election outcomes, and weather forecasts.

How does ZIL ensure the safety of its network?

Zilliqa’s network is protected against threats of all kinds thanks to a combination of the system’s many advanced security mechanisms. Zilliqa uses a Byzantine Fault Tolerant consensus process with two layers of verification as the foundation of its security architecture. The first prevents Sybil attacks by restricting blockchain processing to macro-blocks on individual shards. Finally, a second level of the consensus method verifies and guarantees there will be no network hard forks.

To further ensure the safety of its transaction logs, the Zilliqa blockchain uses elliptic-curve cryptography in conjunction with a Proof of Work mechanism to create shards and assign node identities.

Last, ZIL employs its coding language, Scilla, which guarantees that any apps developed are secure to run on the Zilliqa network by proactively identifying and eliminating security vulnerabilities. This is accomplished at the language level, giving developers more confidence in the safety of Scilla-based intelligent contracts.

Methods of Applying Zilliqa

While anyone is welcome to utilize ZIL’s public blockchain, the network’s rapid transaction speeds will likely attract developers of high-volume intelligent contracts and decentralized applications. Blockchain technology can be used for things like high-volume robotic auctions and decentralized exchanges, high-performance scientific computing, and something that needs precise findings.

Zilliqa’s native token, ZIL, can be used for a wide variety of purposes on the network, including the execution of smart contracts, the payment of transaction fees, and the acquisition of mining or staking rewards.

For those who consider ZIL as a solid investment opportunity, holding or trading it may be preferable.

The ZIL team is committed to further decentralizing the platform. Therefore they’ve enabled staking with the Zilliqa token, ZIL. Users that stake a portion of their ZIL shares will receive access to network governance components and direct incentives for doing so.

This is why the developer team has formed strategic alliances with Staked Seed Node Operators, which are multiple exchanges and wallets supporting staking.

Users can stake a minimum of 10 ZIL and a maximum of any amount the system supports

Conclusion

Zilliqa is a blockchain network designed to address one of the most important issues of existing blockchain networks. It enables users to build smart contracts and decentralized applications using its custom programming language called Scilla. It uses the sharding technique to divide the transactions into smaller pieces.

Disclaimer ||

The Information provided on this website article does not constitute investment advice ,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!