Self-custodial wallet is a digital wallet where you keep total control of your cryptocurrencies and other digital assets, such as Bitcoin, Ether, and Bitcoin.com’s official token VERSE. Custodial crypto wallets and traditional financial institutions like banks hold your assets on your behalf, requiring you to trust they will not misuse your assets.self-custodial wallet

Custodial versus self-custodial wallets

In modern finance, it’s standard practice for service providers like banks to retain custody of your assets. This means, for example, that when you want to make a withdrawal from your bank account, while you may have a legal claim to the money, the reality is that you’re asking for permission from your bank. Banks can and regularly do deny such permission, and

their reasons for doing so do not always align with the best interests of individual customers. Furthermore, even when service providers uphold the custody rights of their customers in good faith, factors outside of their control may force them to deny you access to your money. For example, a government may force banks to restrict withdrawals in an attempt to stop runaway inflation

as happened in Greece in 2015. Another, perhaps more insidious example, is Operation Choke Point, where the US government pressured banks to deny service to people involved in a variety of (legal) industries it had identified as morally corrupt. self-custodial wallet

With the advent of blockchain-supported decentralized systems – of which Bitcoin is the primary example – it became possible, for the first time, to provide self-custodial financial services at a large scale. In the self-custodial model, the customer retains full custody (possession) of their assets at all times, using the service provider merely as an interface for conveniently managing their assets.

When you use a self-custodial wallet (like

the Bitcoin.com Wallet app), first of all, you don’t need to ask for permission to use the service. There’s no account approval process, meaning anyone in the world can download the app and start using it immediately. self-custodial wallet Secondly, only you have access to your funds. This makes it nearly impossible for the service provider (in our case Bitcoin.com), a government, or anyone else to prevent you from using your funds exactly as you wish. self-custodial wallet

Of course, with great power comes great responsibility! In the self-custodial model, since you are the only one with access to your funds, you need to manage your wallet carefully. This includes backing up your wallet and adhering to password management best practices. self-custodial wallet

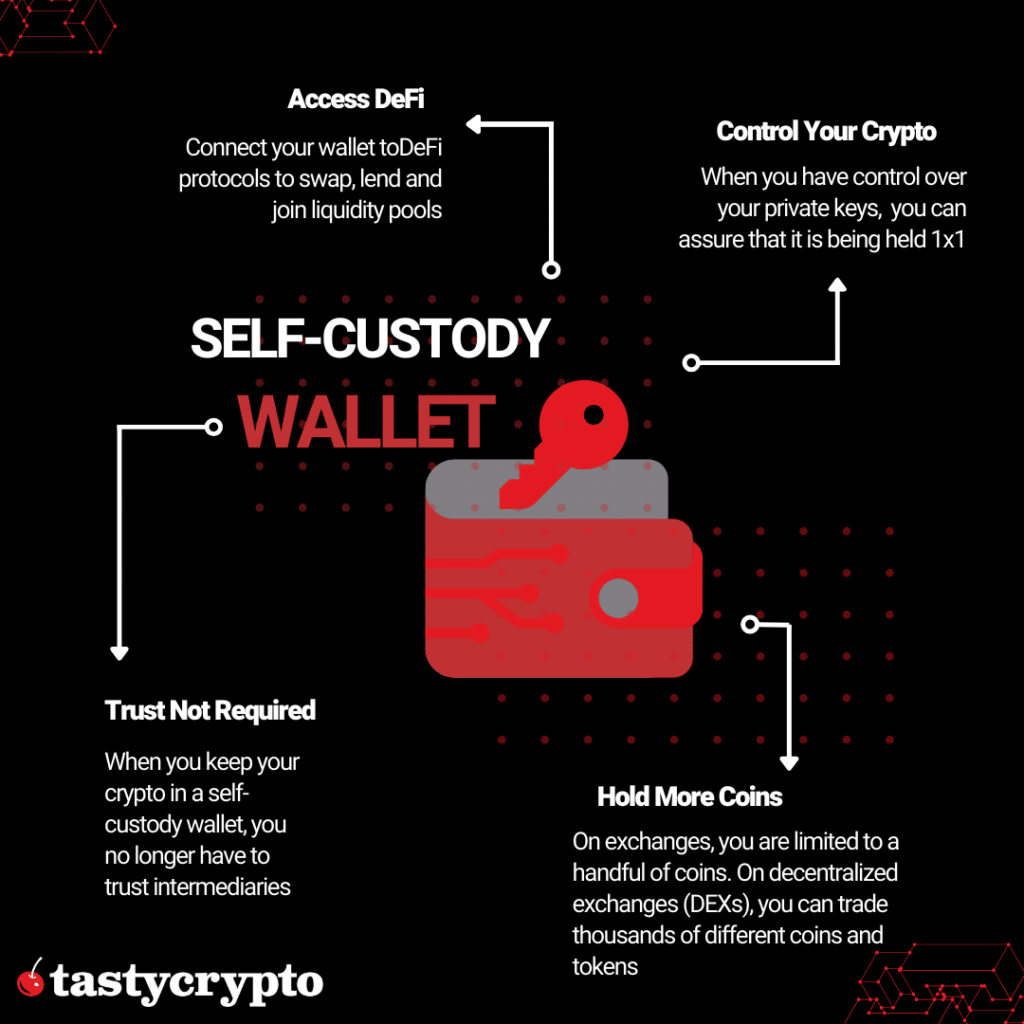

What Can I Do With a Self-Custody Wallet?

Self-Custody Wallets in addition to offering users a safe place to store their crypto, self-custody wallets (also called Web3 wallets) allow users to interact with Web3 protocols, including decentralized finance (DeFi) networks. Some DeFi activities popular on the Ethereum network include:

- Staking crypto/Restaking through EigenLayer technology

- Lending/borrowing crypto

- Liquidity pool participation

- Derivatives trading (DeFi options and perpetuals)

What Types of Self-Custody Wallets Are There?

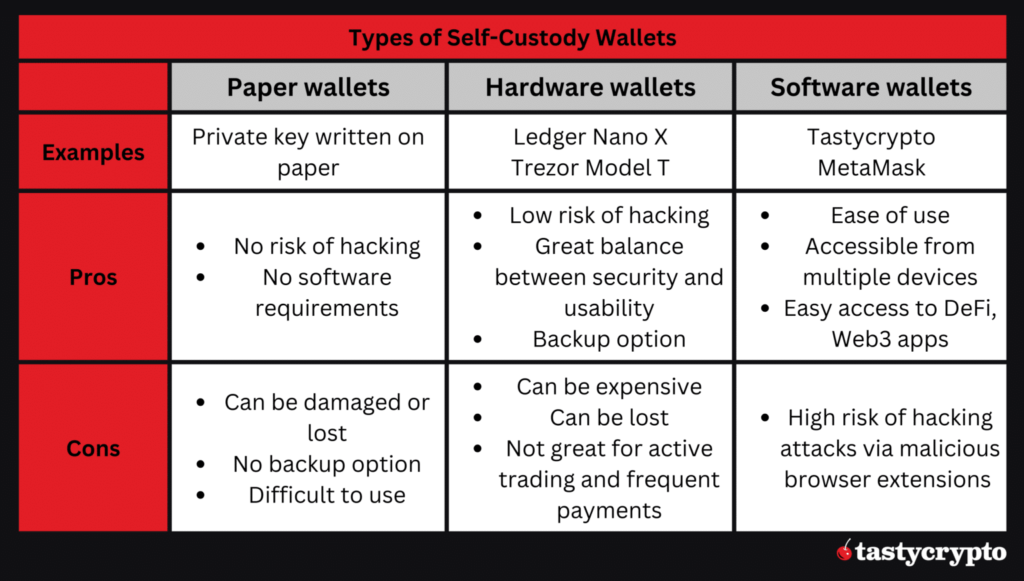

There are three categories of self-custody crypto wallets:

- Paper wallets

- Hardware wallets

- Software wallets

Paper Wallets

A paper wallet is when a private key is simply down on a sheet of paper. Since private keys are comprised of a 256-bit number, it would be tedious to write out this long num

ber every time you wanted to trade crypto. Since paper wallers are never connected to the internet, hacki

ng risks are low with

this type of wallet. Self-Custody Wallets

Hardware Wallet

In hardware wall

ets, private keys are stored on physical devices, such as a USB flash drive. Hardware wallets allow a user to safely store their private keys o

ffline when they are not using them. When the owner of a hardware wallet wants to trade, they simply plug this device into their computer and connect it to a Web3

protocol. Trezor is a popular hardware wallet.

Software Wallets

Software wallets store a user’s private keys on a piece of software that is constantly connected to the internet. Types of software wallets include: self-custodial wallet

- Desktop wallet application

- Mobile device wallet application (Android/iOS)

- Web browser extension

Since software wallets are always connected to the interested, they offer seamless integration with anything you want to do on a blockchain. Software wallets also have the highest risks of being hacked because of this constant connectivity.

What’s the difference between self-custodial and non-custodial?

Nothing. Self-custodial == non-custodial. self-custodial wallet

The terms self-custodial and non-custodial are actually interchangeable when referring to cryptocurrency wallets. They both describe wallets where you hold the private keys, giving you full control over your crypto assets.

Here’s a breakdown of the key difference between these wallets and custodial wallets:

- Control of Private Keys:

- Self-custodial/Non-custodial: You have them.

- Custodial: A third-party service (like an exchange) holds them for you.

This difference in private key control leads to other advantages and disadvantages:

- Security:

- Self-custodial/Non-custodial: More responsibility for security falls on you. If you lose your private key, your funds are gone.

- Custodial: Generally considered less secure because you’re trusting a third party, but they may offer insurance or recovery options.

- Convenience:

- Self-custodial/Non-custodial: Can be more complex to set up and use.

- Custodial: Easier to use, similar to online banking.

Choosing between a self-custodial and custodial wallet depends on your priorities. If you value security and control over your crypto, a self-custodial wallet might be the way to go. If you prioritize ease of use, a custodial wallet might be better. self-custodial wallet

Are all cryptocurrency wallets self-custodial?

Absolutely not. Centralized cryptocurrency exchanges (Coinbase, Binance, etc.) provide custodial cryptocurrency wallets (sometimes known as ‘web wallets’). While such exchanges are useful for buying, selling, and trading crypto assets, when you use these exchanges,self-custodial wallet your crypto is held in trust by the exchange. Note that with self-custodial wallets like the Bitcoin.com Wallet app, you can also buy, sell, and trade cryptocurrencies.

here are two main types of wallets:

- Self-custodial wallets: These wallets give you complete control over your private keys, which are essentially passwords for your crypto assets. With a self-custodial wallet, you are responsible for the security of your own funds.

- Custodial wallets: These wallets are offered by centralized exchanges like Coinbase or Binance. They hold your cryptocurrency for you, similar to how a bank holds your money. You don’t have direct control over your private keys, but custodial wallets are generally considered more user-friendly than self-custodial ones.

What are the risks associated with custodial cryptocurrency wallets?

The risks are similar to (and in many cases greater than) those associated with holding your money at a bank or using a payment app like PayPal. The risks stem from the fact that, fundamentally, you are not in full control of your funds when you use a custodial wallet/account.

Firstly, you are exposed to the risk that the exchange/platform will go bankrupt. If that happens, it is highly unlikely that you will recover the crypto you held on the exchange/platform. If you do end it getting compensated, the recovery process will likely be drawn out over years, and in the end, you will receive a fraction of what the assets are worth.

Second, since taking custody of financial assets is a regulated activity, centralized cryptocurrency exchanges are subject to the whims of regulators in the jurisdiction they are domiciled — and since cryptocurrency regulations are in a state of flux in most regions, this means there’s always the possibility that you’ll wake up to find you are unable to access your crypto assets.

Next, the exchange may charge extra fees for withdrawals (which is common), slow down your withdrawal process (also common), or prevent you from withdrawing altogether (rare but not impossible).

Finally, there’s the risk that the centralized exchange/platform gets hacked. If that happens, since cryptocurrency exchanges generally aren’t insured and are often registered offshore, it’s likely you’ll lose your crypto assets and have no recourse to action. self-custodial wallet

Are there any other reasons to use a self-custodial wallet?

Self-custodial crypto wallets provide you with direct access to public blockchains. The best wallets, like the Bitcoin.com Wallet app, allow you customize the fees you pay to public blockchain miners and validators. This means, for example self-custodial wallet, that you can choose to pay less for transactions when you’re not in a hurry (or more if you’re in a rush!). Finally, because self-custodial wallets provide direct access to blockchains, they also enable you to interact with smart contracts. That means, for example, you can access decentralized finance products that enable you to do things like earn passive income and borrow cryptocurrency using your holdings as collateral.self-custodial wallet

How do I know if I’m using a self-custodial wallet?

All self-custodial crypto wallets enable you (and only you) to possess the private key associated with your public address. Practically speaking, this generally takes the form of either a file you store on your device, or a ‘mnemonic phrase’ that consists of 12-24 randomly generated words. If your wallet doesn’t have this option, it’s custodial (meaning you’re not in full control of your crypto assets).

The Bitcoin.com Wallet app, which is self-custodial, also offers an automated cloud backup service (in addition to giving you the option to store the private key for each of your wallets as a mnemonic phrase). With the automated cloud backup service, you create a single custom password that decrypts a file stored in your Google Drive or Apple iCloud account

providing you with an extra layer of security as well as added convenience. If you lose access to your device, simply reinstall the Wallet app on a new device, enter your password, and you’ll again have access to all of your crypto assets. If you opt-in to the automated cloud backup service, whenever you add more wallets within your Bitcoin.com Wallet app, your backup file will automatically sync. This means you never have to worry about creating or managing a new backup for each new wallet you create! self-custodial wallet

Pros and cons of non-custodial wallets

Maintaining exclusive control of your wallet’s private keys means you don’t have to worry about losing access to your funds through third-party fault.

Hardware wallets have the added benefit of giving you peace of mind that your funds are completely offline so long as the devices are not connected to a laptop or computer. This mitigates any chance of an online hacker accessing your crypto assets and means you only need to worry about physically securing the device.

The main drawback of self custodying your own assets is being solely responsible for copying down and securing your own sensitive information. Any input errors, misplaced passwords or lost devices means you’ll lose access to your funds.

This is why it’s vitally important that people who use non-custodial wallet services or devices make duplicate copies of their sensitive information either on paper or etched into metal plates and spread those across multiple locations. That way, should one copy go missing or the location is compromised (house fire, flooding, etc) you have a backup option.

If you hold substantial amounts of crypto, it can sometimes be beneficial to split the amount across multiple hardware devices to further spread your risk.

Ultimately, when it comes to choosing between custodial and non-custodial wallets you’ll need to weigh up what’s most important to you; convenience or security.

If the former, then custodial options like holding crypto on Kraken are perhaps better suited to your needs. If the latter is more important, then a hardware wallet device or web-based non-custodial solution is likely a better option. self-custodial wallet

What Is a Private Key?

In crypto, a private key is similar to a bank password; whoever has access to the crypto private key, has access to the keys representative crypto on the blockchain.

Private keys are used to generate public keys, which in turn create wallet addresses.

Though these two keys are mathematically linked together, a private key can never be derived from a public key.

A public key is like a mailbox: anyone can see the encrypted address and send mail (crypto) to it. However, only the owner of this mailbox has the (private) key to open the mailbox and receive the messages (cryptocurrency). self-custodial wallet

What Is a Seed Phrase?

A private key is an extremely long string of numbers and letters that represents crypto ownership on a blockchain. Depending on how many digital assets you have, you may have dozens of private keys.

To simplify the process of accessing your private keys, wallet providers (like tastycrypto) use seed phrases.

Seed phrases (sometimes called recovery phrases) are typically 12 randomly selected words that give you access to your crypto wallet and all of the private keys in it.

If you have your seed phrase, you do not need your private keys. They are algorithmically linked together. A seed phrase, therefore, acts more like a ‘master key’.

Hot Wallet vs Cold Wallet

All cryptocurrency wallets fall into one of two categories: hot wallets and cold wallets.

Hot Cryptocurrency Wallet: Any crypto wallet that is connected to the internet (software wallet and hardware wallets when they are connected).

Cold Cryptocurrency Wallet: Any crypto wallet that is not connected to the internet (paper wallets and hardware wallets when disconnected from the internet).

What Are the Risks of a Self-Custody Wallet?

1. Losing your seed phrase

When you maintain custody over your private keys, you alone are responsible for maintaining a record of your seed phrase (recovery phrase). If you lose your seed phrase, you will lose access to your crypto. There is no central authority that maintains a copy of your seed phrase.

2. Hacking risk

The cryptocurrency ecosystem is notorious for hacks. When you have a self-custody wallet, you must take certain steps to mitigate this risk. Browser extension wallets in particular are vulnerable to hackers. In order to assure your wallet is not targeted, it is best practice to have both a clean web browser and a clean computer.

3. Protocol risk

In order to transact with a self-custody wallet, you must interact with Web3 protocols. Before connecting your wallet to a protocol (such as Uniswap or Aave), it is wise to make sure that: 1. The protocol is trusted, popular, and widely used 2. The protocol has had at least two independent audits done.

For a more in-depth article on protecting your wallet

Self-Custody is The Future

When you have a self-custody wallet, blockchain blooms for you. self-custodial wallet

You can connect your self-custody wallet to gaming Web3 apps, buy and sell NFTs (non-fungible tokens), and swap crypto like bitcoin (BTC) and ether (ETH) for much lower fees than centralized exchanges charge.

When you have direct access to your private keys, you can even participate in DeFi (decentralized finance), where you can stake crypto and make interest, lend crypto and earn yield, and even collect fees by becoming your own market maker! self-custodial wallet

So are you ready to take control of your crypto? self-custody wallet today and join us as we step into this exciting new financial frontier.

Disclaimer ||

The Information provided on this website article does not constitute investment advice ,financial advice,trading advice,or any other sort of advice and you should not treat any of the website’s content as such.

Always do your own research! DYOR NFA

Coin Data Cap does not recommend that any cryptocurrency Stocks Bonds should be bought, sold or held by you, Do Conduct your own due diligence and consult your financial adviser before making any investment decisions!

Leave feedback about this